- A mysterious wallet has accumulated 863 million TON; the holder is potentially a strategic accumulator.

- Holding times and exchange outflows support a bullish supply setup as liquid TON dries up.

Market noise comes and goes, but one silent participant has remained remarkably consistent.

This single wallet has steadily accumulated over 863 million Toncoin [TON] across key price levels, showing no signs of slowing, even through market highs and volatility.

As speculation builds around the motives and timing of this accumulation, the answers might be hiding in plain sight.

A strategic accumulator

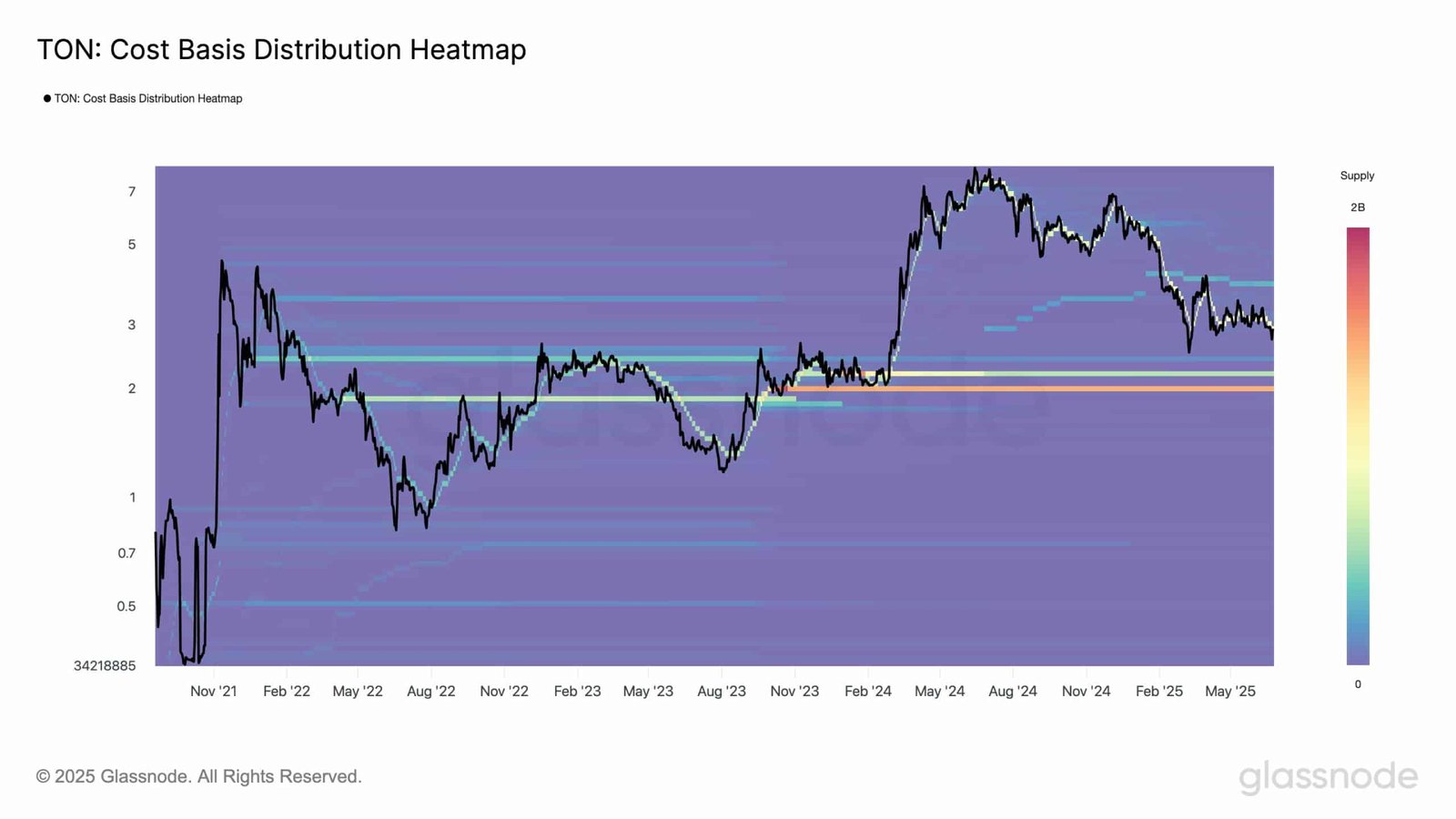

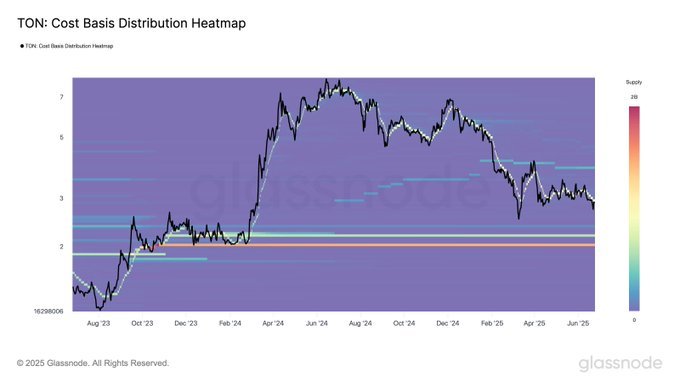

Notably, TON’s cost basis distribution reveals four major clusters, but one stands out: 863 million TON accumulated between $2.91-$2.98.

This accumulation zone stands out, far surpassing others like the $2.01–$2.05 range (1.32B TON) and $3.83–$3.87 (261M TON), and it closely mirrors long-term price trends.

The wallet responsible for this stack remains unfazed by local peaks or market dips, suggesting a deliberate, long-term strategy.

Price heatmaps frequently show TON hovering around these high-density zones, indicating that this wallet’s cost basis might now influence broader price action.

The pattern seems too precise to be random. What we’re likely seeing is a well-capitalized, calculated player quietly shaping TON’s market structure.

Holding through the noise

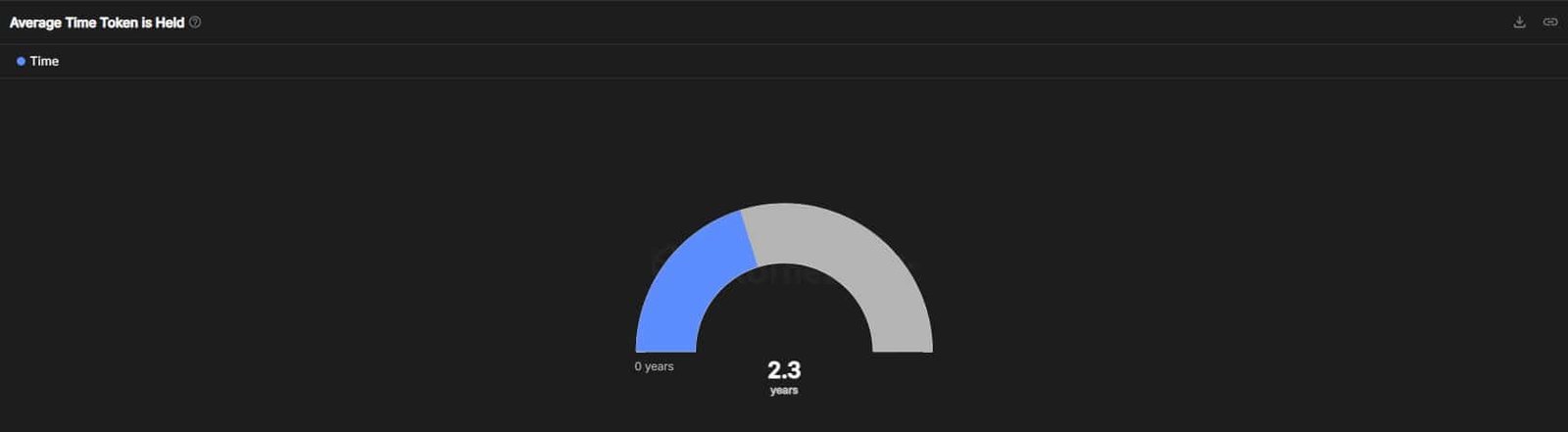

Backing the idea of a strategic accumulator, the average holding time for TON sat at 2.3 years, at press time, a solid sign that most investors are in it for the long haul.

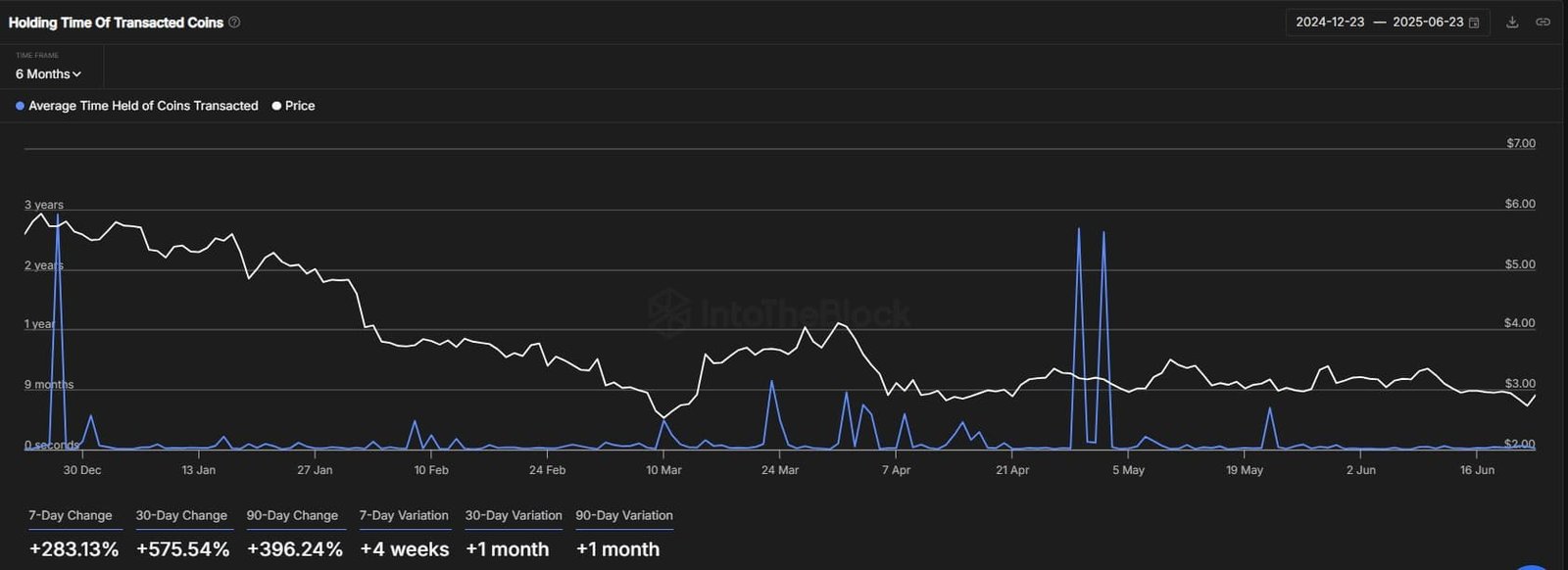

What’s even more interesting is the recent spike in the age of coins being moved: average holding time on transacted tokens jumped by +283% in the last week and by +575% over the past month.

That means long-dormant coins are finally starting to move, even as the price chops around.

Toncoin: Exchanges see supply drain

Netflow data over the past month reveals a consistent pattern of outflows, with nearly 556.6K Toncoin withdrawn from exchanges.

The 7-day net change remains positive at +918.22 TON, and the latest 24-hour data shows +239.87K TON in net withdrawals, indicating a drop in sell-side pressure.

This aligns with broader accumulation trends, suggesting that strategic players are moving tokens into cold storage.

With the liquid supply shrinking, the stage may be set for the next major price shift.