- Hyperliquid saw increased buying pressure in recent months.

- The Bitcoin rejection at $111k and subsequent price dip could force HYPE into a momentary reset.

Hyperliquid [HYPE] set a new all-time high at $44, an eventuality that rising whale inflows and rising Open Interest pointed toward. The 90-day spot CVD data showed buyer dominance, which should encourage buyers.

With a Bitcoin [BTC] dip underway, it was possible that HYPE would see a reset. The divergence witnessed on the 3-day chart strengthened the likelihood of a deeper retracement.

Sustained demand in recent months meant that a dip might not last long or go too deep.

Hyperliquid maintains its bullish structure across timeframes

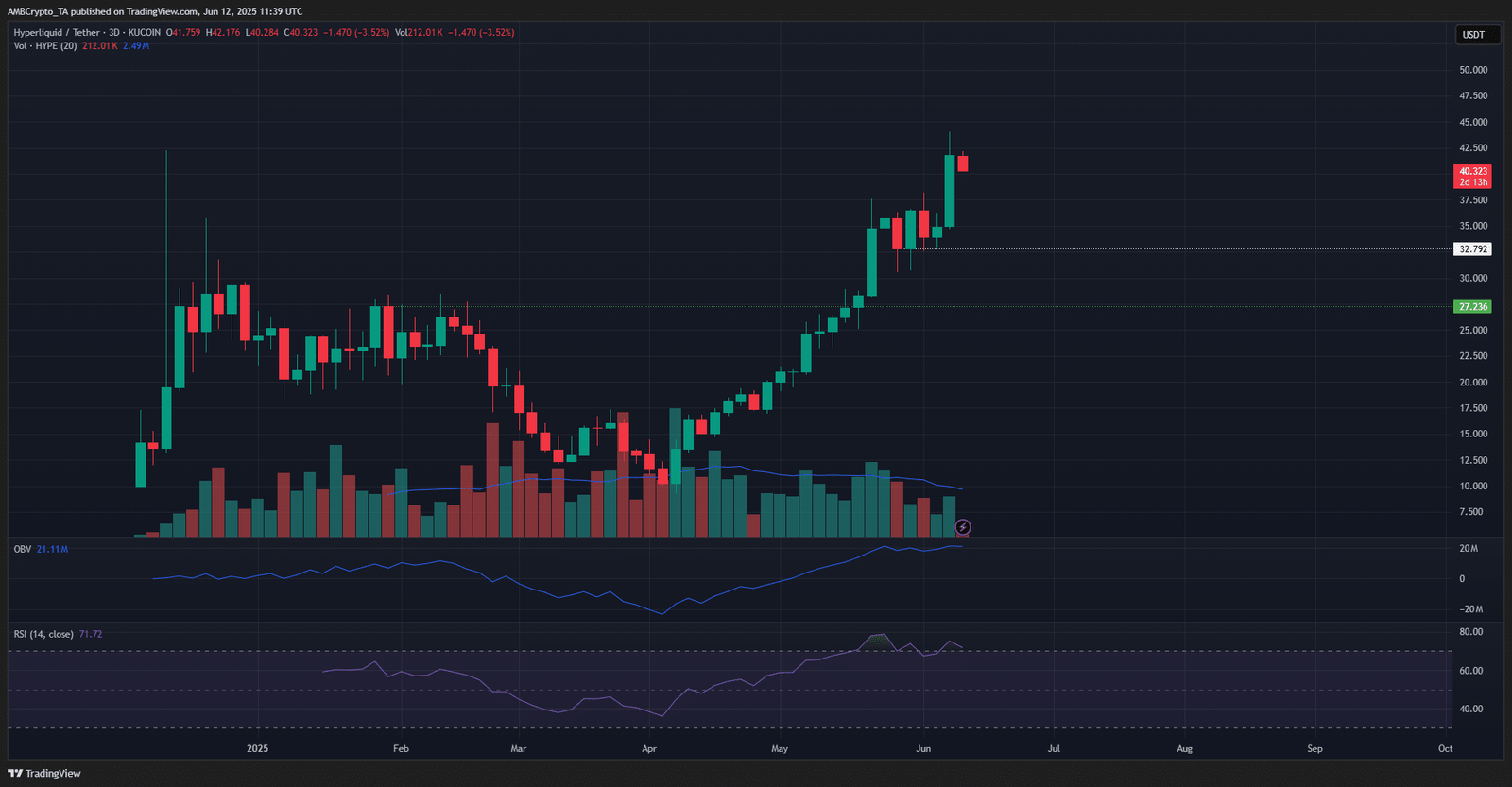

The 3-day chart showed a clear bullish bias for Hyperliquid. Its rally beyond the early January high at $27.2 was a sign of bullish intent.

Over the past month, the same level was retested as a demand zone, and HYPE rallied another 48% in 24 days.

The volume bars have trended downward over the past month, seen by the dip in the 20 DMA of the volume. In an uptrend, this could be a warning sign of overextension.

Hyperliquid might be forced to consolidate in the coming weeks.

This idea was reinforced by the bearish divergence on the 3-day chart. The RSI made lower highs from the 25th of May, while the price made higher highs.

It was a classic bearish divergence with the momentum and was an early clue of a retracement.

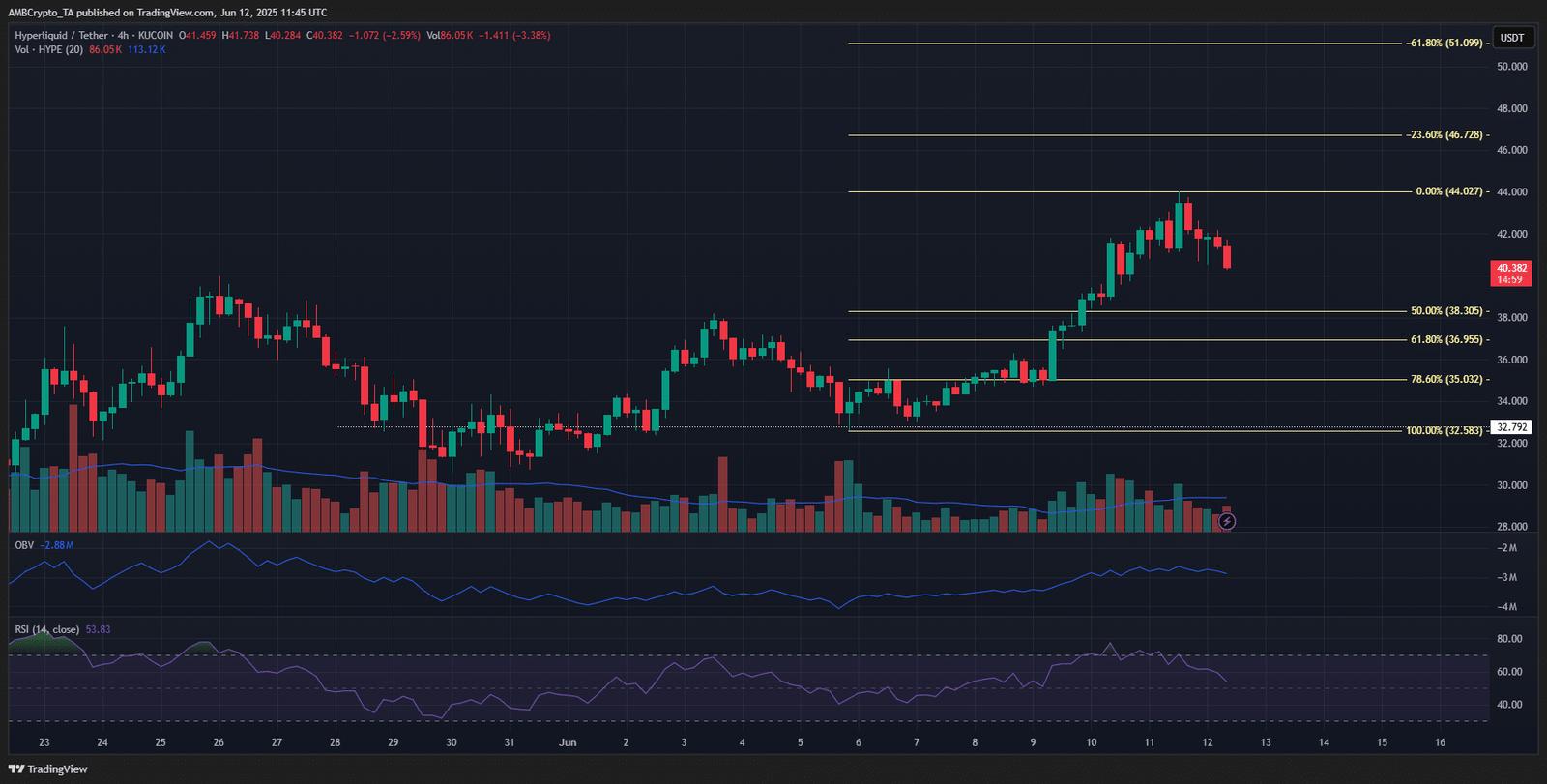

On the 4-hour chart, the retracement appeared to be underway. The H4 market structure was firmly bullish, but momentum has receded toward neutral, as seen on the RSI.

The OBV did not show overwhelming selling pressure yet.

The Fibonacci retracement levels marked the $38.3, $36.95, and $35 levels as the potential supports in the coming days. A further drop in Bitcoin to $102k could see a deeper Hyperliquid price drop.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion