Key Takeaways

- Hyperlane crypto saw a remarkable 490% rally within the last 48 hours, before pulling back slightly. However, it might need some time to consolidate, especially since its charts might offer clear trade ideas and their invalidations

The interoperability protocol Hyperlane [HYPER] surpassed the $0.18-0.2 highs from May, hitting $0.67. In under two days, the token gained by nearly 445% after news of its listing on the popular South Korean exchanges Upbit and Bithumb. This event catalyzed the explosive HYPER rally.

At the time of writing, CoinMarketCap’s data revealed that the daily trading volume of HYPER was $3.37 billion – A nearly 900% increase in trading volume. The strong interest in the token, whose market cap was only $104.7 million, meant that the token could be set for further gains in the short-term.

Should traders and investors worry about an overextended HYPER market?

The recovery from the downtrend in April and May began more than two weeks ago, on 22 June. HYPER formed its low at $0.0866 on this day, and began to form higher lows towards the beginning of July. The series of higher lows and higher highs was established by the first week of July.

The latest rally was a result of the uptrend established earlier in the month. The bullishness from the listing news must not be understated. In fact, it was also a key development in sending HYPER higher.

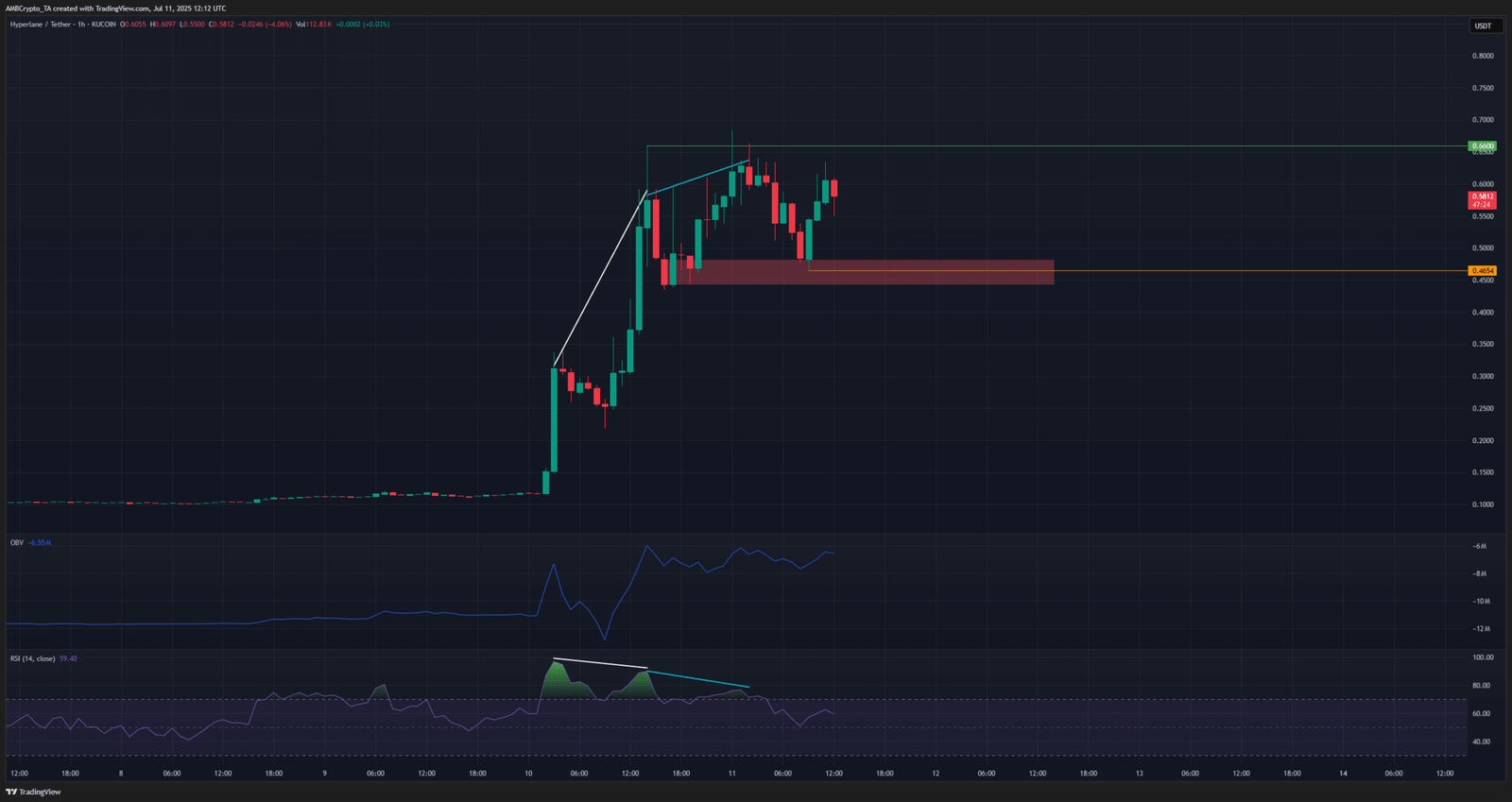

The 1-hour price action highlighted how divergences could be less successful in wildly volatile conditions. Two bearish momentum divergences between the price and the RSI were marked in white and cyan. The first one saw a 23.1% pullback, but another 42% rally was imprinted on the price charts over the next 8 hours.

This rally saw the RSI depressed further, while the price pushed higher. The divergence saw HYPER retrace once again to the $0.45 demand zone – A bullish order block from the initial pullback. The OBV has been rising over the past 24 hours, underlining demand in the market.

The $0.442-$0.482 demand zone might be a place where traders and investors could buy more Hyperlane crypto. A drop below $0.442 would mean that a deeper retracement may be ahead. Meanwhile, a surge past $0.66 would lead to a bullish market structure break and indicate further gains.

Only 17.52% of the total supply of HYPER was circulating, at the time of writing. Monthly unlocks of 1.2%-1.5% of the max supply could dilute prices and spur distribution over time.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion