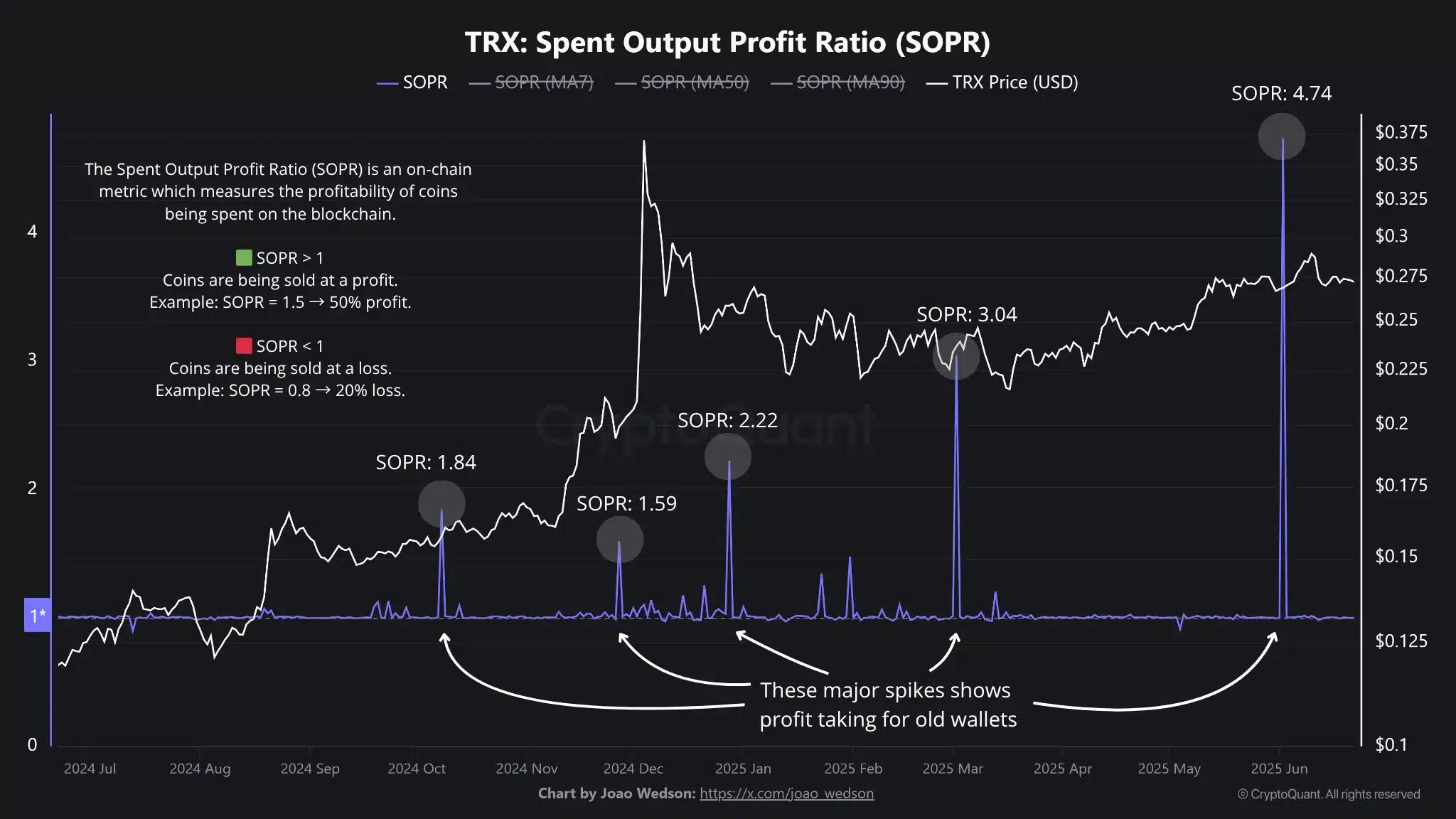

- TRON’s long-term holders realize 374% profits as SOPR hits 4.74, signaling historic wallet activity.

- Despite rising long bias, fading social sentiment, and weak volume, suggest near-term uncertainty.

In early June, TRON’s [TRX] Spent Output Profit Ratio (SOPR) surged to 4.74. This is newsworthy for the reason that it’s highest in months.

That spike confirmed aggressive profit-taking, particularly by long-term holders who bought at roughly $0.0566.

With TRX trading at $0.2730 at press time, these LTHs have realized a 374% profit, having acquired their tokens at approximately $0.0566.

This movement resembles 2022’s historical levels, suggesting these assets remained untouched for over 18 months.

This wasn’t just exit liquidity behavior. Instead, it hinted at portfolio rebalancing or internal strategy shifts by early investors.

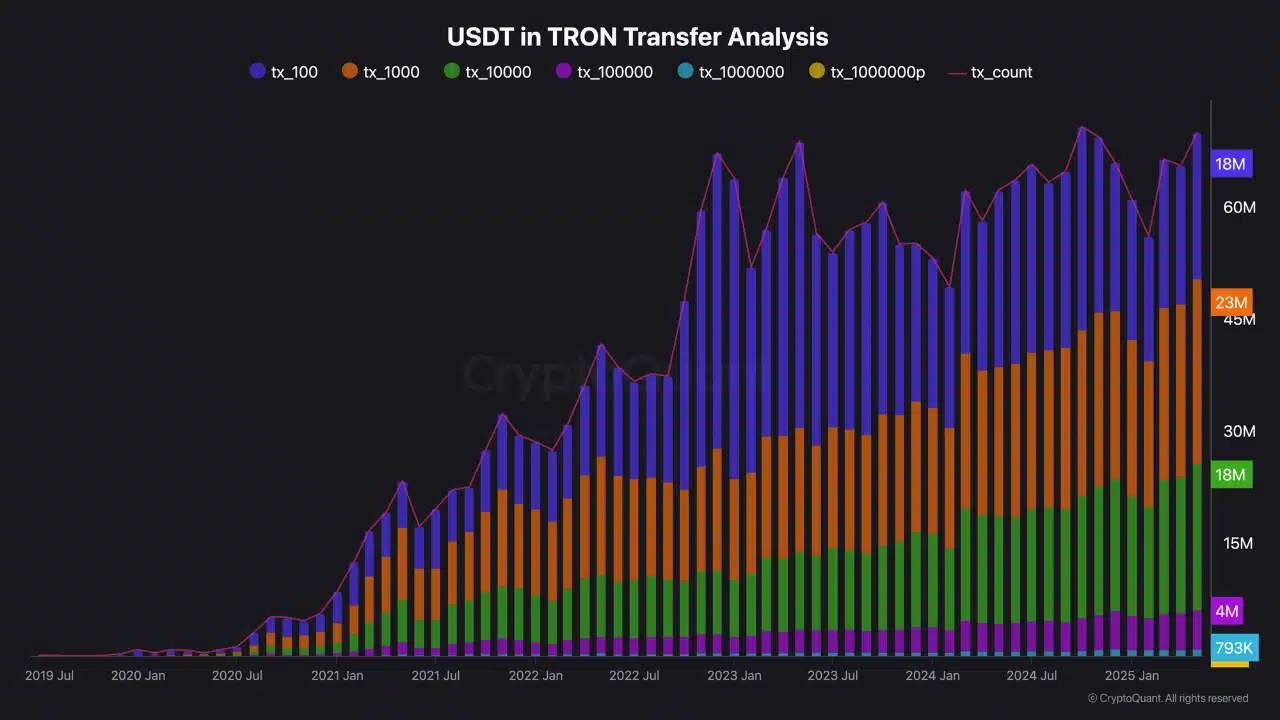

Two stablecoin stories on TRON

TRON’s USDT transfer activity continues to climb, revealing a clear divide in user behavior.

Retail users dominate by volume of transactions, with over 23 million transfers in the $100–$1,000 range.

Meanwhile, institutions that lead in total value transfers exceeding $1 million have surpassed $215 billion since mid-2024, pushing the overall volume to $610 billion.

This contrast highlights TRON’s dual utility: enabling fast, low-cost payments for retail users while supporting large-scale settlements for institutions.

As a result, TRON has cemented itself as a critical infrastructure layer in the stablecoin ecosystem, despite ongoing fluctuations in speculative market activity.

