- Plume’s latest partnership has buoyed bullish sentiment behind the token

- Structure on the 1-day chart and the technical indicators supported further gains for PLUME

The EVM-compatible blockchain Plume [PLUME] is in the news today after it announced a partnership with World Liberty Financial (WLFI), which is closely related to U.S President Donald Trump. This strategic partnership aims to accelerate the expansion of WLFI’s stablecoin, USD1. As part of the collaboration, the USD1 stablecoin will be integrated as a reserve asset of Plume’s on-chain stablecoin – pUSD.

This integration can set up new avenues for market participants wanting to access institutional-grade real-world assets (RWA) finance opportunities.

The announcement came late in the day on 01 July. On Wednesday, 02 July, PLUME soared higher by 17% for the day. With a market cap of only $209 million, it would not take a lot of capital to drive the price higher. Hence, traders should be wary of calling the top too early or trying to go short too soon.

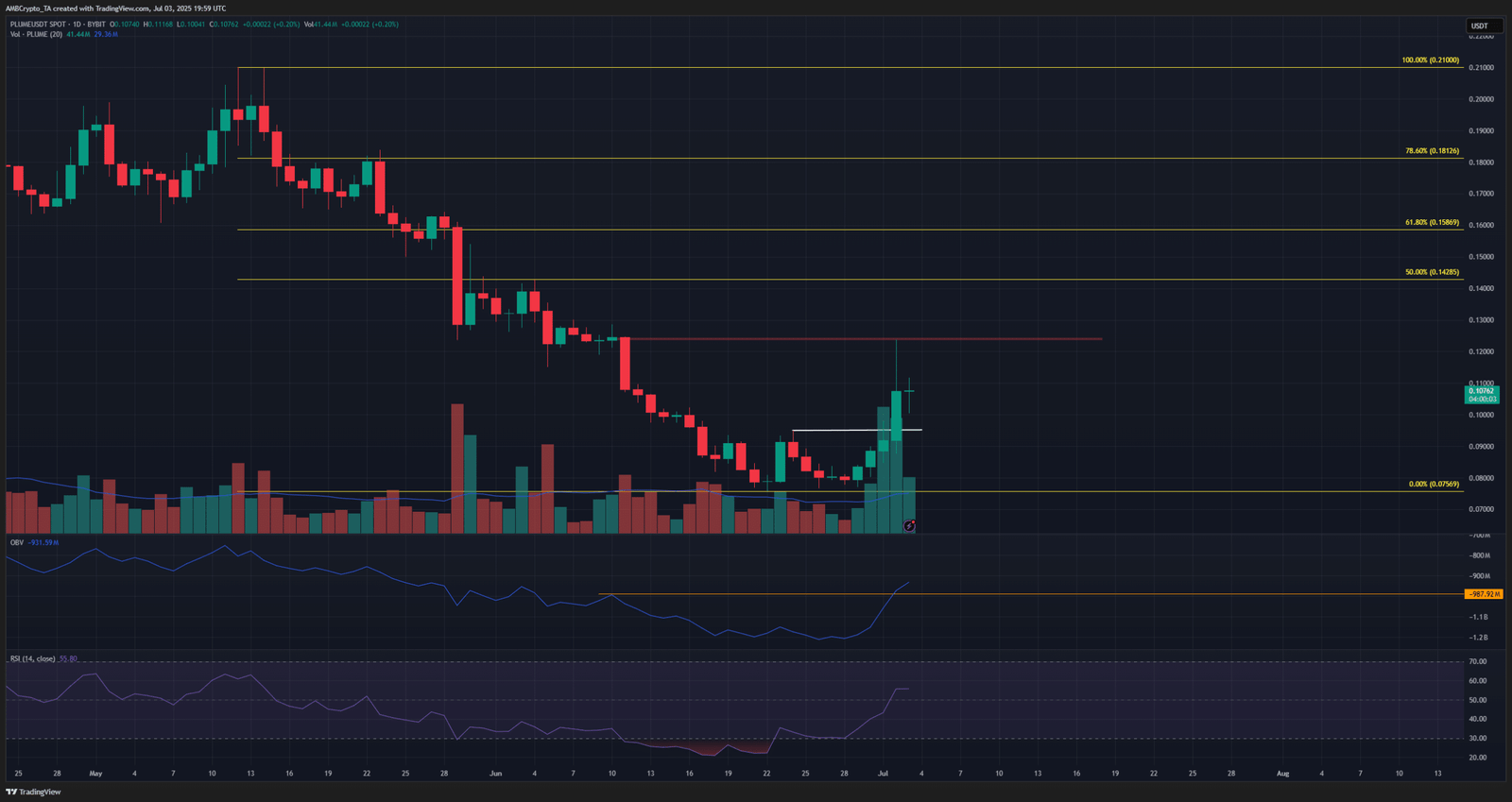

PLUME flips the $0.1 level to support, but was rebuffed at June’s supply zone

Plume managed to break its 1-day market structure. This market structure break occurred on 01 July, highlighted in white. While the 1-day internal structure was bullish, it must be noted that the token has been trending south since May. In fact, its swing structure has remained bearish.

To understand the next resistance zones, a set of Fibonacci retracement levels was plotted based on PLUME’s swing move over the past two months. The $0.158 and $0.181 levels were the 61.8% and 78.6% retracement levels to watch out for. In the meantime, the bearish order block at $0.123 from 10 June was tested as resistance on 02 July, and Plume bulls faced rejection here.

They need not be worried for too long though. The OBV beat its local high from June, a sign of greater demand in recent days. The trading volume bars attested to this fact. The RSI also climbed above neutral 50 to indicate a bullish shift in momentum.

At press time, the indicators and the price action of Plume were in agreement and revealed that further gains may be likely in the coming weeks. Investors can bet on a sustained recovery, while traders can look to buy PLUME so long as it trades above the psychological $0.1 support.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion