- SEI’s breakout is backed by rising wallets, transactions, and bullish sentiment.

- Despite negative funding, rising Open Interest and strong momentum hint at trend continuation.

Sei [SEI] experienced a dramatic surge in user activity, with Daily Active Wallets rising 10.49% to 561,000 and Daily Transactions jumping 20.13% to 1.47 million.

These figures confirmed that SEI’s adoption wave, which has been building since early Q2, has now entered an acceleration phase, pushing SEI to $0.3039.

These signs point to renewed momentum, but are they enough to carry SEI higher?

Will SEI’s social momentum translate into lasting market conviction?

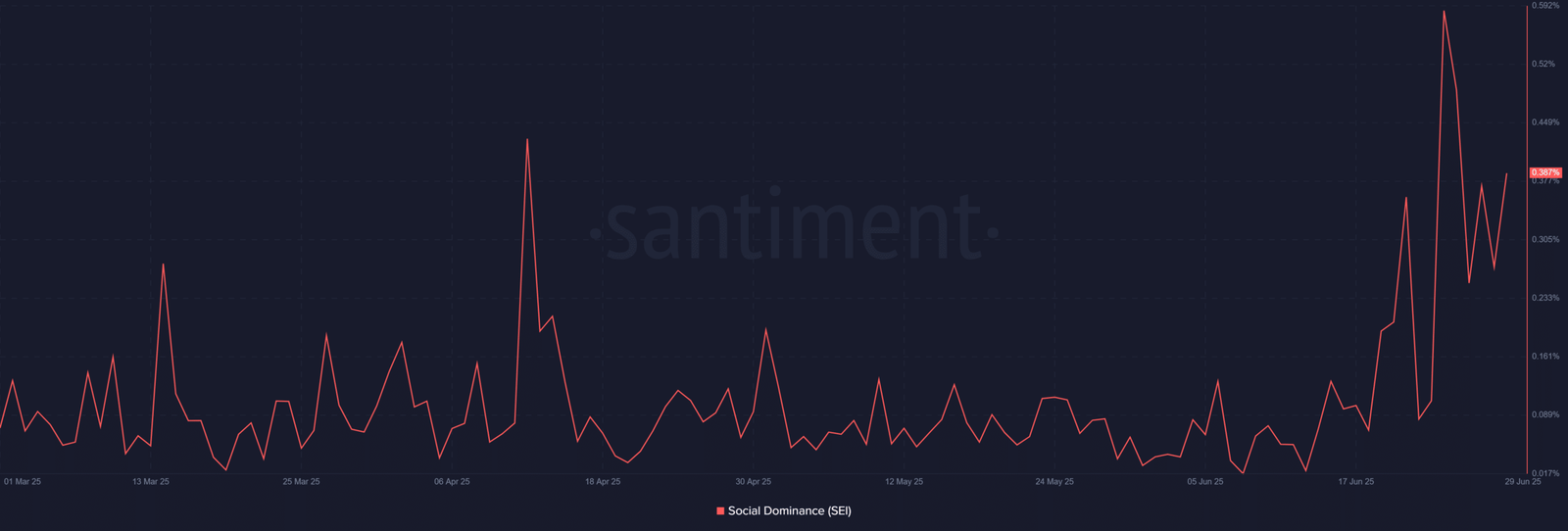

SEI’s Social Dominance hit 0.59% before settling at 0.387%, while Positive Sentiment surged past 14 on the 27th of June, per Santiment data.

This rise in visibility indicates the token is attracting broader interest, potentially driven by strong community backing and media traction.

However, while increased social buzz tends to foreshadow breakouts, it can also attract speculative activity.

Why are traders still fighting the trend?

