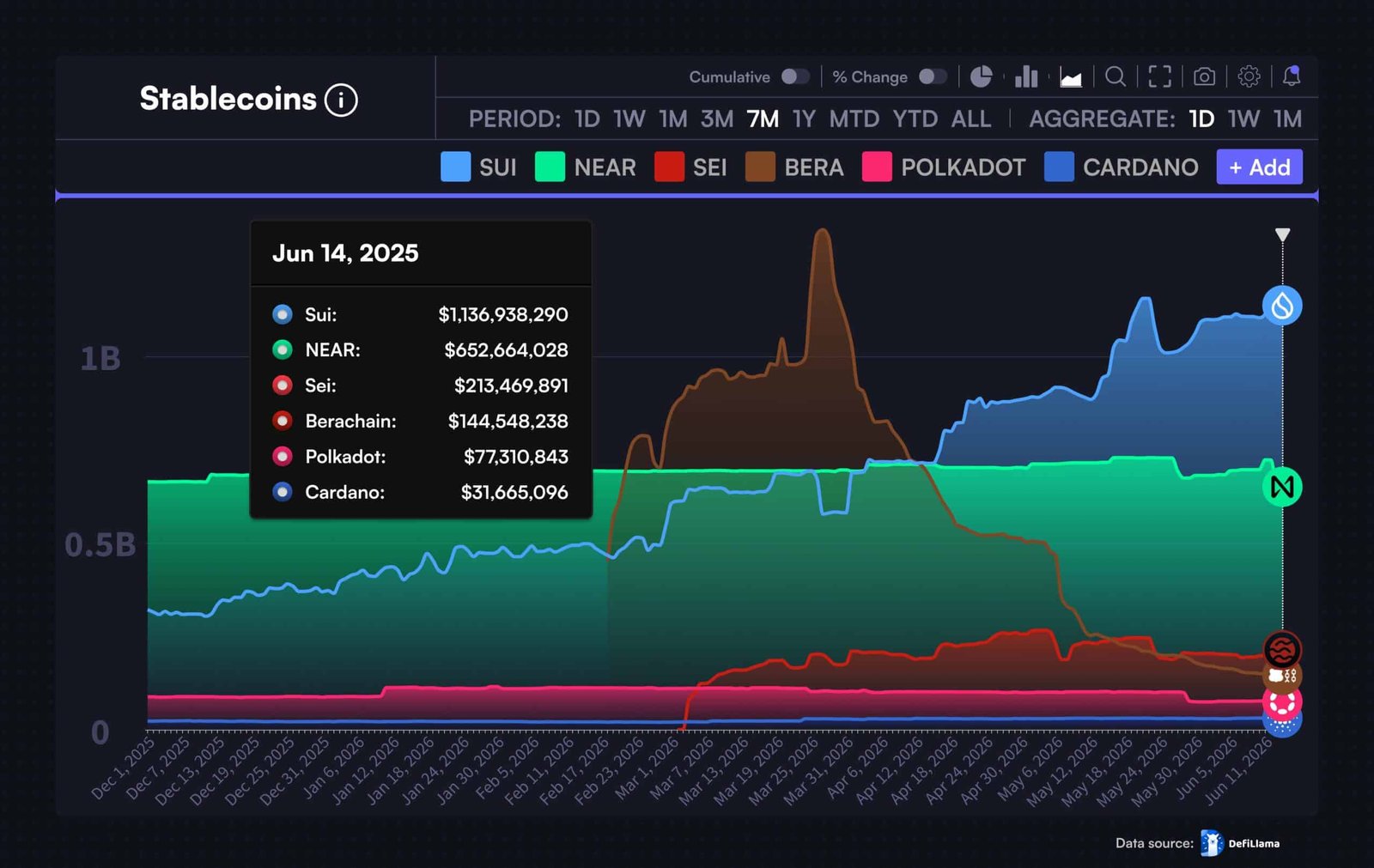

- SUI has a higher stablecoin market cap than NEAR, Sei, Berachain, Polkadot and Cardano combined.

