- TRX held firm above its trendline as whales and investors accelerate accumulation.

- Wallet activity and exchange flows stabilized, hinting at reduced sell pressure and latent user interest.

TRON’s [TRX] price continues to trade within a tight range, with Bollinger Bands narrowing to levels last seen in early June, suggesting a volatility-driven move may be close.

TRX recently rebounded from the lower band near $0.26 and moved above the mid-band, which often signals a shift toward accumulation.

At the time of writing, TRX traded around $0.2775 after climbing 0.72% in 24 hours.

Historically, such compression near structural support sets the stage for decisive price action.

Smart money builds positions while retail remains cautious

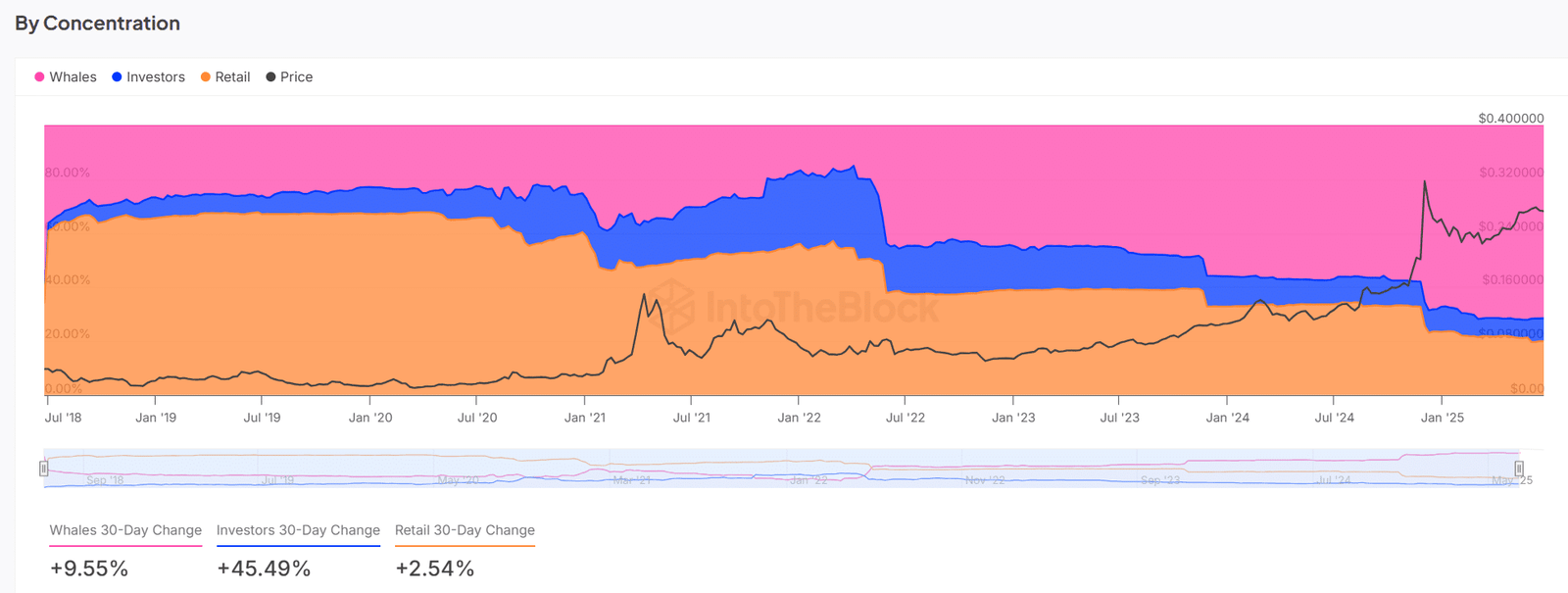

Over the past thirty days, whale holdings have increased by 9.55%, while investor accumulation has soared 45.49%. These trends reveal heightened confidence from large holders and mid-tier wallets, often labeled as smart money.

Meanwhile, retail wallets have only grown by 2.54%, reflecting limited conviction from the broader market. This kind of divergence often appears before major moves, as institutional positioning typically precedes price expansion.

Therefore, TRX could be setting up for a stronger trend if retail follows through and joins the buying momentum established by larger players.

Have netflows finally stabilized after weeks of steady outflows?

