Key Takeaways

- Cardano rallied 23% this week, but on-chain signals and equal liquidations hint at a possible distribution phase ahead. Will ADA revisit $3 this year, or get stuck below?

At press time, Cardano [ADA] posted a 3.52% gain in the past 24 hours, taking its 7-day return over 23%. The recent rally has pushed the altcoin into a high-profit territory, but this might not be all good news.

Is Cardano’s 23% Rally a Warning for a Market Correction?

Market indicators suggest that ADA could soon become overbought, and investors seem to be adjusting accordingly at press time. This aligns with AMBCrypto’s forecast for the altcoin.

Profit-taking could trigger the next market drop

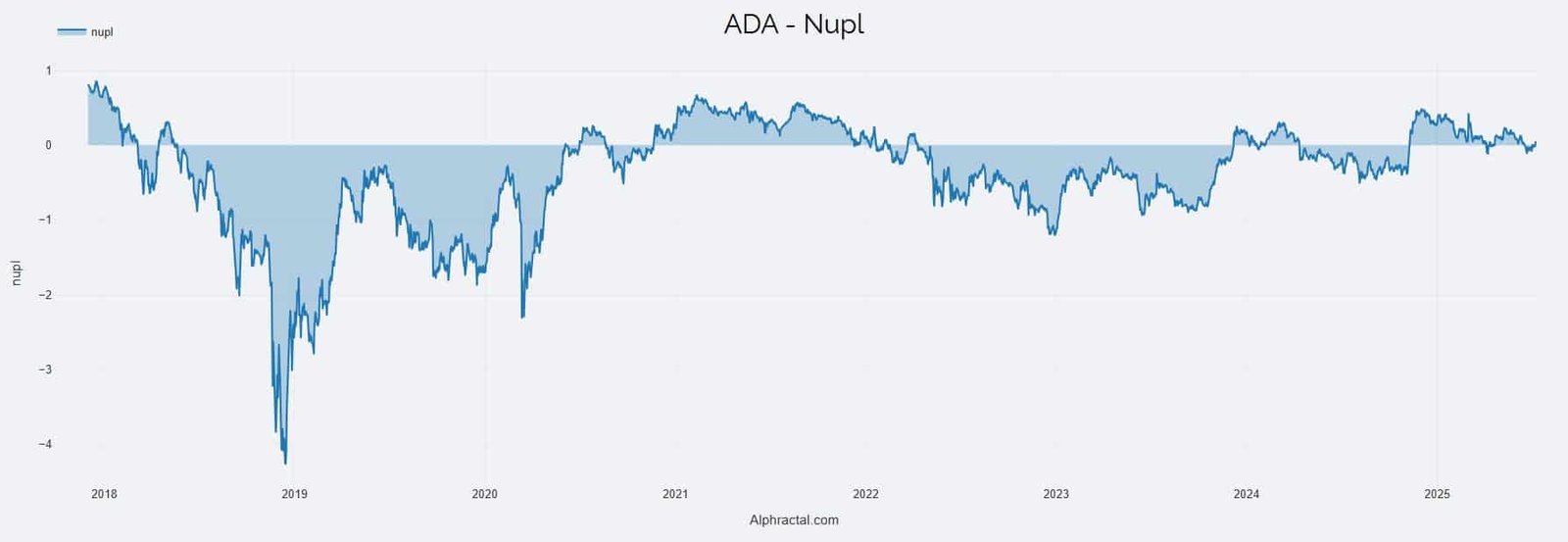

At the time of writing, Cardano’s Net Unrealized Profit and Loss (NUPL) stayed significantly above zero, indicating most holders were in profit.

Historically, such profitability often precedes a decline, as investors move to lock in gains, triggering a downtrend.

With ADA climbing, signs of a distribution phase have started to emerge.

Alphractal’s Joao Wedson echoed this caution, citing a short-term cooling period before ADA possibly rallies past $3 by October or November.

Interestingly, he targets $4.90 as his selling zone.

TVL ticks higher. Signal of conviction or exit trap?

Significant activity has been observed across Cardano’s decentralized finance (DeFi) space and on centralized exchanges, hinting that the market may be preparing for a new phase.

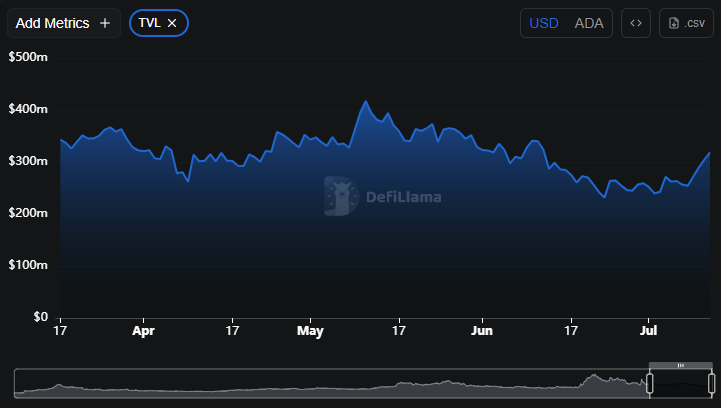

In DeFi, ADA’s Total Value Locked (TVL) has surged by 3.44% over the past 24 hours, according to DeFiLlama.

A rise in TVL typically means that investors are locking their ADA into protocols to earn rewards, often a signal of bullish long-term sentiment.

This recent surge in TVL to $313.75 million could indicate that long-term investors are looking to earn passive income from ADA even as the asset enters a distribution phase.

In the spot market, investor sentiment is clear: ADA is being sold.

At press time, CoinGlass data showed that $280,000 worth of ADA had exited exchanges in the past 24 hours. This marks the first significant outflow after days of steady accumulation.

Bulls and bears in a deadlock? Not quite

In the derivatives market, sentiment appears mixed, although buyers still have a slight advantage.

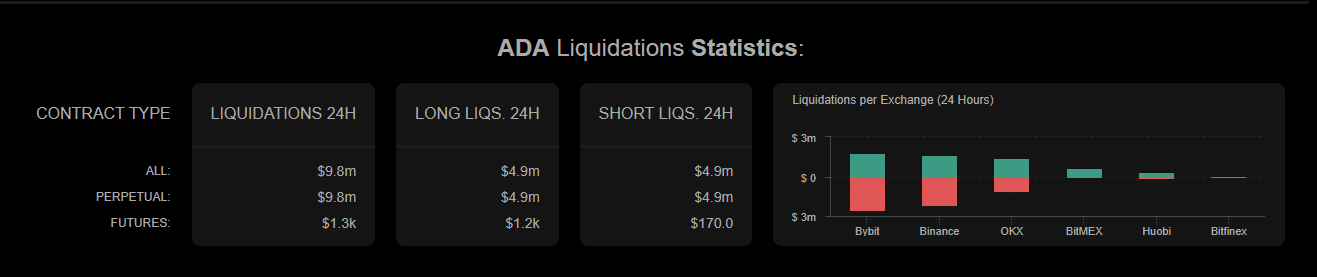

At the time of writing, liquidation data on Coinalyze showed nearly equal volumes for long and short positions in the perpetual market.

Approximately $4.9 million was liquidated on both long and short positions, highlighting indecision in ADA’s market direction.

Despite this uncertainty, the Long-to-Short Ratio suggests bullish sentiment may still dominate.

Recent buyer volume accounted for 76.22% of trades, while sellers made up just 23.78%, giving bulls a potential advantage.

However, if selling pressure intensifies, these buyers could face steep losses.