- Political backing, ETF inflows, and rising institutional and public market adoption show that crypto is having a moment.

- Bitcoin, Ethereum, and altcoins face a decisive second half amid upgrades, IPOs, and shifting dominance.

Crypto is having a moment — in Washington and on Wall Street.

In the year gone by, U.S. President Donald Trump has established a strategic Bitcoin [BTC] and announced an altcoin reserve.

In parallel, the Senate passed the GENIUS Act and the CLARITY Act is underway.

On the tech side of things, Ethereum [ETH] saw a big step forward with the Pectra upgrade in early May. And over in traditional finance, spot bitcoin ETFs are raking in cash, pulling $14.4 billion in net inflows so far this year.

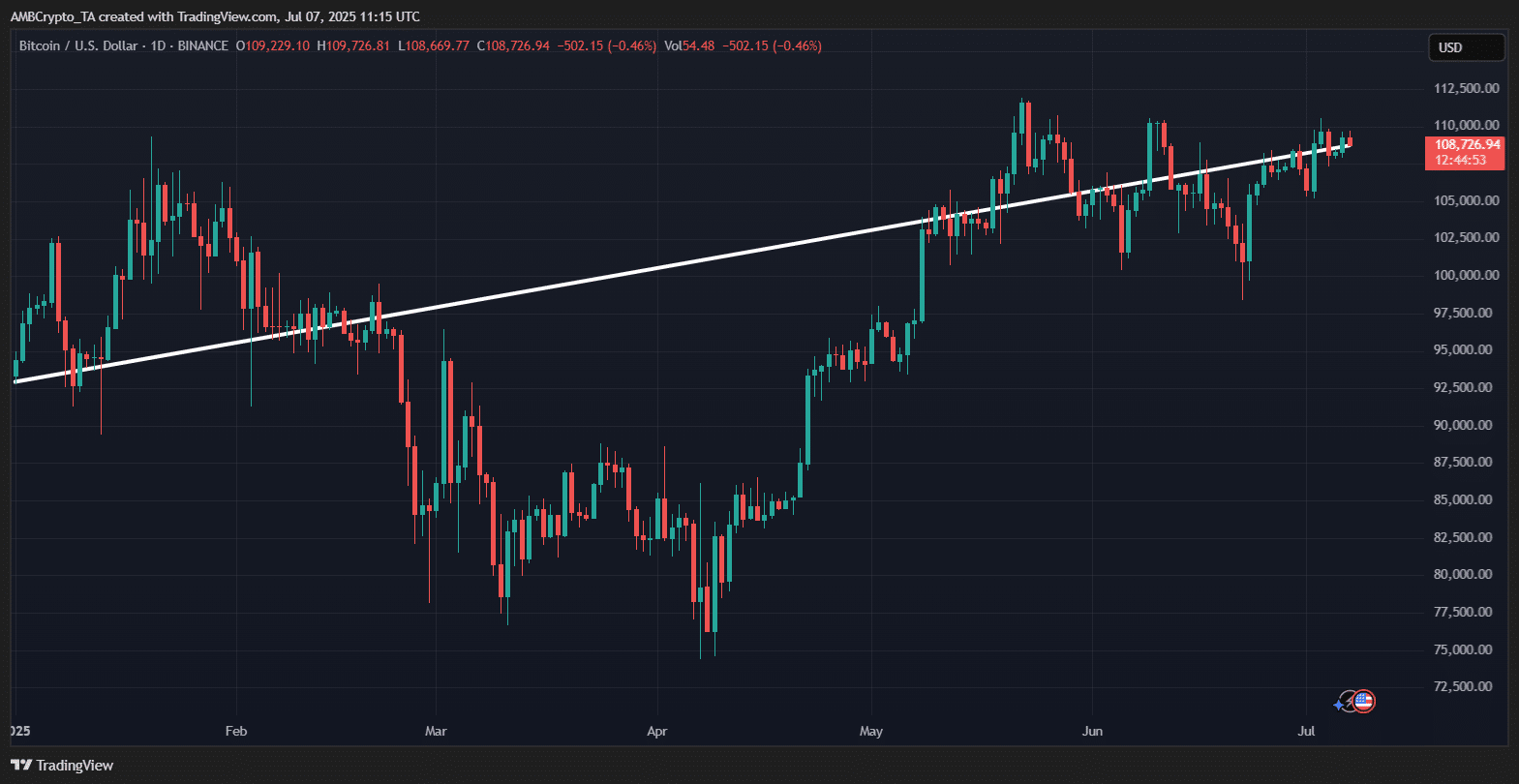

Naturally, the market followed suit. BTC has jumped 15% YTD—double the S&P 500’s gains—nudging closer to its all-time high near $112,000.

Those bullish year-end targets? Suddenly, they’re not looking so far-fetched.

Bitcoin treasuries are booming, but for how long?

With over 135 public companies now holding Bitcoin as a reserve asset, the treasury strategy is becoming mainstream.

Legacy players like Strategy continue to double down, while newer entrants such as Metaplanet and Twenty One have quickly joined the fray.

But not everyone sees an endless upside. Crypto analyst James Check said,

“My instinct is the Bitcoin treasury strategy has a far shorter lifespan than most expect. And for many new entrants, it could already be over.”

According to Check, markets are nearing a saturation point.

“We’re already close to the ‘show me’ phase, where it will be increasingly difficult for random company X to sustain a premium and get off the ground without a serious niche.”

Retail speculators have been the main fuel for these upstarts; but their appetite, and capital, aren’t infinite.

While bullish sentiment around Bitcoin may keep the momentum going, the path ahead likely favors the bold, the early, and the exceptionally well-branded.

Still, there’s room for optimism.

