- ETH Options market sees spike in short-dated calls as traders bet on breakout rally.

- Volatility and skew metrics point to rising bullish sentiment and speculative momentum.

Ethereum [ETH] is back in the spotlight as its Options market lights up with bullish activity.

Traders are piling into short-dated calls, betting big on a near-term rally as ETH breaks free from weeks of consolidation.

Key metrics suggest a surge in speculative appetite, pointing to a market increasingly confident in Ethereum’s upside potential.

Can this momentum carry ETH to fresh highs, or are traders getting ahead of themselves?

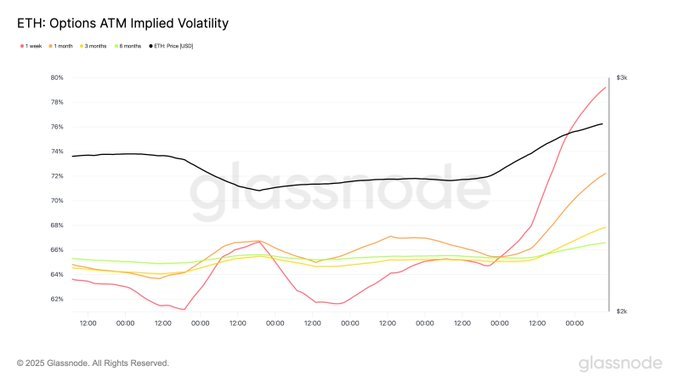

ETH volatility repricing shows bullish urgency

ETH Options market is flashing signs of aggressive repositioning, particularly in the short end of the curve.

Over the past 48 hours, 1-week Implied Volatility surged from 65.2% to 79.0%, while 1-month IV climbed from 66.4% to 72.1%.

This steepening of the volatility term structure suggests traders are rushing to gain upside exposure — or hedge against rapid price swings — as ETH breaks out of its consolidation range.

The demand spike for near-term Options shows rising conviction that a significant move is imminent, aligning with broader bullish sentiment surrounding ETF developments and macro influences.