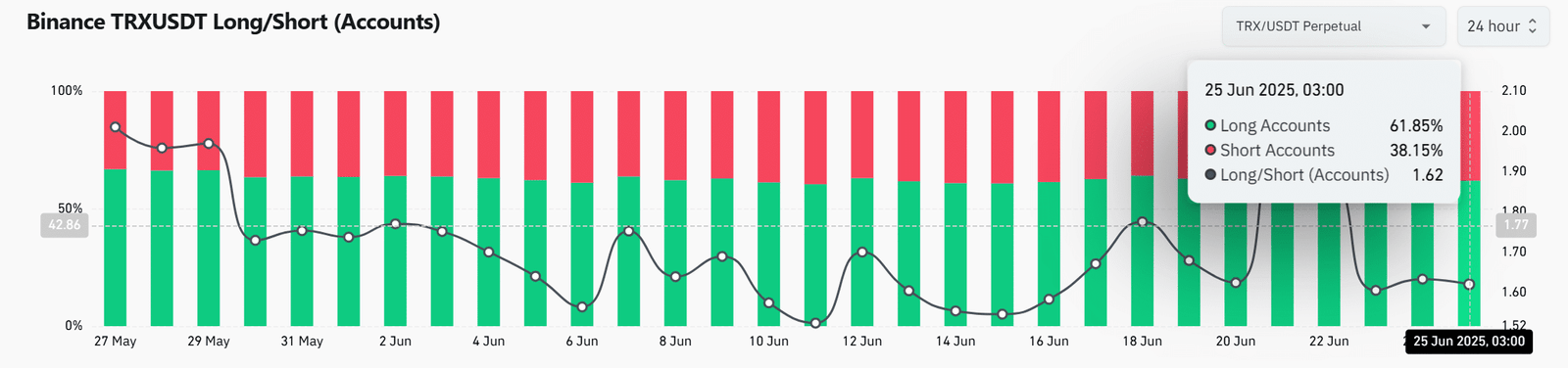

Why are bulls stepping in despite this…

Despite rising bullish sentiment, derivatives activity around TRON is beginning to lose steam.

Long traders held 61.85% dominance, pushing the Long/Short Ratio to 1.62. Still, Open Interest fell 0.54% to $288.82 million, and Derivatives Volume dropped 38.85% to $193.86 million.

Clearly, traders wanted upside, but lacked the conviction to size up positions.

Momentum may return if TRX holds above key psychological levels or experiences renewed catalyst-driven demand.

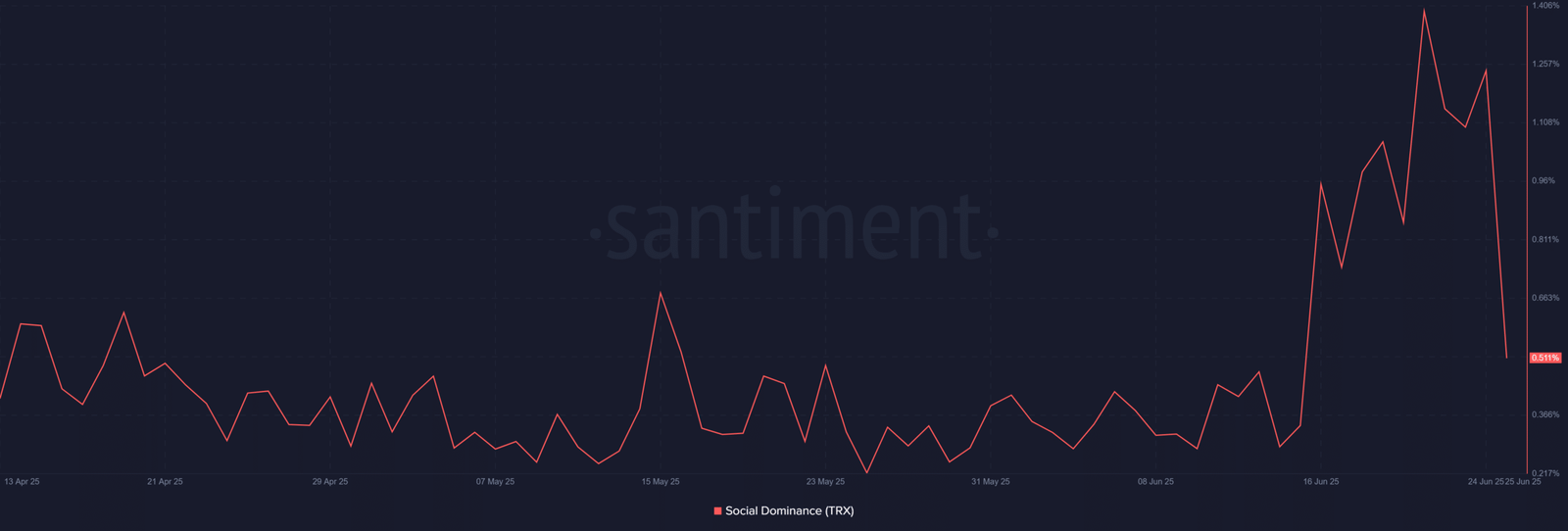

Did social hype peak too soon for TRX bulls?