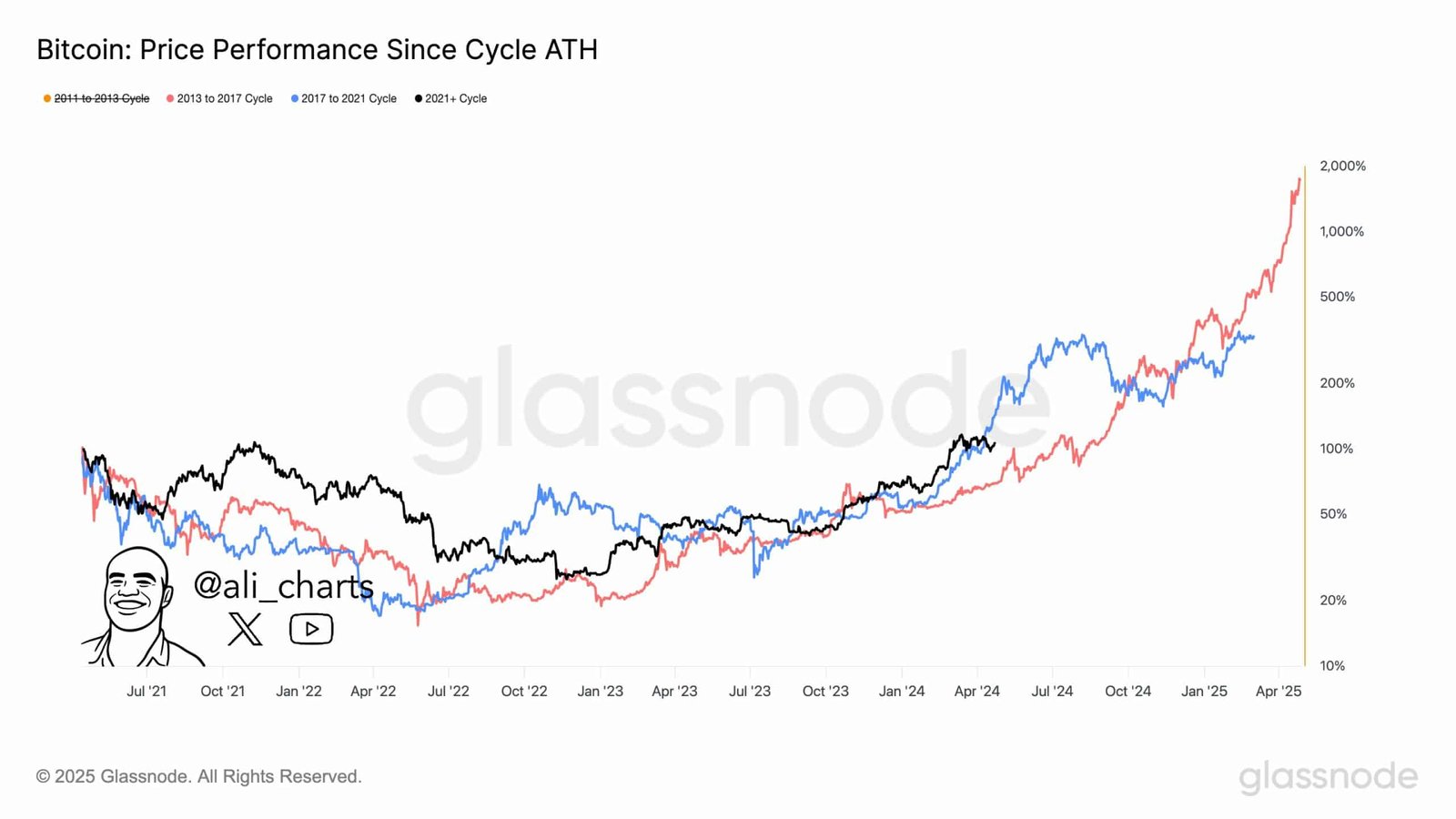

Analyst Ali Martinez recently posted on X that if the current trend mirrors past cycles, the next market top could hit in just six months.

Bitcoin’s current trajectory has outpaced the 2013 and 2017 cycles, rising nearly 2,000% since the last cycle peak; a sign that momentum, while volatile, is far from exhausted.

Ethereum: The race to stay relevant

Ethereum has long held the second spot in crypto, but its dominance hasn’t gone unchallenged. After trailing behind both Bitcoin and faster-moving competitors like Solana [SOL], ETH may finally be at a turning point.

Following a rocky price drop earlier this year, Ethereum’s Pectra upgrade brought renewed confidence.

Next in line: Fusaka, slated for late 2025. This upgrade introduces PeerDAS and Verkle trees, both expected to dramatically reduce storage and computation costs across the Ethereum stack—especially for Layer 2s and validators.

Some analysts are already penciling in a $6,000 ETH price by year-end, banking on Layer 2 traction and developer momentum.

Still, not everyone is sold on ETH’s value accrual story. The actual momentum remains to be seen, but as of now, ETH seems to be coming back — slowly and surely.

Altcoins survive a lull, and Wall Street is watching

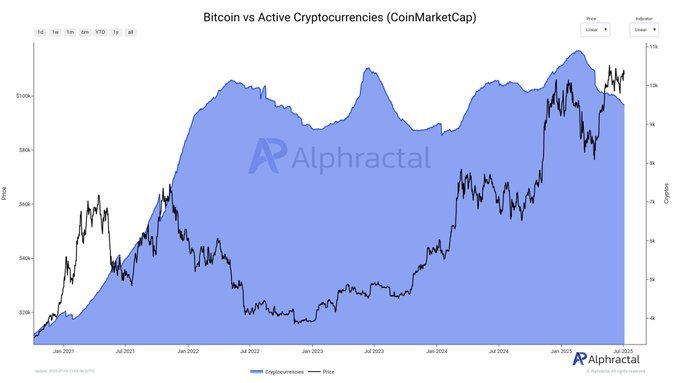

The altcoin market just went through a major cleanse — over 1,400 previously active tokens have disappeared in 2025. It’s a sign of maturing markets: only the most resilient projects remain.

