Bitcoin has reached consecutive record highs this week, yet retail investors seem reluctant to jump back into the market, according to a crypto researcher.

However, demand for spot Bitcoin (BTC) exchange-traded funds (ETFs) is surging, with Thursday and Friday recording daily inflows of over $1 billion, the first time this has happened on two consecutive days.

Bitcoin leg up “driven by institutions”

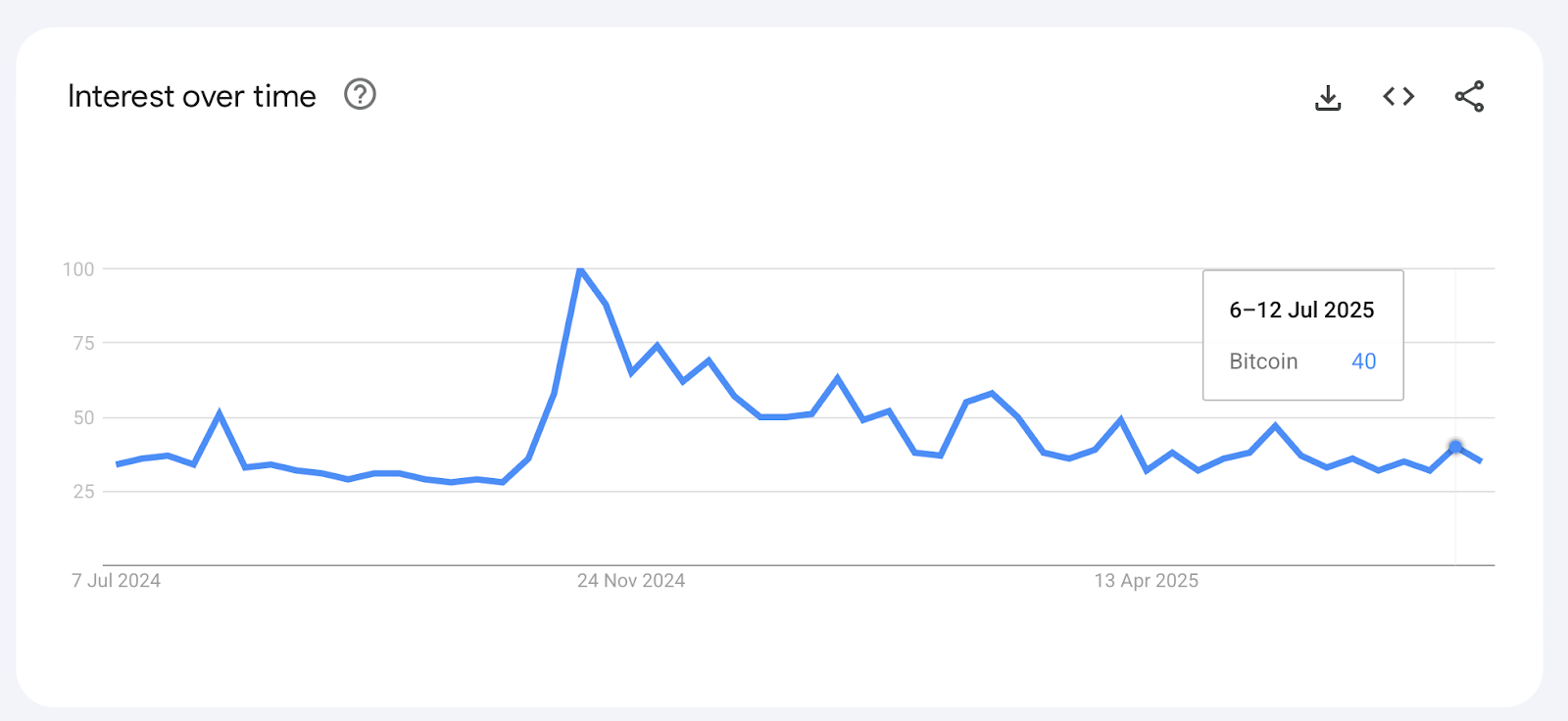

Bitwise head of research André Dragosch said in an X post on Friday, “Bitcoin is at new all-time highs but retail is almost nowhere to be found,” pointing to the lack of Google search interest in “Bitcoin” despite the asset setting consecutive all-time highs this week.

“Latest leg up is mostly driven by institutions,” Dragosch said.

Google global search interest for the term “Bitcoin” increased by 8% from June 29–July 5 to July 6–12, coinciding with Bitcoin breaking its previous all-time high of $111,970 on Wednesday, and climbing further to $118,780 by Friday, according to Google Trends and CoinMarketCap data.

However, Bitcoin search interest is 60% lower than the week of Nov. 10–16, 2024, the week after Donald Trump won the US presidential election.

That period was followed by a month-long rally that propelled Bitcoin to reach $100,000 for the first time ever on Dec. 5.

Bitcoiners say retail thinks they “missed the boat”

Some Bitcoin proponents are speculating that retail investors may perceive the current price of Bitcoin as too high to enter the market.

Bitcoin commentator Lindsay Stamp said, “I think a lot of retail folks find out the price of one Bitcoin is 117k and think, nahhh I missed the boat and don’t even give it a second thought.”

Echoing a similar sentiment, the Bitcoin Matrix podcast host Cedric Youngelman said in an X post on Saturday, “At what Bitcoin price do you think retail wakes up?” I’ll go first. I don’t think they’re coming for a long time.”

Bitcoin onchain analyst Willy Woo said Bitcoin’s uptrend is far from over. “This run has plenty of legs left in it,” Woo said in an X post on Saturday.

Related: Bitcoin price expected to accelerate if daily close above $113K is secured

Meanwhile, spot Bitcoin ETFs had a strong trading week, with $2.72 billion inflows over the five days, according to Farside data.

Cointelegraph recently reported on July 5 that if the end holder of a BTC ETF share is a retail client, it may be time to reconsider how onchain data is interpreted, as this could represent the reality of retail Bitcoin demand.

Magazine: Inside a 30,000 phone bot farm stealing crypto airdrops from real users