Cathie Wood’s investment company ARK Invest has continued dumping Circle shares after selling 1.25 million CRCL shares last week for about $243 million.

ARK sold another 415,844 Circle shares from its funds for $109.6 million on Monday, according to a trade notification seen by Cointelegraph.

The transactions marked the fourth Circle dump by ARK since the asset manager started offloading CRCL shares on June 16, just 11 days after Circle’s public launch on the New York Stock Exchange (NYSE).

With the new sale, ARK has now sold about 1.7 million Circle shares, which accounts for 37% of its 4.5 million CRCL purchase made on June 5.

ARK funds still hold 2.6 million Circle shares

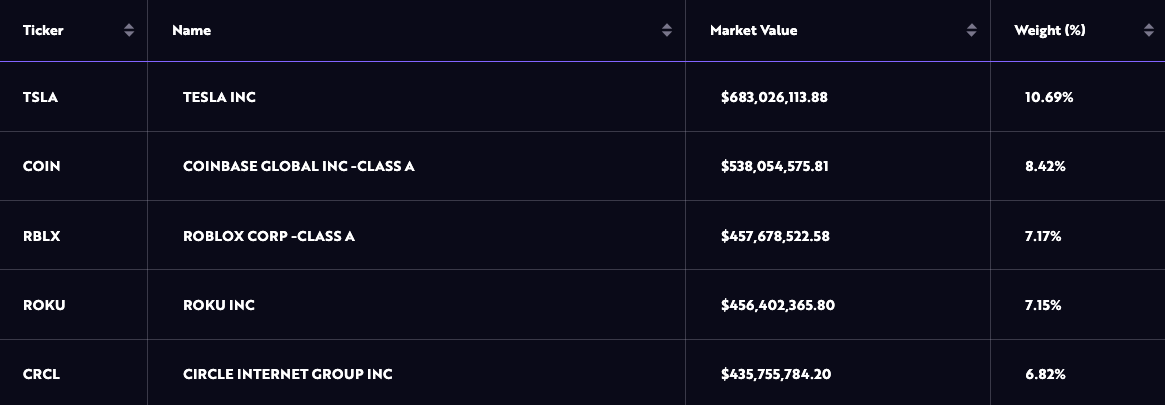

ARK’s latest sale involved transactions from the three holding funds, including the ARK Innovation ETF (ARKK), ARK Next Generation internet ETF (ARKW) and ARK Fintech Innovation ETF (ARKF).

ARKK, the largest ARK fund with assets under management (AUM) of $5.6 billion, sold 306,921 Circle shares on Monday and still holds about 1.7 million shares, accounting for roughly 6.8% of the fund’s total assets.

The two other funds, ARKW and ARKF, offloaded 72,302 shares and 36,621 shares, respectively, resulting in holdings of 625,645 shares and 369,128 shares, or 994,773 CRCL shares combined.

Related: Circle stock becomes largest component of VanEck’s digital asset index

All three funds together held 2.6 million Circle shares after the new sale, valued at around $69.9 million based on Monday’s CRCL closing price of $263.4.

Circle shares to beat USDC in market cap

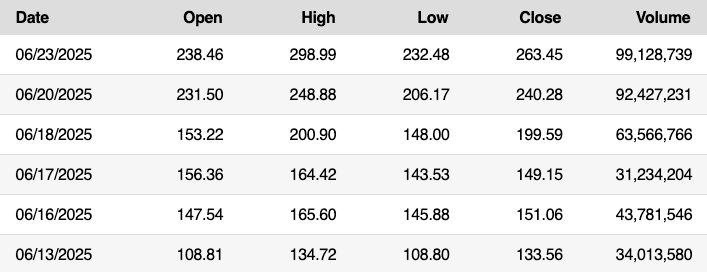

ARK’s latest CRCL sale came amid the ongoing meteoric rise of Circle shares, with the stock briefly topping at $299 on Monday, according to NYSE data.

The notable appreciation of Circle shares led to a surge in its market capitalization as it inched closer to the market value of Circle’s flagship product, the USDC (USDC) stablecoin.

According to CompaniesMarketCap data, Circle Internet Group is now the 324th largest public company worldwide, with a market capitalization of $63.9 billion.

At the same time, other sources like Investing.com estimate Circle’s market cap at roughly $60 billion, suggesting that the company has yet to beat USDC’s current market value of $61.7 billion, according to CoinGecko.

Magazine: Crypto wanted to overthrow banks, now it’s becoming them in stablecoin fight