- Curve continued to sink towards the $0.45 demand zone at press time

- While CRV holders of the past three months faced losses, there was evidence of accumulation since May

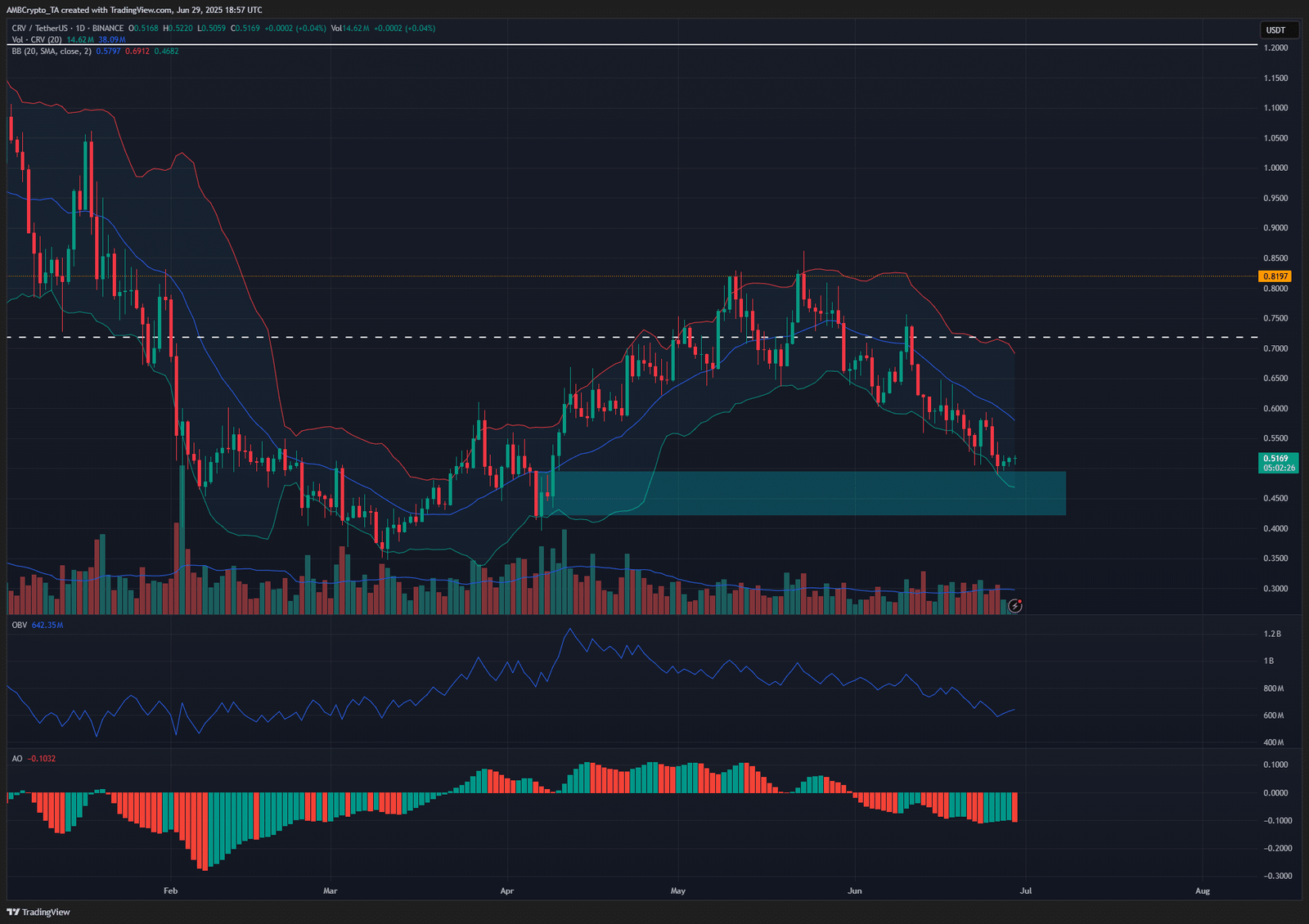

Curve DAO [CRV] was on a downtrend on the daily and weekly charts, at press time. In fact, in a recent report, AMBCrypto noted that the CRV token had a bearish market structure. The selling pressure behind the token has not eased yet, with the momentum remaining bearish too.

The price clung to the lower Bollinger Band, repeatedly testing it as a support. The 20-day moving average has also been a resistance recently. The OBV highlighted the steady selling volume that Curve DAO bulls were powerless to halt.

Without an influx of sustained demand, a bearish trend change would be difficult. However, there may be some hope. The $0.45 zone, highlighted in cyan, was a bullish order block from early April. This is an area of demand that could see a bullish trend reversal in the coming days.

Back then, the price saw a strong bullish reaction from this region. Admittedly, Bitcoin’s [BTC] recovery aided CRV’s rally. Another Bitcoin rally could ease the token’s selling pressure. However, right now, the leading crypto’s situation can be categorized as slightly precarious.

On-chain situation highlighted a potential buying opportunity

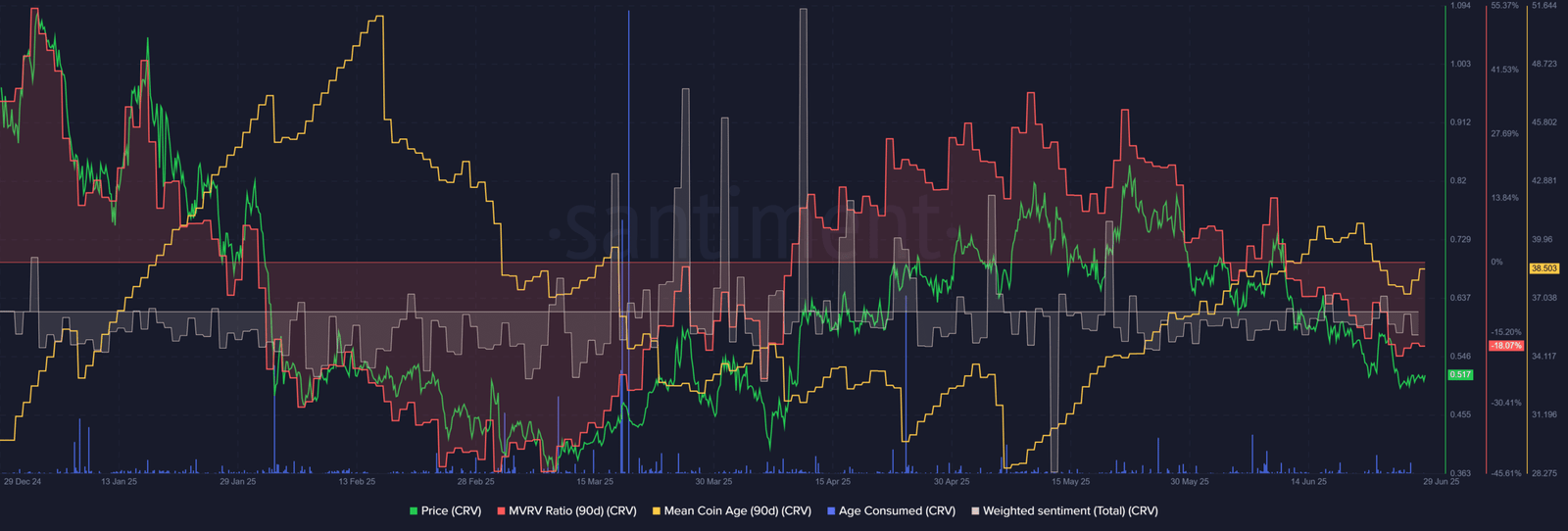

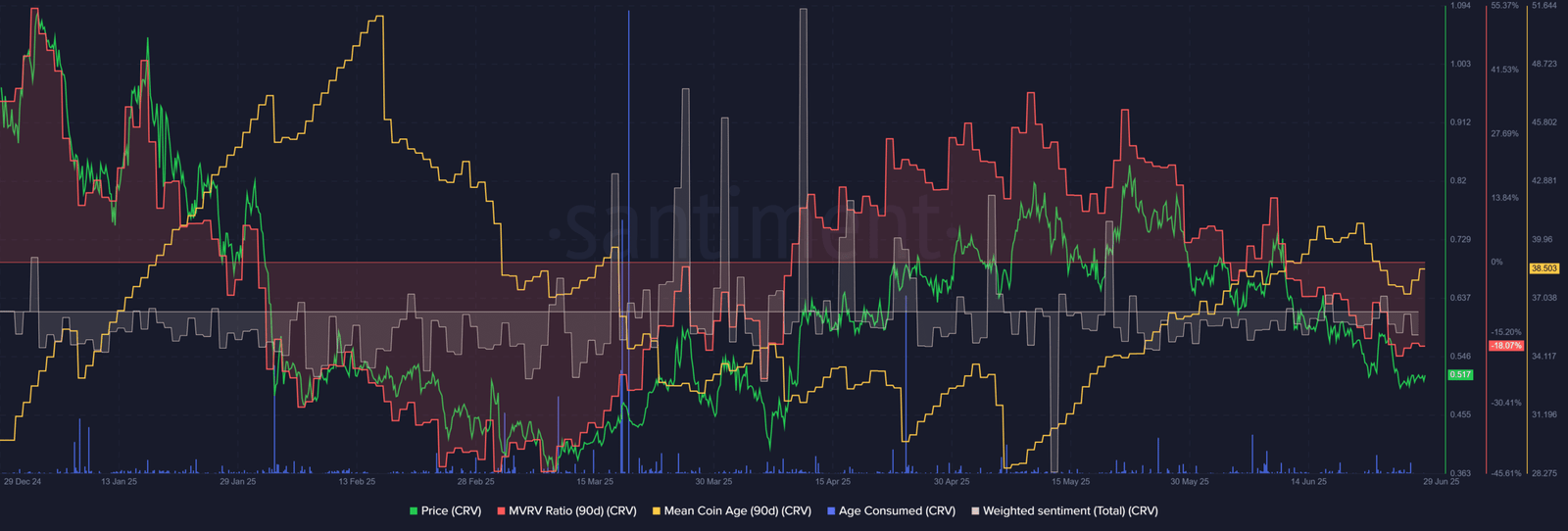

Source: Santiment

With the Curve DAO token threatening to sink towards the bullish order block, the network metrics underlined a possible buying opportunity. The weighted sentiment, which gauges sentiment based on social media engagement, was slightly bearish.

The downtrend over the past month saw the MVRV ratio fall steadily lower, standing at -18% at press time. This showed that CRV holders of the past three months were holding losses. And yet, during this downtrend, the mean coin age trended higher.

Over the past week, the MCA saw a dip, but its uptrend may be a sign of network-wide accumulation. A hike in accumulation and holders at a loss showed that the price was at, or close to, a bottom.

Investors could buy CRV for cheap, according to these metrics. The age consumed metric also suggested some token movement in recent days, a sign of selling. However, the figures were not alarming and did not capture a capitulation event.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion