- Why is crypto up today? Simply, BTC surged to $110K and broke out of its downtrend.

- Still, analysts expected a sideways structure or potential dips in summer.

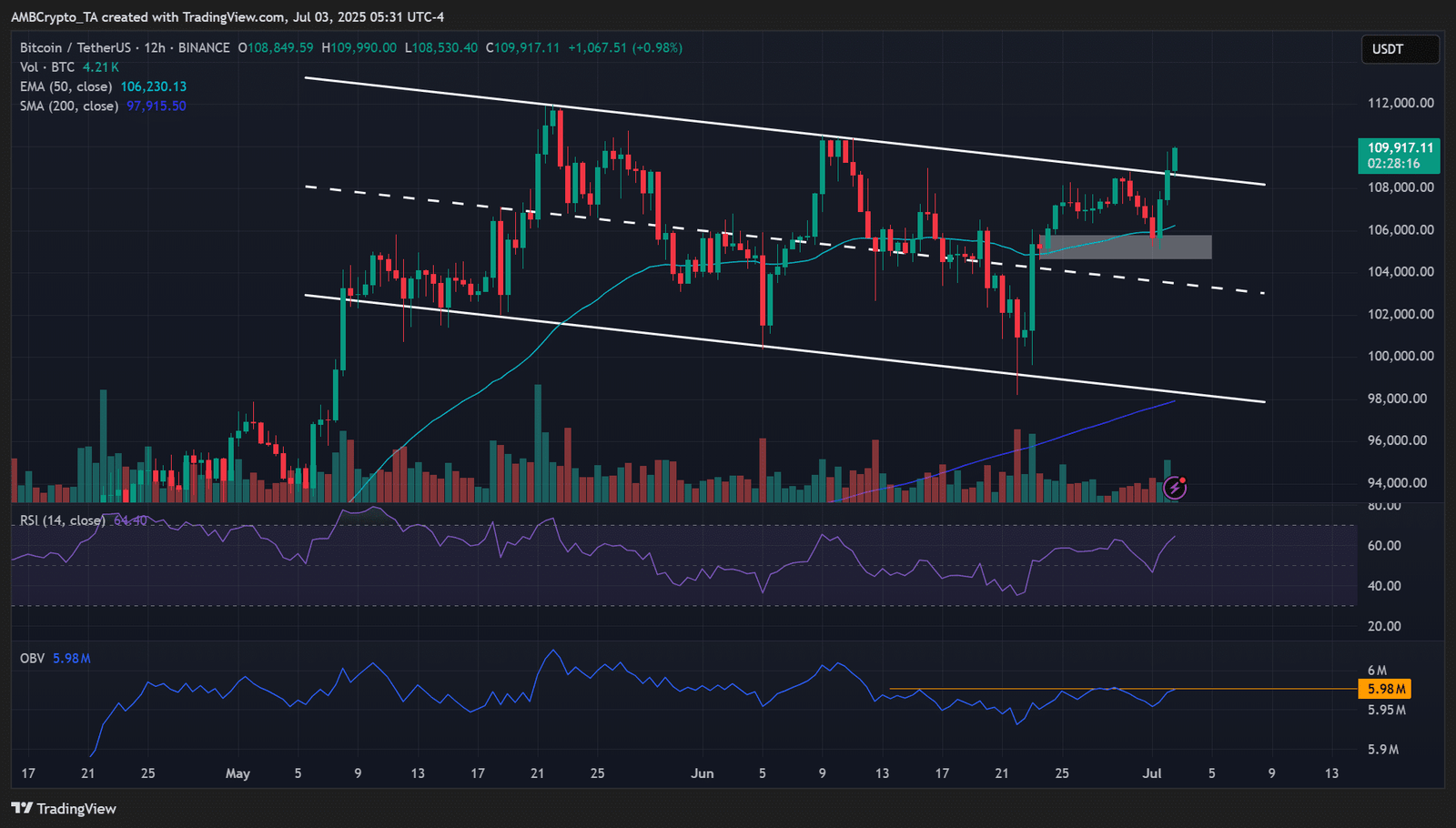

Bitcoin [BTC] shrugged off the early-week dump and surged to $110,200 on the Binance exchange as of the 3rd of July.

The asset was up 12% from June lows, a move that analysts linked to strong interest in the spot and derivatives market.

On the 12-hour chart, BTC effectively broke out of its extended downtrend (white channel), raising hopes of a sustained upside move despite the typical summer lull.

Why is crypto up today?

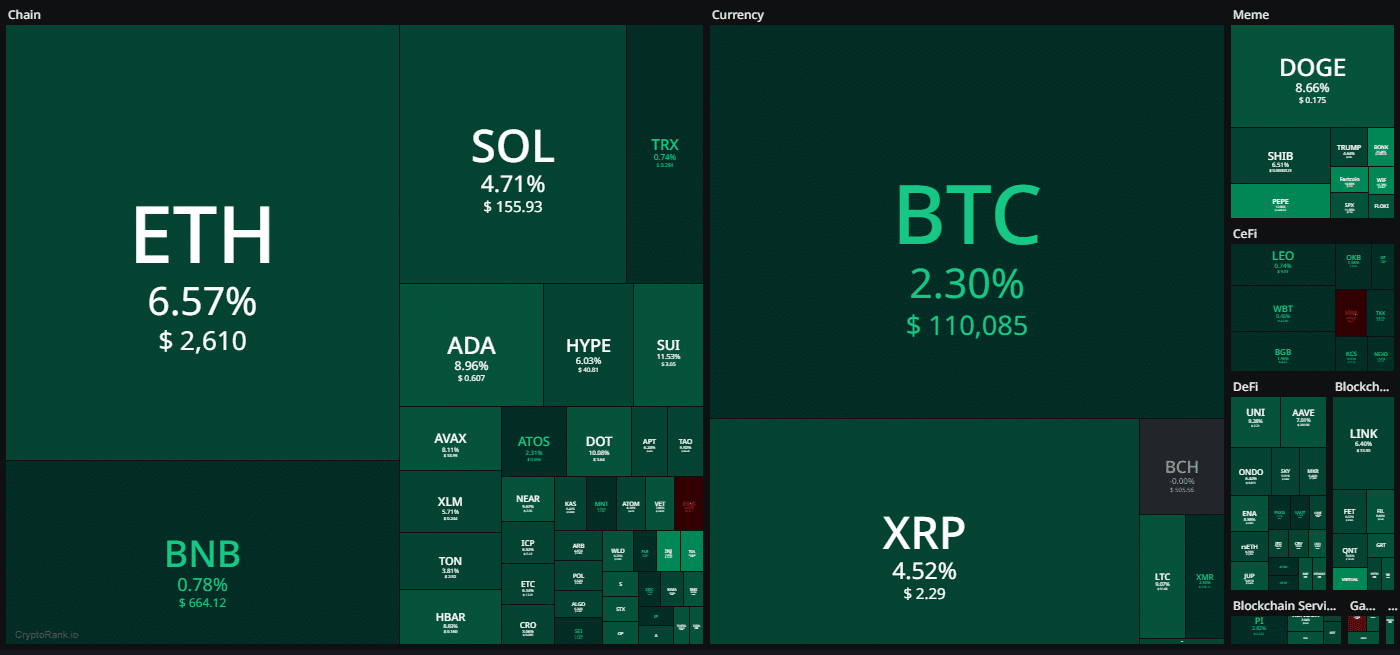

At the time of writing, the entire market was green. Amongst L1s, Cardano [ADA] posted the biggest bounce of 8%, followed by Ethereum’s [ETH] 6.5% rise on the daily performance.

On the currency category, Litecoin [LTC] rallied 9%, while Solana [SOL], XRP, and BTC posted 4.7%, 4.5% and $2.3% respectively.

Uniswap [UNI] led the DeFi market rebound with 9% while Bonk [BONK] jumped a whopping 20% amongst memecoins.

The lift-off and BTC upswing followed a strong daily ETF inflow of $407.78 million on the 2nd of July. This was a relief rebound in demand after a $342 million outflow on Tuesday.

