Key Takeaways

Ethereum’s rally over the past week saw prices rapidly climb past the $2.8k resistance, a problematic area since February. Investors have good reason to continue to HODL.

Ethereum [ETH] was projected to have a bullish Q3 2025.

The ETH/BTC was also recovering, a sign that the leading altcoin was gaining strength against Bitcoin [BTC].

Ethereum experienced nine consecutive weeks of positive spot ETF inflows, solidifying its status as a Wall Street darling.

Ethereum was not thought to be like a tech stock, but rather an asset that fuels DeFi and can earn dividends through staking.

The increased demand for Ethereum among institutions and retail boosted its prices. The psychological $3,000 level continued to pose a sizeable barrier.

BTC in price discovery meant that ETH would soon follow it higher.

Ethereum traders, mind the gap

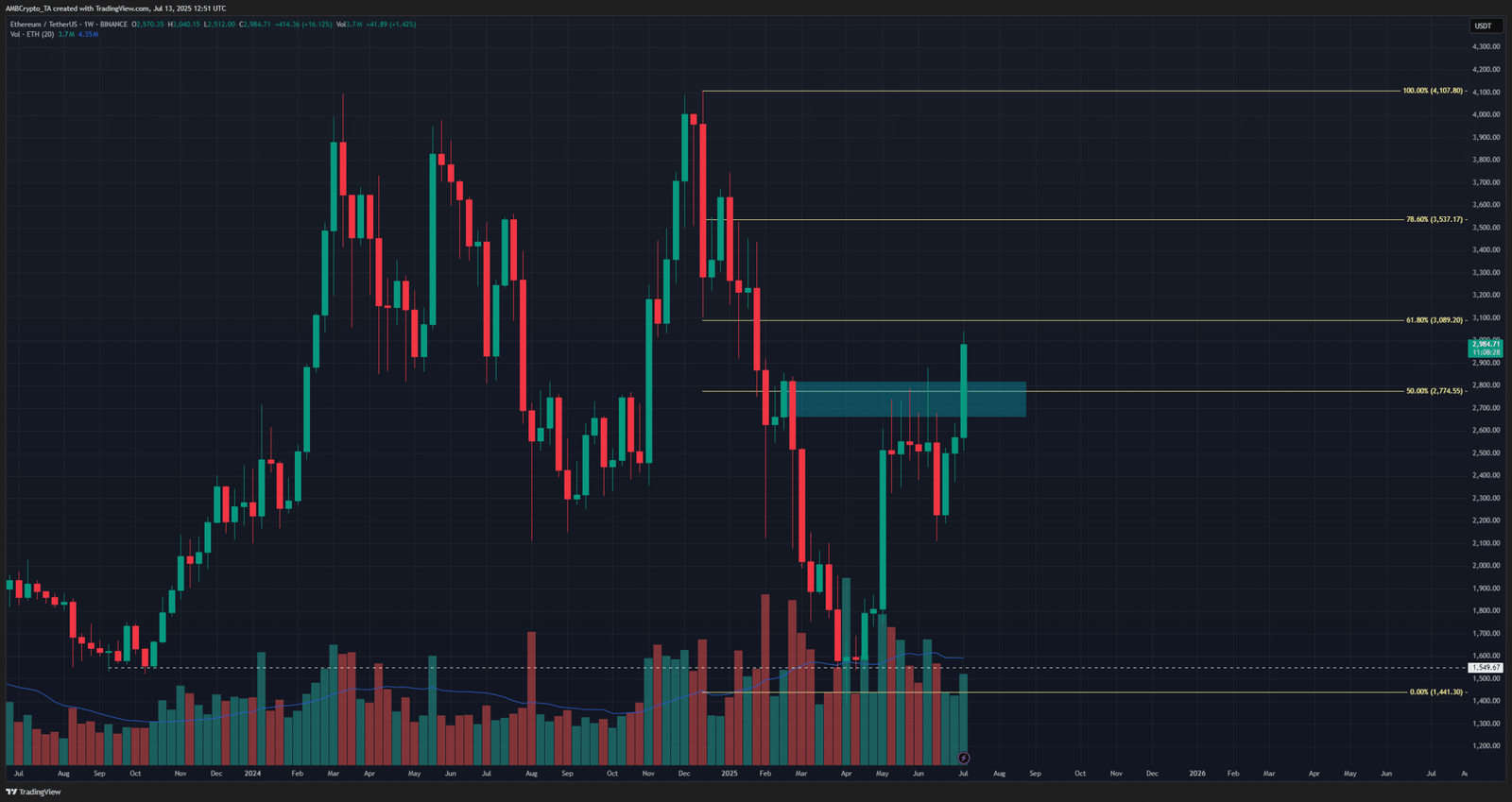

The weekly chart showed Ethereum blasting past a bearish order block (cyan) at the $2.8k mark. This signified intense bullishness and showcased buyer eagerness.

It also meant that swing traders might have to wait for a retest of the $2.8k region as support before entering long positions. The weekly surge has left a gap to the south that might need to be filled before the next rally.

Will short-term bulls need to reload?

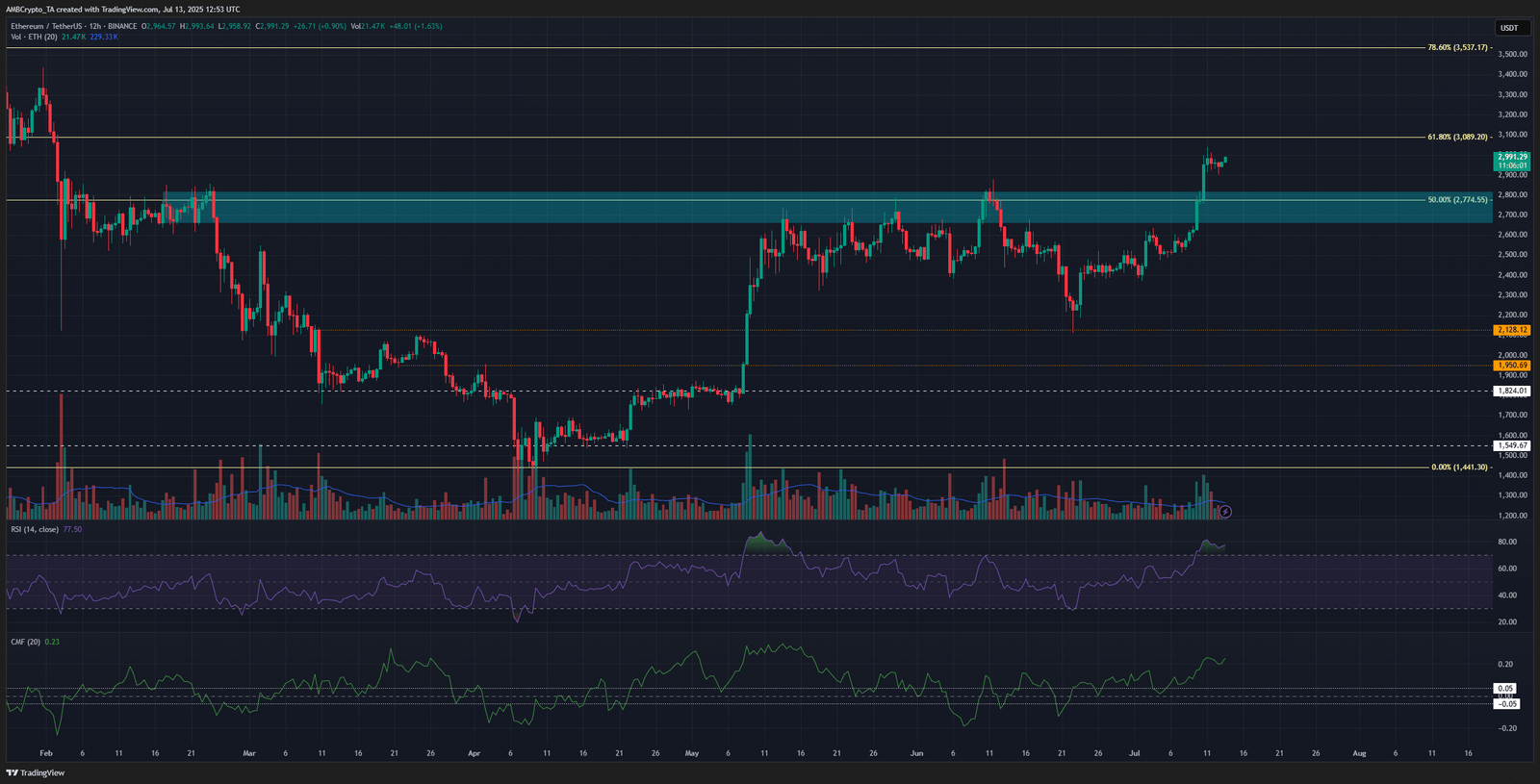

The 12-hour chart also showed that Ethereum did not trade at the $2.8k resistance zone for long during the rally in July. This reinforced the chance of a minor dip in this demand zone before the next rally.

The RSI was at 77, showing strong bullish momentum. A bearish divergence could develop over the next few days, which would be a warning for traders.

The CMF was at +0.23. Values above +0.05 indicate sizeable capital inflow to the market and signify that buying pressure was dominant.

This could aid a swift rally past the psychological $3k resistance.

Source: CoinGlass

The 1-month Liquidation Heatmap showed dense liquidity clusters above the $3k mark.

These magnetic levels often attract price action, and Ethereum appeared poised to chase them down.

In contrast, the liquidity band at $2,880 was faint. While it could briefly pull prices lower, the real action was stacked to the north.

With Bitcoin in price discovery mode and ETH tracking strength across pairs and metrics, further upside looked likely. Still, a return to $2.8K support remained on the table.

Traders should prepare for either move—a continuation to $3.2K or a clean retest before the push.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion