- Unichain leads EVMs with 32% transaction growth despite a 4.1% address drop.

- UNI faces strong resistance at $7.6–$7.8 as whale accumulation remains weak.

Uniswap’s [UNI] Unichain has surged to the top of EVM chains by transaction growth, with a notable 32% increase in activity despite a 4.1% decline in active addresses.

This divergence suggests users are transacting more frequently, potentially driven by new incentives or efficient protocols.

At the time of writing, UNI was trading at $7.58 after a 5.33% daily gain, hinting that this usage intensity may already be influencing price sentiment.

The question now is whether this momentum is sustainable or just speculative.

Could gasless UniswapX limit orders fuel UNI’s next rally?

The introduction of UniswapX’s zero-gas limit orders has sparked optimism across the ecosystem.

These new features allow traders to execute buy and sell orders with no gas fees, while combining on-chain and off-chain liquidity for optimal pricing.

If widely adopted, this upgrade could position Uniswap as a dominant DEX by lowering trading costs and improving execution quality. Consequently, UNI could benefit from heightened utility and stronger demand.

While the upgrade is still new, it aligns with Uniswap’s innovation ethos and may attract retail and institutional users seeking capital efficiency.

Will large holder uncertainty cap UNI’s short-term upside?

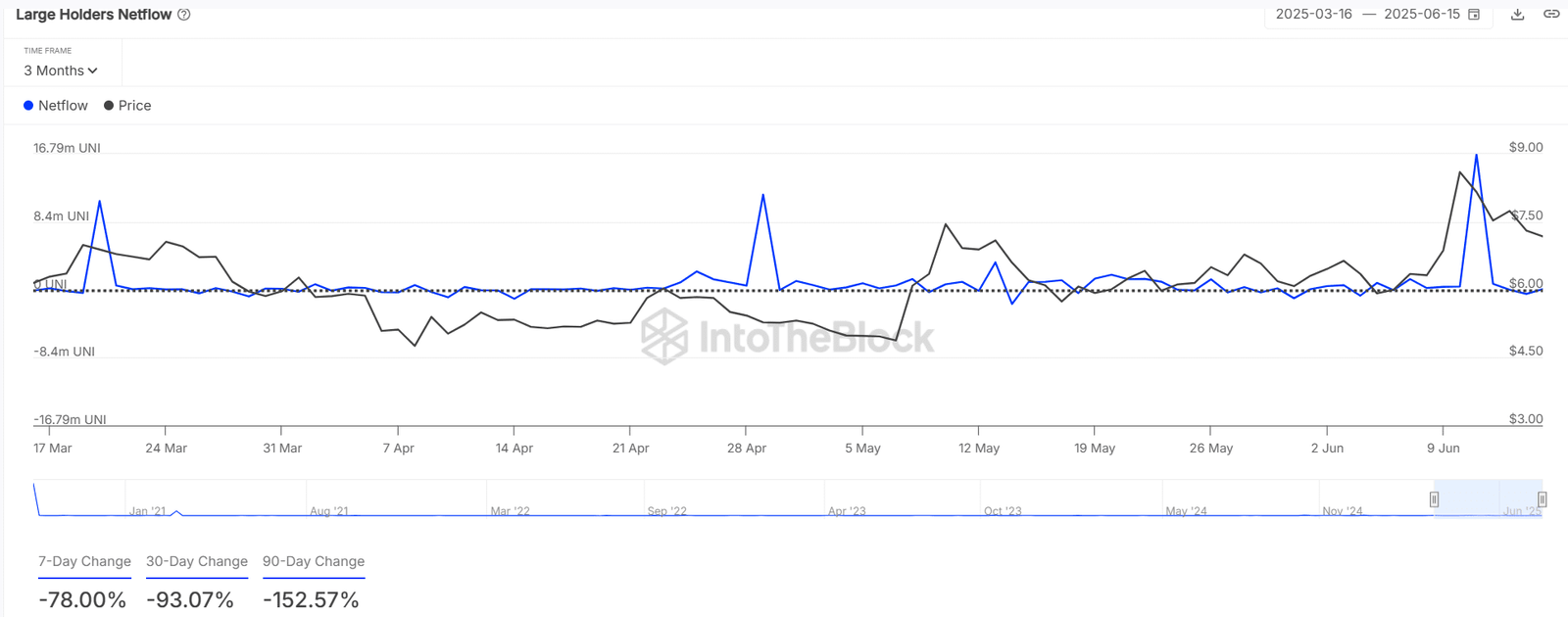

Despite price improvements, large holder netflows have remained volatile, reflecting mixed sentiment from whales.

In the last 30 days, netflows dropped by 93%, while 90-day metrics show an even steeper decline of over 150%. Such fluctuations suggest some profit-taking or strategic exits even as prices climb.

Moreover, the lack of consistent accumulation from key wallets could limit UNI’s upside potential unless reversed.

Besides, UNI has seen a sharp 50.6% increase in exchange outflows, contrasting with a 19.5% drop in inflows.

This imbalance suggests investors are moving tokens to self-custody or staking platforms, reducing sell pressure across exchanges.

