- XRP has been stuck in a lower range below $2.6 in Q2.

- Over 1B XRP tokens were moved from exchanges in H1 2025, signaling accumulation.

Ripple [XRP] has held its 2024 gains of over 300% pretty well despite the mixed H2 2025 performance. In Q2 2025, the altcoin stayed range-bound between $2.0 and $2.6.

But with the SEC lawsuit set to be ‘closed for good’ and high ETF expectations, can XRP surge above $2.6 in Q3?

Assessing XRP breakout odds in Q3

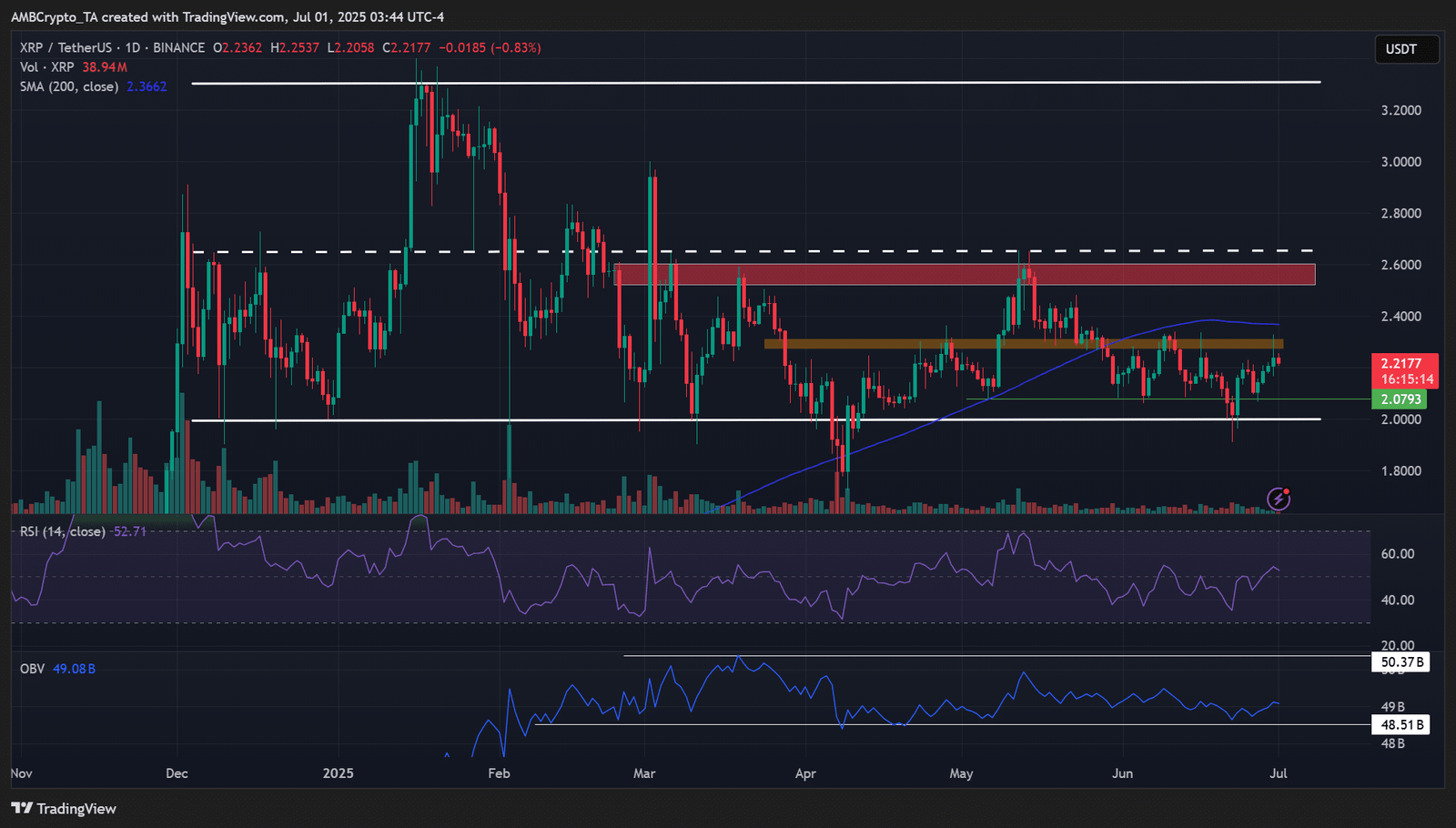

On the daily chart, XRP remained range-bound since printing last year’s peak at $3.4. The flat trading volume, as shown by OBV (On Balance Volume), reinforced the sideways structure.

But in Q2 2025, XRP slipped below $2.6 and has been consolidating below that level.

In May, XRP bulls attempted to break above $2.6, which doubled as a mid-range level and supply zone. But they were rebuffed and dragged XRP below the 200-day Simple Moving Average (SMA, blue).

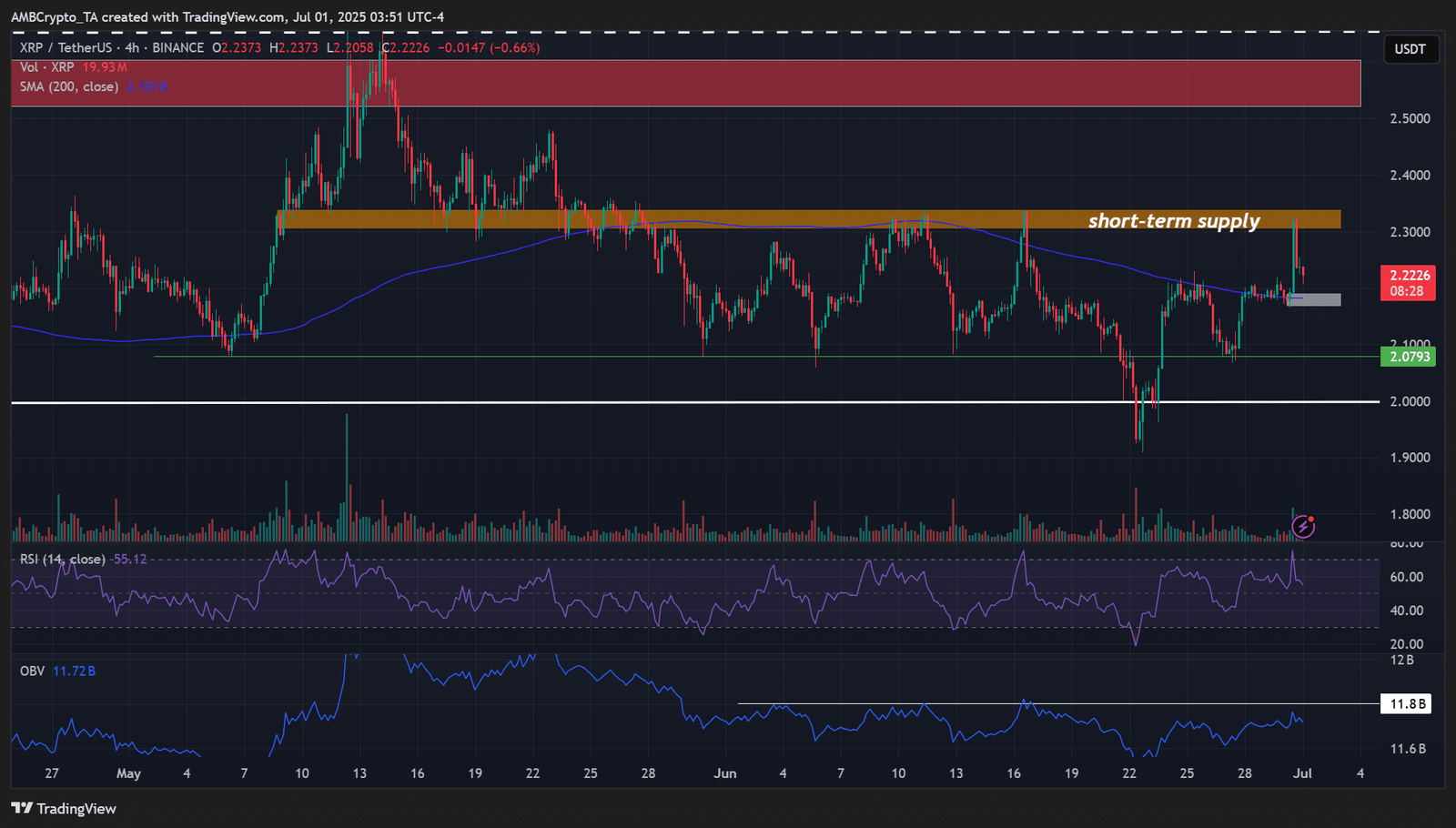

When zoomed in on the lower timeframe (4-hour), XRP has struggled to clear the $2.3 in June. This has made it a key short-term supply zone before bulls could eye $2.6.

