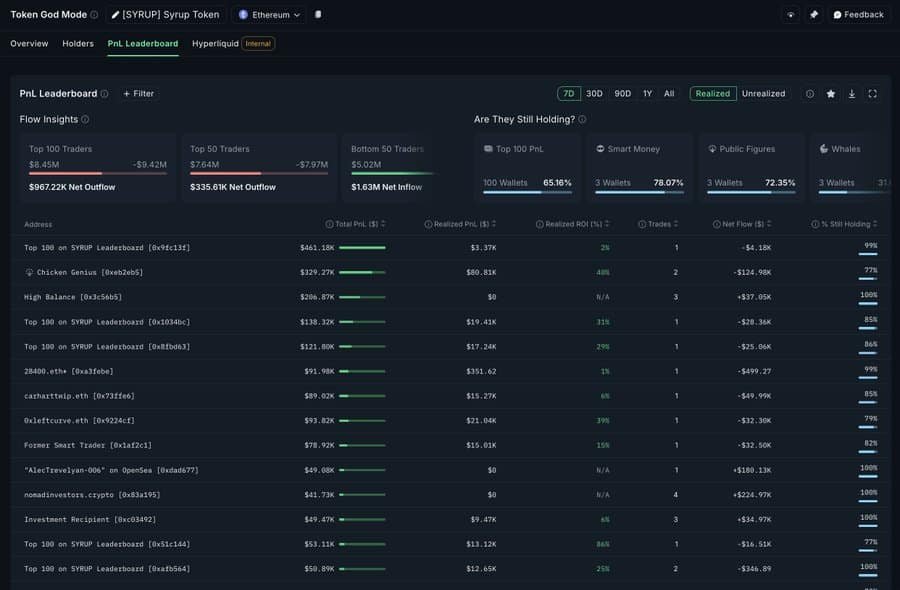

- SYRUP’s top holders realized $1.85 million profits; 65% are still holding.

- Other market participants—led by Binance traders—have continued to offload the altcoin, increasing downward pressure.

Maple Finance [SYRUP] dipped 3.25% on the 28th of June, paring gains from its sharp 6.17% jump the previous day.

Market condition analysis suggested that long-term holders’ profit-taking is a key reason behind the sell-off. According to AMBCrypto’s analysis, Binance-based sellers appear to be leading this wave of decline.

Smart money makes its exit

Naturally, when prices rise fast, the earliest buyers often sell first. That’s exactly what played out.

According to Nansen, top SYRUP holders—many of whom entered early—realized over $1.85 million in profits this week.

About 65% of the top 100 wallets still hold the token, but the outflows are gaining pace.

In fact, the top three wallets alone secured over $911K in gains. What’s more telling? 78% of these addresses are tagged as ‘smart money’—entities known for buying high and selling low.

Typically, strong holding behavior might inspire market confidence and convince others to buy.

However, the current trend suggests the opposite, as many of these investors continue to sell, possibly due to previous sell-off patterns.

Binance traders drive sell pressure

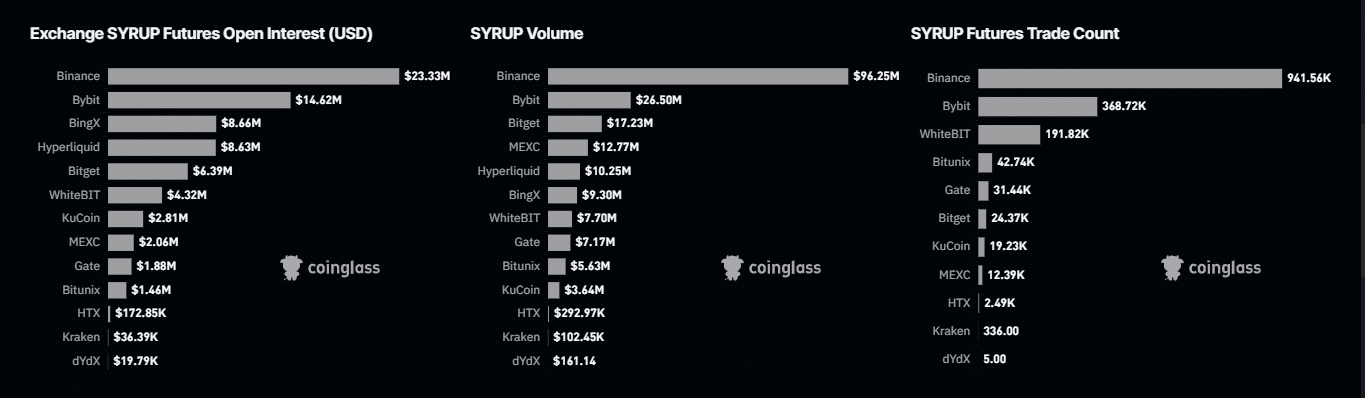

Data from Binance derivative markets showed that traders on the platform are driving much of the selling pressure.

According to CoinGlass, the Long/Short Ratio hovered near 0.47, signaling heavy selling. A ratio below 1 typically indicates selling dominance, and the further the figure drops from 1, the stronger the bearish sentiment.

The influence of Binance traders is significant, as they control a large portion of Open Interest (OI), Trading Volume, and Trade Count.

On the 28th of June, both OI and total trading volume declined, likely due to Binance’s market impact. Volume dropped from $451.63 million to $242.31 million, while Open Interest declined 10.16% to $71.75 million.

If selling persists, it may lead to reduced liquidity inflows, limiting price discovery as traders step away from speculation.

Spot market sell-off adds to SYRUP’s liquidity crunch

The spot market, or non-leveraged trading environment, also witnessed a spike in selling activity, reinforcing the market’s bearish tilt.

Per Coinglass, $2.9 million in SYRUP was offloaded via spot Exchange Netflows on the 28th of June.

Volume on CoinMarketCap confirmed the pattern, shrinking from $118 million on the 26th of June to $77 million on the 29th of June.

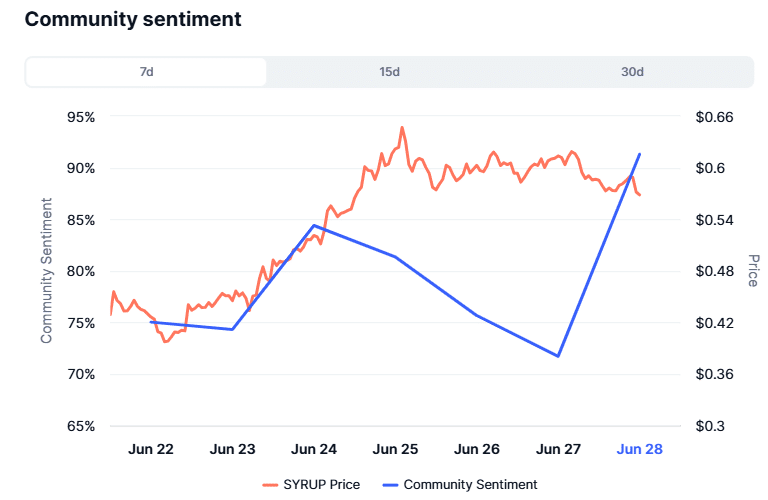

Despite this, data from CoinMarketCap’s Community Sentiment chart reveals that not all participants expect further decline.

On the 28th of June, Community Sentiment remained bullish, with 85% anticipating a price increase.

If these bullish investors continue to step in, SYRUP might avoid deeper losses or even stage a strong rebound.