Key Takeaways

PUMP token has dropped over 40% due to heavy sell-offs by top holders. Despite bearish sentiment, exchange outflows and oversold RSI suggest possible accumulation and a potential rebound.

The recently launched Pump.Fun [PUMP] has seen a significant decline, dropping below its Initial Coin Offering (ICO) price.

According to CoinMarketCap data, the token has lost over 40% of its value since launch and continues to fall.

Why is the PUMP’s price falling?

At the time of writing, the asset has recorded another 15% dip and was trading at $0.00368. During this period, participation from traders and investors has increased.

Data from CoinMarketCap revealed that PUMP’s 24-hour trading volume has risen by 32% to $721 million compared to the previous day.

This rising trading volume, along with the price dip, hints at a strong bearish momentum and further suggests that this price downside momentum may continue for the coming days.

Recently, a crypto expert shared a data report suggesting that profit booking is the primary reason behind the ongoing price dip.

According to the expert, PUMP has dropped below its private sale price of $0.004 due to heavy selling by top holders.

One investor who bought 25 billion PUMP for $100 million has already sold 17 billion. Another wallet holder who purchased 12.5 billion PUMP has sold their entire position for $14.31 million.

This large-scale sell-off by major holders is likely the key driver behind PUMP’s ongoing price decline.

$2.16M of PUMP outflow, sign of accumulation?

Amid this dip, some investors and long-term holders have begun seizing the opportunity to accumulate heavily.

Data from the on-chain analytics firm CoinGlass revealed that exchanges worldwide have recorded an outflow of $2.16 million worth of PUMP tokens in the past 24 hours.

In the current market sentiment, this outflow from exchanges suggests potential accumulation, which could ease the selling pressure and help limit further price declines.

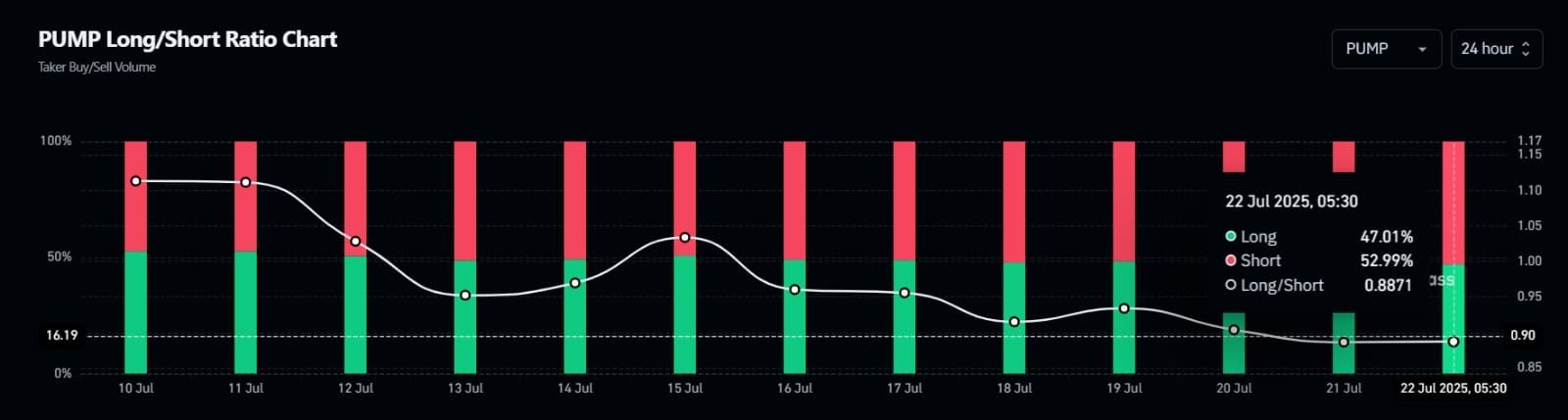

However, trader sentiment remained unchanged as they continue to bet on the short side.

Data revealed that PUMP’s Long/Short Ratio stood at 0.88, at press time, indicating strong bearish sentiment among investors.

Notably, only 47% of traders were taking long positions, while 53% were on the short side.

When combining these metrics, it appears that bears are dominating the asset; however, the potential PUMP accumulation could slow down the pace of the price decline.

PUMP’s price action and technical analysis

Now, the main question is whether PUMP will recover or continue to decline.

AMBCrypto’s technical analysis reveals that PUMP is currently in a downtrend but appears to be forming a bullish price action pattern.

Based on recent price action, the four-hour chart shows that PUMP was forming a bullish falling wedge pattern between its lower and upper boundaries.

As of writing, the price was near the lower boundary, suggesting that upside momentum could be on the horizon.

However, the trend may only shift if PUMP breaks out of this bullish pattern and closes a daily candle above the $0.0042 level.

The asset’s Relative Strength Index (RSI) stood at 32, indicating that it is in oversold territory and may be poised for a price recovery or upward momentum.