That said, 7% surge on the 30th of June was rejected at $2.3, but the pullback could ease at $2.16-$2.19 (white) or $2.0.

Still, the 4-hour chart OBV was below June resistance, suggesting a jump above $2.3 could need a strong catalyst.

Overall, XRP could trade within $2.0-$2.3 in the short term or extend to $2.6 in the mid-term in case of a summer catalyst.

Over 1B XRP moved from exchanges

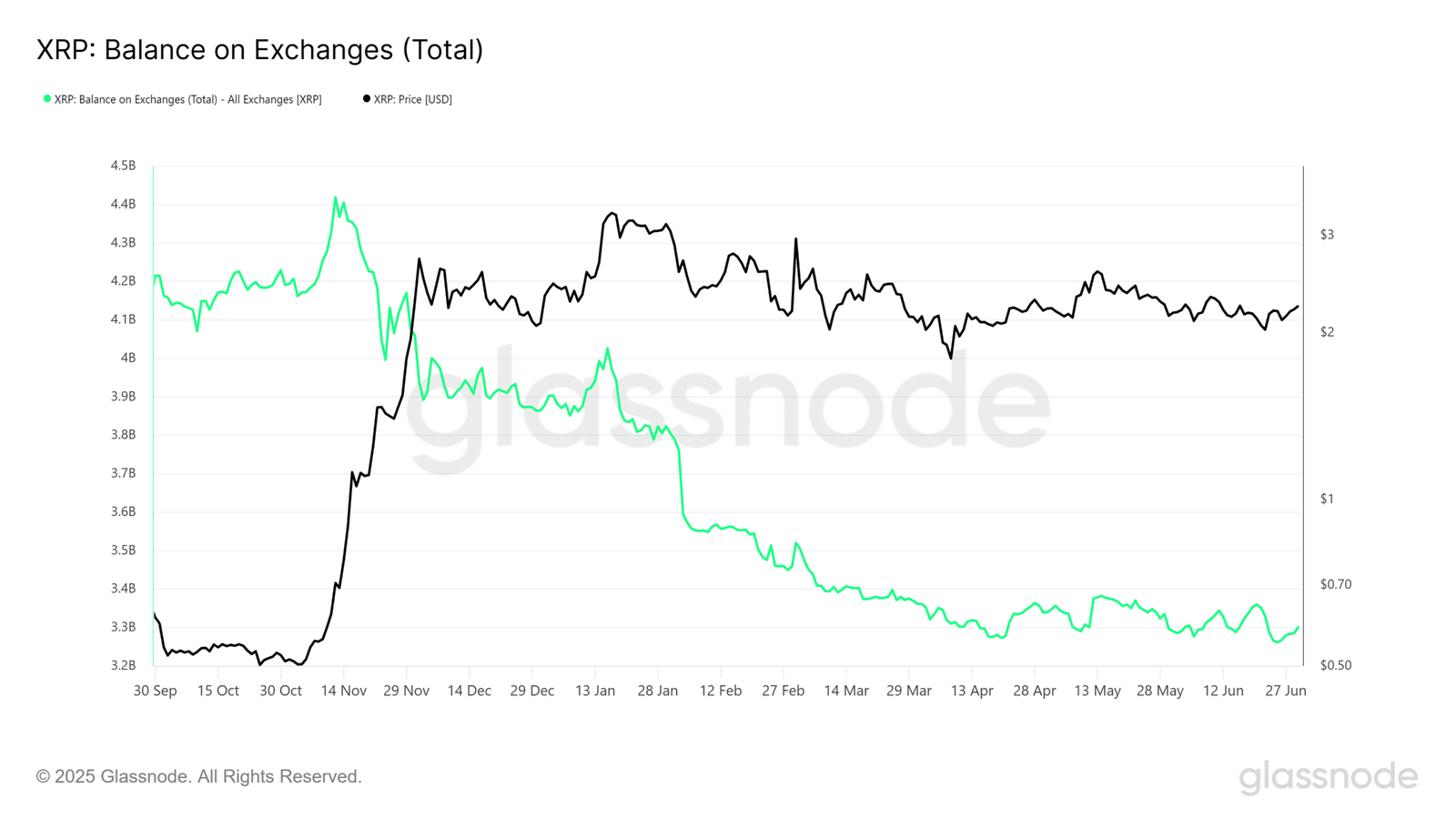

Here’s the kicker—despite the tight range, XRP’s Exchange Balance has dropped significantly.

According to Glassnode data, XRP supply on centralized exchanges shrank from 4.4 billion to 3.3 billion tokens since October 2024. That’s over 1 billion XRP withdrawn.

