- WLFI proposes opening its token to public trading, shifting from a closed to open ecosystem

- The move ties into Trump’s deeper crypto involvement, with concerns about politics and token governance

As Independence Day fireworks lit up the sky, the Donald Trump-linked WLFI (World Liberty Financial) project lit a fuse of its own.

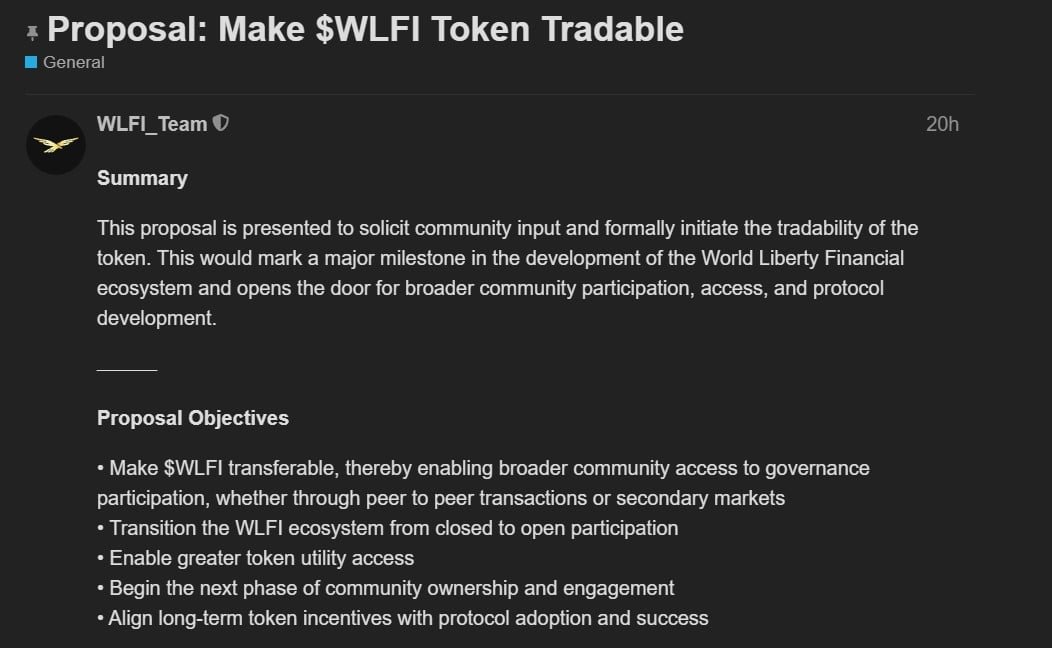

A new proposal went live, asking its community whether the WLFI token should break out of its gated network and go fully tradable.

The vote, if passed, could open the doors to wider crypto access – and offer yet another sign that President Trump isn’t just back in politics, but deeper into digital finance too.

The core development proposal

The WLFI team’s proposal lays out a clear path: make the token tradable and bring the broader crypto community in.

This is a major shift from its current closed model, where token movement is restricted.

If passed, the vote would make WLFI transferable – unlocking peer-to-peer trades, enabling listing on secondary markets, and expanding governance access.

Early supporters would see a partial unlock of their holdings, while founders and team members remain on a stricter schedule.

The goal? Transition WLFI from an exclusive ecosystem to an open one; bringing participation, growth, and price discovery beyond its original user base.

A power shift in the making

Tradability offers more than just market access—it expands governance to a broader community.

Under the new proposal, token holders would gain voting rights on several key issues. These include emissions, treasury allocation, and incentive structures.

A separate vote will decide the unlocking schedule for the remaining tokens. This would shift major decisions into the hands of the broader community.

Notably, the founders’ and team’s tokens will remain locked for a longer period. This move is designed to demonstrate alignment with the project and reduce perceived risk.

If approved, WLFI’s direction will no longer be controlled solely by insiders. Instead, it will be shaped by a distributed group of stakeholders who are actively invested in its success.

But why now?

That the proposal went live on Independence Day feels more than symbolic.

WLFI, backed by Eric Trump and Donald Trump Jr., is eyeing public tradability just as Donald Trump’s personal crypto exposure hits a new high.

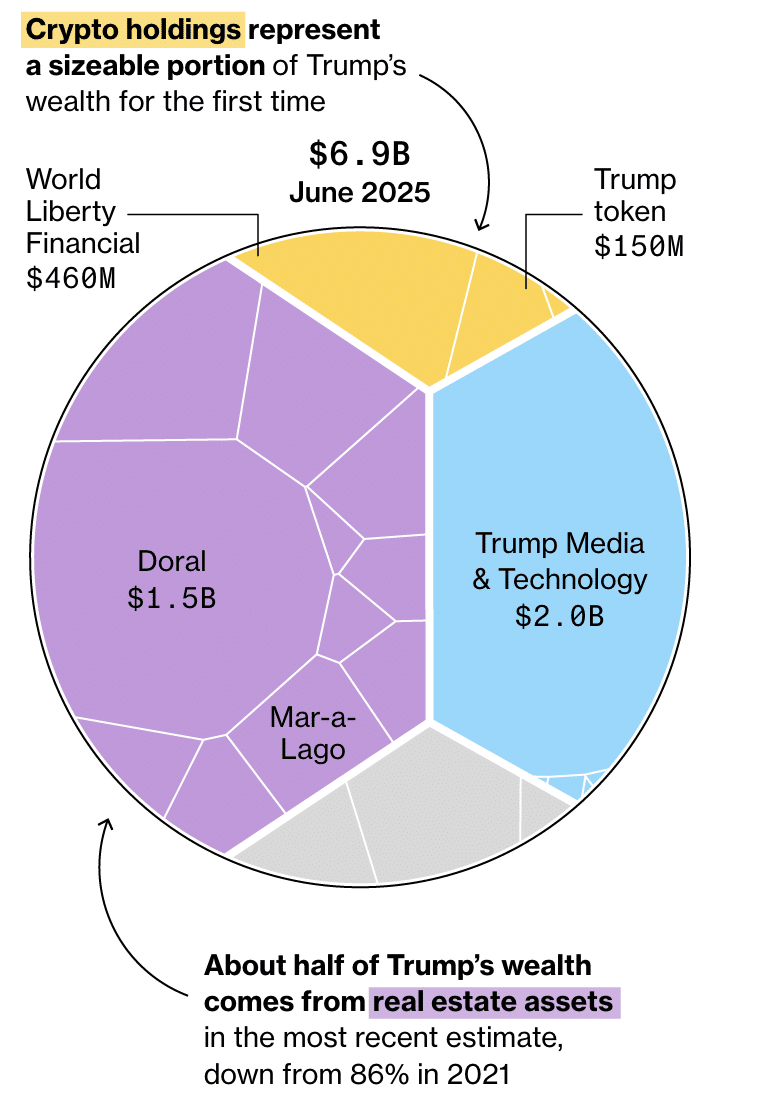

As of June 2025, crypto makes up a sizable slice of his $6.9 billion net worth – around $610 million across WLFI and other tokens.

It’s the first time digital assets have held this much weight in his portfolio.

Yet, controversy looms: critics warn of conflicts of interest, especially with legislation like the COIN Act looming.

This vote isn’t just about making a token tradable; it raises bigger questions about the growing link between politics and crypto.