- Ethereum’s EIP-7983 proposal limits gas per transaction to boost stability and block DoS risks.

- Big names like BlackRock and Trump back ETH, with signs hinting at a bullish breakout ahead.

Ethereum [ETH] just got a new rule on the table — and it’s all about keeping things running smoothly.

A fresh proposal, EIP-7983, wants to put a cap on how much gas a single transaction can use. The goal is to stop spammy attacks, tighten security, and make the network a little more predictable.

With Ethereum co-founder Vitalik Buterin backing the idea — and big players like BlackRock and U.S. President Donald Trump betting big on ETH — the timing couldn’t be more telling.

Why Ethereum wants to limit gas per transaction

Ethereum developers are warning us about single transactions that consume nearly the entire block’s Gas Limit.

The proposed fix, EIP-7983, introduces a cap of 16.77 million gas units per transaction – no matter how high the block’s total gas limit is. The idea is to make the network more stable and prevent denial-of-service (DoS) risks.

The proposal states,

“Any block having a transaction with gasLimit > 16.77 million is deemed invalid and rejected…”

Developers say most users won’t even feel the change, as

“most transactions today fall well below the proposed cap.”

Big money is betting on Ethereum

That being said, institutional and high-profile interest in Ethereum is hitting new highs.

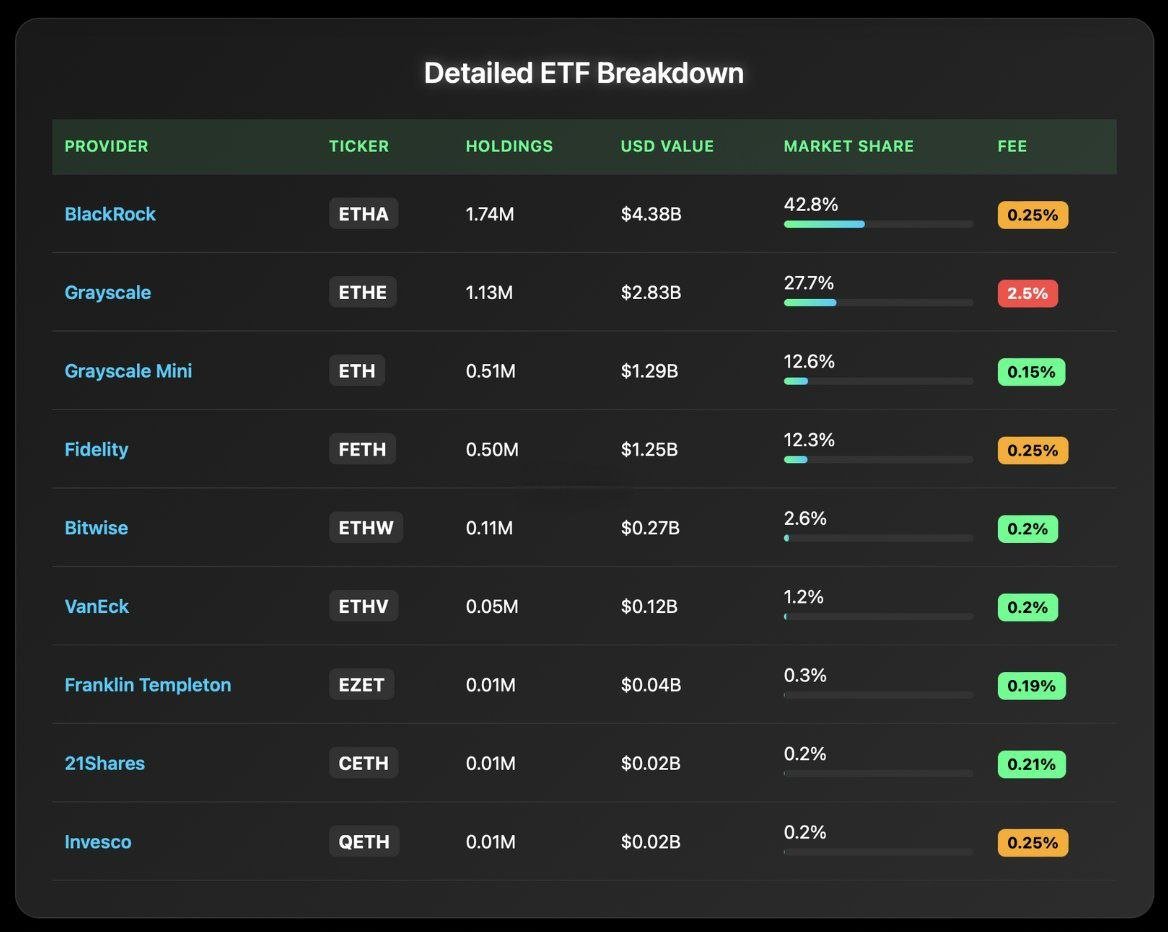

BlackRock now holds a staggering $4.38 billion in ETH, commanding 42.8% of all institutional Ethereum holdings.

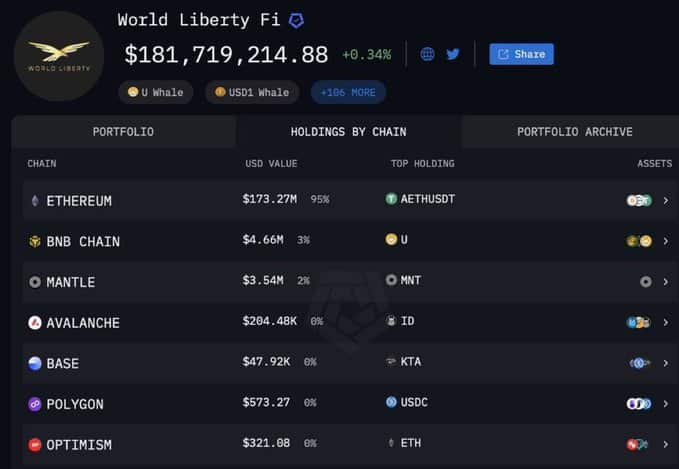

According to World Liberty Fi, one $181.7 million whale allocated 95 percent of its assets to Ethereum, about $173.3 million.

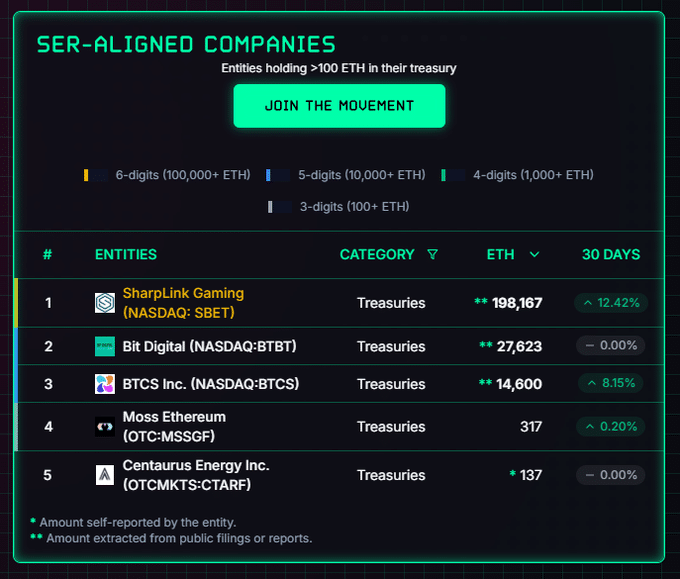

Five Ethereum treasury companies currently hold a combined 240,000 ETH, worth around $600 million.

And more are lining up; Tom Lee’s BitMine plans to buy $250 million worth of ETH soon.

Leading the pack is SharpLink Gaming with 198,167 ETH in its treasury, followed by Bit Digital and BTCS Inc. with 27,623 and 14,600 ETH respectively.

The top three alone account for over 99% of all reported treasury holdings to date.

With more treasuries expected to join in over the next year, Ethereum’s appeal as a long-term asset looks stronger than ever.

If ETH bulls step in, there could be a breakout

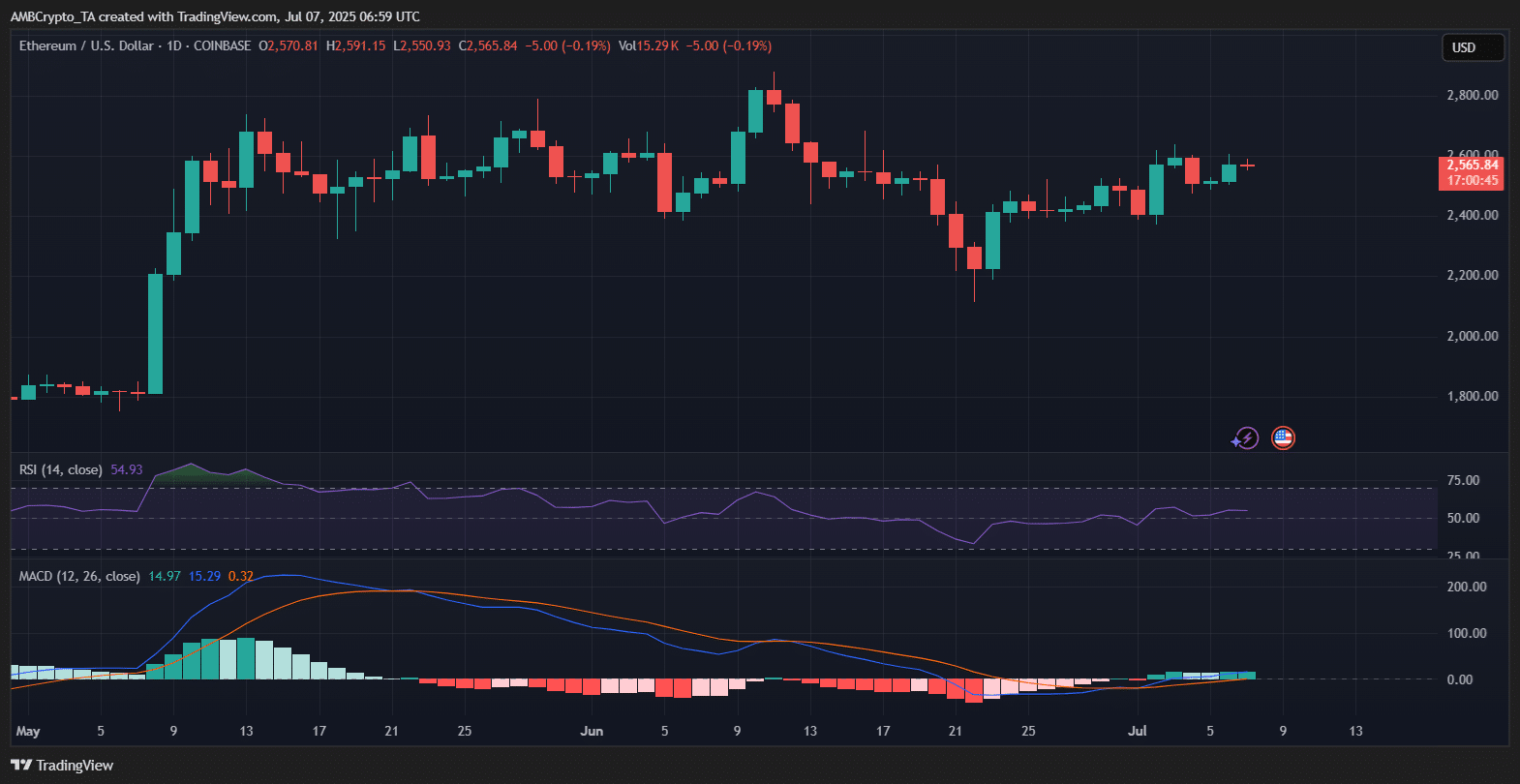

ETH traded just above $2,560, showing modest gains but no explosive move yet. The RSI was at 54.93 at press time, suggesting neutral momentum.

However, the MACD is a bit more interesting: the indicator just flipped bullish, with the MACD line crossing above the signal line. That, paired with a slight uptick in histogram bars, suggests growing upward momentum.

While ETH has been range-bound since mid-June, the current setup hints at a possible breakout if buying volume picks up.