That, in itself, isn’t a breakout trigger—but it sets the stage. In other words, a strong catalyst could fuel an explosive XRP rally under this muted selling condition.

Where could the next liquidations hit?

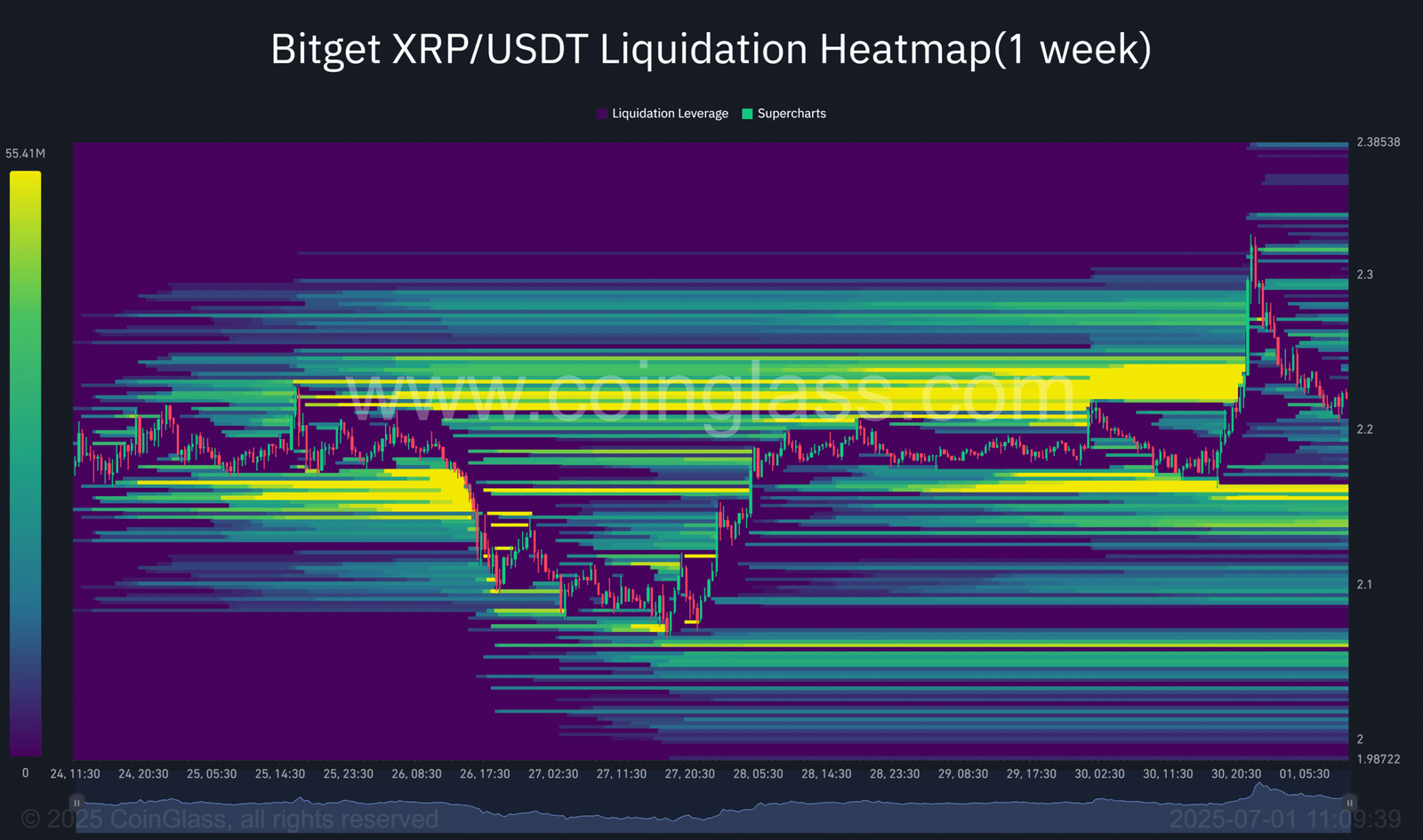

Meanwhile, the Liquidation Heatmap also showed that the short-term pullback could ease at $2.1 or $2.0. These levels had relative liquidity pools of leveraged longs that could act as price magnets.

XRP has been stuck in the $2.0-$3.4 price range for over six months and could extend into Q3 unless a strong catalyst emerges.

In the near term, pullbacks to $2.0 could be buying opportunities if the range remains intact.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion