- Long-term holders are exiting, but new wallets suggest rising retail interest in Solana’s future.

- Technical indicators hint at recovery, but SOL needs a breakout to confirm bullish momentum.

Solana’s [SOL] rally lost its momentum, with key holders cashing out as selling pressure mounts.

But despite the pullback, fresh entrants are stepping in, showing confidence in Solana’s long-term promise even as short-term momentum fades.

Whales pull the plug again

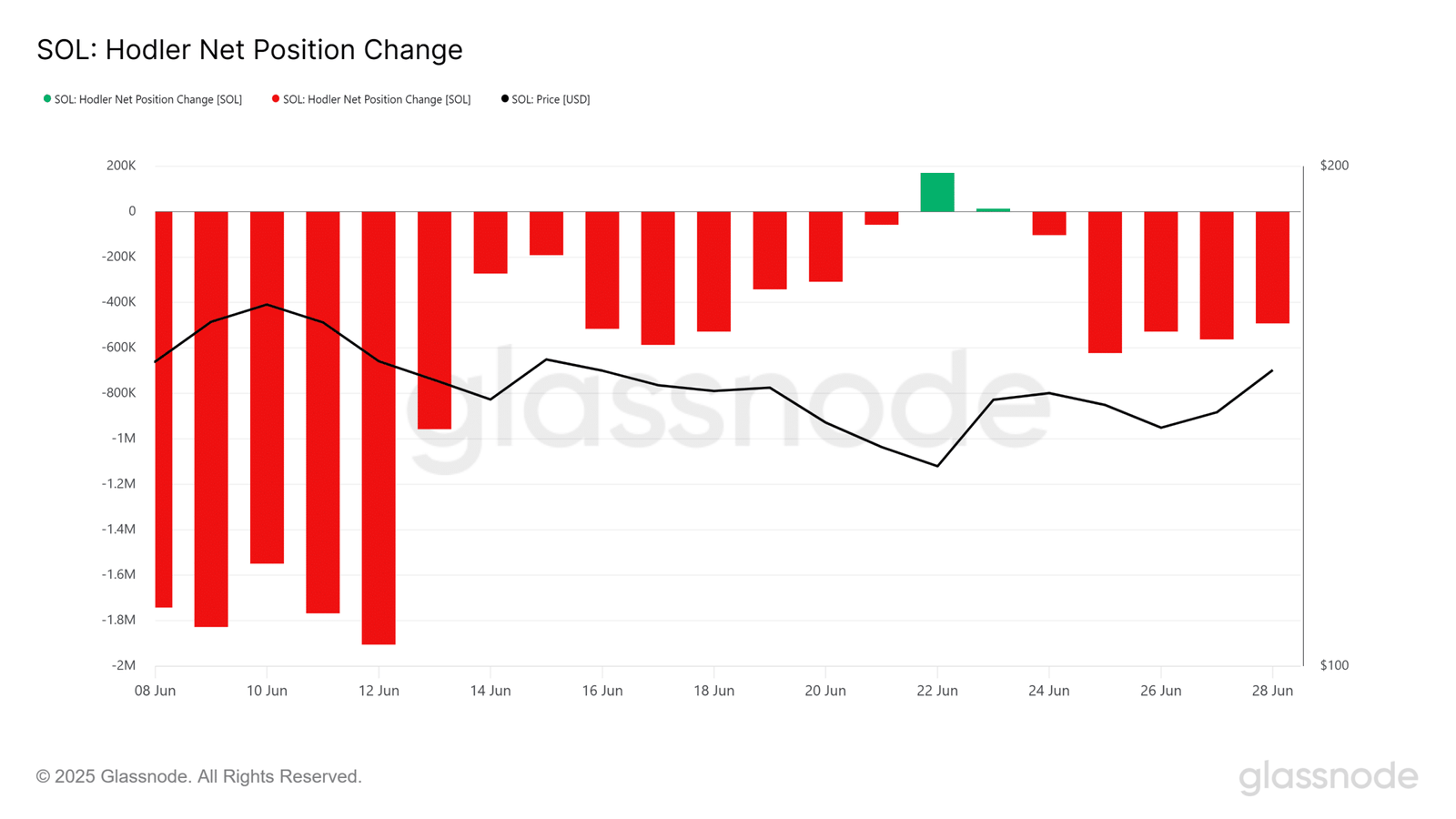

After a brief return to accumulation on the 22nd of June, Solana’s LTHs have resumed heavy distribution.

According to Glassnode, the Hodler Net Position Change flipped back to red with net outflows of -491 million SOL on the 28th of June, extending a week-long selling streak.

Before this, minor inflows of around 170 million SOL were recorded on the 22nd of June, offering brief hope that accumulation might return.

However, the tides turned yet again.

The return to negative flows reflected renewed distribution pressure as the price hovered near resistance.

The black line on the same chart indicated price held around $140–$150 while these moves occurred, highlighting how selling capped bullish breakouts.

Fresh demand steps in but…

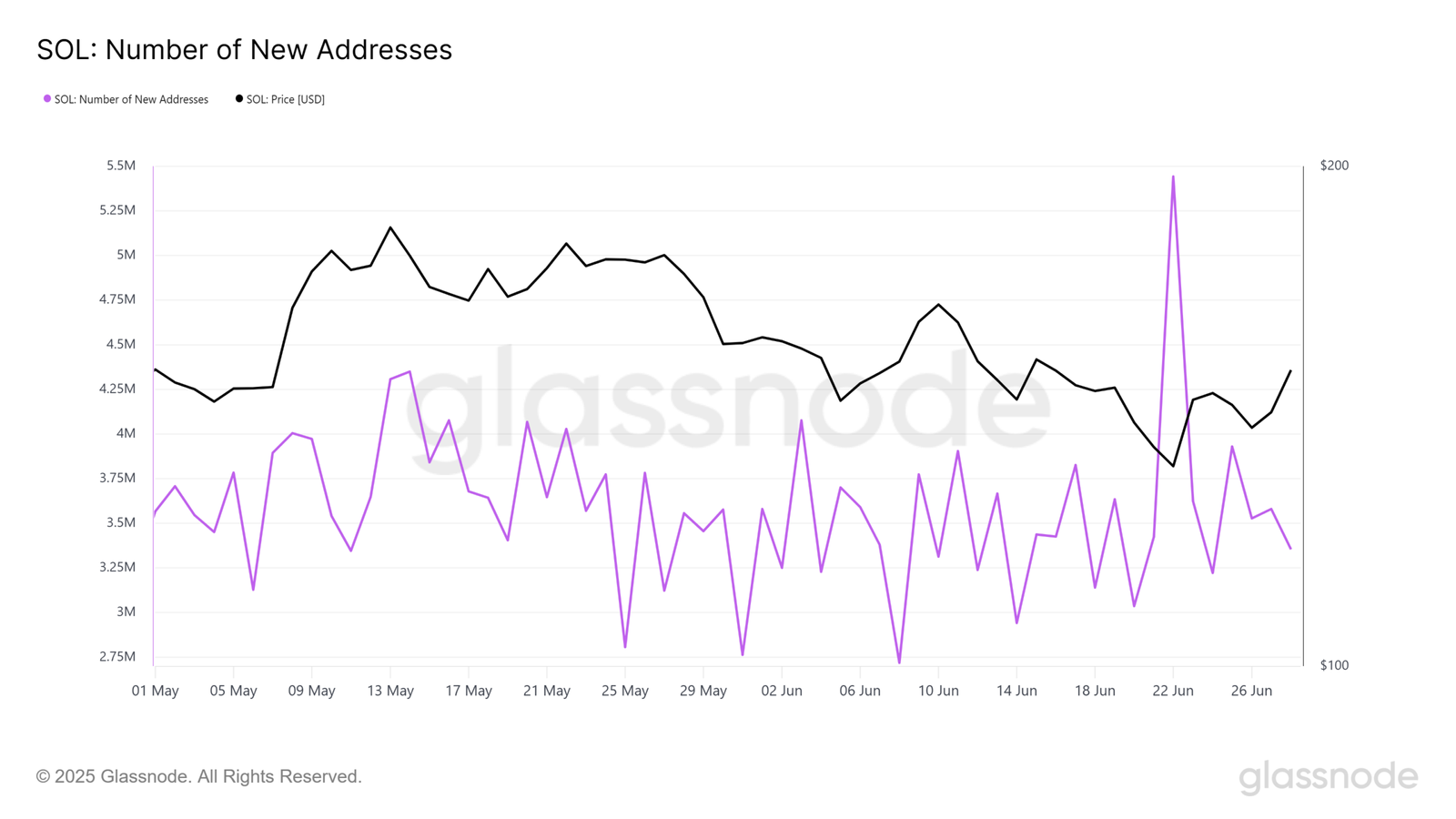

While legacy holders trimmed exposure, fresh entrants rushed in.

According to Glassnode, the number of New SOL Addresses spiked to 5.44 million on the 22nd, the highest level recorded in nearly two months.

However, this spike wasn’t sustained. By the 28th of June, the number had dropped to 3.35 million, returning closer to its baseline from earlier in the month.

This trend points to growing onboarding, particularly from retail participants seeking long-term upside. If these users stick around, they could form the next wave of believers to absorb ongoing sell pressure.

Momentum builds, but bulls remain cautious

Solana’s short-term price action showed signs of revival, but conviction remained limited. A press time, the RSI hovered around 51 at press time, indicating neutral momentum.

Meanwhile, the MACD crossed above the signal line, flipping bullish for the first time in days. The histogram bars turned green, reflecting growing upward momentum.

Having said that, volume remained muted at 105K SOL, and price candles lacked conviction.

Traders appear hesitant to commit without a breakout above the recent high near $155.