- Over 4,000 BTC and 61,000 ETH were withdrawn from Binance amid easing geopolitical tensions.

- S&P 500 surge and oil price drop show macro support for crypto accumulation and risk appetite.

Bitcoin [BTC] and Ethereum [ETH] recorded significant outflows from Binance on the 23rd of June, a shift toward long-term investor confidence as global tensions ease.

The exodus came on the heels of President Donald Trump’s ceasefire announcement between Iran and Israel, triggering a broader risk-on rally – oil prices tumbled, U.S. equities surged, and crypto markets caught the bullish bug.

Massive Bitcoin and Ethereum outflows

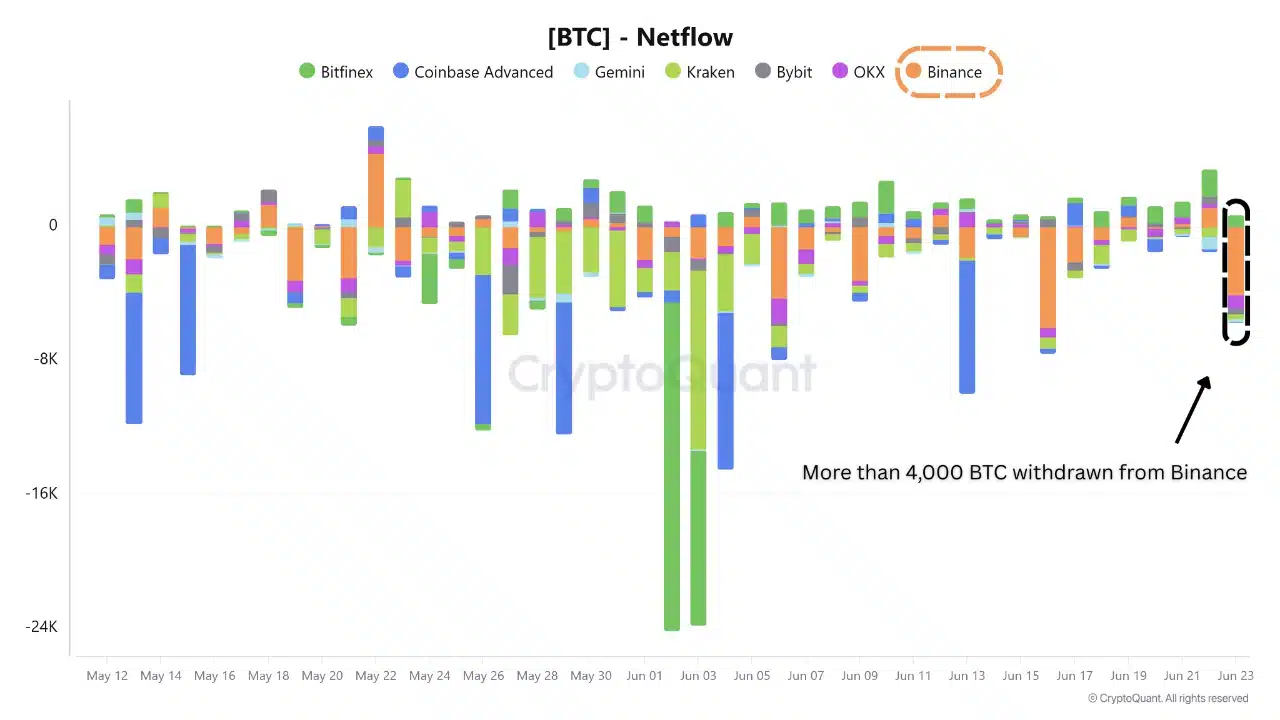

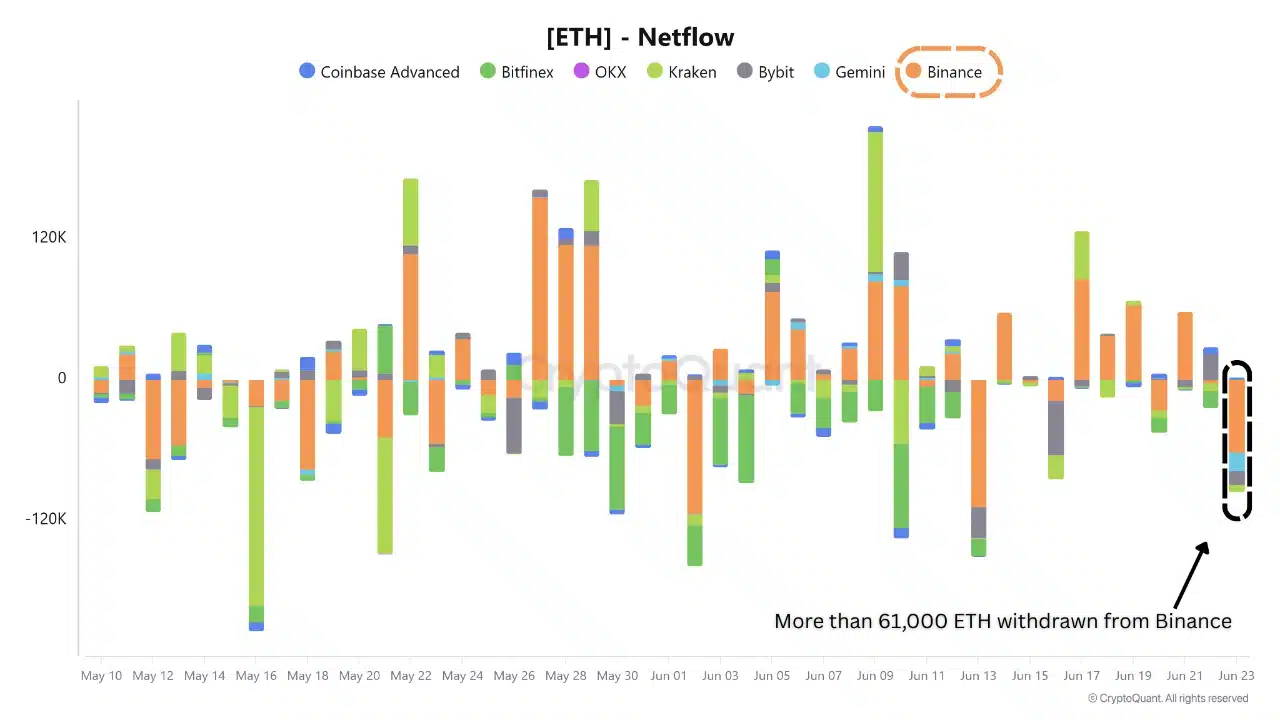

On the 23rd of June, Binance registered sharp outflows – more than 4,000 BTC and over 61,000 ETH – marking one of the largest single-day withdrawals in recent memory.

As shown in CryptoQuant’s netflow charts, Binance was the primary driver of negative flow while other exchanges remained largely neutral. This highlights an exchange-specific move likely tied to accumulation strategies.

The scale of these outflows suggests institutional or HNIs (High Net-Worth Individuals) repositioning away from short-term speculation.

This behavior is in line with rising confidence in market stability and a preference for self-custody; often seen in early-stage bull cycle positioning.

Ceasefire holds despite early tensions

The ceasefire between Israel and Iran began on shaky ground, with both sides quickly accusing each other of violations.

Israeli Defense Minister Israel Katz alleged that Iran launched missiles into Israeli territory, prompting a military response. Iran denied the accusations and, in turn, accused Israel of aggression.

President Trump urged both nations to show restraint and reiterated U.S. backing for the ceasefire.

Despite the tense start, the truce remains in effect, calming market nerves and potentially boosting risk sentiment across global and crypto markets.

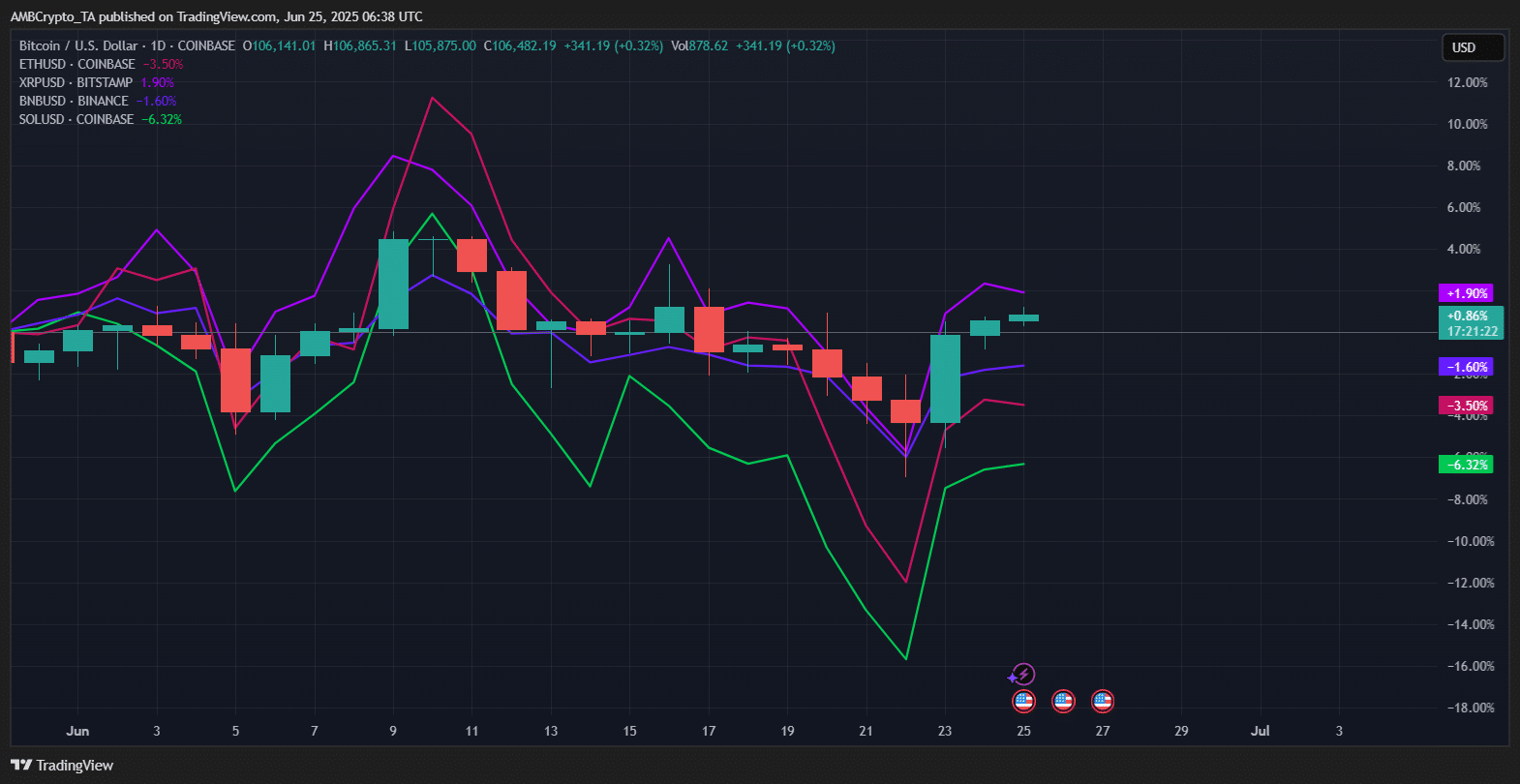

Leading crypto assets responded to the improving sentiment, with Bitcoin and Solana [SOL] rebounding into positive territory.

