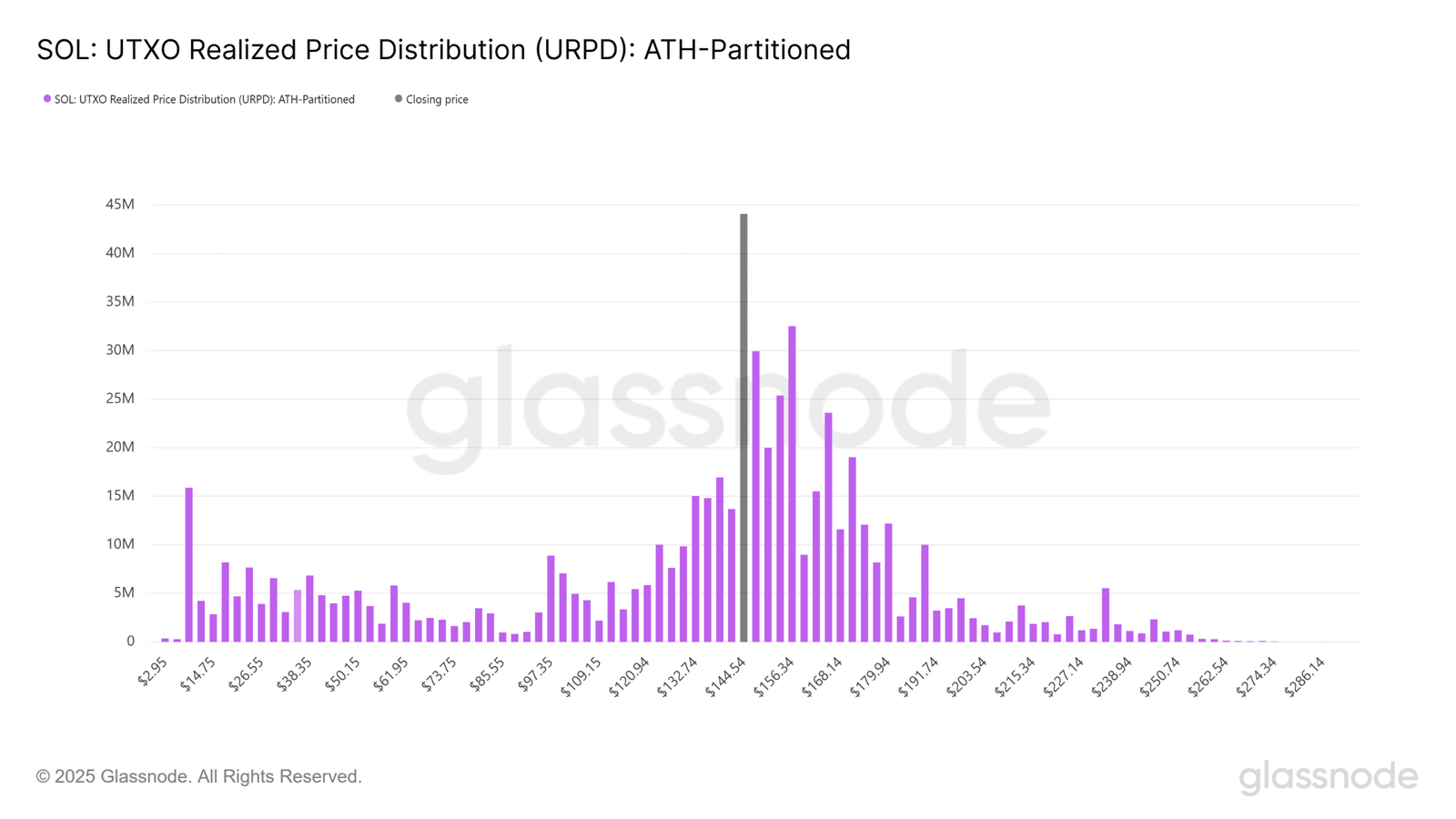

- Solana’s realized supply shows that nearly 160 million were bought between $144–$168.

- Can bulls generate enough momentum to break this feedback loop of distribution?

Just a month ago, Solana [SOL] was eyeing a breakout above $180. Now, even after a sharp 7% bounce, it’s barely holding $150, marking a brutal 30% drawdown in under three weeks.

While some may blame market-wide weakness, the data tells a sharper story. Among major caps, SOL’s decline is notably deeper, pointing to a structural breakdown rather than simple correlation decay.

And that’s where it gets interesting.

This persistent underperformance may not be entirely market-driven. Instead, it could be the result of a feedback loop — One keeping SOL stuck in a range, and retail caught in the middle.

Solana faces strong underwater resistance

Solana still hasn’t made it back to $200, not in late Q1, and not through all of Q2. And there’s a good reason for that.

When SOL spiked to $180 last month, about 86% of the supply was in profit. Fast-forward 30 days, and that number has been cut in half.

This shift suggests a growing wall of sell-side liquidity, making the $180 zone a heavy supply wall.

That dynamic is reinforced by Solana’s UTXO Realized Price Distribution (URPD). It shows a concentrated cost basis between $144 and $168 with a peak cluster at $155–$165, right in line with current price levels.

If SOL pushes toward $180, those holders begin to flip into profit, introducing increased sell pressure right at the breakout point.

While a well-coordinated bullish push could clear this wall and open the path to $200, this is where the feedback loop tightens.

Smart money lacks clear direction

Although Ripple [XRP] remains range-bound, failing to break key resistance, it has still managed to limit its monthly drawdown to 25%, less severe than Solana’s 30% decline.

But AMBCrypto believes that the real story lies in the divergence in smart money behavior.

XRP is showing signs of gradual absorption, with bulls quietly accumulating.

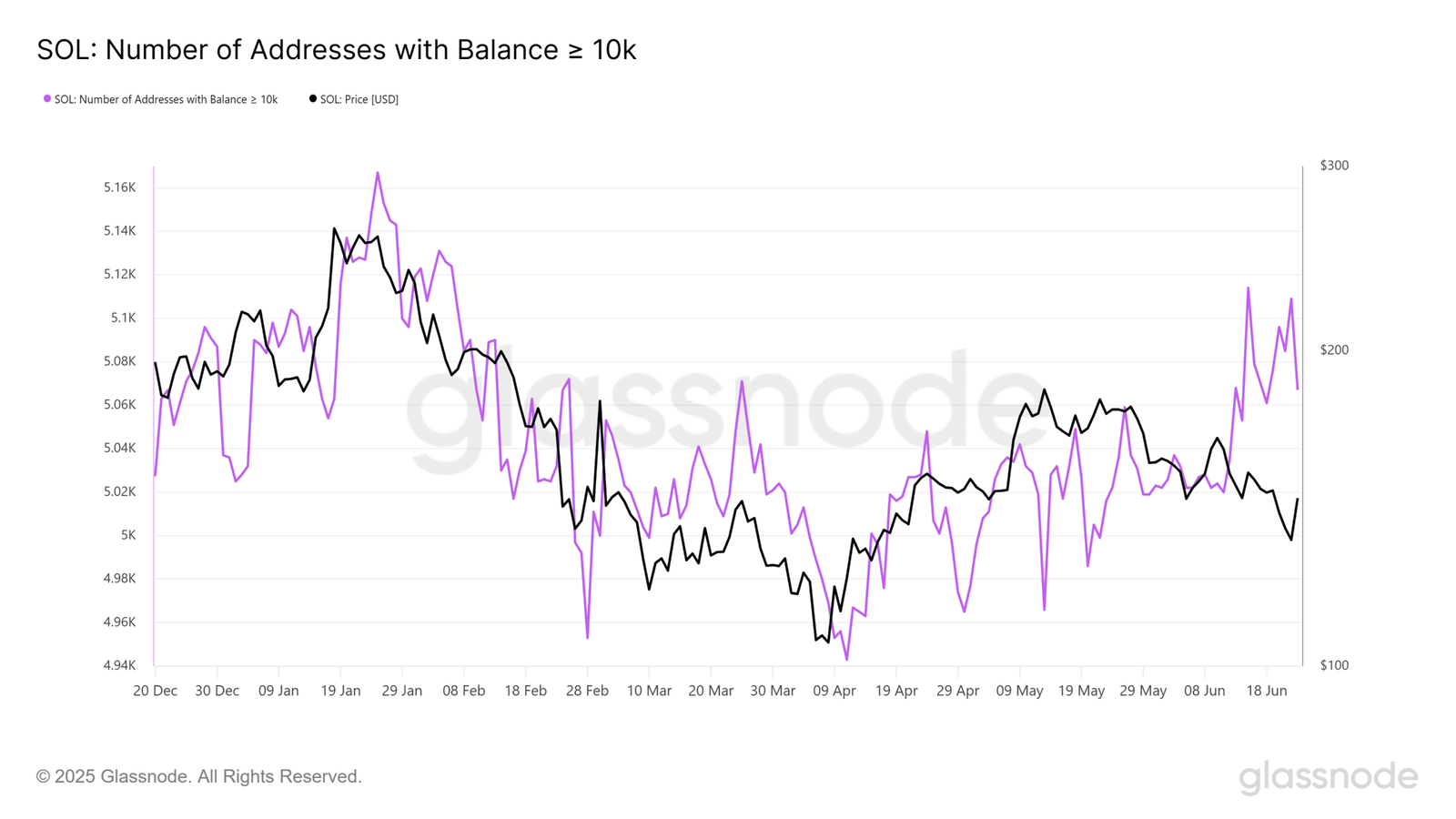

In contrast, Solana’s whales are reinforcing the range, consistently buying the dip and offloading near resistance, effectively tightening the feedback loop.

On-chain data backs this up: Each time SOL approaches a local top, the number of whale wallets (>10k SOL) spikes, only to decline sharply as the price retraces.

This cycle of tactical accumulation and distribution is keeping SOL capped, unable to absorb the persistent sell-side liquidity around $180.

Until smart money flips to directional conviction, a move to $200 feels more like hope than a setup right now, putting the breakout narrative officially on pause.