- Bloomberg’s Balchunas downplayed demand for REX-Osprey SOL staking ETF.

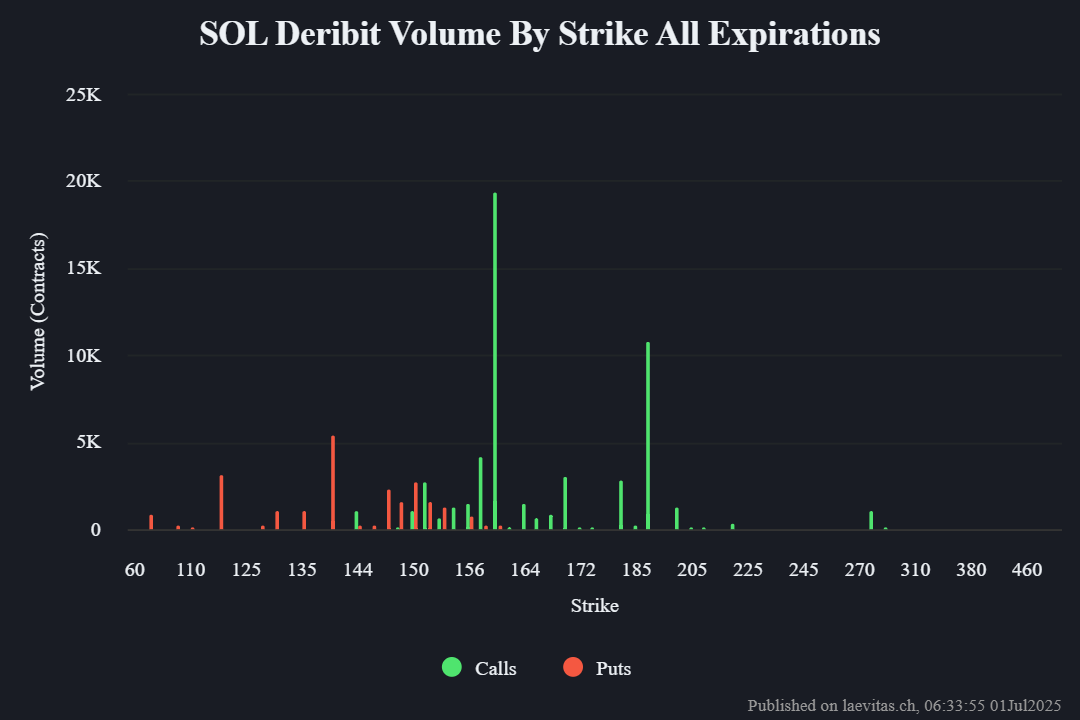

- Option traders eyed $140-$190 range, with low expectations of SOL over $200 in the short term.

The much-awaited U.S. Solana [SOL] ETF(exchange-traded fund) with staking, from REX-Osprey, will go live on the 2nd of July.

This would be the first-ever staked crypto-related ETF in the country, and the hype quickly sparked a 5% SOL rally.

The altcoin jumped from $149 to $160, but erased the gains shortly afterwards as analysts downplayed the impact of the debut.

Analyst on SOL ETF: ‘Manage expectations’

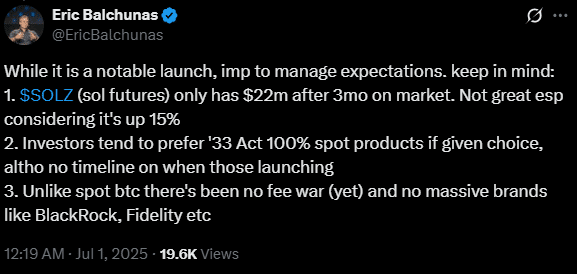

Bloomberg’s Eric Balchunas broke down the fund’s structure on X (formerly Twitter).

He revealed that the ETF, registered under the Investment Company Act of 1940, will allocate 40% of its holdings via other funds (ETNs) to meet regulatory compliance.

However, that’s not the only catch.

The fund’s overall fees will increase from 0.75% to 1.23% once tax expenses are factored in.

Balchunas added that the fund’s structure (under the 40 Act) and the underwhelming performance of the recently launched Volatility Shares SOL Futures ETF don’t bode well for the staking product.

