- Fundstrat’s Tom Lee echoed Bitwise CIO’s $10 billion ETH ETF inflows projection in H2.

- Polymarket’s odds of ETH’s price hitting an ATH in 2025 were low, at 21%.

Ethereum [ETH] could post its best performance in H2. According to Bitwise CIO, Matt Hougan, the U.S. spot ETH ETFs could attract $10 billion, citing two catalysts.

“The combination of stablecoins & stocks moving over Ethereum is an easy-to-grasp narrative for traditional investors. They (ETH ETFs) could do $10B in H2.”

FundStrat CIO Tom Lee echoed the projection, arguing that Ethereum is the primary settlement layer for tokenized assets, including stablecoins and on-chain stocks.

ETH price catalysts

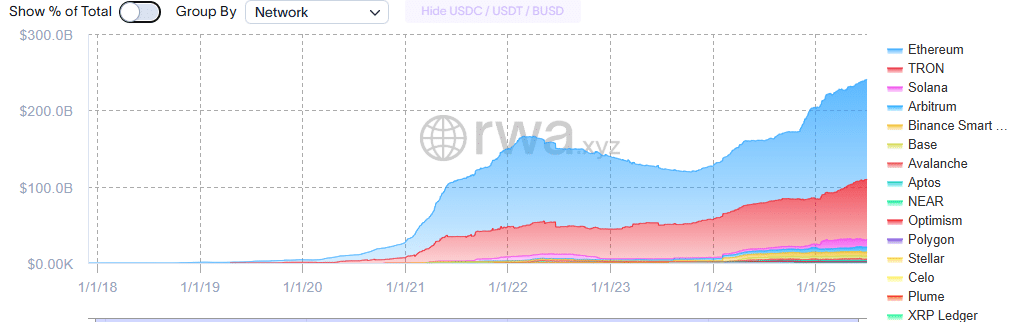

Currently, Ethereum leads with $130 billion in the stablecoin market, followed by TRON [TRX] at $77 billion.

With an expected boom to $3 trillion market size, Lee believes the growth could boost Ethereum network effects and fees.

Ethereum also dominates the tokenized U.S. treasuries sub-sector, currently valued at $7 billion. The recent trend of on-chain stocks could further boost Ethereum as a settlement layer.

In fact, Lee is so convinced of these positive catalysts that he unveiled a $250 million ETH corporate strategy plan with BitMine Technologies to capture this expected growth.

This could add to the growing treasury trend that has accumulated 1.2 million ETH worth $3.15B.

Still, ETFs lead on the ETH demand front. The products have attracted $4.28 billion in cumulative inflows since they launched in July 2024.

Last month, the products saw $1.17 billion in inflows. A surge in inflows to $10B, nearly 2x the current demand, could positively impact ETH prices.

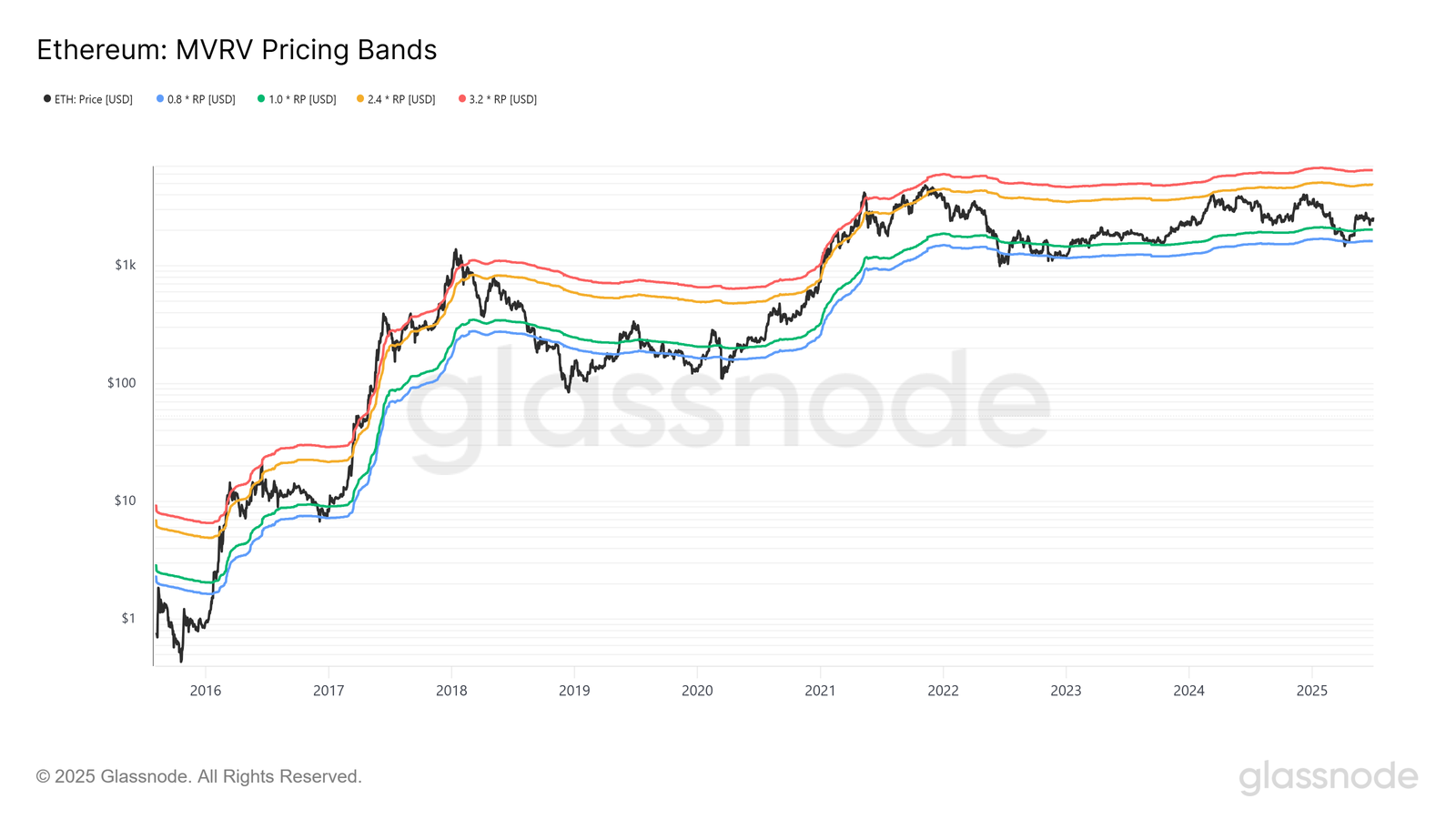

The overall capital inflows, as tracked by Realized Cap, showed recovery in Q2. The indicator surged from $240 billion to $249 billion, lifting ETH from $1.8K to over $2.5K.

So, ETH price could climb higher if the inflows keep coming in H2.

The above bullish conviction is also evident amongst ETH holders. The balance held by accumulation addresses jumped from 16 million to a record high of 23 million ETH in the past two months.

But speculators doubt if ETH’s price could print a new all-time high (ATH) this year. The odds of an ATH in 2025 were 21%, per the prediction site Polymarket.

Meanwhile, MVRV pricing bands showed that ETH could peak at $4.8k or $6.4k (upper bands) this cycle, if the historical trend repeats. The altcoin tagged the upper bands during the 2017 and 2021 cycle peaks.