In contrast, Ethereum and Binance Chain [BNB] remained relatively flat, signaling a selective market recovery and a tentative return of investor confidence.

Macro conditions strengthen

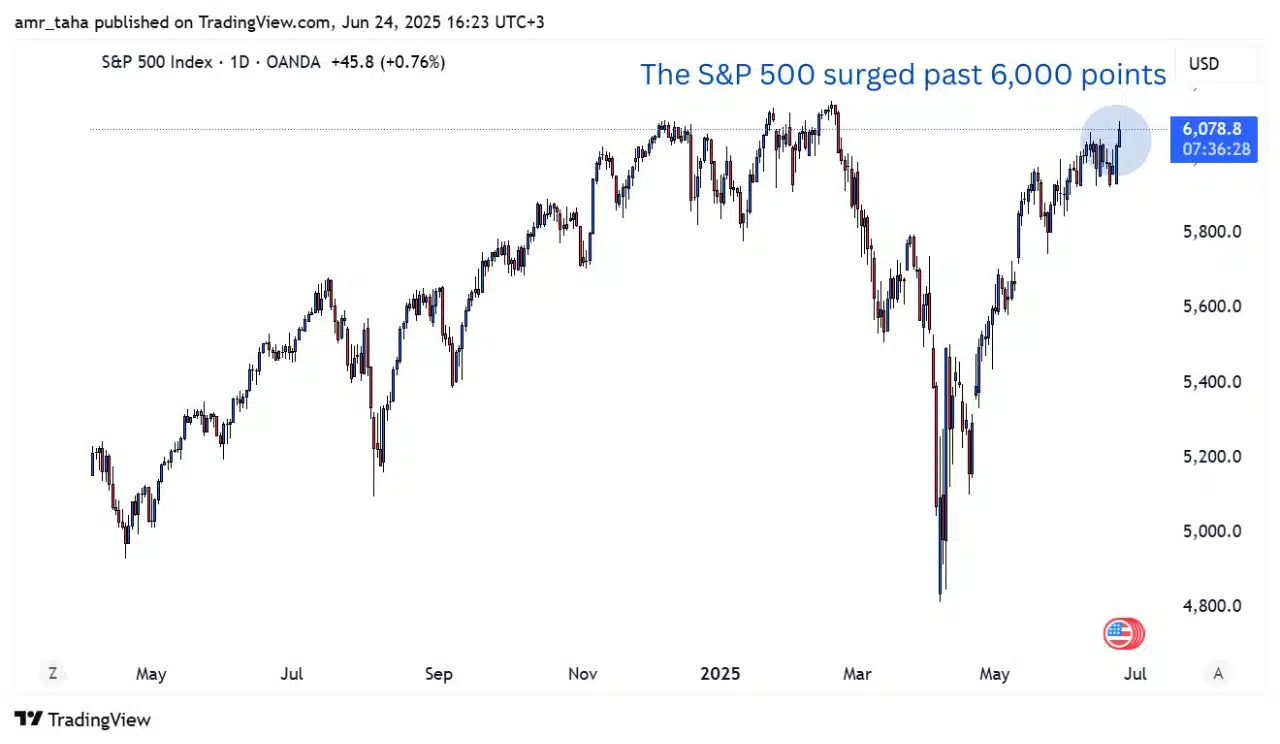

The S&P 500 surged past the 6,000 mark for the first time since February 2025, showing investor confidence and a clear shift toward risk assets.

Simultaneously, West Texas oil prices plunged over 14%, a move that reinforces the global disinflation narrative.

These indicators suggest a backdrop of easing geopolitical tensions, declining cost pressures, and strong growth appetite.

For crypto, this macro environment creates a favorable setup for accumulation—especially as digital assets increasingly mirror risk-on sentiment in traditional financial (TradFi) markets.