Key takeaways:

-

Rising spot ETH ETF inflows and BlackRock’s accumulation signal strong institutional investor interest, supporting a bullish outlook.

-

A dip to $2,100 could be a strategic entry point, bolstered by tokenized AUM surpassing $5 billion and a potential Q4 breakout driven by year-end strategies.

Ether (ETH) price witnessed a volatile period this week as the altcoin reached a 15-week high of $2,879 on Wednesday and dipped to $2,433 on Friday, a 15% crash. While ETH is consolidating just under $2,600, a higher-time frame pattern could extend its woes over the coming weeks.

As observed in the 1-week time frame, ETH has formed an ascending channel pattern on the chart. This pattern, characterized by higher highs and higher lows within parallel upward-sloping lines, suggests a steady uptrend. However, it also indicates that Ether could exhibit a bearish breakdown below the supporting trendline, leading to corrections near the support range at $2,100-$2,200 if sell pressure increases.

The $2,100-$2,200 is a multimonth range, which previously acted as support from the end of 2023 to August 2024.

Ether’s historical Q3 performance adds weight to expectations of a potential drawdown period. The altcoin has averaged a modest 0.88% return in Q3, with the prior two quarters showing significant declines of 24.19% and 13.64%, respectively.

The cryptocurrency market tends to see reduced trading volume and volatility due to the summer vacation season, and if these seasonal trends persist into Q3 2025, Ether could dip to the $2,100-$2,200 range.

Related: SharpLink buys $463M in ETH, becomes largest public ETH holder

Ether at $2,100 is a bullish bet

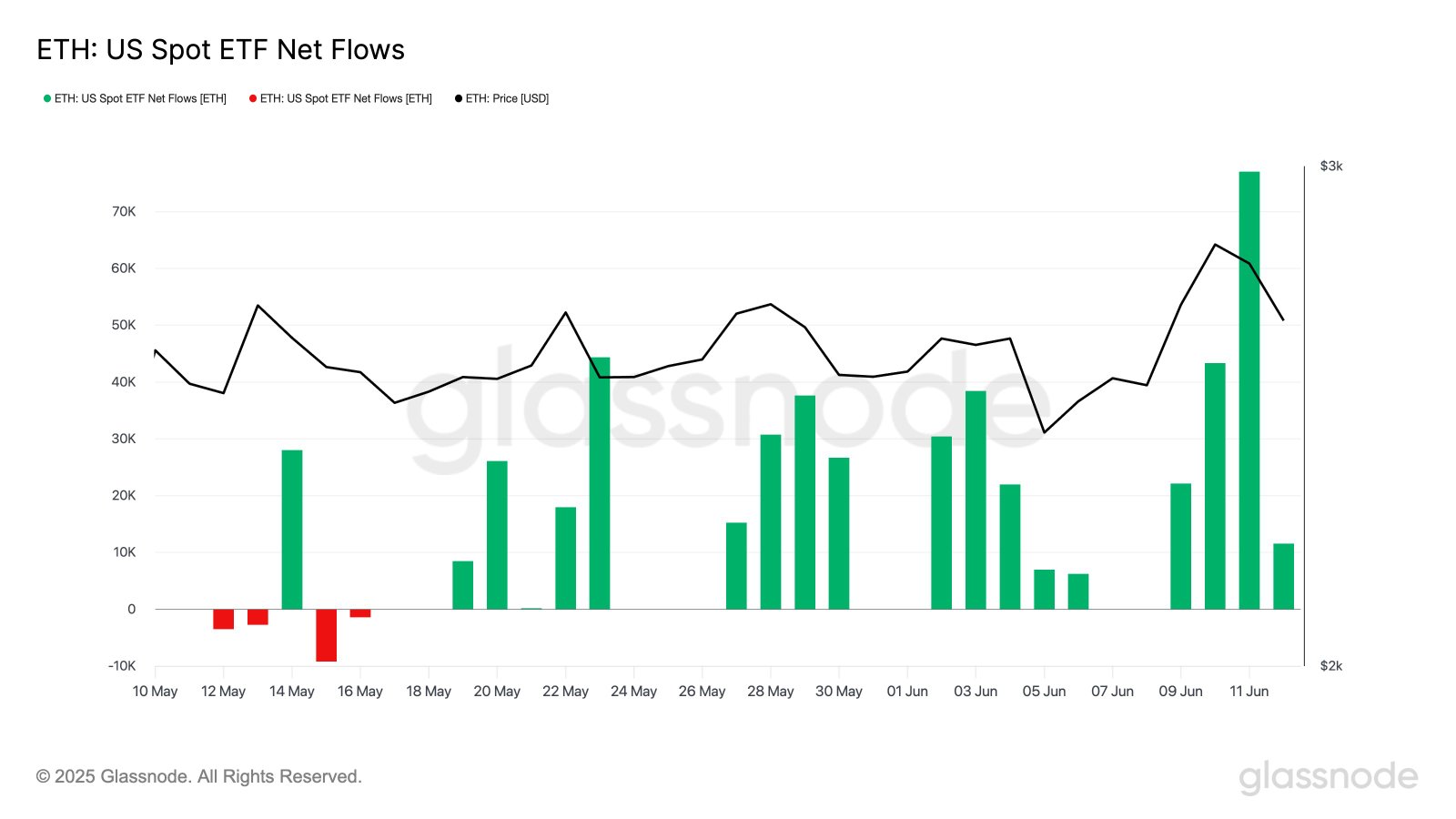

A price near $2,100 could mark a prime entry point for ETH. Spot ETH ETF flows are on the rise. According to Glassnode,

“This week alone, they’ve seen 154K ETH in inflows – 5x higher than their recent weekly average. For context: the biggest single-day ETH inflow this month was 77K ETH on June 11th.”

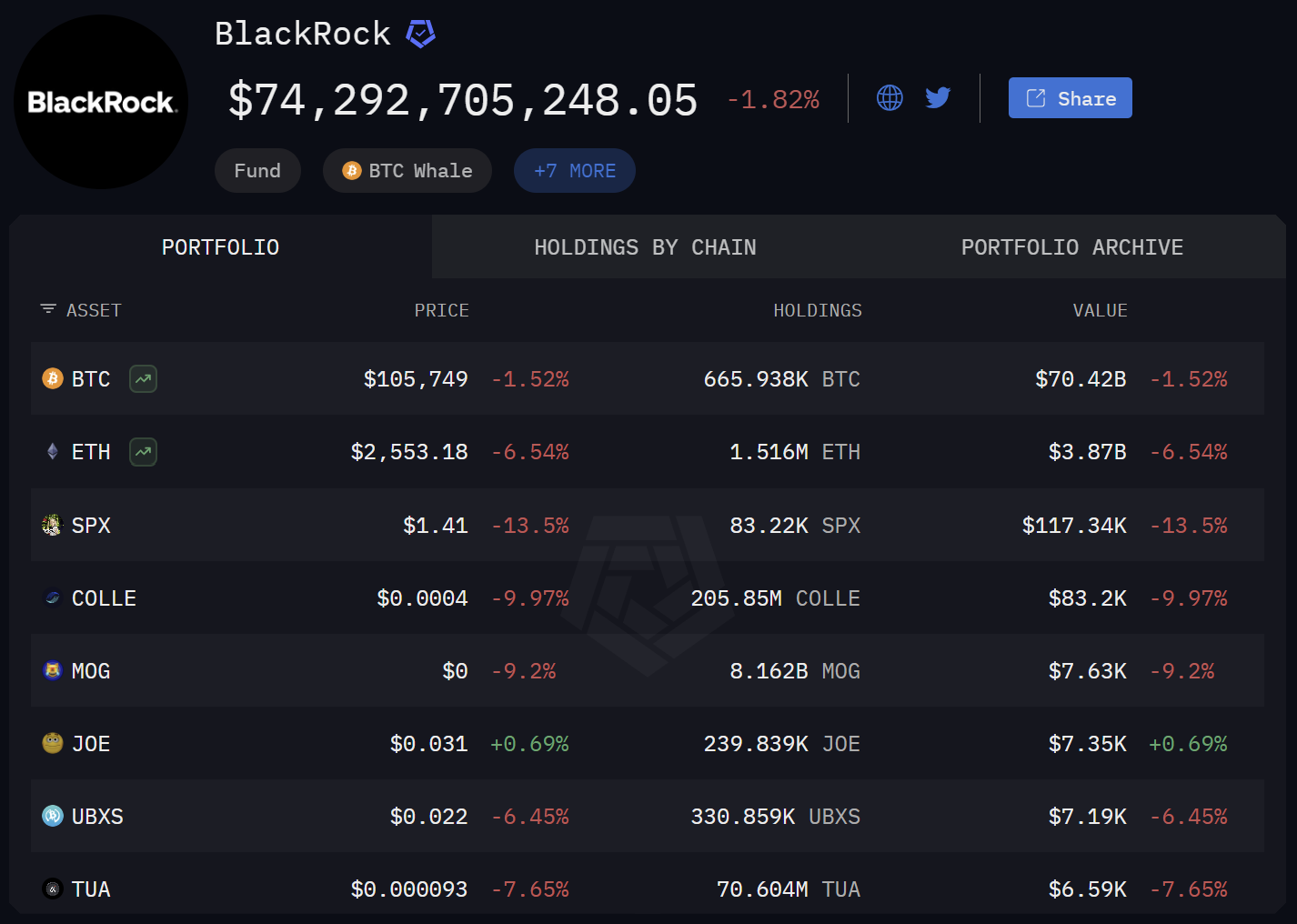

Besides spot ETFs accumulating, BlackRock’s buying of Ether through its iShares Ethereum Trust (ETHA) underscores the flow of institutional capital. With over $500 million in ETH added in recent weeks, bringing its holdings to 1.51 million ETH ($3.87 billion), BlackRock’s structured accumulation points to a longer-term bullish outlook.

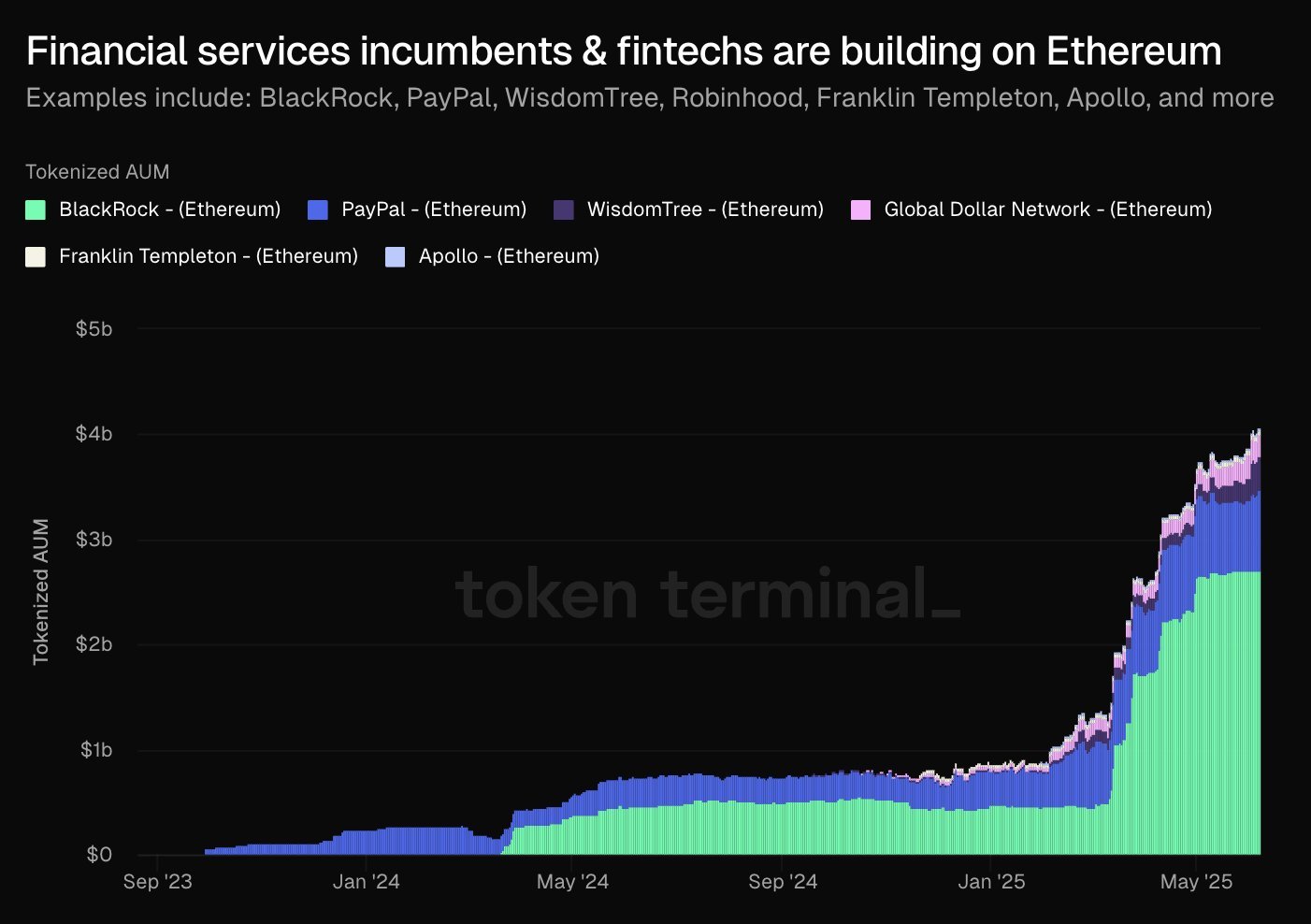

Data from Token Terminal also pointed out that billions of dollars are flowing into Ether as financial services incumbents and financial technology companies tokenize assets. The chart shows tokenized assets under management surging past $5 billion, with major players like BlackRock and Apollo driving the trend.

This institutional buildout, combined with historical Q4 strength—often fueled by year-end investment strategies—could trigger an ETH breakout by the end of 2025.

Related: Ether futures open interest hits $20B all-time high: Will ETH price follow?

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.