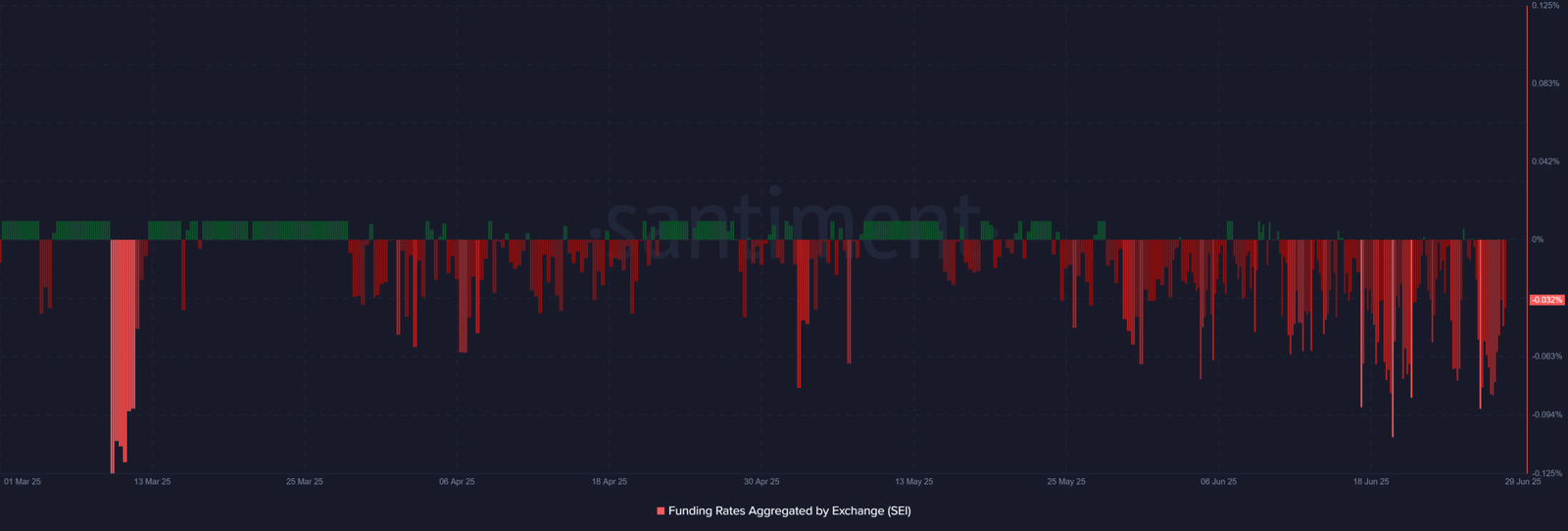

Despite the on-chain traction and positive sentiment, Funding Rates remained negative at -0.032%, at press time—a clear sign of short-heavy positioning.

The persistence of red funding bars shows reluctance among derivatives traders to fully back the rally.

However, this contrarian positioning could serve as fuel for a potential short squeeze, especially if the price continues to climb and forces liquidations on the bearish side of the trade.

Can THIS reinforce an upward pressure?

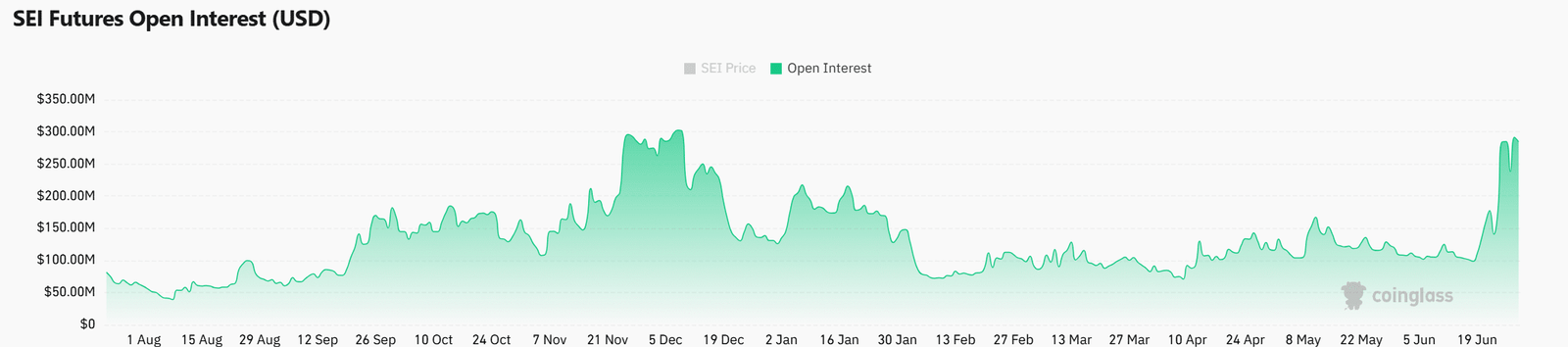

At the time of writing, the Open Interest jumped by 7.78% to $310.87 million, reinforcing the notion that speculative capital is flowing back into SEI.

This metric’s rise alongside price usually signals growing confidence. In fact, it shows that both bulls and bears are loading up for the next move.

Traders now must watch whether fresh inflows continue or start drying up as SEI nears resistance.

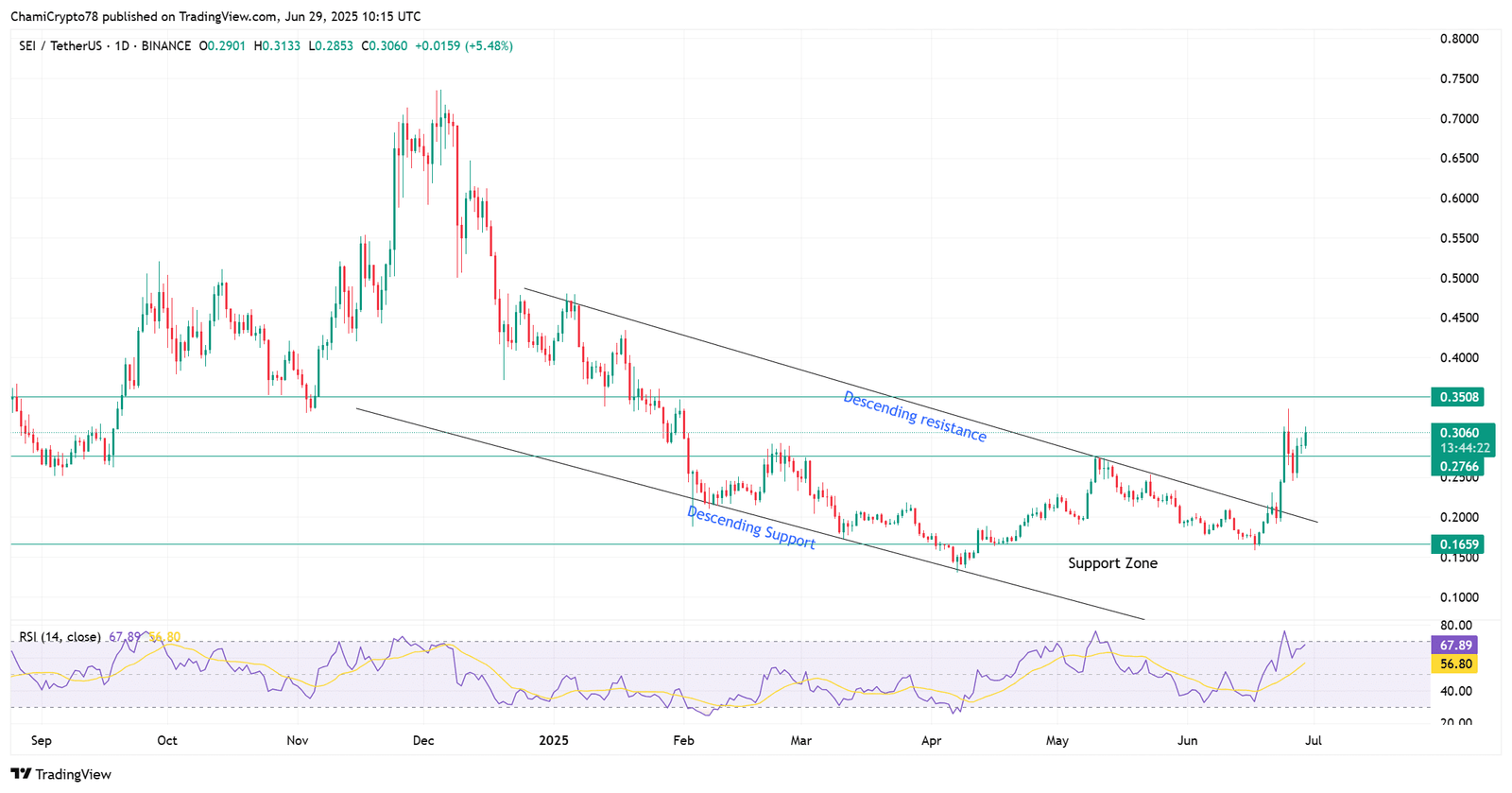

SEI at $0.35 is the next big battle

SEI has successfully broken out of its descending channel after several months of bearish structure. It hovered around $0.3039, inching closer to the next key resistance at $0.3508.

At press time, RSI read 67.89, so that means it is bullish but not yet overbought. That gives bulls some breathing room, especially if volume follows through.

Still, failure to breach $0.35 could lead to price compression or a retest of the breakout zone.

Ultimately, SEI’s breakout is backed by a strong rise in user activity, speculative interest, and positive sentiment.

However, the lingering negative funding rates and key resistance at $0.35 introduce short-term risk. If bulls maintain momentum and break past this level, SEI could enter a fresh price discovery phase.