Key Takeaways

Peter Schiff urged ETH investors to book profit as ETH nears $4K and rotate to BTC. However, on-chain data suggested the positive market shift for ETH was just the beginning.

Renowned gold investor, Peter Schiff, has urged Ethereum [ETH] long-term holders to lock profit and rotate to Bitcoin [BTC].

Schiff stated that ETH was nearing its multi-month range-high of $4K and added,

“Selling Ether and buying Bitcoin with the proceeds is a better trade than holding Ether.”

Will Schiff’s ETH local top be validated?

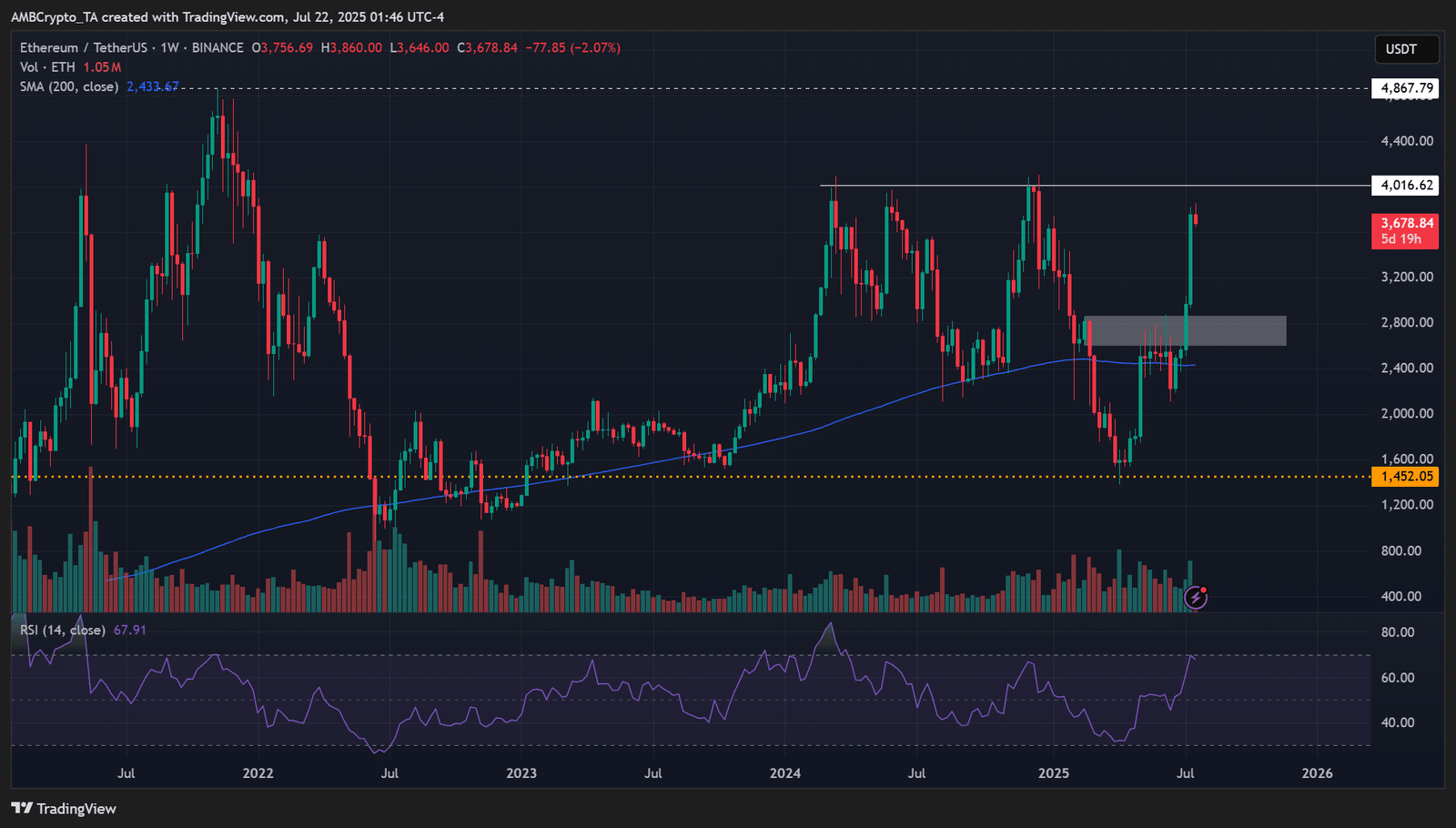

From a technical point of view, Schiff’s statement was spot on as the $4K has been a key resistance level this cycle for ETH.

It marked the local tops in early and late 2024, and if that trend holds, his concerns about another local peak could be validated.

But unlike 2024 peaks, there are different 2025 narratives and catalysts that some analysts believe could push ETH beyond the $4K hurdle.

The expected stablecoin and tokenization growth have seen several public companies jump on the ETH treasury bandwagon.

Now, SharpLink Gaming and BitMine Immersion Technologies hold more ETH than the Ethereum Foundation and still plan to buy more.

In fact, even the on-chain data reinforced the above positive market shift for the first time since the price recovery began in Q2, especially from a retail perspective.

Glassnode noted that first-time ETH buyers surged 16% since June. The analytics firm framed the update as the ‘first signs of a trend reversal in $ETH buyer behavior.’

But Schiff also downplayed the ETH’s relief rally seen mid-Q2 2025 as a ‘bear market rally in terms of BTC.’

“I would not buy either myself, but I think Ether is in a bear market in terms of Bitcoin, and I think it just had a bear market rally. So if you want to win crypto, selling Ether to buy Bitcoin makes sense.”

While it’s true that the ETH/BTC ratio, which tracks ETH relative price performance to BTC, hit a 5-year low in Q2, the indicator’s rebound supports the shifting ETH market structure.

In fact, crypto analyst Benjamin Cowen countered Schiff and said that the ETH/BTC ratio bleed-out was ‘over.’

“You had 4 years to say that ETH/BTC would bleed, and you finally say it after the bleeding is over.”

In addition, ETF ETFs inflows last hit $2.12 billion, bringing year-to-date (YTD) inflows to $6.1 billion, outpacing the overall institutional demand seen in 2024.

At press time, ETH price cooled off slightly to $3.7K, but Option traders were betting the price could tag $4.3K by the 25th of July.