Key Takeaways

- HBAR’s whale accumulation and rising spot and Futures volumes signal bullish momentum, with resistance at $0.21–$0.29 being the next key test.

Hedera [HBAR] made the headlines after recording an over 15% price gain in the last 24 hours, at the time of writing.

This rally comes while the overall market momentum is uncertain, putting HBAR on the list of the biggest movers of the day.

Whale activity is driving the rally

One of the main catalysts of this surprise boost is whale accumulation. AMBCrypto’s close analysis indicated that a new wave of whales was accumulating HBAR since the commencement of the BTC bullish run.

This new optimism by whales has a history of being followed by upbeat price action.

At the same time, the trading activity was surging, with both spot and futures volumes rising strongly. On key exchanges, buyers dominated, echoing a pro-bull shift in market sentiment.

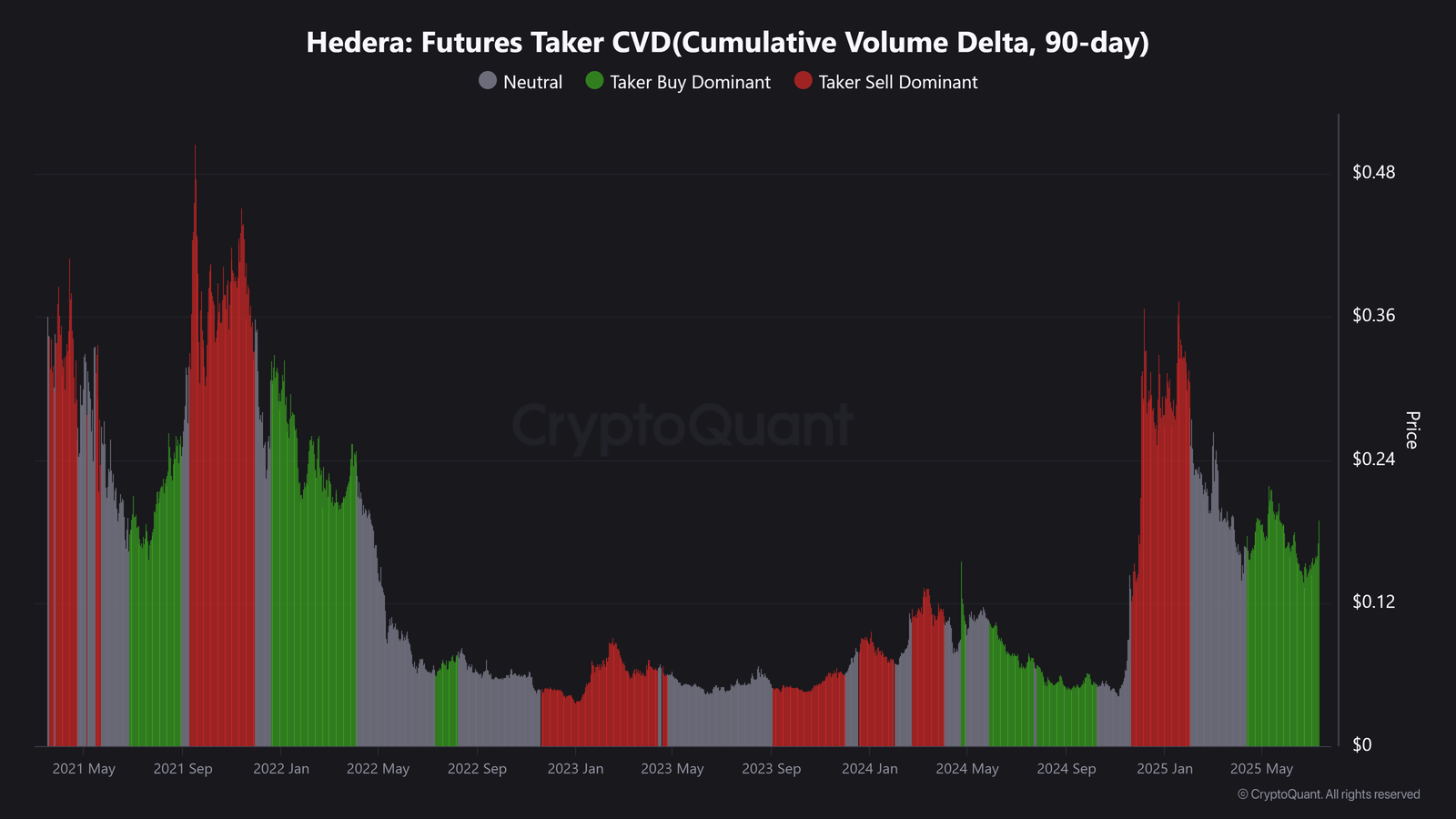

Spot and futures markets are in harmony

In the spot market, buyers continue to outpace sellers, indicating strong demand for HBAR even at elevated price levels.

Bullish momentum is also visible in the derivatives market, where buyers remain dominant, suggesting that traders anticipate further upside.

The alignment of both spot and derivatives markets adds strength to the ongoing rally and increases the likelihood of sustained momentum.

What comes next for HBAR?

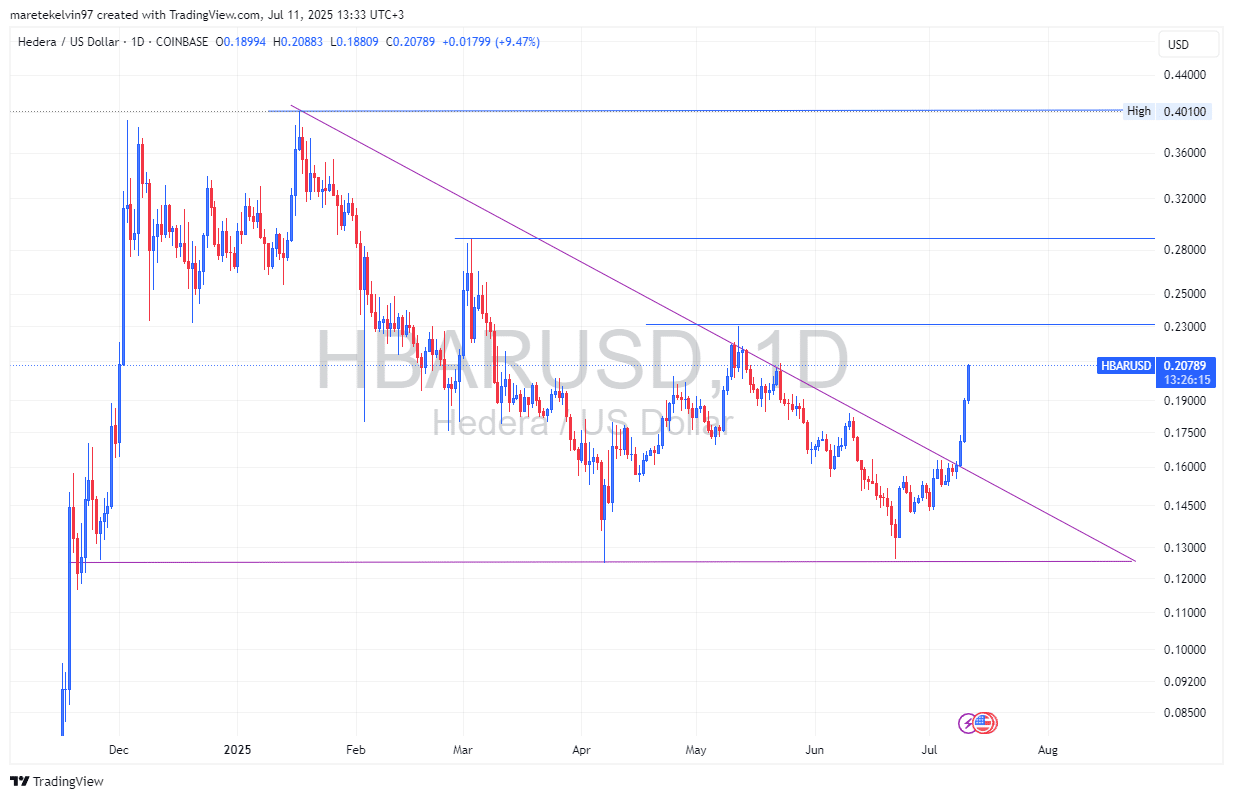

Zooming down to technicals, the next test lies at the $0.21 to $0.29 resistance levels, key resistance levels that previously encountered rejection during the triangle pattern consolidation.

However, having broken free from the consolidation phase on the current bullish run, HBAR bulls may drive the price past this region, leaving it open toward its potential new highs.

Technical indicators are turning bullish as well. But investors should be on guard for any sudden spike in sell pressure, particularly from short-term holders who want to take profits.

As network usage and ecosystem participation gradually increase, HBAR bullish momentum seems set for a rally ,but the next few days will be critical.

However, for the time being, the bulls are still in control, and a further bullish run is still on the cards.