Such behavior typically precedes price appreciation, as a shrinking exchange supply often coincides with bullish expectations.

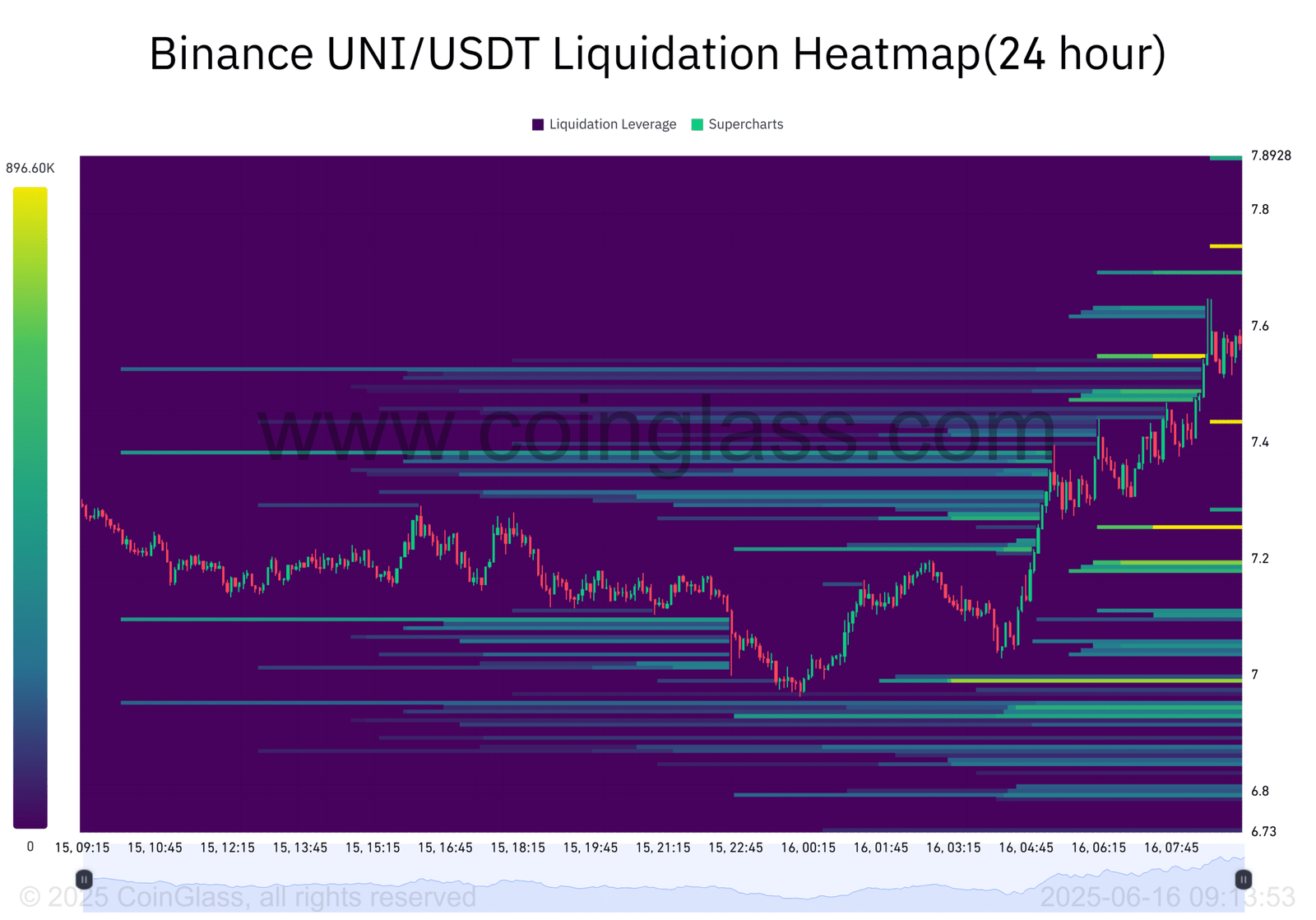

Will liquidation clusters above $7.6 become breakout zones or traps?

The Binance liquidation heatmap reveals high short liquidations near the $7.6 and $7.8 levels—zones that often act as magnets for price action.

These levels could trigger sharp moves if breached with strong momentum, forcing liquidations that push UNI even higher.

However, if price fails to break above these bands decisively, it could signal exhaustion and lead to a pullback.

Open Interest-Weighted Funding Rates have mostly stayed in positive territory, indicating a mild but persistent long bias among derivatives traders.

At press time, the rate is +0.0062%, suggesting bulls are gaining confidence without resorting to excessive leverage. This balanced positioning reduces the risk of mass liquidations and supports a more stable rally.

Can UNI maintain its climb, or is this just a spike?

While Unichain leads in transaction growth and UniswapX upgrades drive usage, UNI’s price faces resistance between $7.6 and $7.8.

Large holder hesitation adds uncertainty, potentially limiting further upside unless confidence returns.

For UNI to maintain its momentum, it must overcome key technical barriers while sustaining user interest and on-chain activity.

The next move depends on whether bulls can convert current traction into a breakout backed by solid investor conviction.