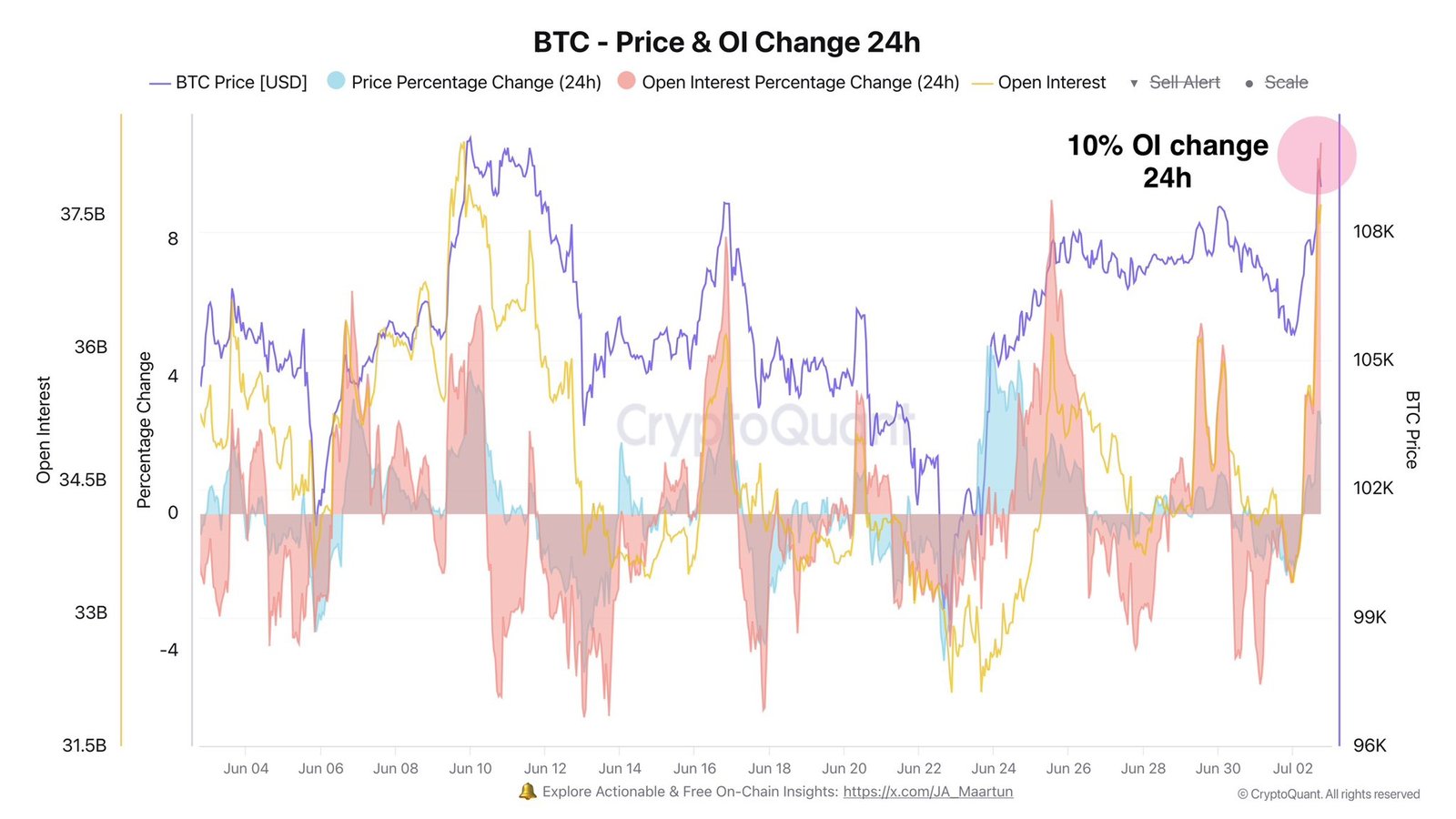

At the same time, though, CryptoQuant noted that BTC’s speculative interest spiked 10%. This meant the rally was also fueled by leveraged bulls and could heighten liquidation or flushes.

That said, Joshua Deuk, Head of Trade at Mozaik Capital, said that BTC was primed for a breakout.

According to him, the macro risk has eased after President Donald Trump stabilized Middle East tensions and oil volatility. The next catalyst would be a likely Fed rate cut in September.

Still, he expected a range-bound activity until September after the summer holidays.

“No major macro risks on the calendar until September. That’s when people get back to desks, + real activity picks up again.”

However, other analysts remained cautious. In particular, Santiment warned that the rally was driven by retail FOMO and could face a sharp pullback as the market always goes against them.

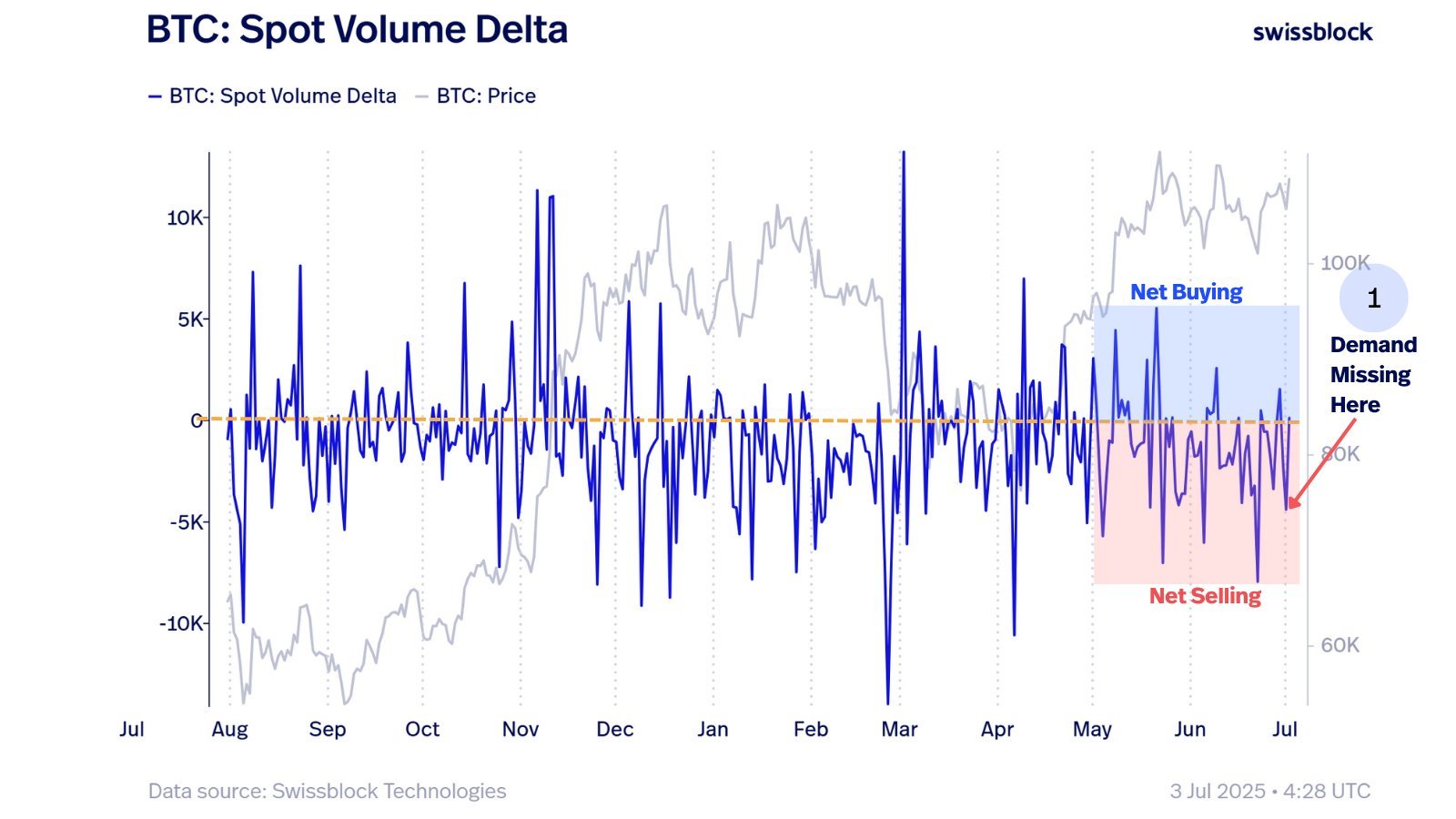

For Swissblock analysts, the breakout lacked a strong spot market demand to be sustainable.

In fact, BitMEX Founder, Arthur Hayes, warned that a liquidity squeeze could create the typical summer lull, forcing risk assets into a sideways structure or potentially drag BTC to $90K.