- Despite a bearish outlook, a strong majority of 71.03% held a positive sentiment toward Solana.

- On-chain metrics revealed that exchanges have witnessed an outflow of $73 million worth of SOL in the past 48 hours.

After a continuous struggle over the past few days, Solana’s [SOL] has failed to hold its key support level of $141 and is now poised for significant downside momentum.

This comes as geopolitical tensions between Israel, Iran, and the United States escalated.

Following the ongoing escalation of the war, market sentiment has turned bearish. The asset continues to bleed and has formed a bearish structure.

At press time, SOL was trading near $135.5 and has lost over 4.10% of its value in the past 24 hours. However, the major price drop in the asset occurred after the tensions escalated.

During this period, trader and investor participation also declined notably, leading to a 10% drop in trading volume compared to the previous day.

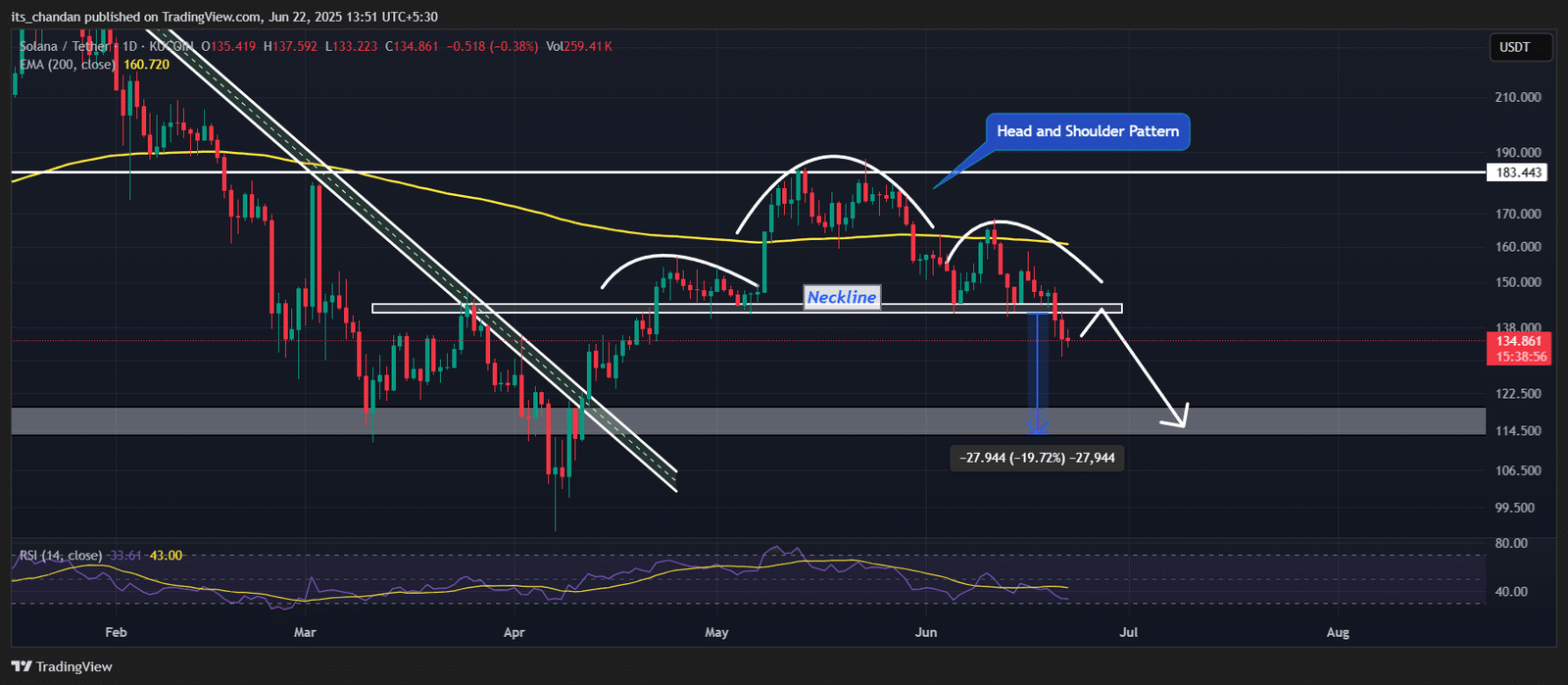

Solana price action and key technical levels

According to AMBCrypto’s analysis, SOL appears bearish and is poised for further downside momentum.

The daily chart reveals that the asset has broken down from a bearish head and shoulders pattern, further confirming this bearish outlook as the daily candle closed below the neckline.

If current sentiment holds, the asset could drop over 20%, potentially reaching $114 in the coming days.

However, SOL may regain bullish momentum only if it reclaims the $145 level. A break above that could trigger a 15% rally, pushing the price toward $166.

Technical analysis: EMA and RSI insights

At the time of writing, SOL was trading below both the 50-day and 200-day EMAs on the daily chart, indicating a sustained downtrend. The price may continue to fall unless it reclaims levels above these key moving averages.

Meanwhile, SOL’s RSI sat at 33.50, signaling that the asset is in oversold territory. This could suggest a short-term rebound if buying pressure builds.

Bullish on-chain metric

Despite the bearish outlook, on-chain data from Santiment revealed that a strong majority of 71.03% held a positive sentiment toward Solana, at press time suggesting that most users remained optimistic.

