- Binance Coin’s daily transactions dropped 6.49% to 14 million.

- Price remains steady, but weakening on-chain metrics hint at downside risks.

In the past 24 hours, Binance Coin [BNB] maintained a relatively stable performance, with no major gain or rally, posting a minor change of just 0.56%.

But beneath that still surface, key activity metrics have taken a noticeable hit, suggesting a weakening demand outlook that could pressure BNB in the coming days.

User activity dips across the board

A closer look at the BNB Smart Chain shows a decline in overall engagement. Both transaction count and unique user numbers have declined significantly.

Daily Transactions fell by 6.49% to 14 million on the 24th of June, down from a local high of 17.7 million just four days prior.

AMBCrypto links this trend to ongoing adoption challenges. New Addresses creation also dropped 20.73%, falling to around 449,000.

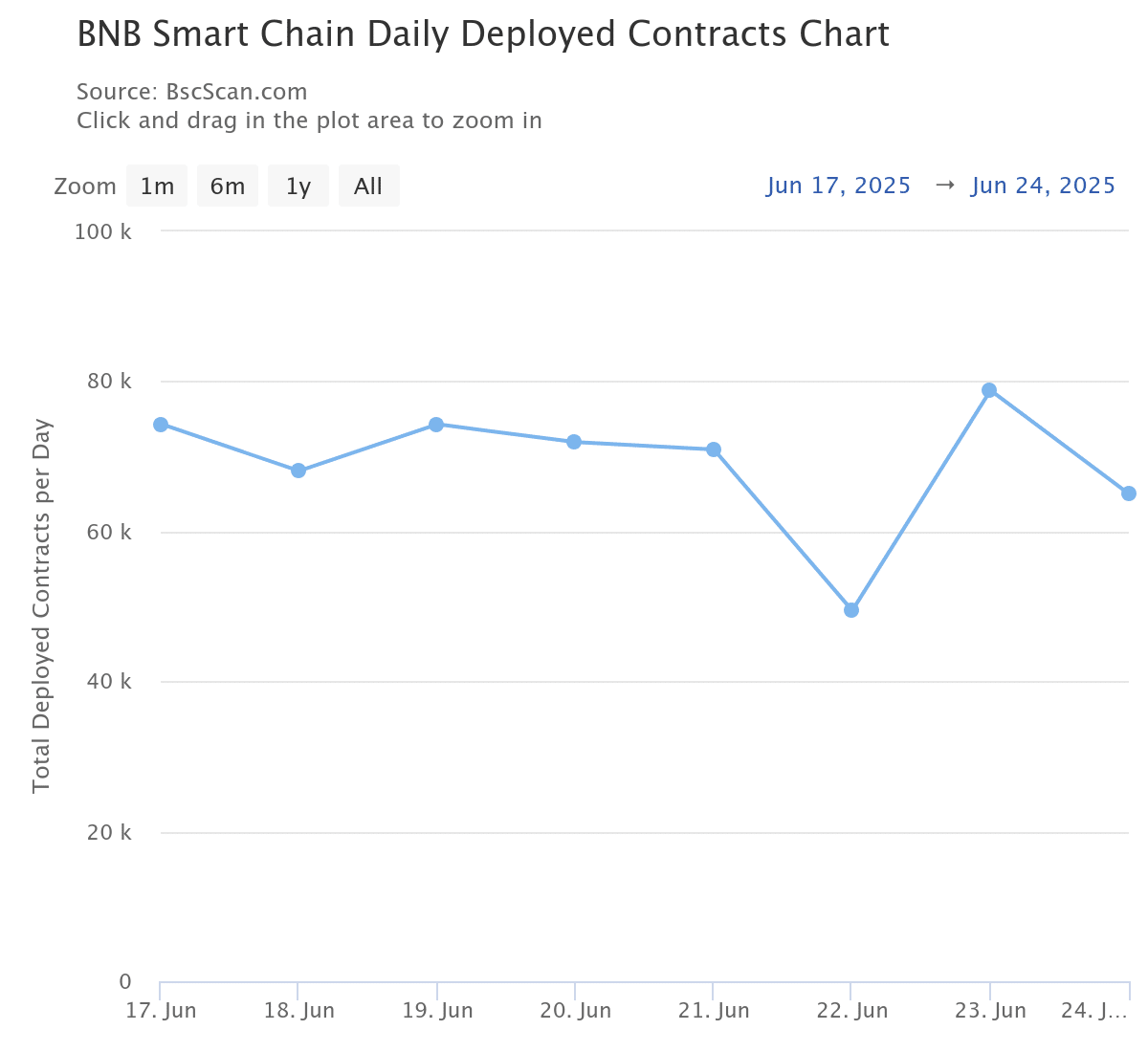

This suggests waning interest in BNB among on-chain users. Developers appear to share this sentiment, with Smart Contract Deployment also showing a steep decline.

During the same period, daily Deployed Contracts dropped 17.4%, closing at 67,000 on the 24th of June compared to nearly 81,000 on the 23rd.

Smart Contract Deployment is a key measure of development activity. A higher number typically indicates growing demand and user engagement.

The recent decline reflects reduced interest from both developers and users, which has limited BNB’s price movement in the last 24 hours.

BNB usage down, but supply stays put!

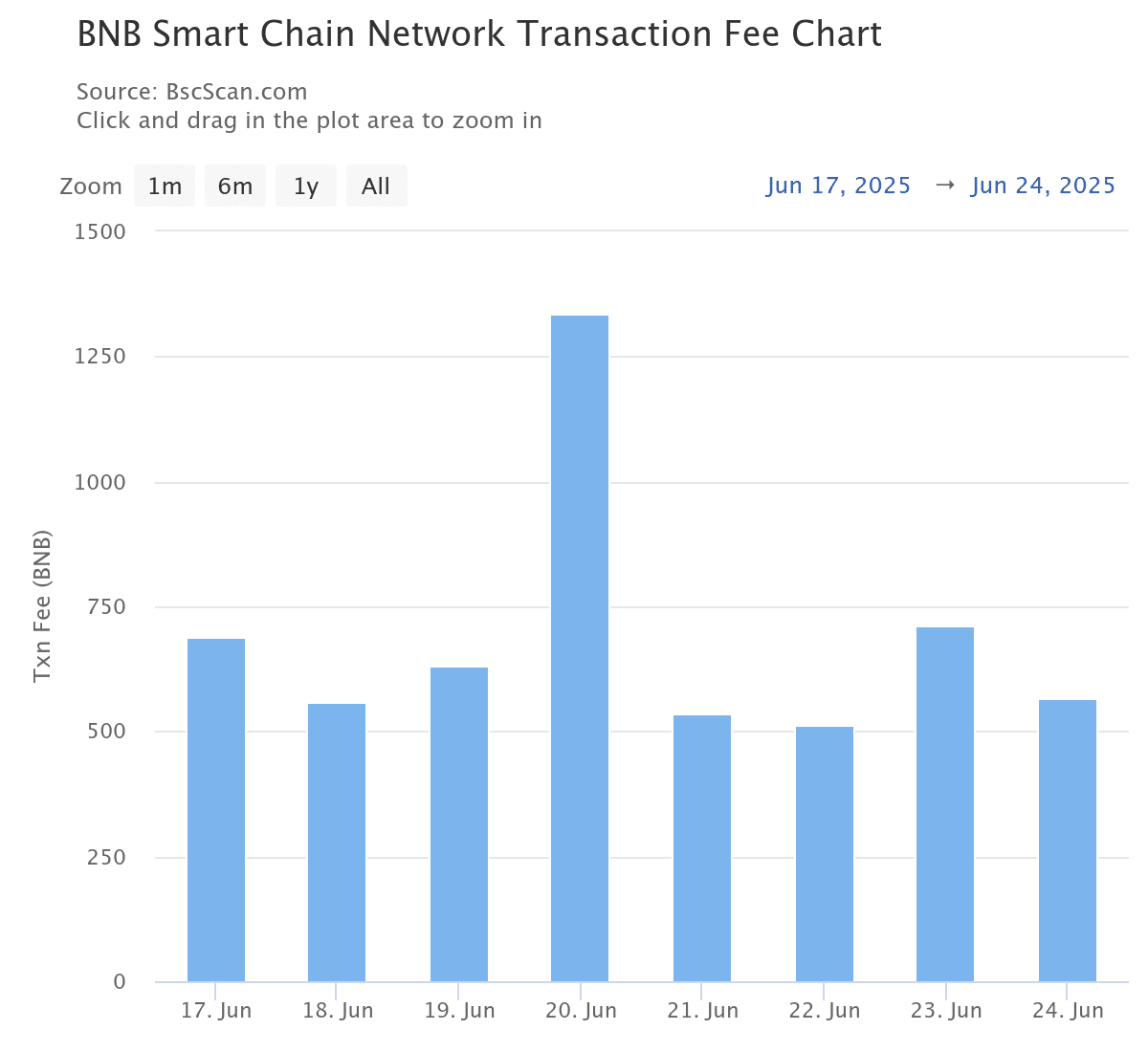

On-chain user activity and protocol interaction have declined, and so has BNB usage. Total Transaction Fees paid on the 24th of June amounted to just 565.14 BNB, down 20.43% from 710.12 BNB on the 23rd.

This drop coincided with lower user engagement, reflecting shrinking demand to move assets or interact with protocols.

Even more stark was the fee peak earlier in the week. On the 20th of June, BNB Transaction Fees spiked to 1,348.44 BNB—likely tied to a short-lived activity surge when Daily Transactions briefly hit 17.7 million.

Since then, fees and transactions have steadily declined. Average Fees per transaction also slipped 14% over the past day, dropping to roughly $0.03.

With fewer tokens being burned via gas, BNB’s circulating supply remains static while demand cools—a setup that could build bearish pressure.