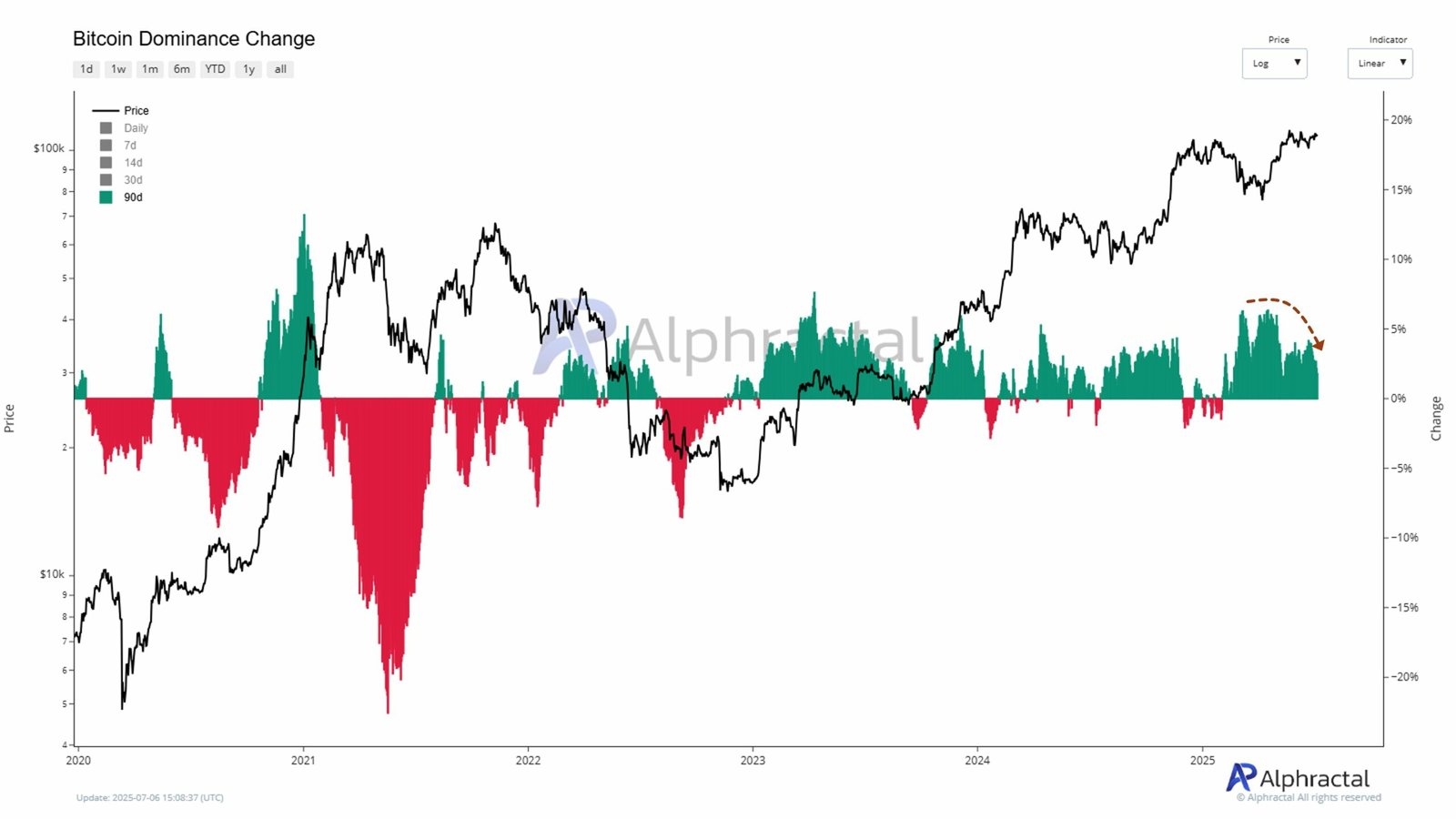

As Bitcoin dominance shows signs of dipping, investors are speculating: Is this the start of altcoin season 2.0?

Meanwhile, access to crypto via public markets is expanding. Bitcoin and Ether ETFs are already live, and tweaks like in-kind redemption and staking could soon improve them.

Bloomberg’s James Seyffart has suggested ETFs for other digital assets may follow.

And after Circle’s blockbuster IPO, firms like Galaxy, eToro, and possibly even Kraken or Consensys could be next.

The rest of the year is a critical time and could decide just how far this momentum can carry.