- Whale outflows and strong Taker Buy Volume suggest rising bullish conviction.

- Drop in short-term holder activity contrasts with overvaluation signals from NVT.

Cardano [ADA] has reclaimed a crucial support zone near $0.59 after weeks of sustained bearish pressure, signaling a potential trend reversal amid strengthening buyer activity.

At press time, ADA was trading near $0.61, and bulls aim to push it toward the $0.67 resistance, a level that coincides with the upper boundary of a descending channel.

However, without a clear daily close above this level, ADA remains vulnerable to rejection.

A confirmed breakout above $0.67 could trigger a rapid move toward the $0.83–$0.91 range, as technical and sentiment factors begin to align favorably for buyers.

Are aggressive buyers laying the groundwork for ADA’s breakout?

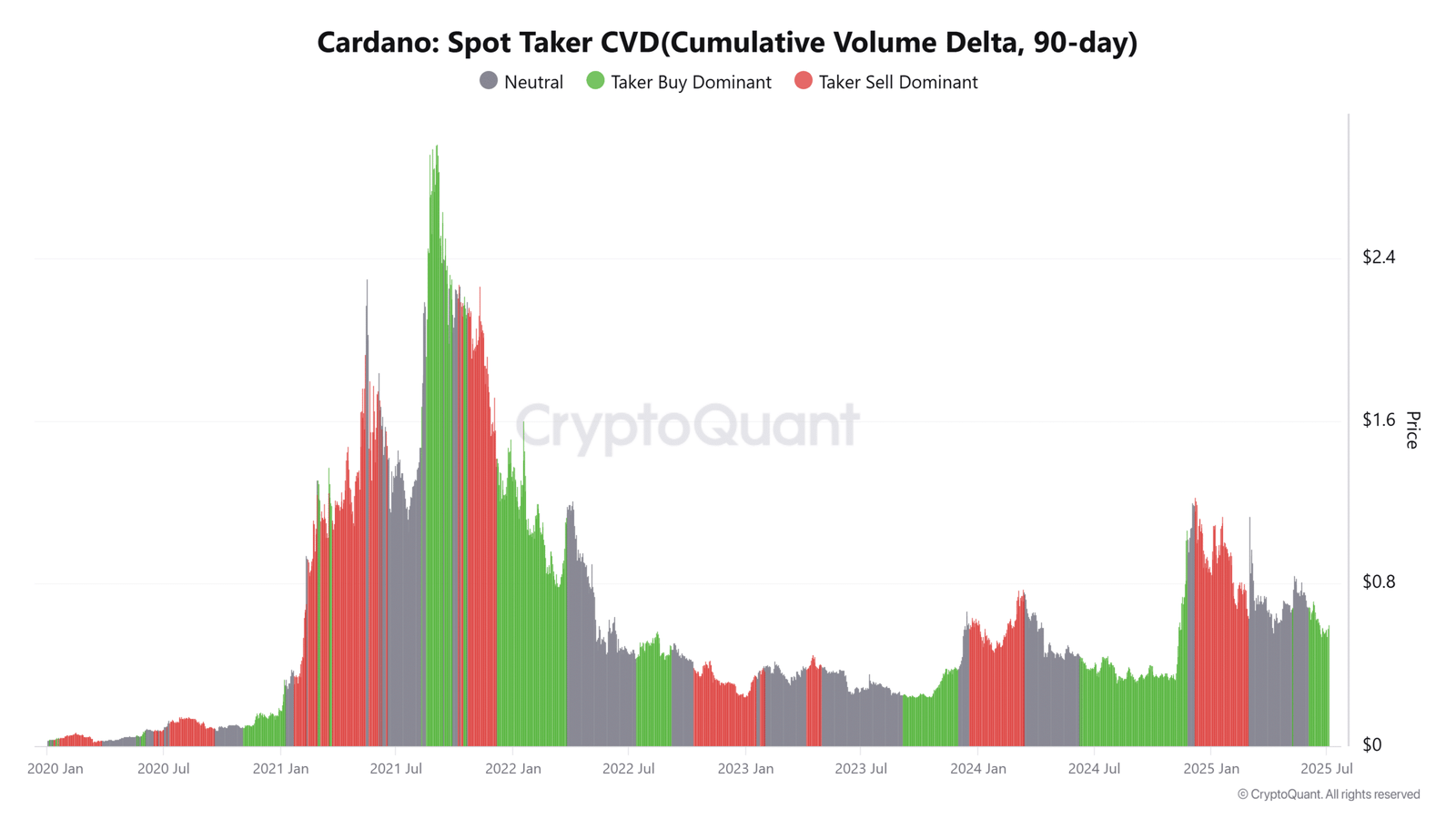

Spot Taker CVD data suggests so. Buyers have dominated the market over the past 90 days, consistently executing market orders at the ask price.

This sustained buying pressure reflects growing conviction among market participants. Therefore, if demand persists and ADA breaches $0.67, the rally may gain speed.

However, if buyer interest fades before the breakout, the price could slide back into consolidation, keeping bulls on the defensive yet again.

For now, derivatives data continues to support a short-term bullish narrative amid building spot market momentum.

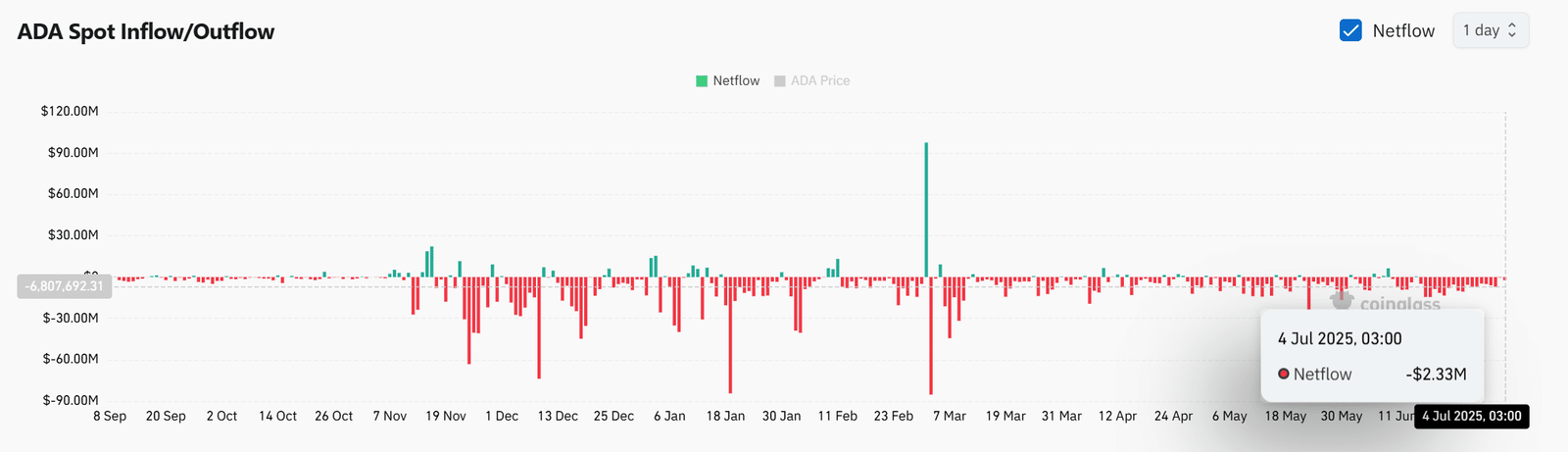

Whales resume accumulation as $2.33M exits exchanges

Whales appear to be preparing for a longer-term hold, with on-chain data revealing a $2.33 million net outflow from exchanges on the 4th of July.

This negative netflow implies that investors are moving ADA into self-custody or cold wallets, which typically reduces short-term selling pressure.

Consequently, this could support price stability or even spark a breakout if accumulation continues.

That said, such outflows must persist over time to solidify a bullish thesis. A reversal in netflows could quickly undermine the recovery, especially near critical resistance.

