- AAVE gained over 100% since April and broke $290, a key resistance now acting as support.

- The price is above the 200-day EMA, suggesting a continued bullish trend.

Despite market uncertainty, Aave [AAVE] has been consistently garnering significant attention from investors and traders due to its impressive performance.

The daily chart reveals that the altcoin has rallied over 100% since late April 2025 and analysts think it is poised for an additional 40% upside.

This bullish speculation is based on AAVE’s recent breakout above resistance, a strong surge in whale participation, and notable exchange outflows over the past 48 hours.

Whale activity skyrockets!

Large transaction counts have exploded.

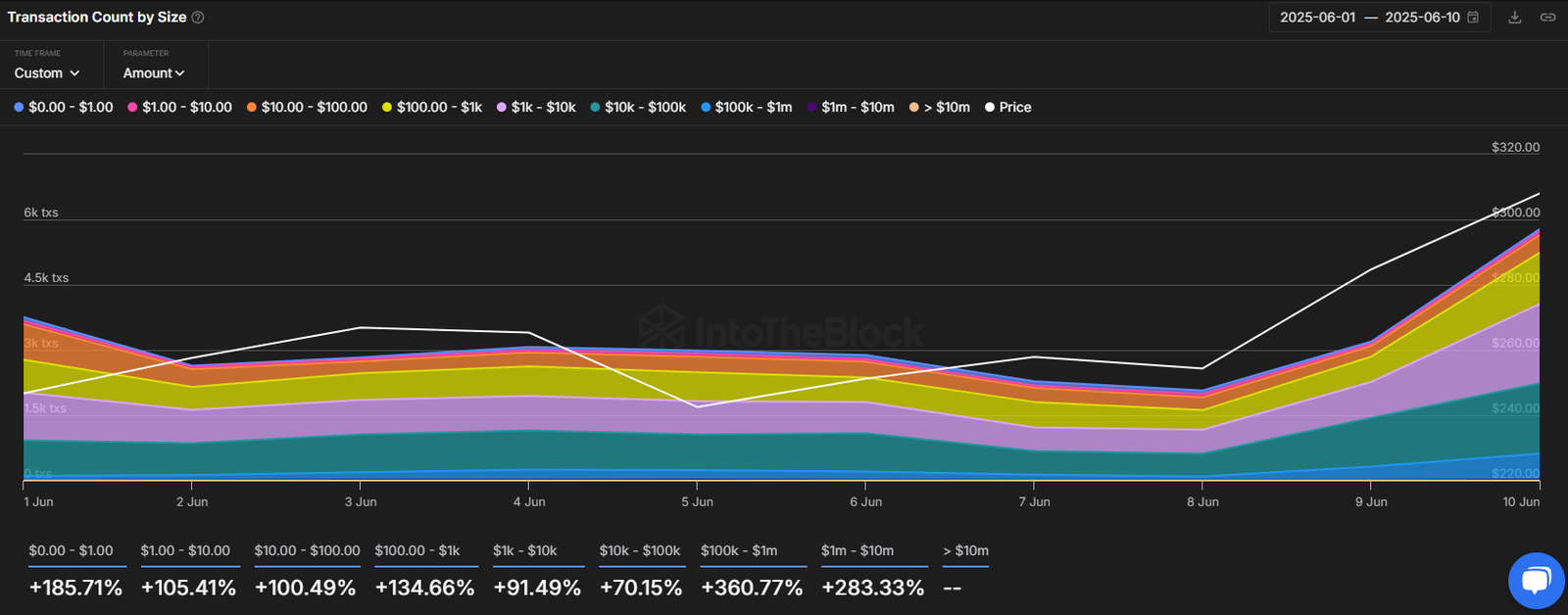

According to IntoTheBlock, transactions in the $100K–$1M range spiked by 360.77%, while the $1M–$10M cohort surged 283.33%.

Such notable transactions are typically associated with whales or institutions.

Moreover, this surge was observed following a breakout above a key level, which likely contributed to the price rally and now signals continued bullishness for the asset.

$310 and climbing…..

At press time, the altcoin traded just above $310, clocking a 7% gain in 24 hours. More importantly, Trading Volume jumped by 55%, confirming strong spot participation.

When price increases happen alongside spikes in trading volume, it often indicates genuine conviction rather than temporary hype.

A rise in volume with the price suggests strong market support and buyer confidence, indicating a potentially sustainable rally.

Technical analysis from AMBCrypto suggested that AAVE appeared bullish, having successfully broken out of a strong resistance level at $290.

This breakout followed a period of prolonged consolidation, which is itself a bullish signal, and it indicates that the upcoming rally could be parabolic.

If the altcoin maintains its upside momentum and holds above the $290 level, the upward trend could continue. Thus, there is a strong possibility that AAVE’s price could surge by over 35%, reaching the $416 level.

This breakout, paired with the asset trading above the 200-day Exponential Moving Average, strengthens the case for continuation.

$5.63 million worth of AAVE outflow

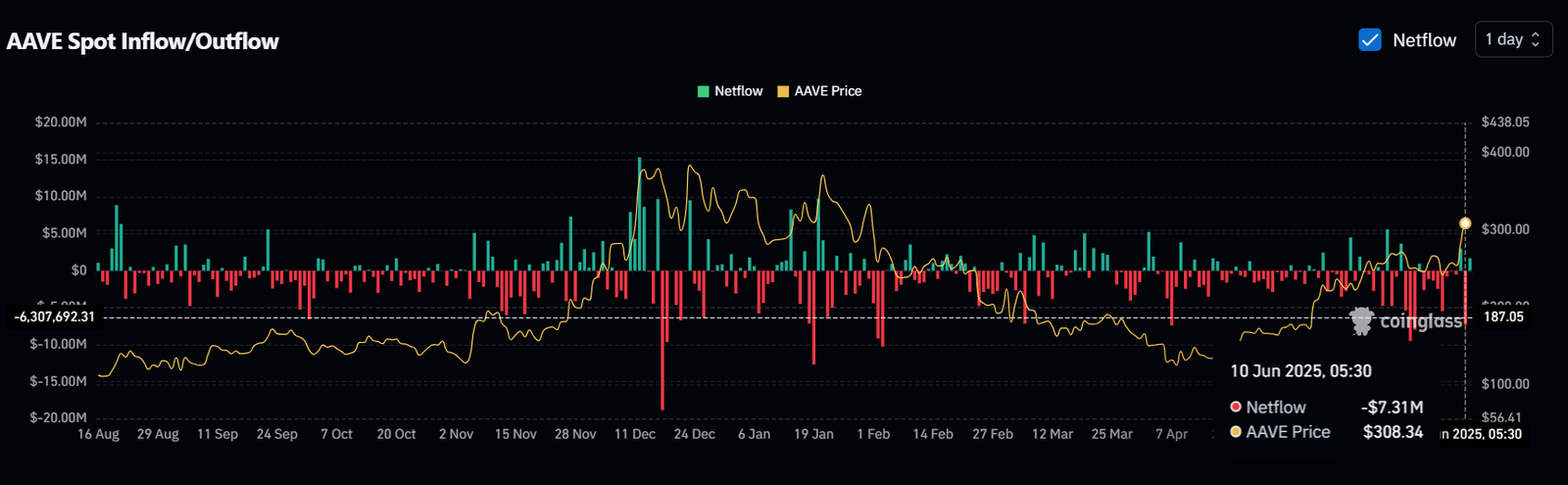

Meanwhile, this bullish outlook is further strengthened by potential accumulation from investors and long-term holders, as reported by the on-chain analytics firm CoinGlass.

Data from Spot Inflows/Outflows revealed that exchanges recorded an outflow of approximately $5.63 million worth of AAVE tokens over the past 48 hours.

Currently, such outflows indicate potential accumulation, creating buying pressure and upward momentum. Overall, it seems that the bulls are pushing AAVE’s price toward a new high.