“While it is a notable launch, it’s important to manage expectations…Investors tend to prefer ’33 Act 100% spot products if given a choice, although no timeline on when those launching”

Not your usual staking rewards

On the staking side, Solana offers about 6-8% annual rewards, and the fund plans to stake at least 40% of its holdings.

However, factoring in fees and staking performance, the rewards could be around 4-6%. Besides, the yield is compounded into the ETF value and not distributed in SOL.

In fact, one user estimated that yield could drop to 1.12% compared to 7% from direct staking, warning that the ETF product would make SOL unpopular.

“Not worth the fanfare, and think there must be more fees from ETNs. This won’t get many inflows in my opinion, so will make SOL look unpopular.”

Importantly, staking rewards aren’t paid out in SOL — they’re compounded into the ETF’s NAV.

Neutral sentiment, but can SOL climb higher?

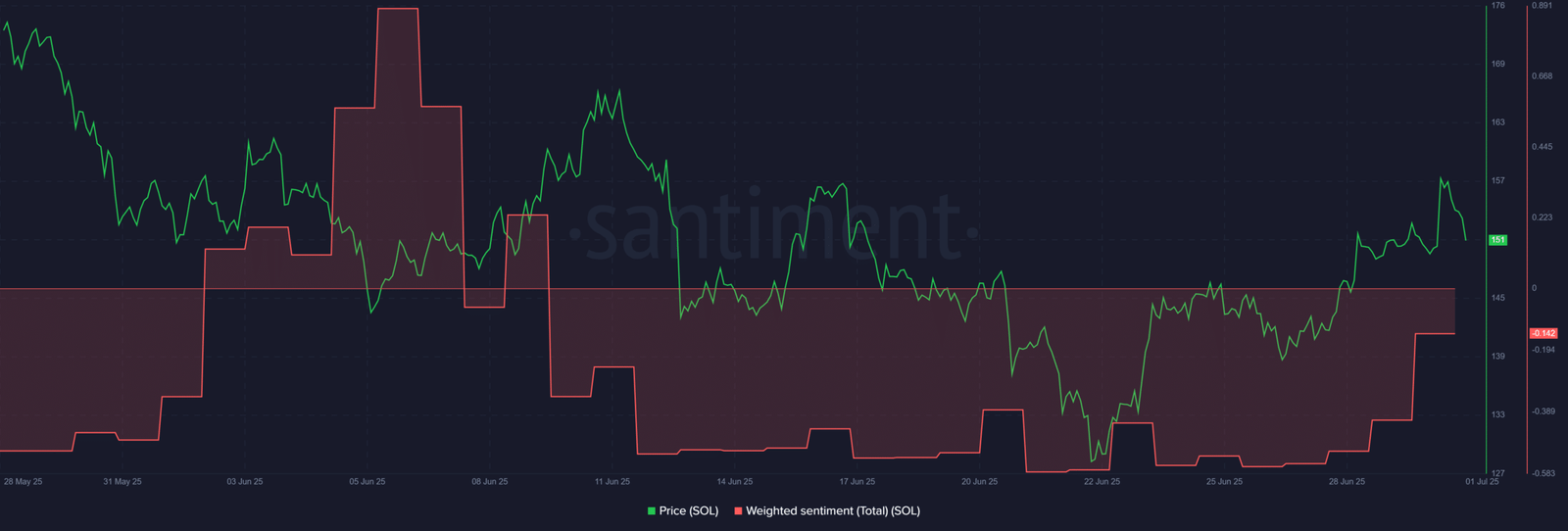

Despite the buzz, sentiment across Solana’s ecosystem remains flat. Meanwhile, Solana’s greed and fear index flashed a neutral signal.

According to Santiment, the Weighted Sentiment metric saw a mild uptick following the ETF news, but it still hovered near neutral levels.

The Options market also reinforced the neutral sentiment. However, traders eyed $160 and $190 as short-term upside targets (high calls, bullish bets, green bars).

On the other hand, $140 (more puts, red bar) and $120 were key downside risks or floor price (potential support).

Overall, the staking ETF update sparked market interest and pushed SOL briefly to retest $160 with the potential to extend to $190.

However, at press time, Options traders were less optimistic about SOL surging above $200 in the short term, as indicated by less volume above the level.