Key Takeaways

- Story Protocol led the AI coins on the second day of seeing altcoins’ gains, with liquidity zone and chain activity supporting this bullishness. However, IP faces a key test at $5?

The crypto markets continued to rise after the potential start to altcoin season, as noted in an earlier AMBCrypto analysis, where alts outperformed Bitcoin.

Among the performers are AI coins, which have been led by Story [IP], Injective [INJ], among others.

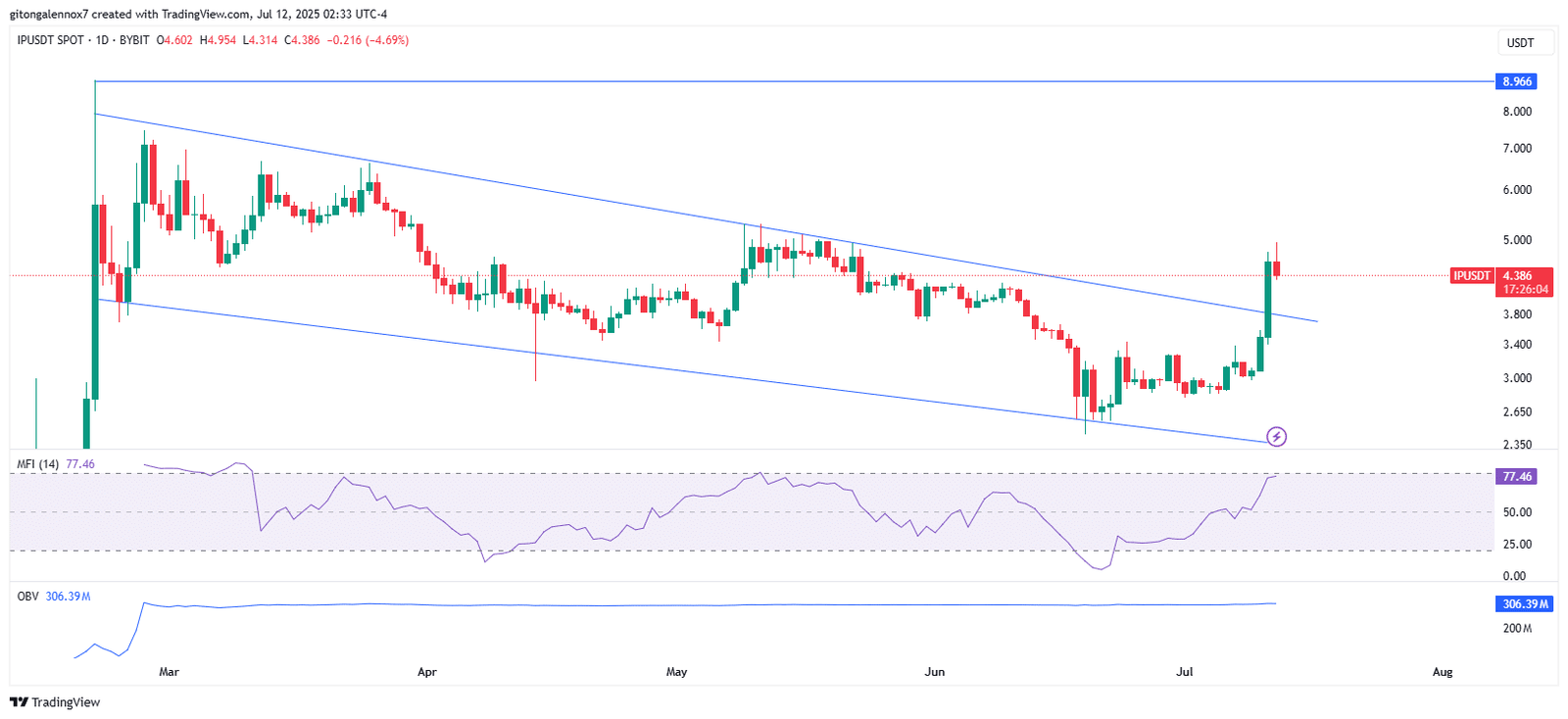

For IP, the altcoin gained 25% in a day while the volume was at $181.44 million, up about 170%. The ATH was still at $8.96 or a drop of about 52%, with its low of the day at $3.59.

The price surge of IP was an indication that triggering the continuity of the uptrend was still a possibility.

In fact, the token’s price crossed the descending channel and moved above the resistance, which confined upper advances. The channel’s top was above $7 while its low was at $2.5.

At press time, IP was trading at $4.386 and appears to be heading toward the pattern’s lower boundary at $3.80, where a decisive move – either a rebound or breakdown- may occur.

Buyers drove the charge

Naturally, the Money Flow Index (MFI) at 77.46 flagged strong buying pressure, almost to an overbought level.

The inability to break above $5 after the retest may prompt a downside decline to $3.60, a former support zone.

Additionally, the buying momentum was still in effect as the On-Balance Volume (OBV) was still appreciating.

Still, if IP manages to reclaim $5 and flip it into support, the bullish thesis could stay alive.

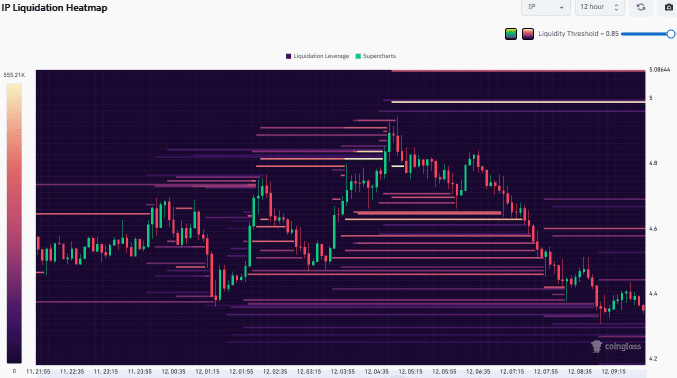

Leverage magnets show danger zones near $5

On CoinGlass’ Liquidation Heatmap, dense clusters of liquidations were stacked between $4.5 and $5.08, including a high-concentration zone at $516K.

That level aligns perfectly with the resistance IP just failed to conquer, implying it’s not just technical traders watching this line – leverage is loaded here too.

In fact, if price reclaims this region, another round of short liquidations could cascade upwards. But failure to hold $4.3 might just as easily unravel bullish momentum.

Assessing Story’s (IP) chain activity?

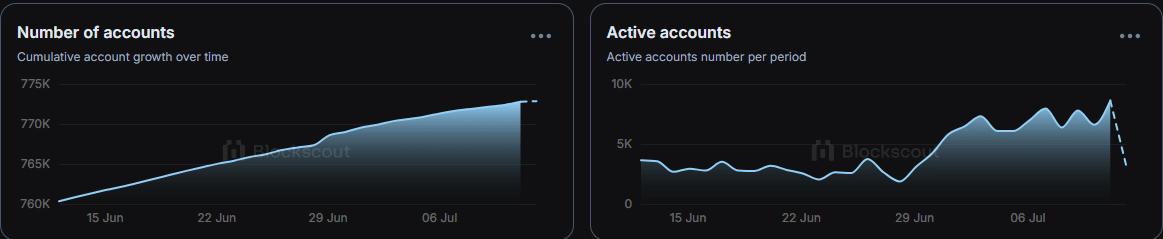

Further look into chain activity on Story Scan, it indicated various important metrics were currently rising.

The Cumulative Completed Transactions of IP were 34.907 million transactions, while 253,807 accounted for the last 24 hours alone.

For the overall accounts, the number crossed 772,858, while Active Accounts were below 10,000.

The total addresses 3.83 million as new transactions stayed flat since the 29th of July, and the total volume of IP transfers stood at 1.789 million, at press time.

Additionally, the active accounts also indicated an increasing engagement, with a significant rise in early July.

Contract activity backed this rise in participation. Over the past two weeks, 2,742 new contracts were confirmed, raising the total count to 321,935.

Such spikes in on-chain deployments often precede platform stickiness, and in this case, support the thesis that this isn’t just a one-day pump.

![AI tokens are heating up! Story’s [IP] 25% pump is just the start IF…](https://cryptotickernews.com/wp-content/uploads/2025/07/1752334404_AI-tokens-are-heating-up-Storys-IP-25-pump-is.png)