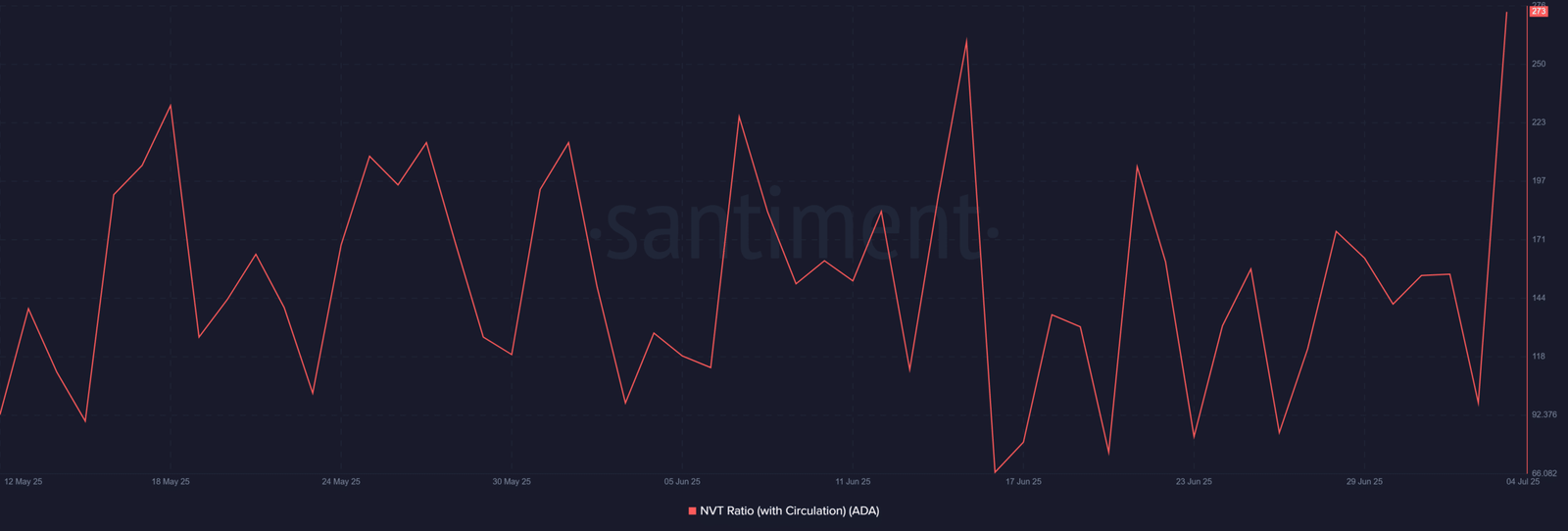

Is ADA’s network value outpacing its utility?

At the time of writing, the NVT ratio reading jumped to 273, raising eyebrows. A high NVT suggests ADA may be overvalued relative to the level of on-chain transaction activity.

Despite improving price action, this disconnect may indicate speculative interest is running ahead of real network usage. Therefore, ADA must pair price gains with improved circulation and transactional volume to sustain a meaningful uptrend.

Otherwise, the rally may weaken under valuation pressure. For now, elevated NVT remains a red flag as it signals an imbalance between market value and actual utility.

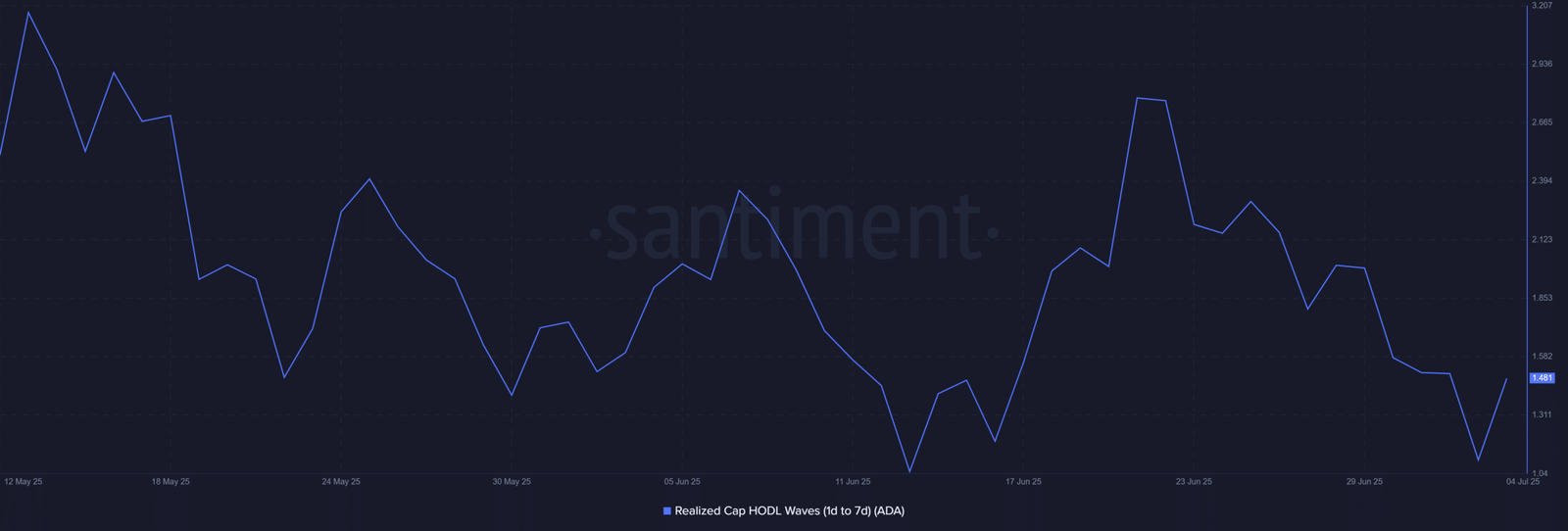

Speculators pull back as short-term holder activity dips

Realized Cap HODL Waves data shows that short-term holders are retreating. The 1d–7d band has steadily declined over the past two weeks, falling below 1.5% of the realized cap.

This trend reflects reduced speculative activity and increased long-term holding behavior, which often stabilizes price action. Additionally, it may indicate investor patience, allowing ADA room to consolidate before any major breakout.

However, if short-term traders re-enter quickly, renewed volatility could disrupt this base-building phase. For now, the lower presence of short-term holders supports a healthier setup.

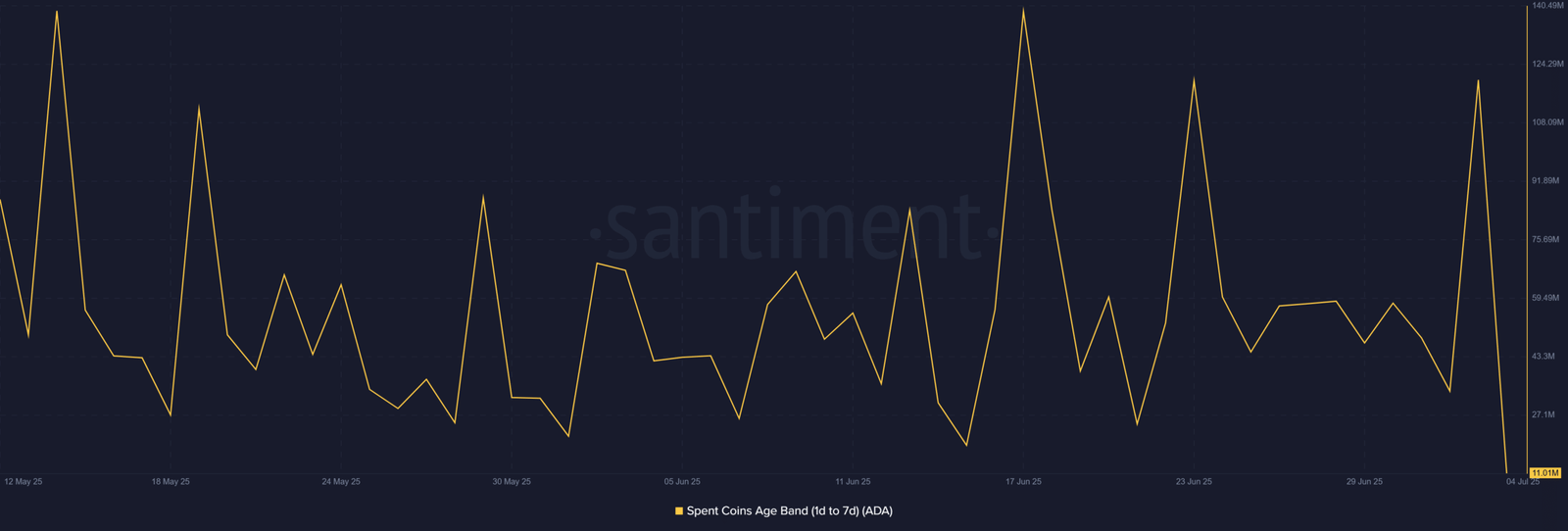

Are fewer coins being spent on-chain as conviction grows?

Spent Output Age Bands data seems to suggest so. The volume of spent coins aged 1–7 days dropped sharply to $11 million, down from repeated spikes above $100 million last month.

This steep decline implies reduced short-term profit-taking, reinforcing the idea that recent holders are opting to wait. If sustained, this trend may reduce immediate sell pressure and allow bullish momentum to develop.

Still, if coin spending rises suddenly, it could offset the current bullish bias. Investors should watch for consistency in this metric to gauge conviction.

Can ADA rally to $0.91 without stronger on-chain support?

ADA’s structure has improved technically, and buyers are showing strength across key derivatives and on-chain metrics.

However, valuation pressures and the need for a confirmed breakout above $0.67 still present challenges.

For ADA to reach the projected $0.83–$0.91 range, it must pair momentum with utility and maintain low sell pressure.

Until then, investors should expect further consolidation or gradual progress unless catalysts drive stronger conviction.