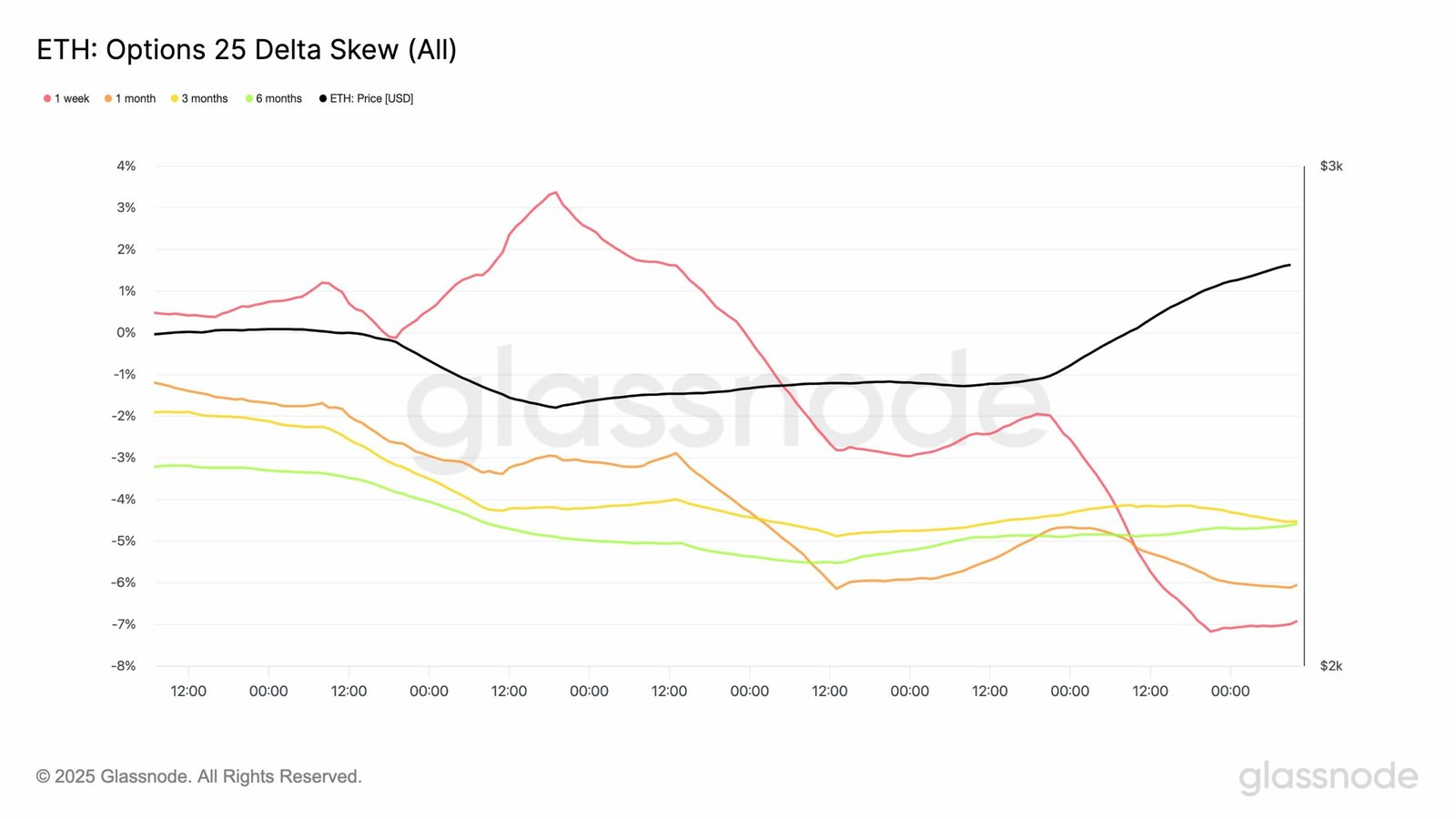

Skew turns deeply negative as traders chase calls

Ethereum’s 25-delta options skew has flipped decisively bearish-for-puts, a sign of intensifying demand for call options.

Over the past 48 hours, the 1-week skew plunged from -2.4% to -7.0%, while the 1-month skew also dropped from -5.6% to -6.1%.

This deepening negative skew reflects a sharp preference for short-dated calls over puts, a classic signal that traders are positioning aggressively for near-term upside.

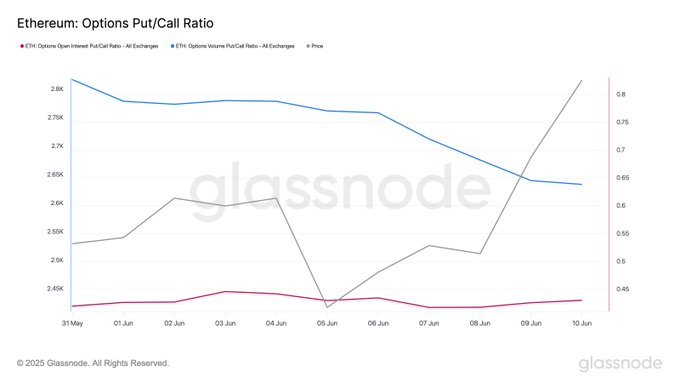

Put/Call Ratios confirm speculative tilt

Bullish sentiment in ETH Options market is further validated by a persistent drop in both Open Interest and volume-based Put/Call Ratios.

As of the 10th of June, the Open Interest ratio sat near cycle lows at 0.43. Likewise, the volume-based ratio slid to 0.63.

This indicates that traders are favoring calls over puts by a significant margin, consistent with rising demand for upside exposure.

This positioning complements the steepening volatility curve and deepening skew, showing a market bracing for a breakout.