Key Takeaways

AVAX held above $21 as Buy Volume flipped positive. Momentum remains strong, but reclaiming $22.75 is key — a failure to defend $20 could drag price back to $17.

Avalanche [AVAX] has traded within an ascending channel since breaking out of a prolonged consolidation five days ago.

The surge led to an 18.23% rally, topping out at $21.53 before slightly cooling off. As of this writing, AVAX sat at $21.22, still holding a 2.12% daily gain, while the market cap rose to $8.94 billion.

But what’s behind Avalanche’s resilience despite market volatility?

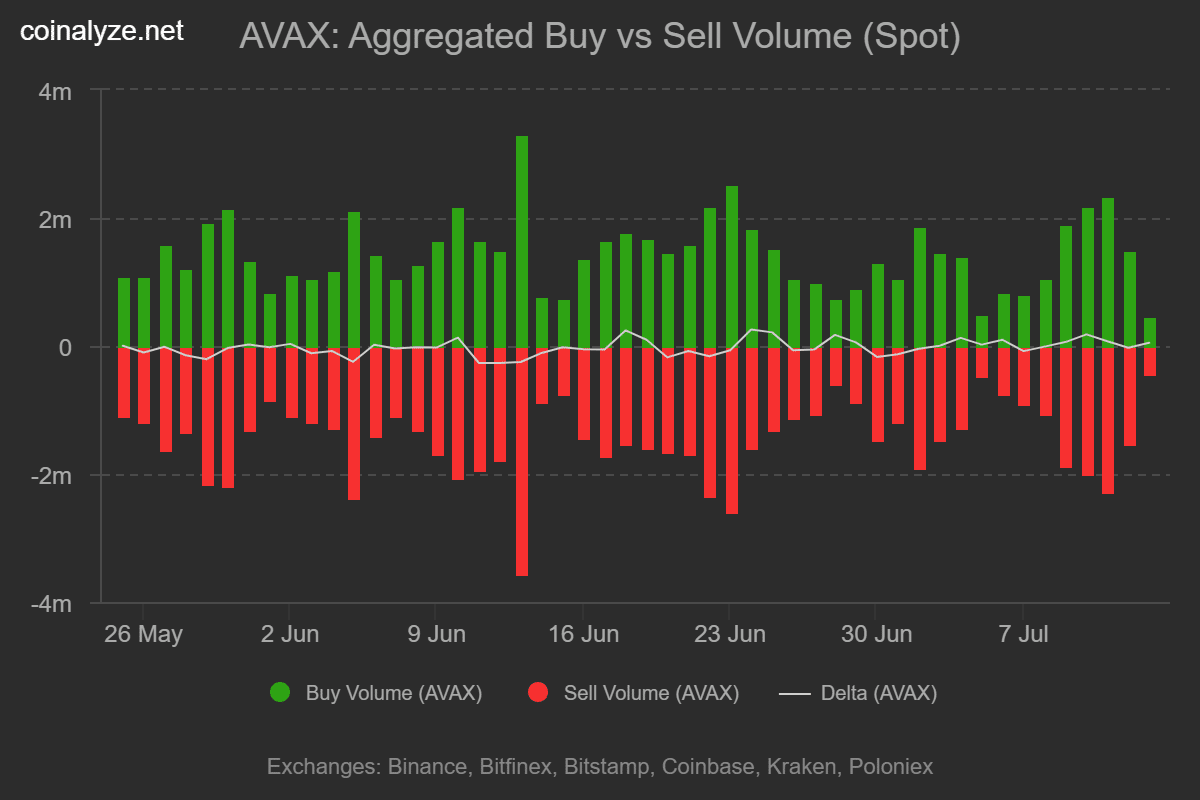

Buy walls rising — Spot traders step in

After its recent pullback, buyers stepped in aggressively to defend $21, a move reflected in spot market data.

According to Coinalyze, Buy Volume hit 481K, while Sell Volume came in slightly lower at 430K, yielding a positive Buy-Sell Delta of 50K — a bullish spot market sign.

In fact, this was a recovery from the 12th of July, when Sell Volume spiked to 1.53 million and Buy Volume dipped to 1.51 million, briefly handing power to bears.

A similar pattern emerged in the buyers’ and sellers’ power dynamics. According to MobChart, Avalanche recorded 118.47K in Buy Orders compared to 99K in Sell Orders, resulting in a positive Order Imbalance.

This tilt in real-time trading sentiment added fuel to the rally.

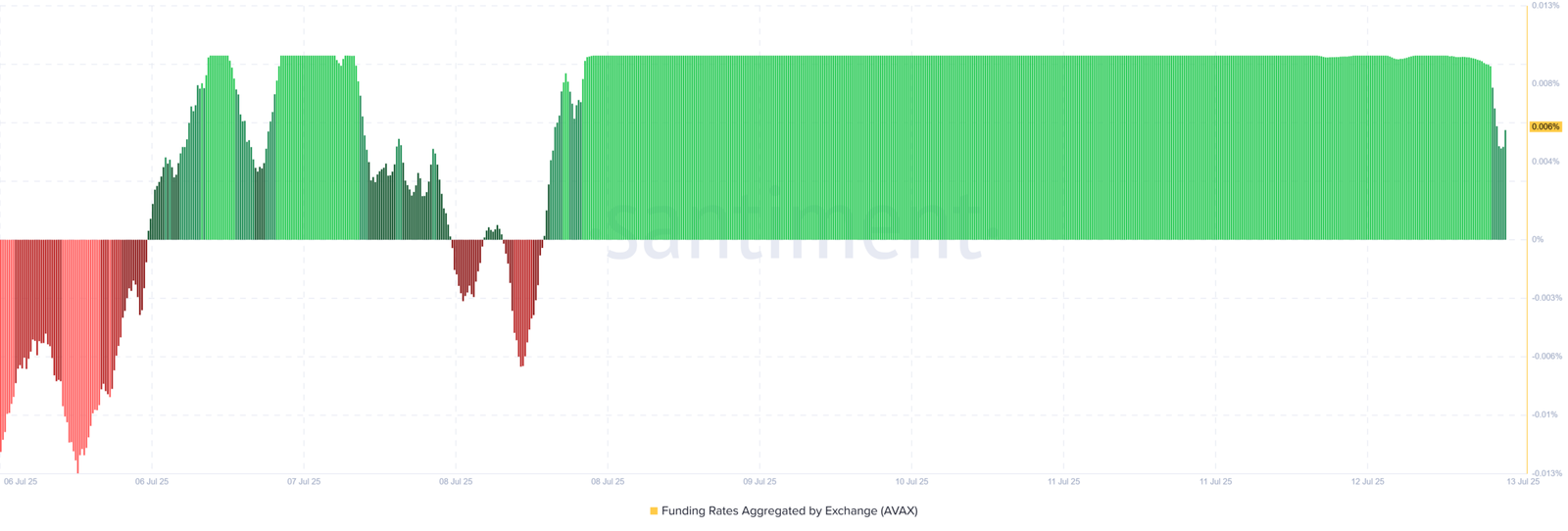

Futures still eyeing a rally

Per the Futures market, investors were overly bullish. Avalanche’s Funding Rates have stayed positive for five straight days, per Santiment, with the press time reading around 0.00616%.

On top of that, Coinalyze’s Long/Short Ratio climbed to 3.883, with longs accounting for a hefty 79.18% share.

When longs dominate, it implies most investors are actively betting on prices to continue rising — but also hints at a market leaning too far in one direction.

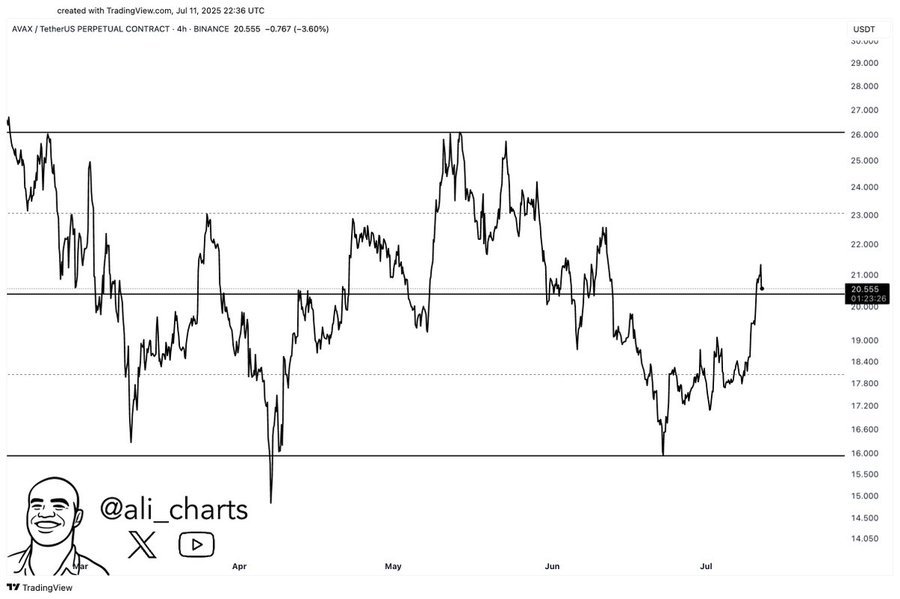

What are analysts saying?

According to Ali Martinez, AVAX must defend $20 to preserve bullish structure. A close below could trigger renewed selling, while holding it could open doors to higher targets.

If bulls hold the market above this level, the uptrend will continue, as bears will have no incentive to reenter the market.

AVAX momentum indicators say…

According to AMBCrypto’s analysis, AVAX showed resilience as bulls rushed into the market to defend the rally.

As a result, the altcoin’s Stochastic RSI remained elevated around 99.63, reflecting overbought conditions. Likewise, Avalanche’s +D1 of DMI remained around 30, further confirming the presence of a strong upward momentum.

If AVAX holds momentum and flips $22.75 into support, the next stop could be $24.40.

However, a break below $20.01 could drag the price down to $17, especially if sellers regain control and spot support vanishes.