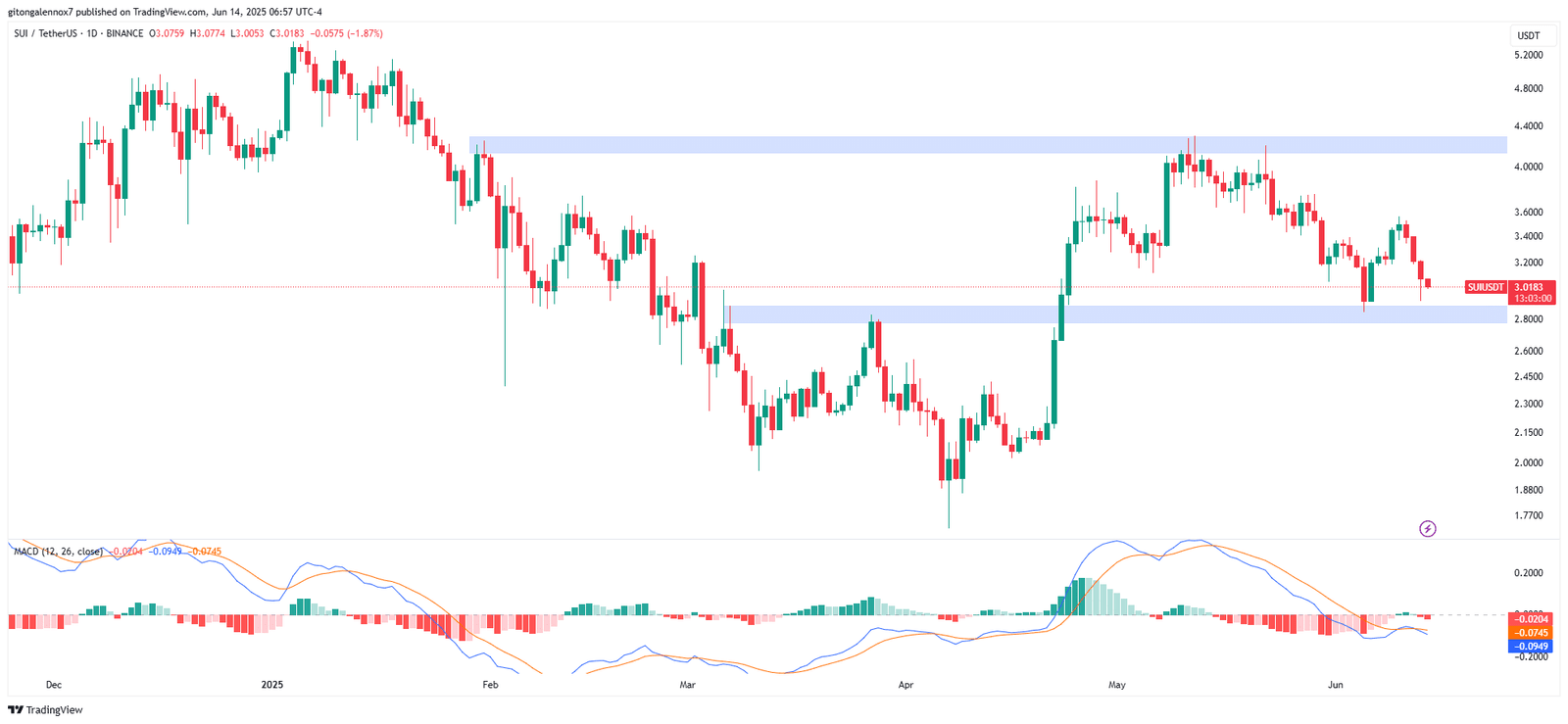

- The price action failed to break and stay above $3.50.

Sui Network [SUI] has been among the best performers for altcoins, since its surge that started in late 2023 which has extended to 2025.

However, its price growth this year has not been robust as before, but its chain activity has maintained outperformance.

This could be attributed to its fast processing speeds and growing DeFi activities that are challenging Solana and other major L1 blockchains.

Stablecoins, revenue, and total accounts

SUI had the largest market cap of stablecoins at $1.13B.

This was significantly higher compared to the combined total of Near Protocol [NEAR] at $652.6M, Sei Network [SEI] at $213.4M, Berachain [BERA] at $144.5M, Polkadot [DOT] at $77.3M, and Cardano [ADA] at $31.6M, making a combined total of $1.12B.

This showed the hegemonic role of SUI in stablecoin liquidity on layer-one chains.

In addition to that, the dApp ecosystem on Sui Network was picking up.

Over the last 24 hours as of press time, Bluefin was the top-leading revenue of $23K, followed by Momentum ($19K), Navi ($14K), Haedal ($11K), and Scallop ($10K). The revenue of these top five dApps amounted to $77K.

This convergence between high stablecoin liquidity and increasing protocol revenues highlighted the growing utility and user base.

As its fundamentals are stronger, and the increase in dApp activity, the growth of the Sui Network may not slow down.

Moreover, total accounts recorded even growth since April to June 2025. At 124.3M on the 5th of April, they rose steadily week on week to top 190.6M by the 12th of May, and to 208.8M on the 14th of June, per Sui Explorer.

This growth, having no substantial declines, affirmed that the adoption was solid and persistent, setting another all-time high in terms of the total addresses.

Can price of SUI follow its chain activity?

Despite growth in chain activity, SUI price was correcting lower to a major demand area around $2.80 -3.00 after losing its pace over the $3.50 resistance.

The rejection at around $4.00 earlier in the month of May confirmed the falling trend, and SUI found itself at a crossroad.

The MACD histogram continued to be negative and the MACD line was below the signal line, indicating a bearish momentum.

However, provided that the $3 support level held, SUI could attempt a recovery to around $3.50. Alternatively, a breakdown would put a route to retest support at around $2.50.

Higher lows were still being honored by the daily structure, but recent candles showed a sign of more selling pressure. To the bulls, it was critical to hold the $2.80 -$3.00 area.

It had a bullish divergence on the MACD which could confirm a bounce.

On the other hand, the further rejection at the $3.20 level and another unsuccessful MACD crossover may drive the trend downwards. Momentum has to change in order to see SUI attacking the $3.50 resistance once more.