Meanwhile, 8.33% of the sentiment was neutral, and 20.63% was negative. When combining all these, it appears that positive sentiment is currently dominating Solana’s market sentiment.

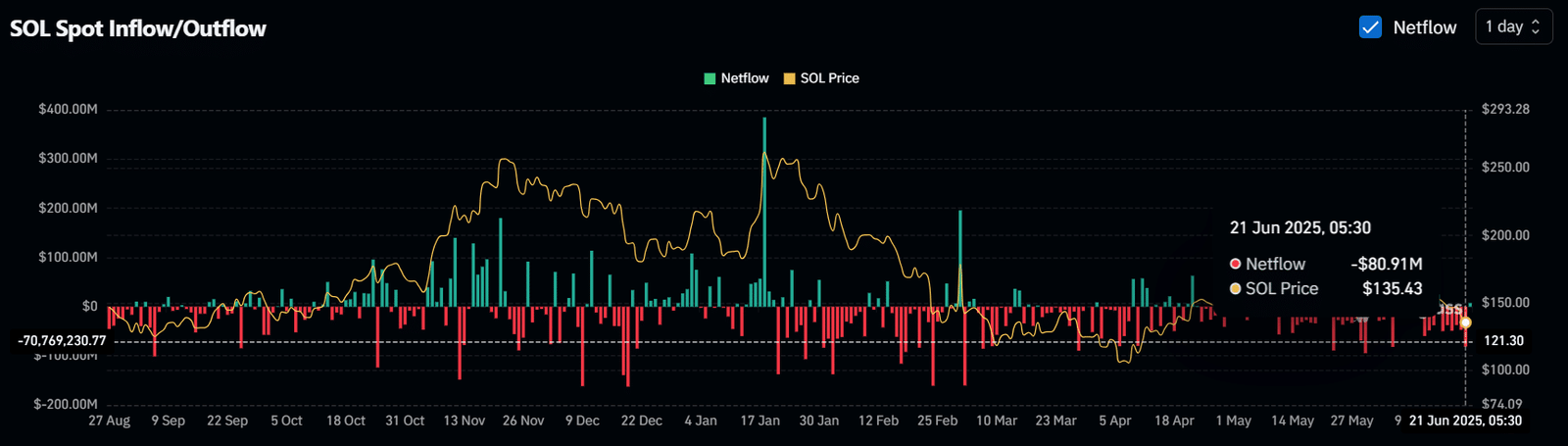

$73 million worth of SOL leaves the exchanges

Given the current market sentiment, investors and long-term holders appear to be taking advantage of the price dip, as they have been accumulating the token.

Data from the on-chain analytics tool CoinGlass revealed that exchanges across the crypto landscape have witnessed an outflow of approximately $73 million worth of SOL in the past 48 hours.

This substantial outflow from exchanges suggests potential accumulation and could reduce selling pressure if it continues, which is a bullish sign for SOL holders.

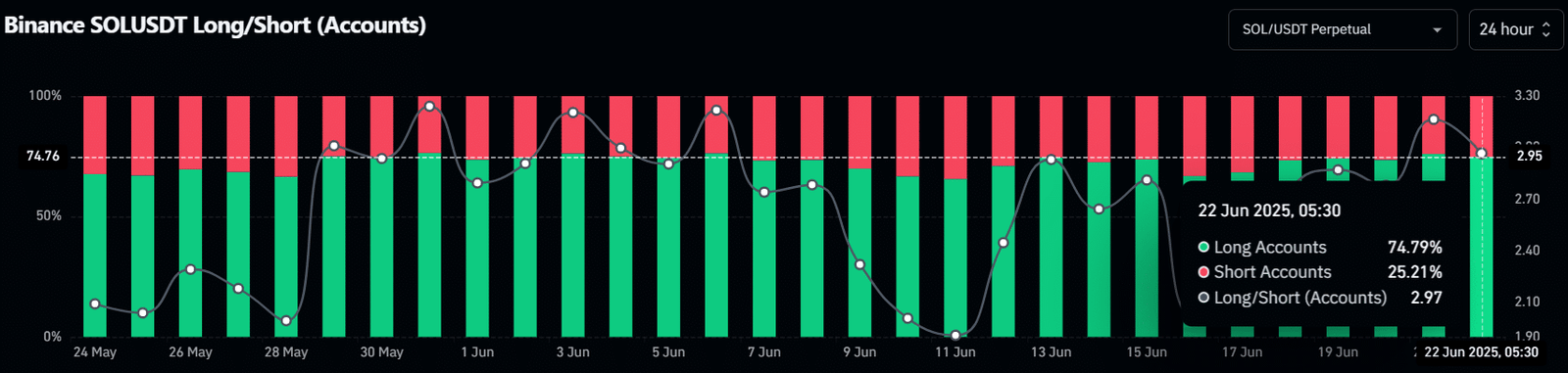

75% of Binance traders go long

Not only investors, but traders also appear to be strongly betting on the long side. Data revealed that the Binance SOLUSDT Long/Short Ratio stood at 2.97, indicating strong bullish sentiment among traders.

Latest data shows that 74.79% of Binance traders are long on Solana, while only 25.21% are short. This skew suggests that, despite a bearish price trend, bullish sentiment remains dominant.

When combined with Solana’s recent price action, the current market setup raises a key question: Is this dip a genuine buying opportunity, or a trap for bulls?