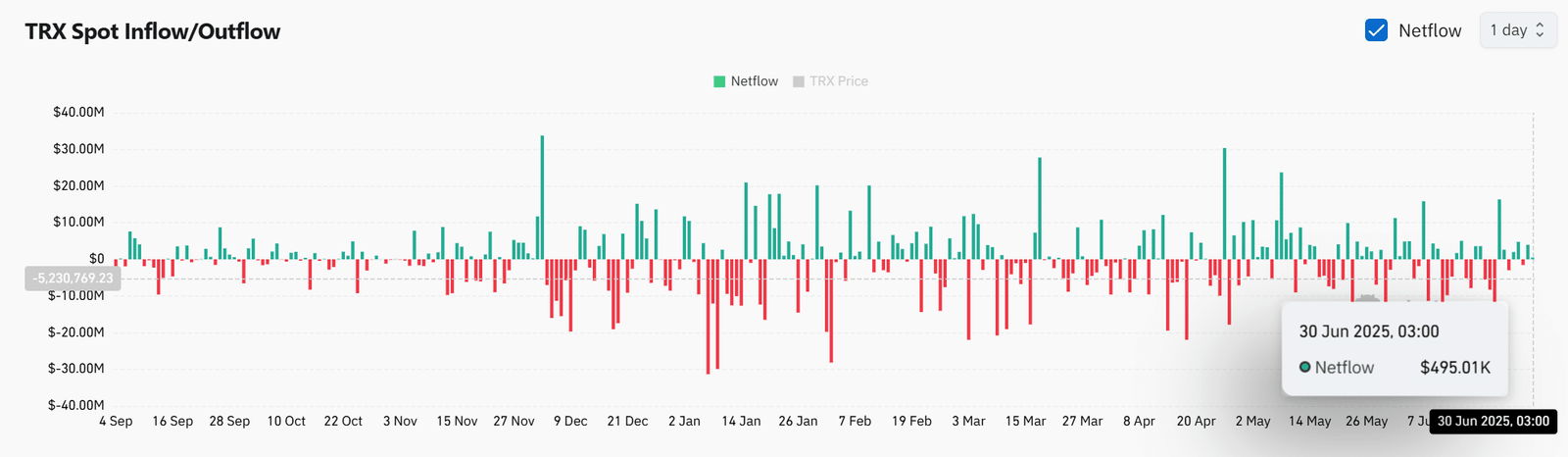

After persistent outflows in recent months, TRX’s netflows appear to be leveling off. At the time of writing, netflows hovered near neutral at $495.01K, indicating a shift in sentiment.

This stabilization comes after numerous sessions where outflows exceeded $10 million, suggesting that sellers may be exhausted. While neutral flows aren’t a direct bullish signal, they reflect a temporary balance between buyers and sellers.

Therefore, if inflows begin rising again while compression continues, it could validate a stronger bullish bias.

Rising wallet creation hints at growing interest—but is it active?

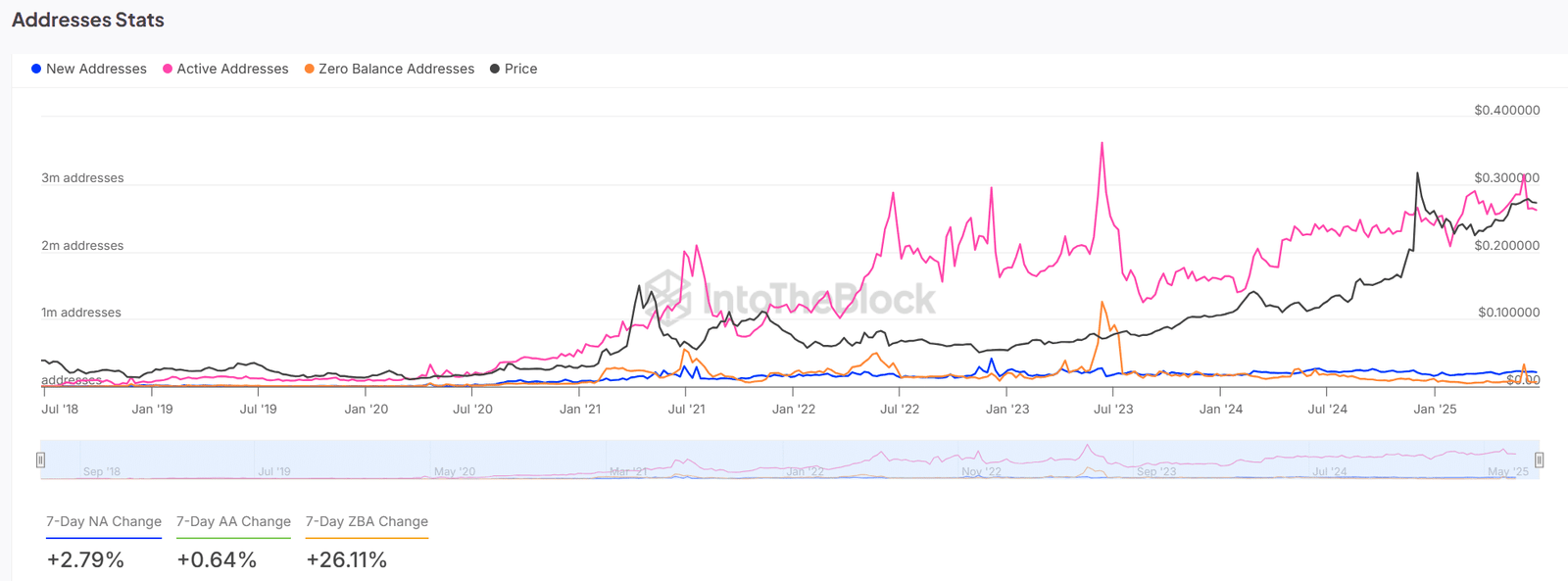

TRON has experienced a 2.79% rise in new wallet creation over the past week, signaling increasing attention from potential users or speculators.

However, the number of Active Addresses has only grown by 0.64%, at the same time, showing a disparity between address generation and actual engagement.

This could imply either speculative interest or dormant wallets waiting for a clearer trend.

Therefore, stronger price action may be needed to activate this latent user base. If usage starts catching up with wallet creation, on-chain strength could reinforce the bullish structure TRX is currently displaying.

TRX sees rising buzz, but can sentiment alone drive price action?

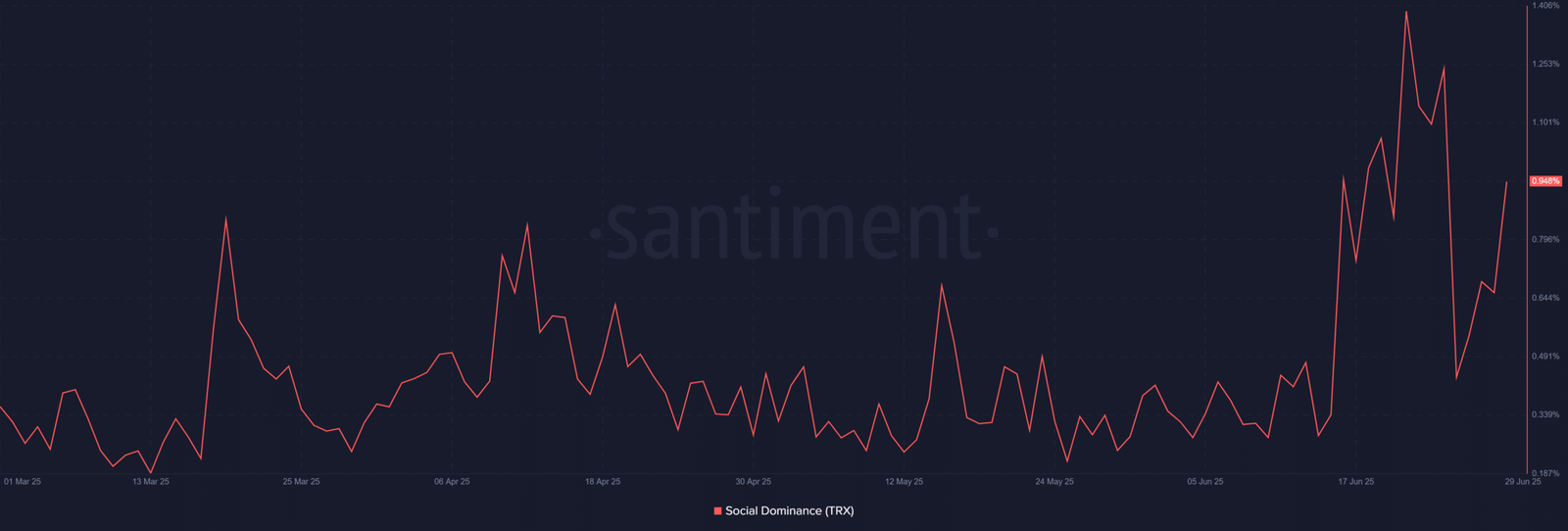

Social dominance for TRX jumped to 0.948%, reflecting increased mentions and discussions across the crypto community.

Although still below the 1.4% peak seen mid-June, the surge aligns with rising accumulation and price structure compression. However, sentiment alone rarely sustains momentum.

If a breakout occurs while social attention remains elevated, it could trigger a retail-driven wave. Otherwise, buzz without confirmation may lead to short-term overreactions.

Will TRX break its range or continue coiling below resistance?

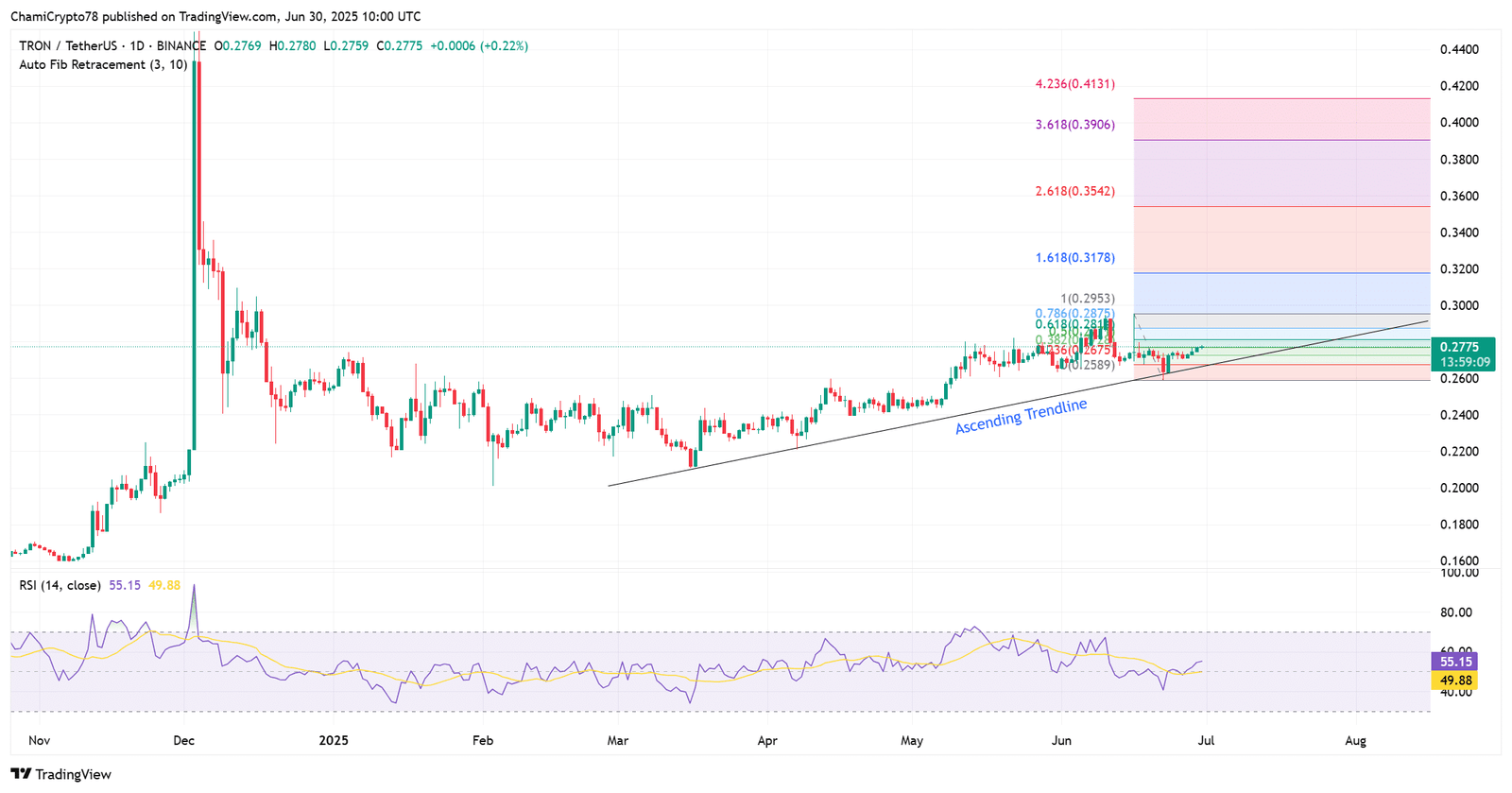

At press time, TRX was trading above its ascending trendline and was hovering just below the 0.786 Fibonacci level at $0.2875.

The RSI reading of 55.15 indicated moderate bullish momentum, while compressed Bollinger Bands and a pattern of higher lows pointed to growing upward pressure.

These signals suggest a bullish setup is forming. A confirmed breakout above resistance could pave the way for a move toward the 1.618 Fibonacci extension at $0.3178.

However, if the price fails to break out, it may retreat to the trendline support. For now, market structure remains bullish, but a decisive breakout is needed to confirm a sustained rally.

Conclusively, TRX shows a strong technical structure, supported by smart money accumulation and improving sentiment. However, weak user engagement and hesitant retail behavior remain hurdles.

If price breaks above immediate resistance while volume and participation increase, TRX could initiate a strong rally toward new highs.

Until then, consolidation remains the dominant theme.