- Ethereum reserves on Binance surge, but whales may be positioning.

- U.S. demand and ETF inflows show bullish accumulation, while technicals point to market indecision.

Ethereum [ETH] is on the move, but which way is it heading?

Reserves on Binance just hit their highest level since May 2023, sparking debate about whether a sell-off or a surprise rally is around the corner.

Meanwhile, U.S. investors are buying steadily, with strong ETF inflows and signs of rising demand pointing to a possible breakout.

Ethereum floods Binance

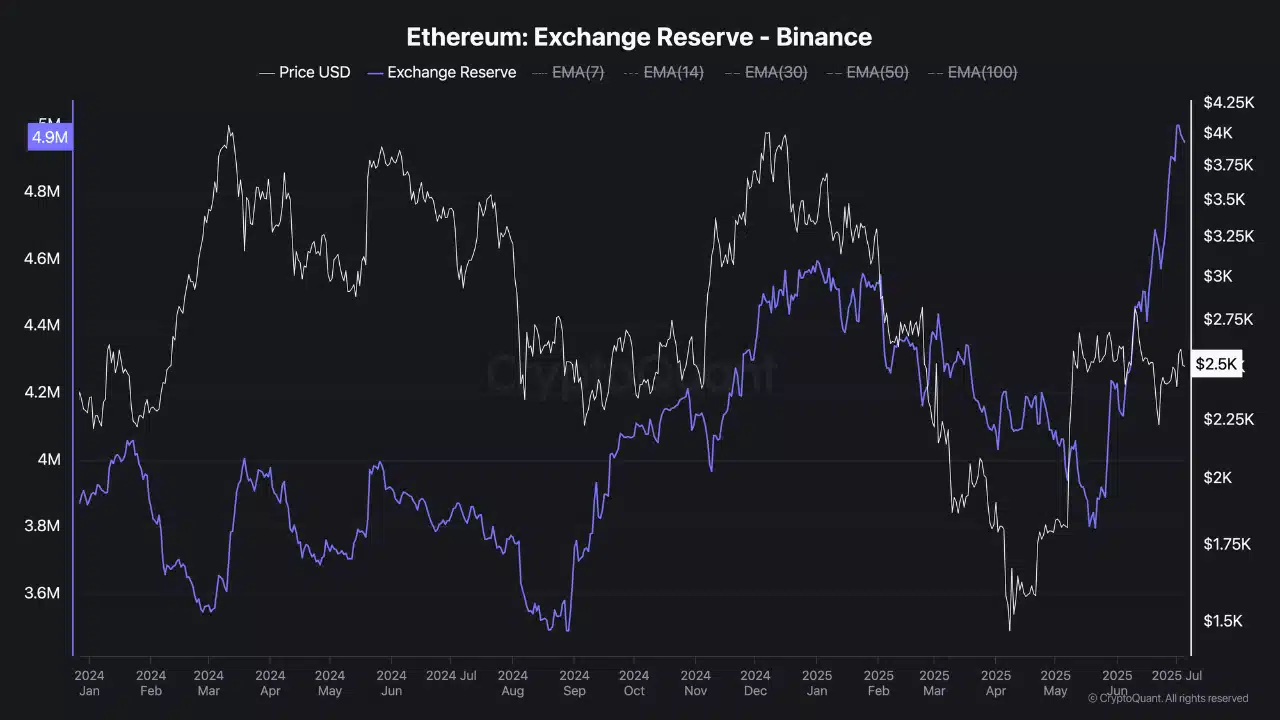

Ethereum’s Exchange Reserve on Binance surged past 4.9 million, the highest level seen since May 2023.

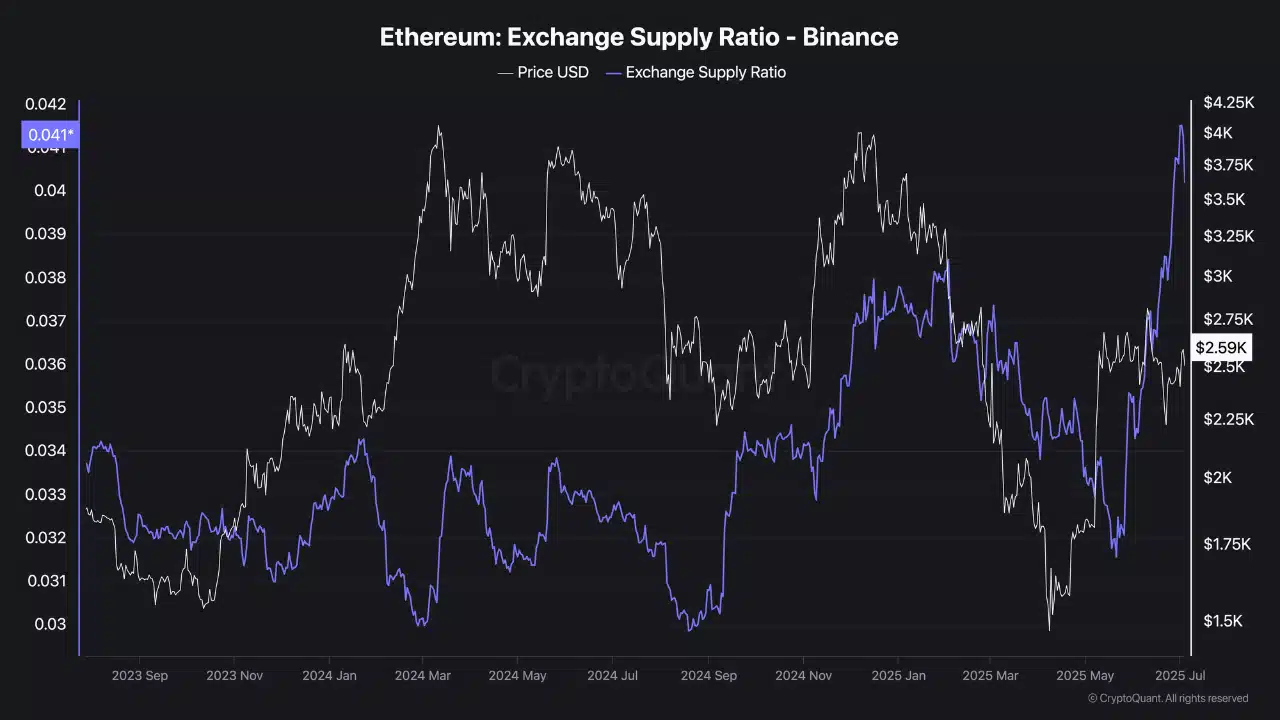

That’s over 4% of ETH’s total circulating supply now sitting on a single exchange.

This kind of spike is often linked to incoming selling pressure. Historically, growing reserves on centralized exchanges like Binance have preceded price corrections.

Yet this time, the price hasn’t buckled.

Despite the reserve spike, ETH stayed relatively stable around $2,590. That kind of resilience is a sign that buyers might be absorbing the sell-side pressure or that whales are gearing up for something bigger.

Either way, this is no ordinary supply shift.

The case for a bullish breakout

While Binance reserves surge, U.S. investor appetite appears to be on the rise; so not all ETH moving to exchanges is destined for sell orders.

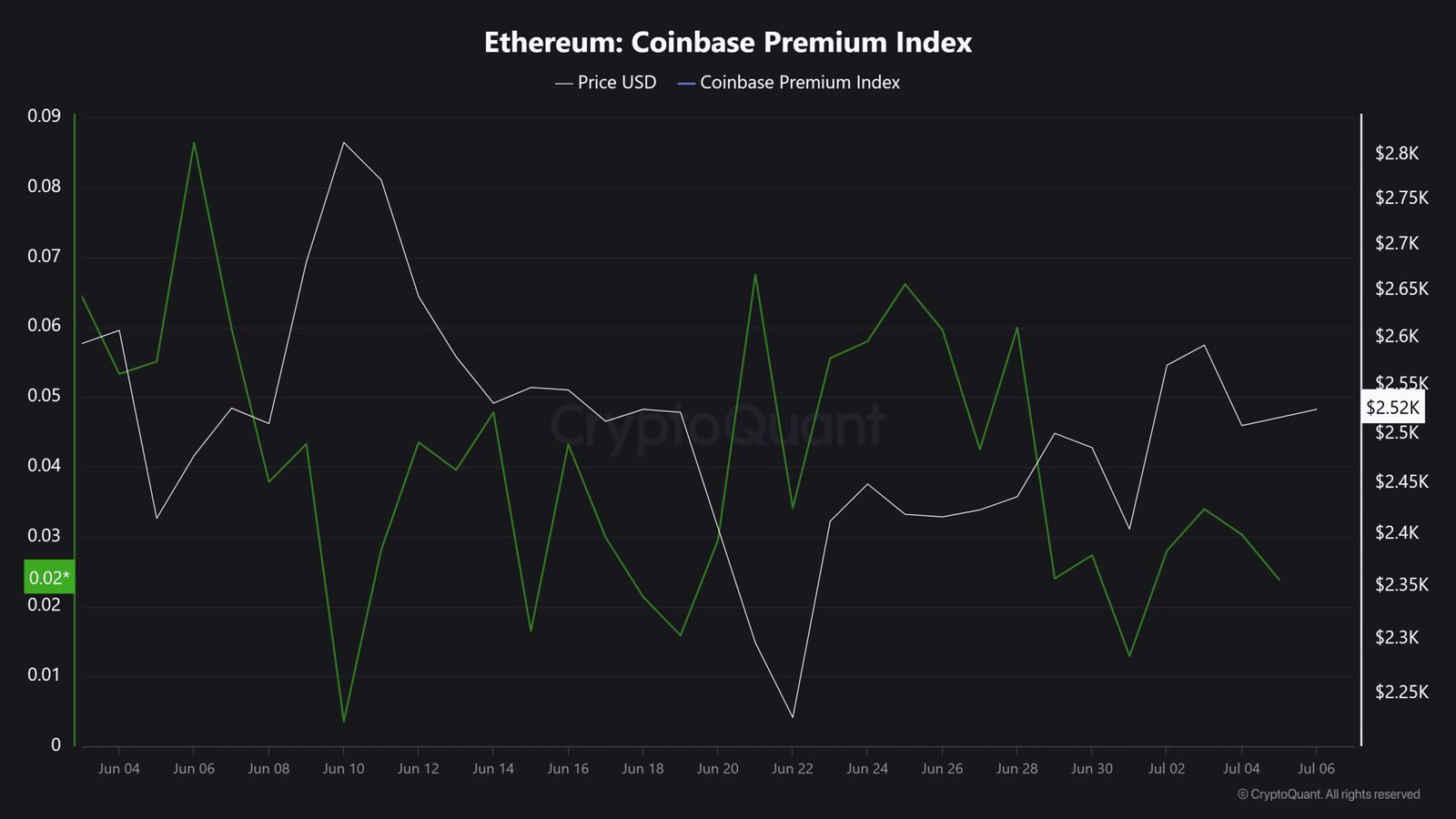

The Coinbase Premium Index has held mostly positive through June and early July, showing stronger spot demand on U.S. platforms compared to international ones.

This often reflects buying pressure from institutional or high-net-worth investors.

Backing this up, ETH spot ETF net inflows are gaining pace again, with $148 million in Daily Inflows on the 3rd of July, and Total Net Assets now exceeding $10.8 billion.

These strong inflow trends suggest accumulation, not panic selling — possibly absorbing the Binance supply surge.

Technicals stay neutral, markets wait for a trigger

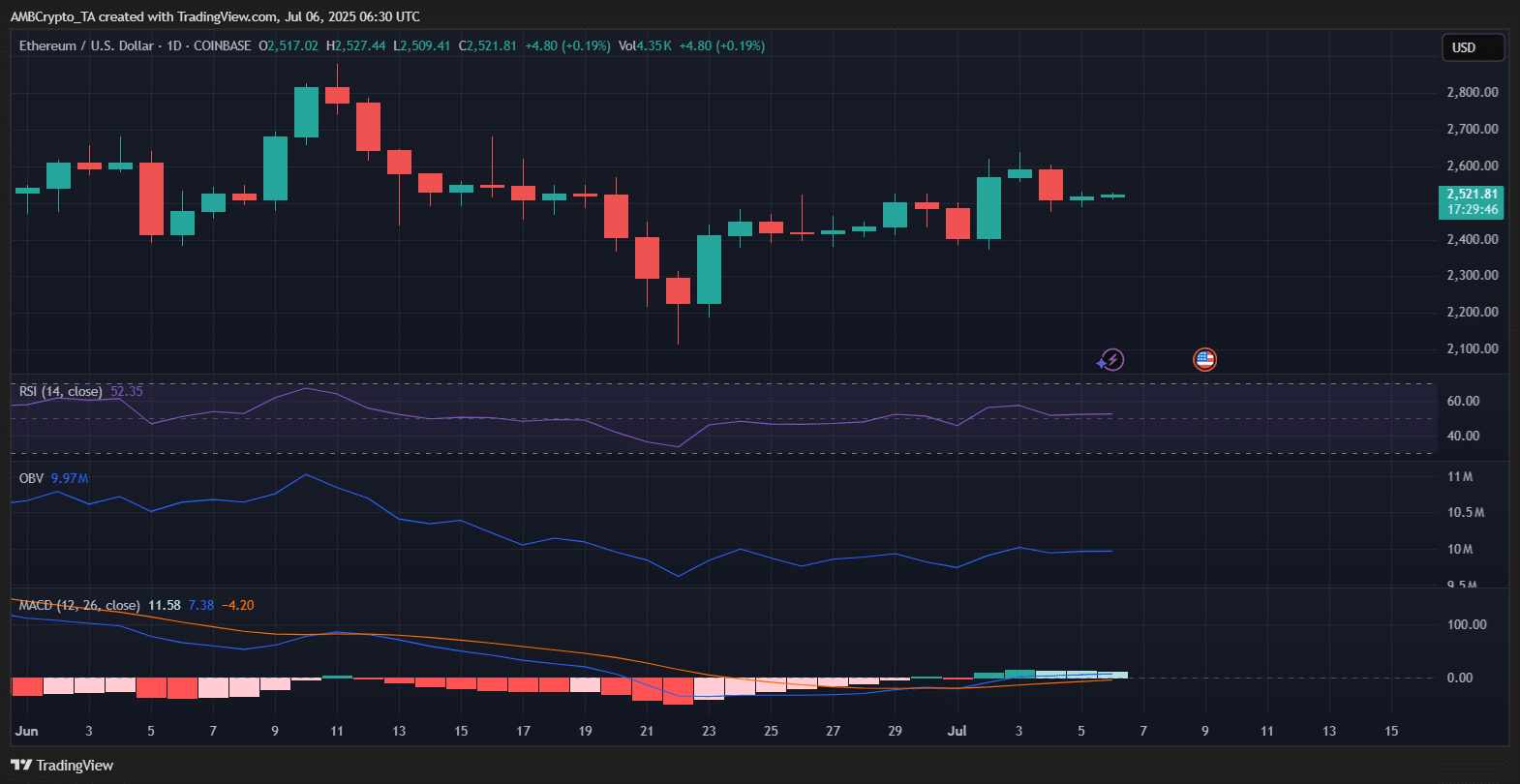

At press time, ETH traded at $2,521, showing muted price movement despite on-chain and ETF activity. The RSI hovered around 52, reflecting neutral momentum.

The MACD line recently crossed above the signal line but stayed below zero; a potential early bullish crossover lacking strong conviction.

Meanwhile, the OBV sat at 9.97M, showing no major shift in buying or selling volume. Without a decisive breakout or breakdown, ETH looked to be consolidating, possibly preparing for its next big move.