- There has been a massive outflow of stablecoins from the TRON network, putting TRX at risk of a major drop.

- Revenue has declined, and the market sell-off has intensified as more investors become active on-chain.

TRON’s [TRX] gains have remained modest, with just a 4.43% increase over the past month and a 0.78% rise in the last 24 hours.

This slight market movement is tied to a surge in on-chain activity, suggesting that users are fleeing the network and have limited use for TRX.

TRX revenue drops amidst stablecoin outflow

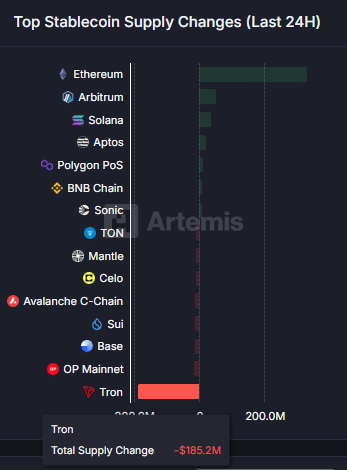

According to stablecoin supply data from Artemis, there has been a significant outflow of stablecoins from the TRON blockchain.

Approximately $185 million worth of stablecoins has left the network. This comes shortly after TRON hit a record high of $80 billion in total stablecoin supply in June.

This sudden outflow suggests a shift in user sentiment and preferences, indicating that on-chain participants may now favor other chains for transactions—reducing TRX’s utility for facilitating these operations.

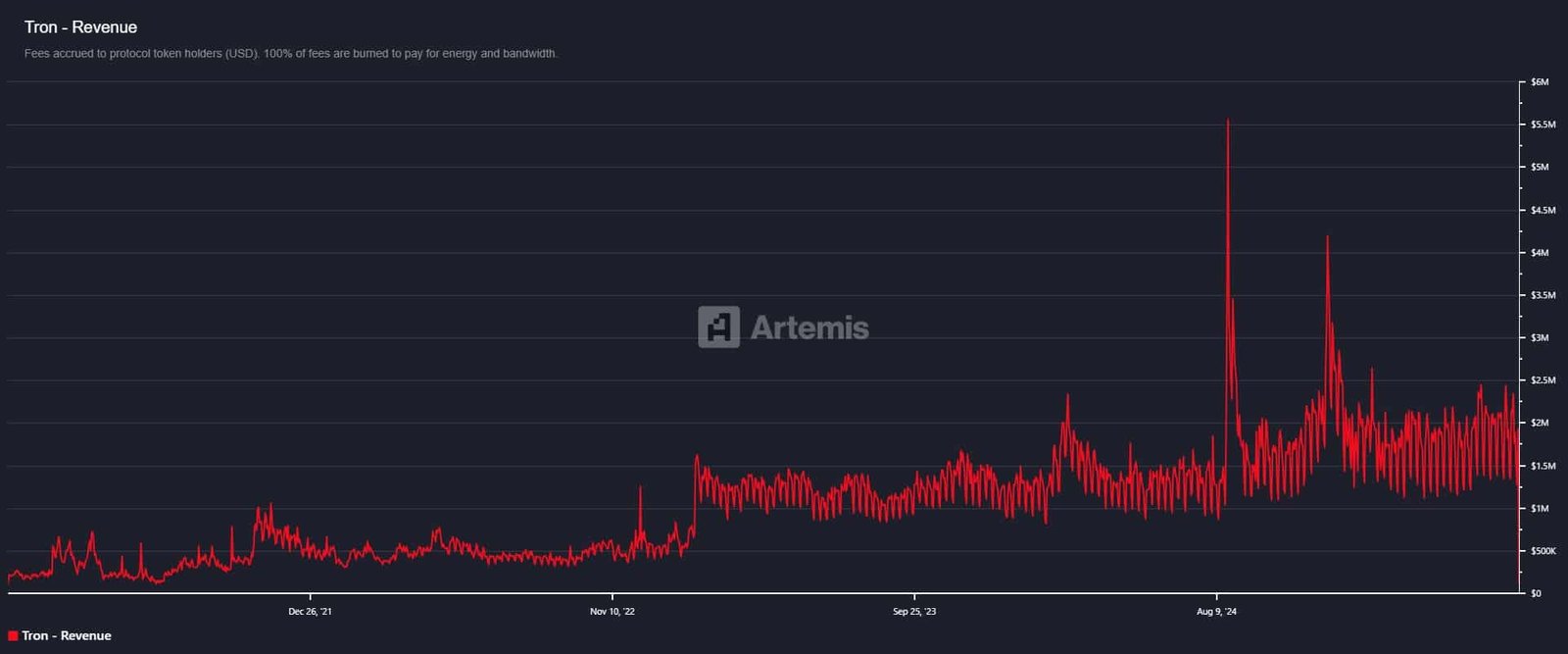

The impact of this outflow is more intense than it appears. According to data from Artemis, TRX’s total revenue has dropped to a four-year low.

In the past day, total revenue from TRX trades amounted to just $114,000, a steep decline compared to its previous market performance.

AMBCrypto analysis suggests there’s more to it, as the rise in active participants likely signals renewed sell pressure on TRX

User activity spikes adding more sell Pressure

The stablecoin outflow has been accompanied by a sharp spike in both daily transaction counts and active addresses.

According to data from Artemis, the number of daily transactions surged to 9.4 million, up from 7.5 million the previous day.

Similarly, the number of on-chain participants also rose. Daily Active Addresses climbed to 2.7 million, the highest level recorded since the 6th of June.

This spike in activity appears to be tied to the recent stablecoin outflow, a trend that generally reflects bearish sentiment for the network.

Despite the liquidity drain and increased transactional activity, TRX has remained relatively resilient.

However, further analysis indicates a high likelihood of a price drop as liquidity continues to exit TRON-based protocols.

Liquidity exits protocols

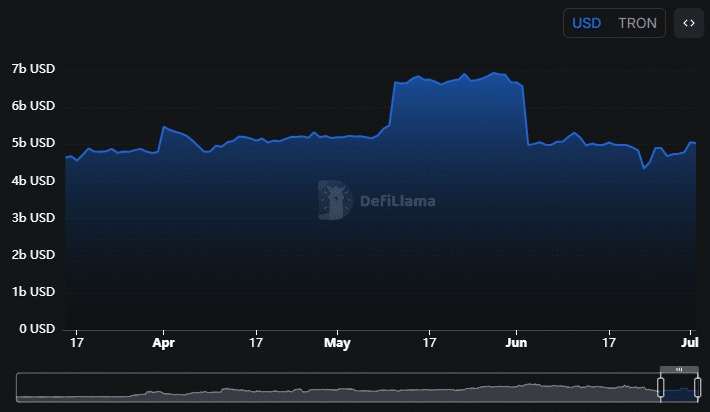

On-chain data shows a gradual sell-off, with liquidity steadily removed from TRON protocols.

As of the time of writing, Total Value Locked (TVL)—a key metric for protocol activity— on DeFiLlama has declined by 0.53% in the past day, falling from $4.878 billion to $4.852 billion. This represents a $26 million outflow.

Such outflows reflect weakening investor confidence and suggest that holders are reluctant to keep TRX, fearing potential losses.

If TVL continues to fall and stablecoin supply on TRON hits new lows, the broader market sell-off could intensify, pushing TRX even lower.