- ETH and SOL could catch up to BTC as stablecoins and tokenized stocks narratives converge.

- Solana-based tokenized stocks surged to $8.5 million, indicating early traction.

Bitcoin [BTC] has enjoyed all the market attention and briefly tagged $110K again on the 3rd of July.

But Solana [SOL] and Ethereum [ETH] could soon catch up too, according to Ryan Watkins, co-founder of crypto VC Syncracy Capital.

Watkins expected the duo to rally in the coming quarters as Wall Street piles in to chase the stablecoin and tokenization narratives. He added,

“Won’t be surprised seeing them chase ETH + SOL over the coming quarters to get ‘index’ exposure to stablecoins and tokenization.”

Tokenized stocks debut on Solana, Ethereum

The most notable headlines this week have been on-chain stocks. Or, simply, tokenized stocks of major public firms and even private firms that are yet to go public.

These are derivatives that track the performance of underlying stocks, allowing retailers to gain exposure without directly owning the stock.

Think of them as CFDs (Contracts of Difference) but issued on a blockchain, accessible globally and traded 24/7.

At the moment, Solana and Ethereum chains seem to be the primary beneficiaries of this trend.

Robinhood, a retail-focused trading platform, recently launched tokenized U.S. stocks for its E.U. users, allowing 24/5 access for over 200 equities.

The trading firm also announced Robinhood Chain, an L2 on Ethereum, as part of its broader operations.

According to Vivek Raman, founder of the ETH ecosystem marketing firm, Etherealize, the move was a bet on ETH.

The on-chain stocks also launched across Solana, available via Kraken exchange and DEX (decentralised exchange) aggregator Jupiter exchange.

Unlike Robinhood, Solana’s offering, xStocks, trades 24/7 and is reconciled before the next opening of the U.S. trading day.

And more stocks, ETFs, and tokenized assets will be available on-chain.

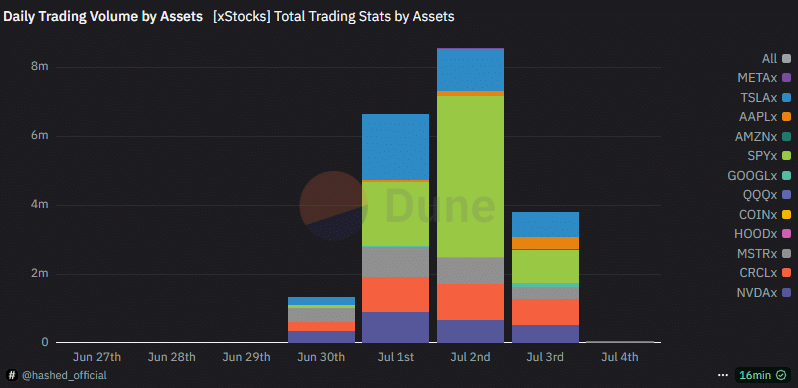

While it’s too early to tell whether the trend will hold or fade, the past three days have shown genuine interest. Per Dune Analytics data, xStocks have hit $8.5 million in volume, and overall transactions surged to 25k.

Paired up with the expected stablecoin boom, tokenized stocks, and corporate treasury trend, analysts foresee these institutional adoption and narratives as catalysts for ETH and SOL.

Commenting on the trend, Coinbase analysts said,

“Equities could join dollars and Treasuries as the next real-world asset class to find meaningful product-market fit on public blockchains—well ahead of most expectations.”

Should these projections play out and fuel the underlying blockchains, SOL and ETH could offer better risk-adjusted returns in the mid to long term.