In a landscape where many decentralized exchanges struggle to attract users or maintain momentum, Hyperliquid has emerged as a rare success story. While much of the discussion has centered on its technical advantages — sub-second finality, full on-chain orderbook, and a custom L1 — the deeper reason for its dominance lies in smart economic design. This article explores the economic engine behind Hyperliquid’s growth and highlights the number-one priority that enabled it to outpace competitors like dYdX, Aevo, and GMX.

Hyperliquid Gave the Value to Users, Not VCs

Unlike most DeFi protocols, Hyperliquid never raised money from venture capitals. There were no private token sales, no VC allocations, and no investor cliffs or unlock schedules. Instead, the team bootstrapped the project independently. When the token launched, they airdropped 31% of HYPE token supply directly to early users supported, making it one of the most equitable token launches in DeFi.

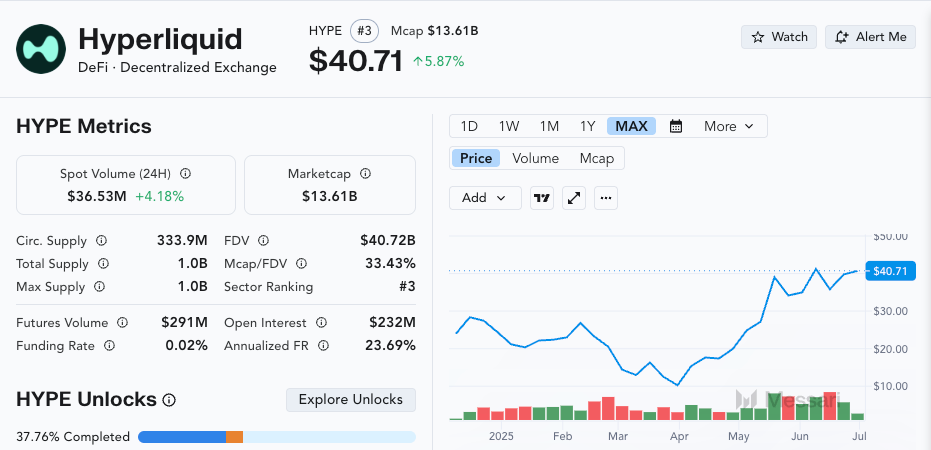

This strategy had two major consequences. First, there was zero sell pressure from insiders. Second, a broad user ownership fostered loyalty and alignment. As of June 2025, Hyperliquid airdropped for nearly 94,000 wallets. Roughly $1.2B worth of HYPE was distributed at launch prices, with the average eligible user receiving $45,000–50,000 worth of tokens. This massive distribution helped HYPE avoid the usual post-airdrop dump. In fact, HYPE rose 1028% in seven months — from $3.90 at launch in November 2024 to $40 in July 2025.

Source: Messari

Economic Utility of HYPE Created Sticky Demand

The HYPE token is not just a governance placeholder; it is fully embedded in Hyperliquid’s economic flywheel. Validators must stake HYPE to participate in consensus. Regular users can delegate their HYPE to validators to earn a share of staking rewards. Traders who stake HYPE receive up to 40% in trading fee discounts, giving them a direct financial incentive to hold the token long-term.

While traders on HyperCore are gasless, on HyperEVM — the platform’s smart contract layer — users need HYPE as gas. Finally, and as a trading asset, HYPE is listed on Hyperliquid’s spot and perp markets, even allowing leveraged trades up to 3x.

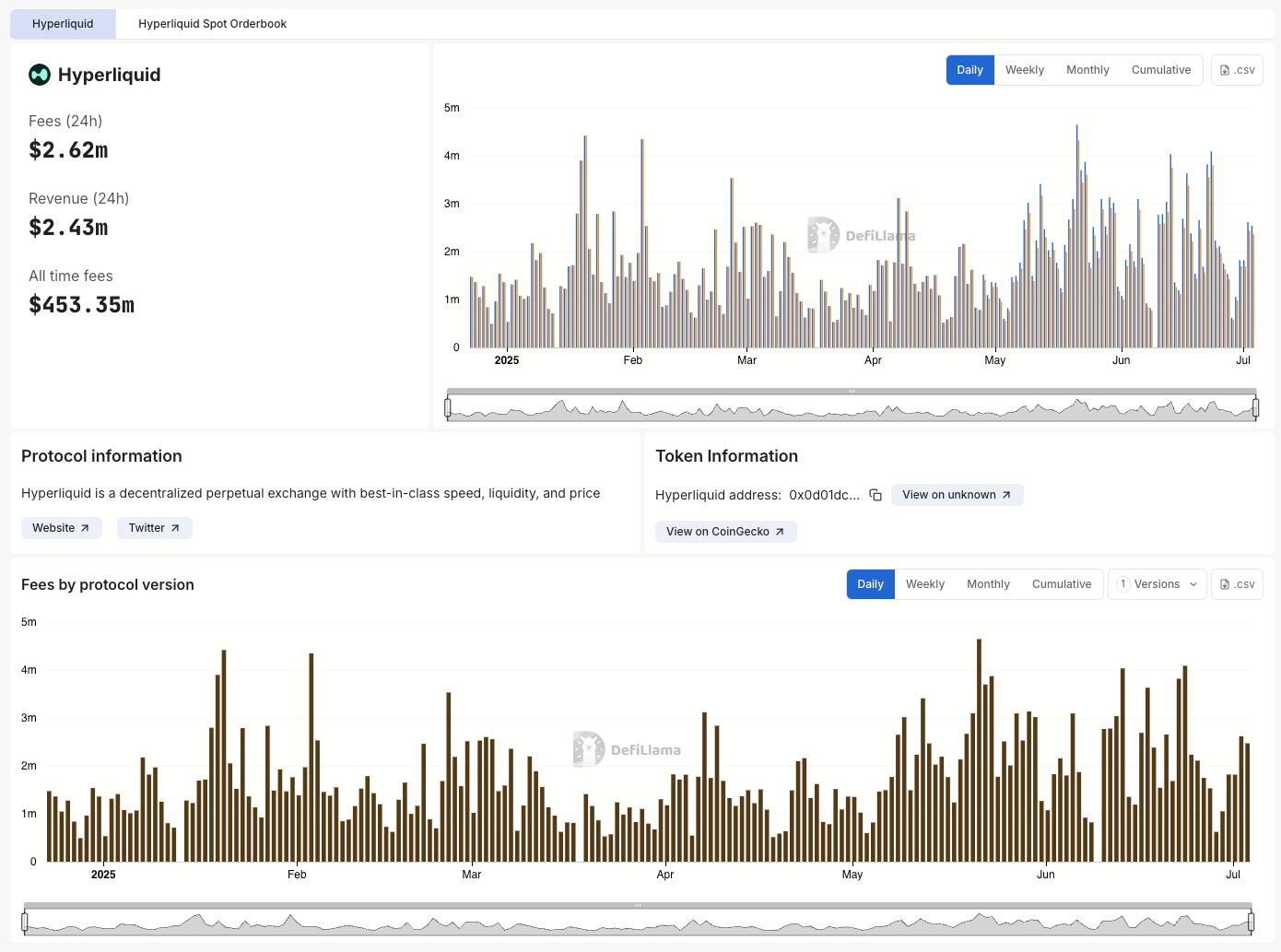

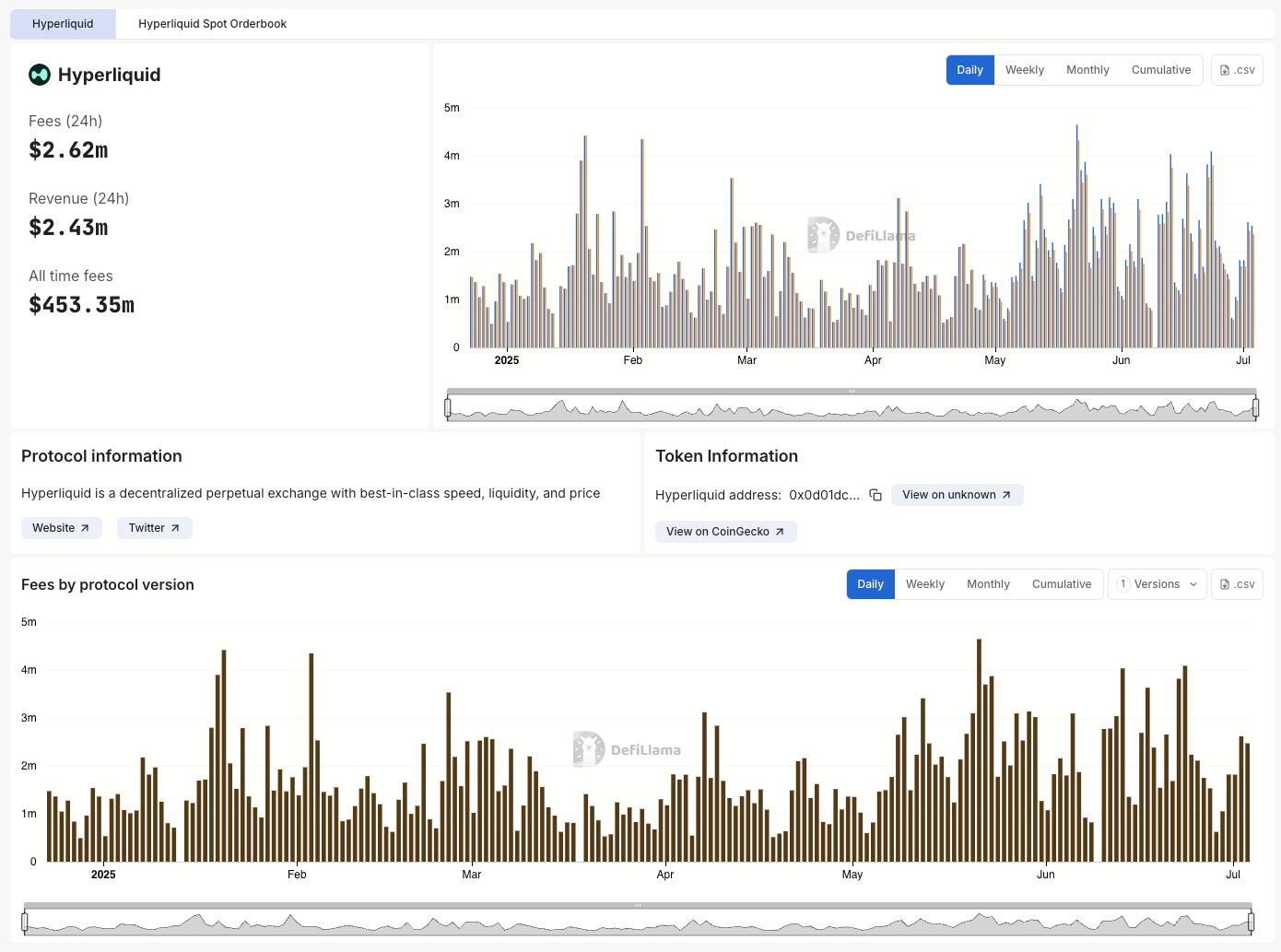

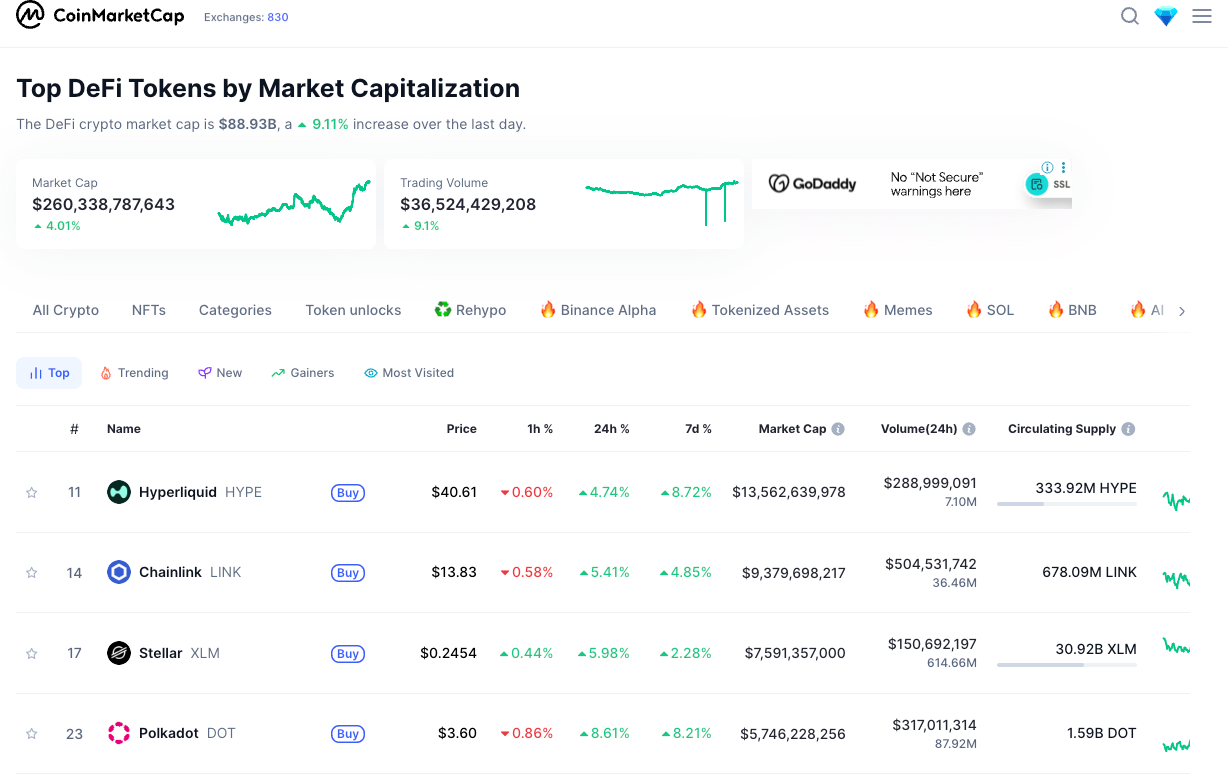

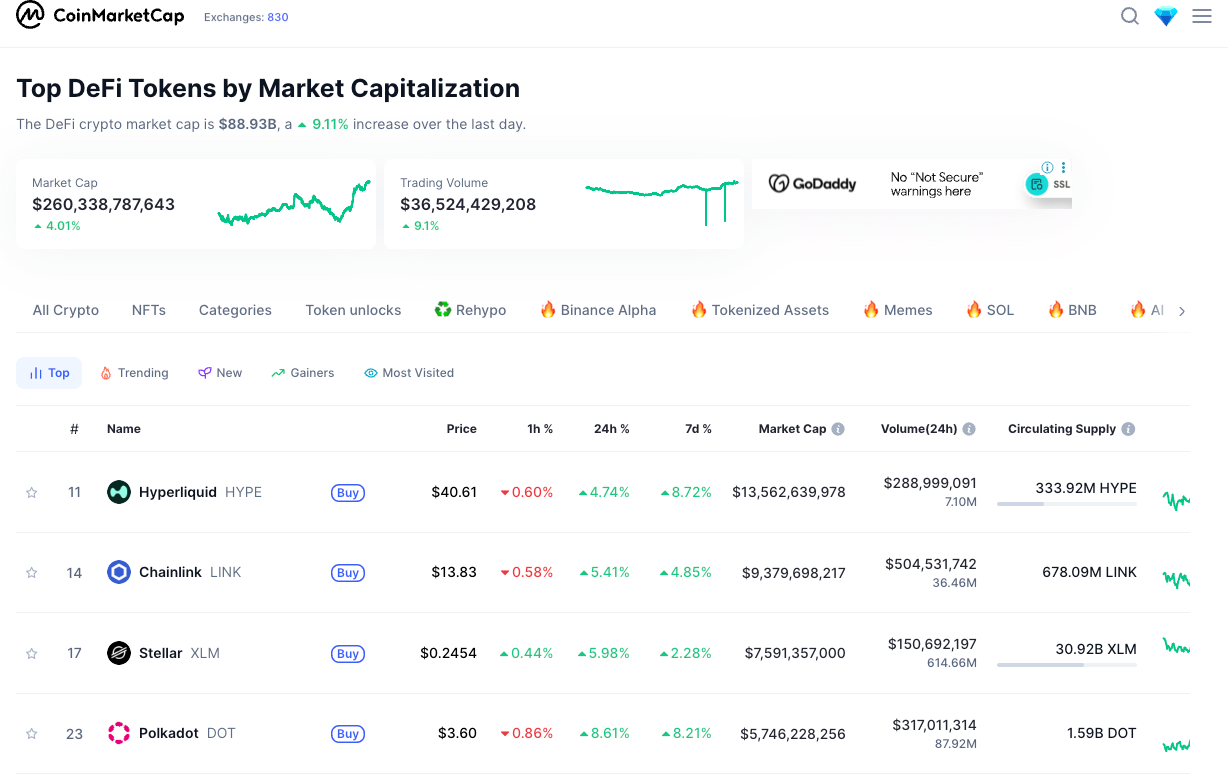

These roles give the token practical value. As of mid-2025, around 334 million HYPE tokens were in circulation, representing about one-third of the max supply. The platform regularly recorded over $5.6 million in daily fees, while HYPE trading volumes averaged $300 million or more per day. This consistent utility drives real demand for the token.

For more: Hyperliquid vs. dYdX, Aevo, GMX: Into the Future of Derivatives

Source: DefiLlama

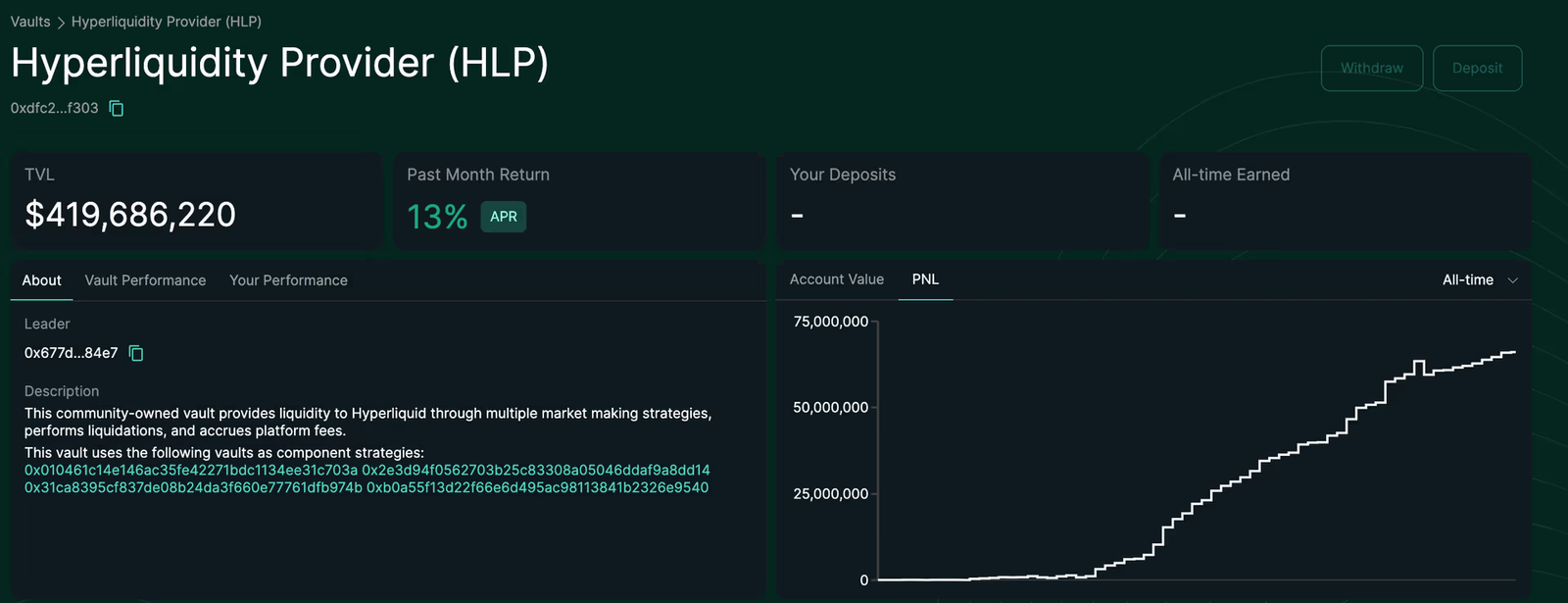

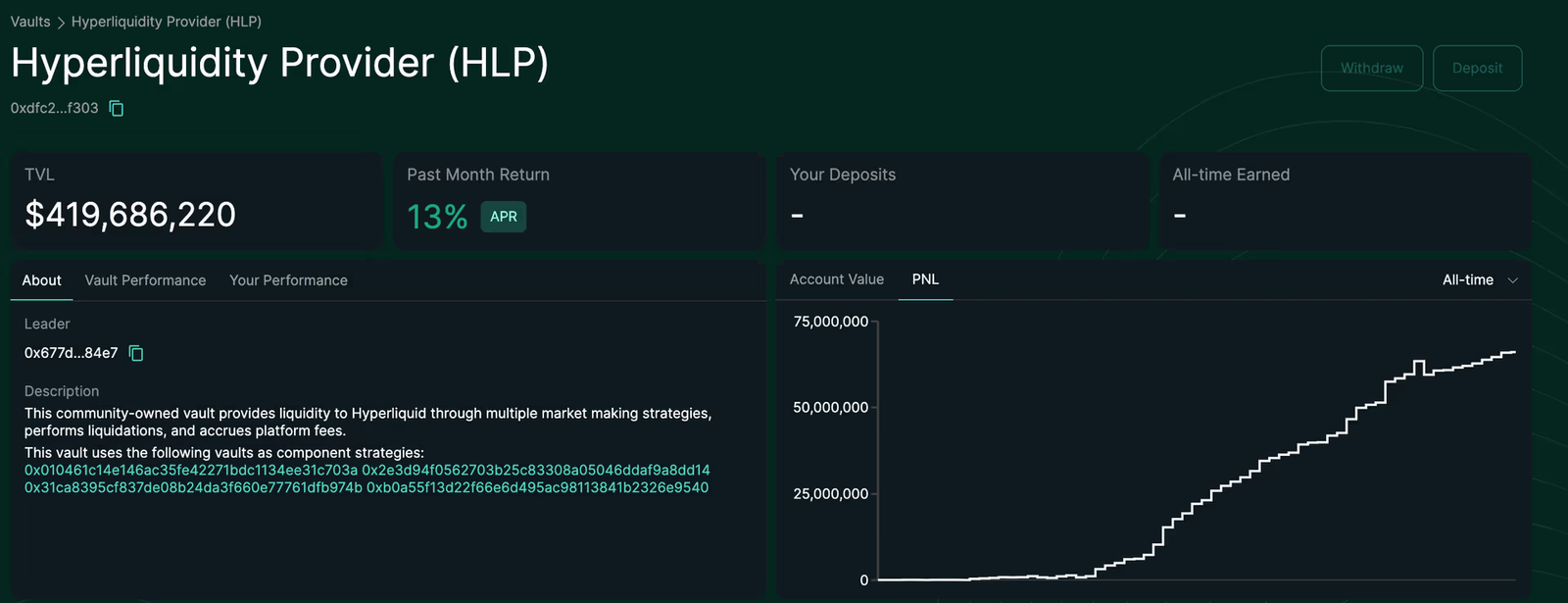

Protocol-Owned Liquidity Through the HLP Vault

Hyperliquid replaced the traditional AMM model by building HyperLiquidity Provider (HLP) Vault. This vault acts as an active market maker, stepping in to fill unmatched orders and participate in liquidations. All trading-related fees — including maker/taker, funding, and liquidation fees — are funneled back into the vault, not the development team. Users who deposit USDC into the vault share in the protocol’s revenue.

Unlike passive liquidity vaults like GMX’s GLP, the HLP vault actively manages its capital through real-time strategies. Analytics from Dune show, in Q2 2025, the vault offered APYs as high as 17% and reached over $800 million in total value locked (TVL). It also showed that the vault handled more than 40% of trading volume, providing deep, consistent liquidity. This design ensures that both traders and LPs benefit directly from the platform’s success.

Source: Hyperliquid

No Rent Extraction, No Insider Edge

One of the strongest economic principles behind Hyperliquid is its refusal to extract rent from users. It means the protocol does not take a cut of the revenue, it takes no fee for itself. All trading-related fees go to the HLP vault, which redistributes them to liquidity providers. In the future, governance could vote to use treasury funds for buybacks or other incentive programs.

This is a stark contrast to competitors like dYdX, Aevo, or GMX, which allocate parts of the fee revenue to foundations, investors, or passive mechanisms. Hyperliquid’s approach feels transparent, fair, and sustainable. It rewards actual participants rather than insiders.

Community-Centric Airdrop Strategy

The HYPE airdrop in November 2024 set a new standard for equitable distribution. With 31% of the total supply allocated to over 90,000 recipients, the campaign prioritized users over speculators. Instead of triggering a sell-off, the airdrop fueled growth. HYPE surged post-launch, with whales accumulating over $10 million worth of tokens in the early weeks.

By June 2025, HYPE’s all-time high reached $45.59, with a current price of $36.12. Its circulating market cap stood at $12 billion, while its fully diluted valuation hit $36 billion. These figures placed HYPE among the top DeFi assets by value. Importantly, this value was supported not just by speculation, but by real metrics — including record volumes, rising open interest, and deep liquidity.

For more: Hyperliquid Airdrop Season 2 Guide

Source: Coinmarketcap

Final Thought: Economic Alignment Is the Top Priority

Stripped of its technical achievements, Hyperliquid’s success boils down to one simple principle: economic alignment. The protocol created a system where traders, LPs, token holders, and developers all benefit directly from platform growth. There are no venture capital intermediaries, no team extractive fees, and no passive token roles. Every participant has skin in the game and a reason to care about long-term success.

By putting the user first — economically and structurally — Hyperliquid has proven that community-owned, value-aligned models can win in DeFi.