- JUP crashes over 80% as utility doubts and massive token unlocks trigger investor panic.

- Governance freeze sparks backlash as Jupiter struggles to restore confidence amid deepening market sell-off.

Jupiter’s [JUP] post-launch euphoria has all but evaporated.

Down over 80% from its peak, the token is caught in a brutal freefall, causing panic among holders and raising uncomfortable questions about its long-term viability.

With governance paused and utility in doubt, Jupiter now stands at a crossroads.

JUP’s downturn deepens as selling pressure mounts

Since peaking at $2.04 shortly after launch, JUP has nosedived over 82%, with more than 33% of that loss occurring in just the past month.

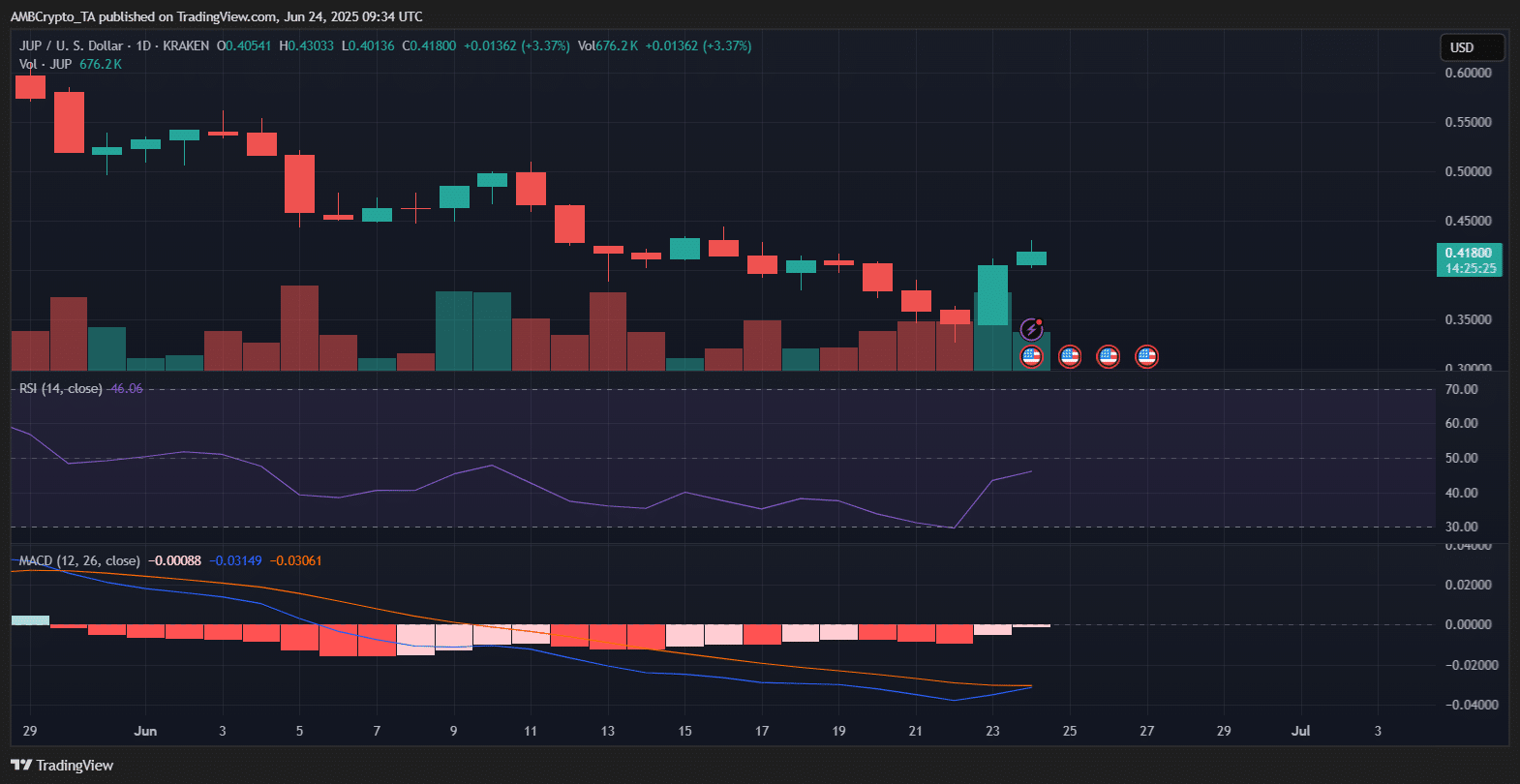

The token briefly showed signs of a recovery in February above $1, but the momentum faded quickly. At press time, JUP traded near $0.41, reflecting a prolonged bearish grip.

