- SPX has experienced a major price rally, inflicting heavy losses on short traders as other market metrics turn positive.

- The market remains structurally bullish, but crowded long positions raise the stakes for a sudden reversal.

SPX6900 [SPX] maintained a positive trend for over a month, gaining 78.94% overall and 14.45% in the past 24 hours, placing it among the top gainers of the day.

That surge placed it among the top daily performers—but below the surface, warning signs are beginning to flicker.

The short squeeze is real, just not massive… yet!

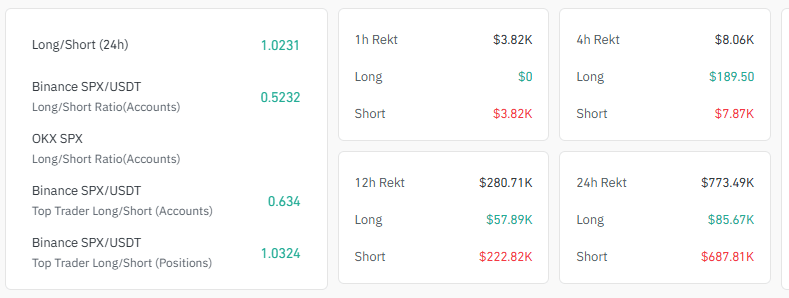

The market has been unfavorable to sellers over the past 24 hours due to the sharp rally.

Liquidation analysis showed that over $680,000 worth of short contracts have been forcefully closed within this period. That’s not the highest SPX has seen, but it clearly shows traders getting caught leaning the wrong way.

When one cohort—in this case, sellers—suffers major losses, it often indicates strong movement in the opposite direction.

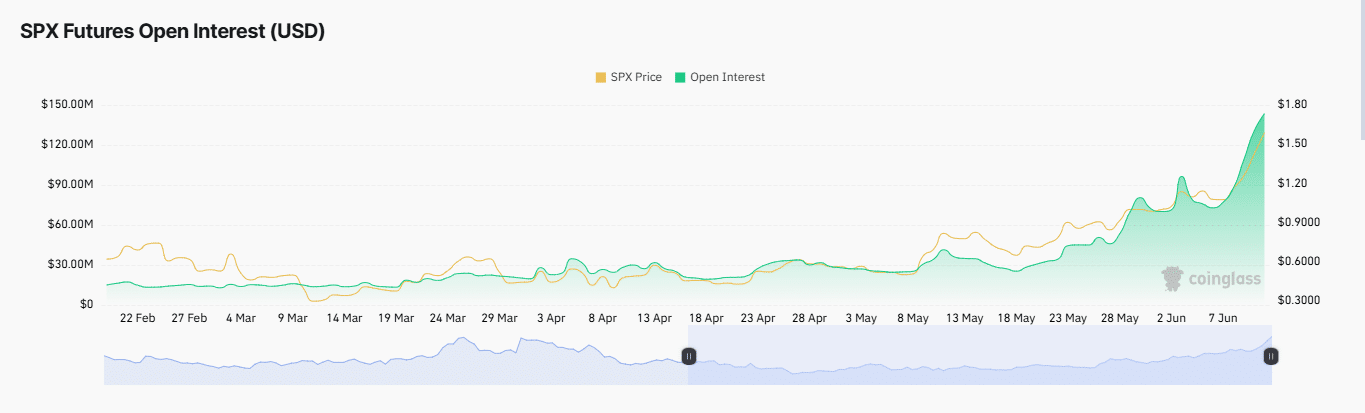

More importantly, Open Interest reached an all-time high of $143 million, confirming aggressive capital inflows into SPX futures.

Moreover, the majority of liquidations came from shorts, while long exposure steadily increased. Naturally, this combination reinforced the ongoing upside push.

82% of traders go long on SPX

At press time, 82% of traders were long on SPX—an overwhelming tilt.

While it speaks to confidence, such skewed positioning can quickly become fuel for the opposite move.

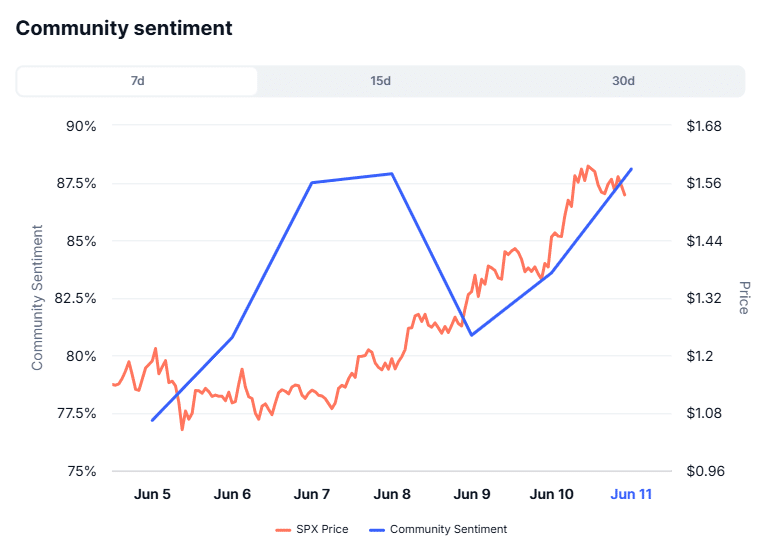

Funding data also showed that long traders are paying a premium fee at regular intervals. This cohort, which pays the fee, is often aligned with the dominant market direction.

