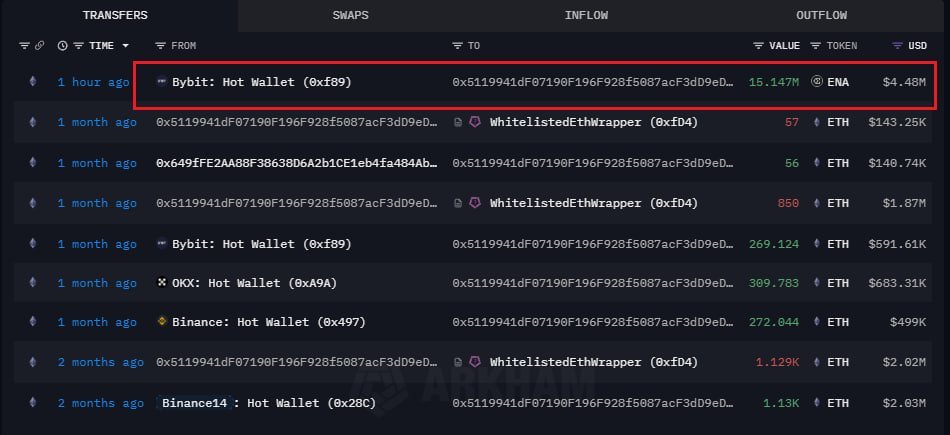

- The wallet belonging to Mellow Finance withdrew 15.147 million ENA worth $4.48 million from Bybit.

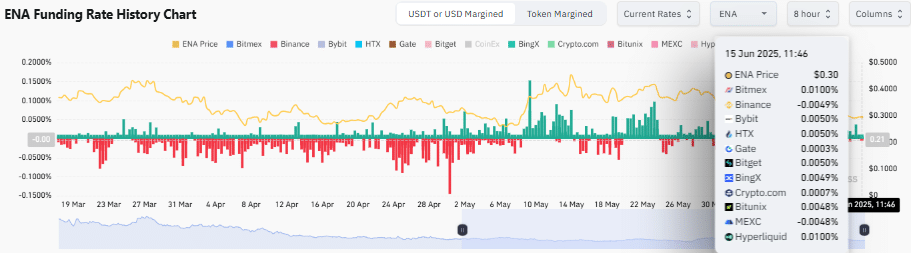

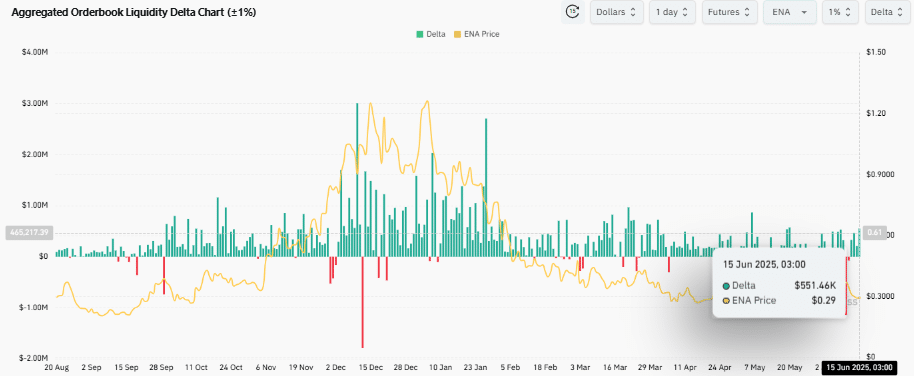

- Funding Rates turned positive across several major exchanges, while the aggregated order book liquidity delta also returned to positive territory.

By choosing Ethena [ENA] as its first altcoin to invest in, Mellow Finance took a big bet at a time when the market was in the process of correcting.

With the wider toppings of the altcoins, the fund issued 15.147 million ENA, worth about $4.48 million, out of Bybit to the personal wallet.

Buying the dip… or backing the future?

This first time storage of the altcoin was a sign of high confidence in the future of Ethena Labs.

The timing strategy by a correction implied that Mellow Finance perceived ENA had valuable fundamentals that were undervalued.

The step can also be indicative of institutional confidence in Ethena in the crypto infrastructure of the future. This could support hope amid a generally poor altcoin performance in the market.

ENA’s derivative markets signals

A dive into derivative markets showed that ENA’s Funding Rate History presented a rebound into the positive region on the bigger exchanges.

Funding Rates turned positive on major platforms, including Bitmex, Hyperliquid, and Bybit, signaling traders are again paying to hold longs.

That’s a key shift after April’s prolonged negative Funding Rates streak.

Additionally, the Aggregated Orderbook Liquidity Delta once again increased to positive figures, about $551.46K, a few days later after a drastic decrease on June 10.

This inflow of around $0.29–$0.30 suggests renewed buy interest, even if cautious.

The rampant green delta bars indicated that there was a revival of interest in going by but on a guarded basis. This inflow arrested the price at around $0.30 and showed a possible short-term base.

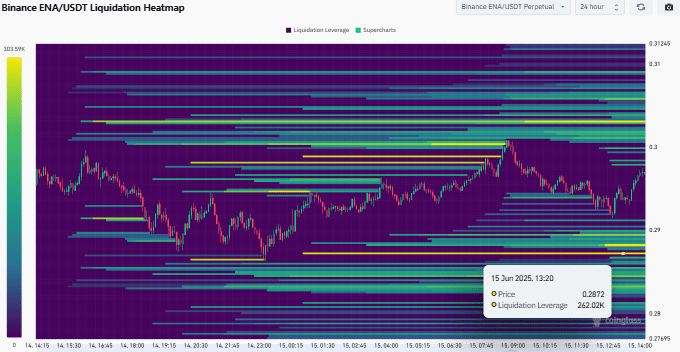

Key liquidation levels to watch

The Binance ENA/USDT Liquidation Heatmap reveals key risk zones.

There’s $262K in liquidation leverage below $0.28—a zone that could act as short-term support if bulls defend it.

Meanwhile, stacked short liquidations above $0.30 present an opportunity for a squeeze if the price breaks through.

In short, the closer ENA trades to these levels, the more explosive the next move could be.

Whether that’s a breakout or a trap depends on how much conviction traders bring to the table.