Technicals also showed the sentiment; the RSI hovered below neutral at 46, while the MACD remained in negative territory despite signs of flattening.

The modest uptick in volume offers some hope, but for now, JUP’s downtrend shows little sign of reversal.

DAO suspension triggers debate

As Jupiter’s price collapsed, so did community morale. Investors, once bullish, have become increasingly disillusioned by the lack of strategic clarity.

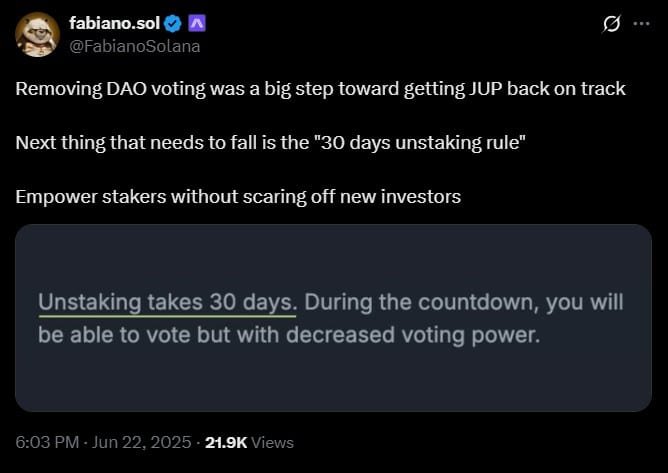

In a dramatic change, the Jupiter Foundation suspended DAO voting — a move intended to cut through bureaucratic gridlock and redirect focus toward product development.

While some see this as necessary triage, others fear it undermines the project’s decentralized ethos.

With tokenholders sidelined and morale fragile, the platform’s future now hinges on whether this centralized decision-making can actually deliver meaningful recovery.

Does Jupiter have no floor?

Behind JUP’s brutal drawdown lies a deeper concern: its tokenomics. Large-scale token unlocks have flooded the market, sparking panic selling as supply overwhelms demand.

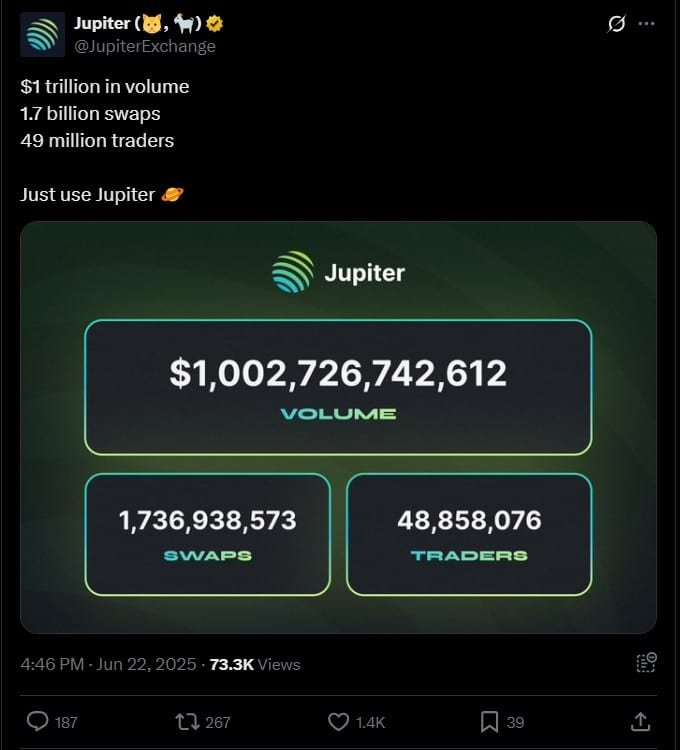

Compounding the problem is a growing perception that JUP lacks compelling utility beyond speculation.

While the protocol boasts $1 trillion in cumulative trading volume, critics argue that this hasn’t translated into sustainable token value.

With staking constraints still in place and no clear roadmap to enhance token usage, holders are left grasping for a narrative strong enough to reverse JUP’s fall from grace.