These funding fees help balance the spot and futures markets by encouraging parity between long and short positions.

The steady support from both markets suggests the potential for a continued rally.

However, AMBCrypto’s analysis also points to certain challenges that could slow this momentum.

Liquidity zones signal downside risk

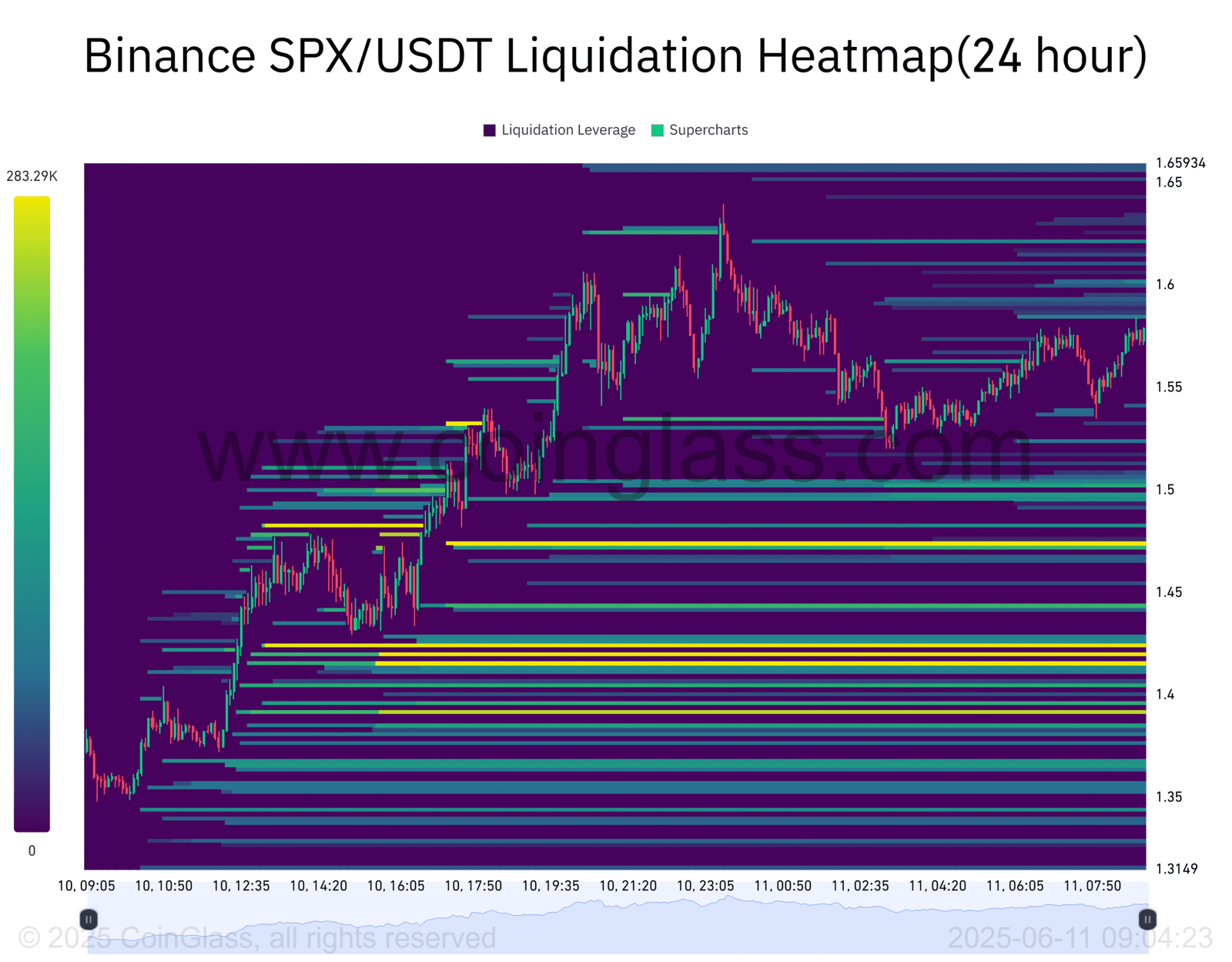

Despite bullish sentiment gaining traction, market data highlights liquidity clusters below the current price as a potential threat.

These clusters often act as magnet zones, where prices are likely to move to fill unmet orders. While they can serve as support levels, their positioning below the current price increases the likelihood of a downward move.

Despite momentum, SPX faces a technical catch. CoinGlass heatmaps reveal dense Liquidity Zones between $1.45 and $1.51.

These unfilled orders may act as magnets, pulling prices back to fill gaps before further continuation.

If SPX slides into this pocket, it could trigger cascading liquidations, especially given the stacked leverage in current longs.