- $74.59 million worth of S tokens unlocked, raising circulating supply by 7.39%.

- Market participants have already begun selling the asset, adding downward pressure to its performance.

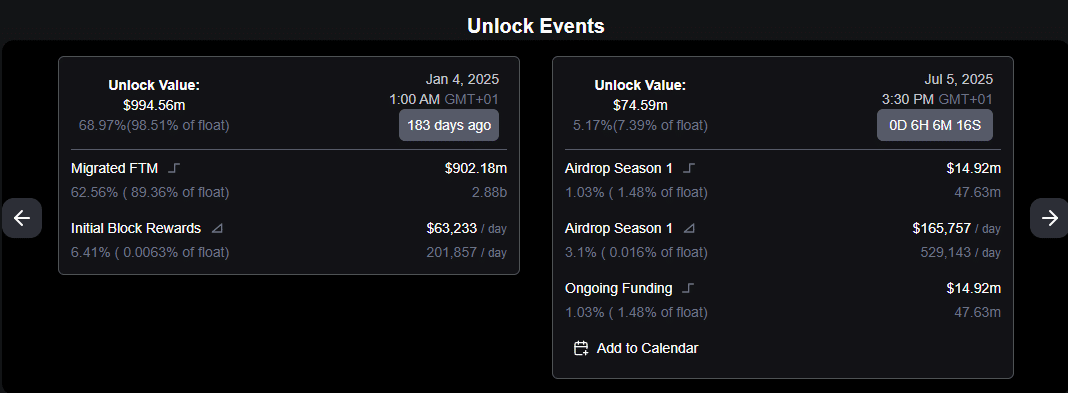

A major token unlock for Sonic [S] went live on the 5th of July—injecting $74.59 million worth of tokens into circulation.

According to DeFiLlama, this accounted for 5.17% of the total supply and 7.39% of the circulating supply.

The sudden increase in float raised concerns about a potential supply glut. Unless matched by proportional demand, the imbalance could trigger further downside across spot and derivatives markets.

This increase in float suggests that if supply outweighs demand, it could lead to a market-wide selloff. AMBCrypto analysis found that the likelihood of an equal surge in demand remains slim.

DeFi investors made the first move

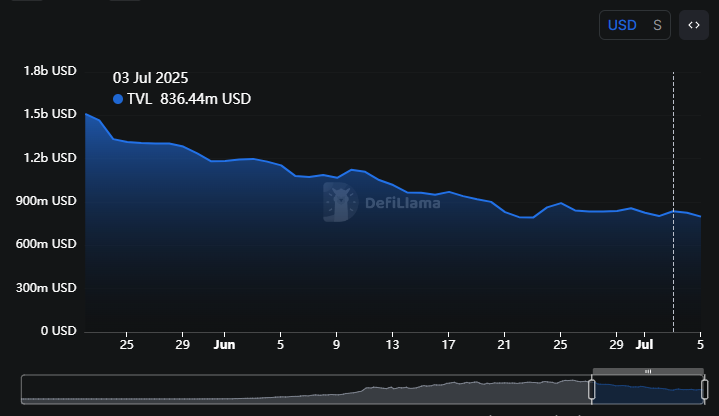

At the time of writing, a selloff was already underway. Notably, decentralized finance (DeFi) investors have been reducing their exposure to S tokens.

Between the 3rd and 5th of July, DeFi wallet holders offloaded $37.9 million worth of S tokens. Their cumulative holdings dropped from $836.44 million to $798.49 million.

This outflow indicates that investors are unlocking S across multiple platforms and withdrawing their assets, implying a shift from long-term holding to a more bearish, sell-oriented sentiment.

Sellers’ dominance spreads across markets

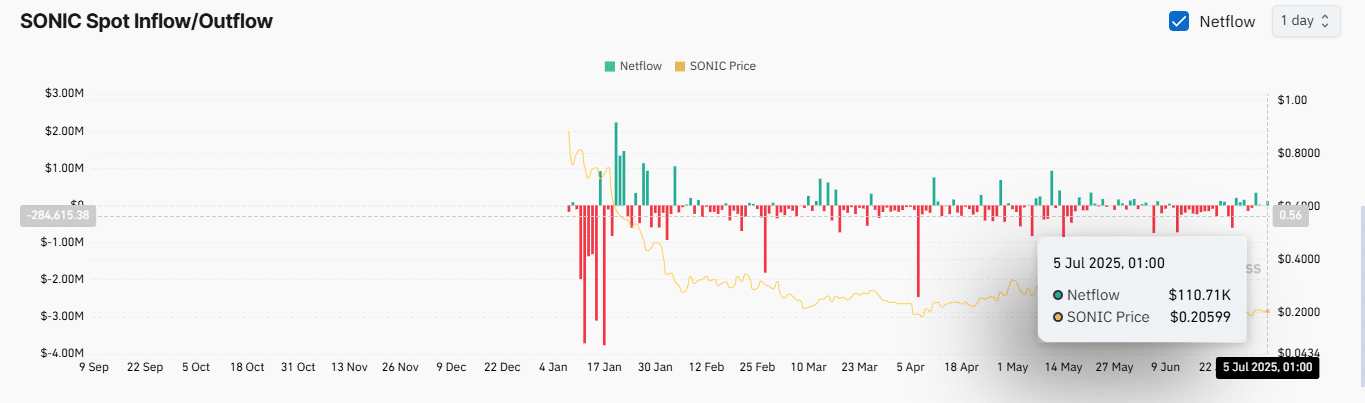

On-chain metrics showed the trend wasn’t isolated. Retail investors followed suit.

According to CoinGlass’ Exchange Netflow data, there was a significant outflow of assets over the past week, totaling $427,000 moved from private wallets to exchanges.

The most notable selloff occurred within the past 24 hours, during which spot investors sold approximately $110,000 worth of S crypto, accounting for more than 25% of the week’s total outflows.

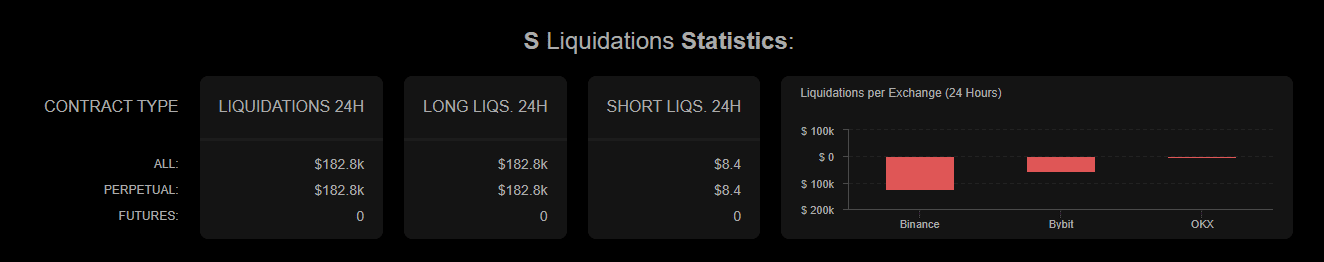

Liquidation data from Coinalyze further confirmed bearish sentiment in the perpetual markets.

In the perpetuals market, long traders saw $182,800 in liquidations, while shorts lost just $8.4.

The takeaway? For every $1 wiped from bearish traders, bullish longs were hit for over $21,000. Such a lopsided ratio implied a market tilted heavily in favor of sellers.

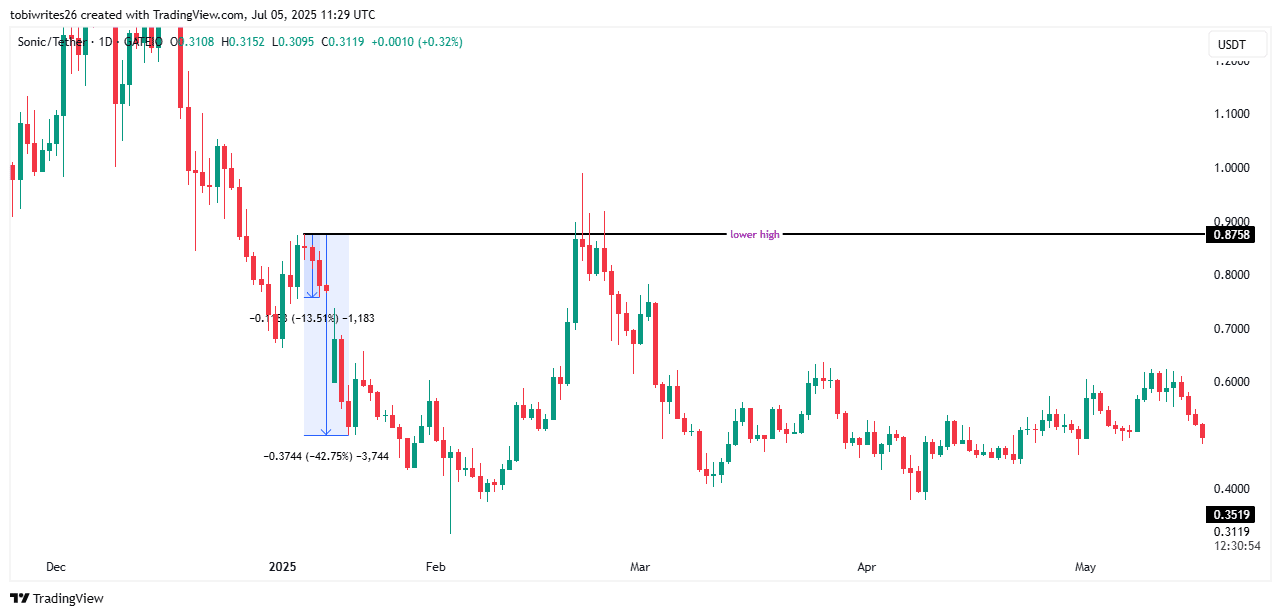

January’s unlock left scars—Will July do the same?

AMBCrypto analyzed S’s performance during its last major token unlock to determine whether a similar pattern could emerge.

During the unlock event on the 4th of January—when $998.72 million worth of Sonic token entered circulation—the token experienced a notable drop.

From a local high on the 4th of January, S token declined 13.5% by the 7th. By the 20th of January, it had recorded a cumulative decline of 42.75% after forming a local low.

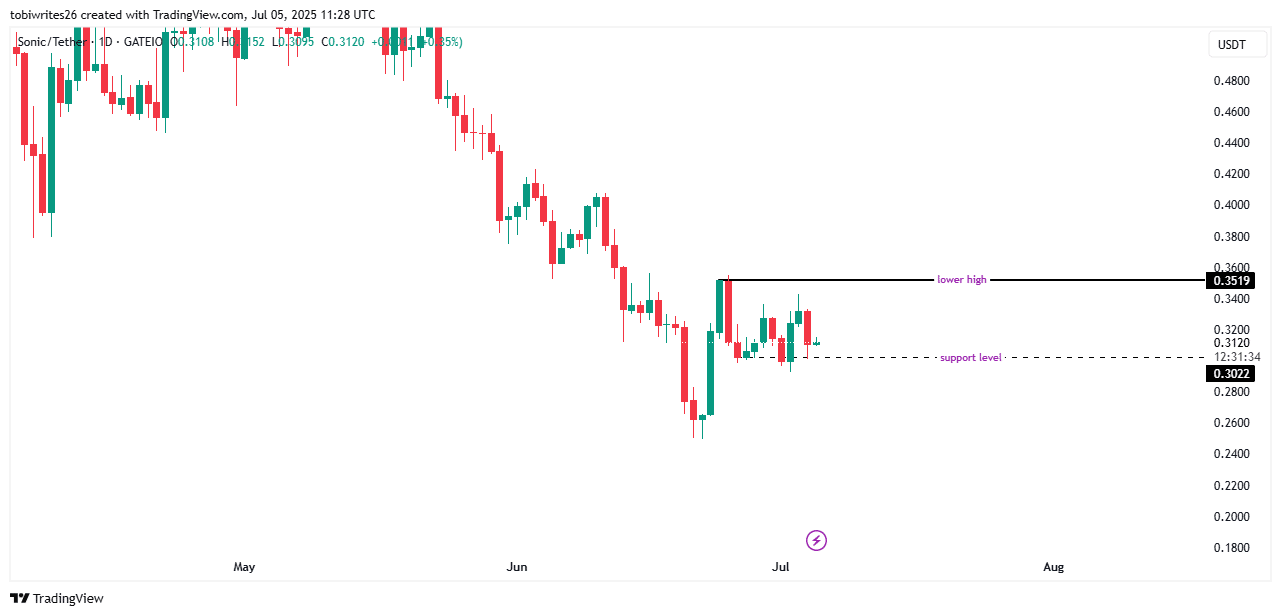

At press time, S created a local high on the 25th of June. While this does not confirm an impending price drop, a break below the support level at $0.3022 could signal the formation of a local lower low.

Given the prevailing bearish trend and additional supply pressure expected from the token unlock, S is likely to break down and form a new lower low.