At the time of writing, TRON’s Social Dominance spiked to 1.3% earlier this month, but quickly cooled to 0.51%.

This drop suggests the initial excitement surrounding long-term wallet activity and stablecoin dominance may have faded.

In fact, while retail and institutional engagement on-chain remains high, sentiment-driven buzz appears to have lost traction.

Consequently, this decline in attention could weaken short-term price momentum unless TRX reclaims market attention through new developments or strong technical breakouts.

What are the risk zones?

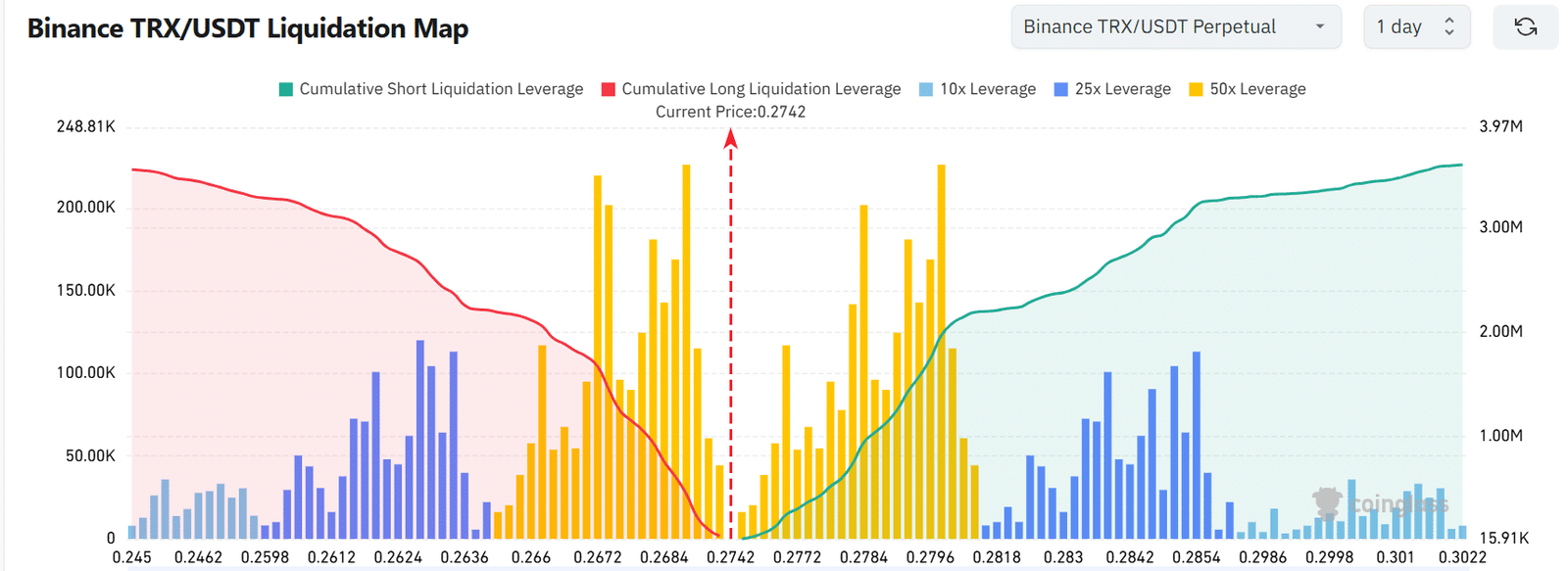

At $0.2746, TRX hovered near a key liquidation cluster at $0.2742. Below, short-side positions were already under threat.

Meanwhile, long liquidations clustered between $0.275–$0.285, especially in high-leverage zones like 50x. A flip above $0.28 could trigger cascading liquidations and short squeezes.

But a dip below $0.265 could easily set off downside acceleration, given the leverage imbalance.

Recent activity from old wallets has injected fresh uncertainty into TRON’s market outlook.

Despite solid on-chain engagement from both institutional and retail users, weakening social sentiment and declining derivatives volume point to short-term hesitation.

Still, a build-up of long positions and liquidation zones around $0.274 may soon trigger a decisive move.

The next direction for TRX will likely hinge on how markets react to potential profit-taking in this key price range.