- Steady trading volume and hike in new users on the DEX were encouraging factors

- Hyperliquid looked likely to rally towards $45, provided it can maintain its bullish structure

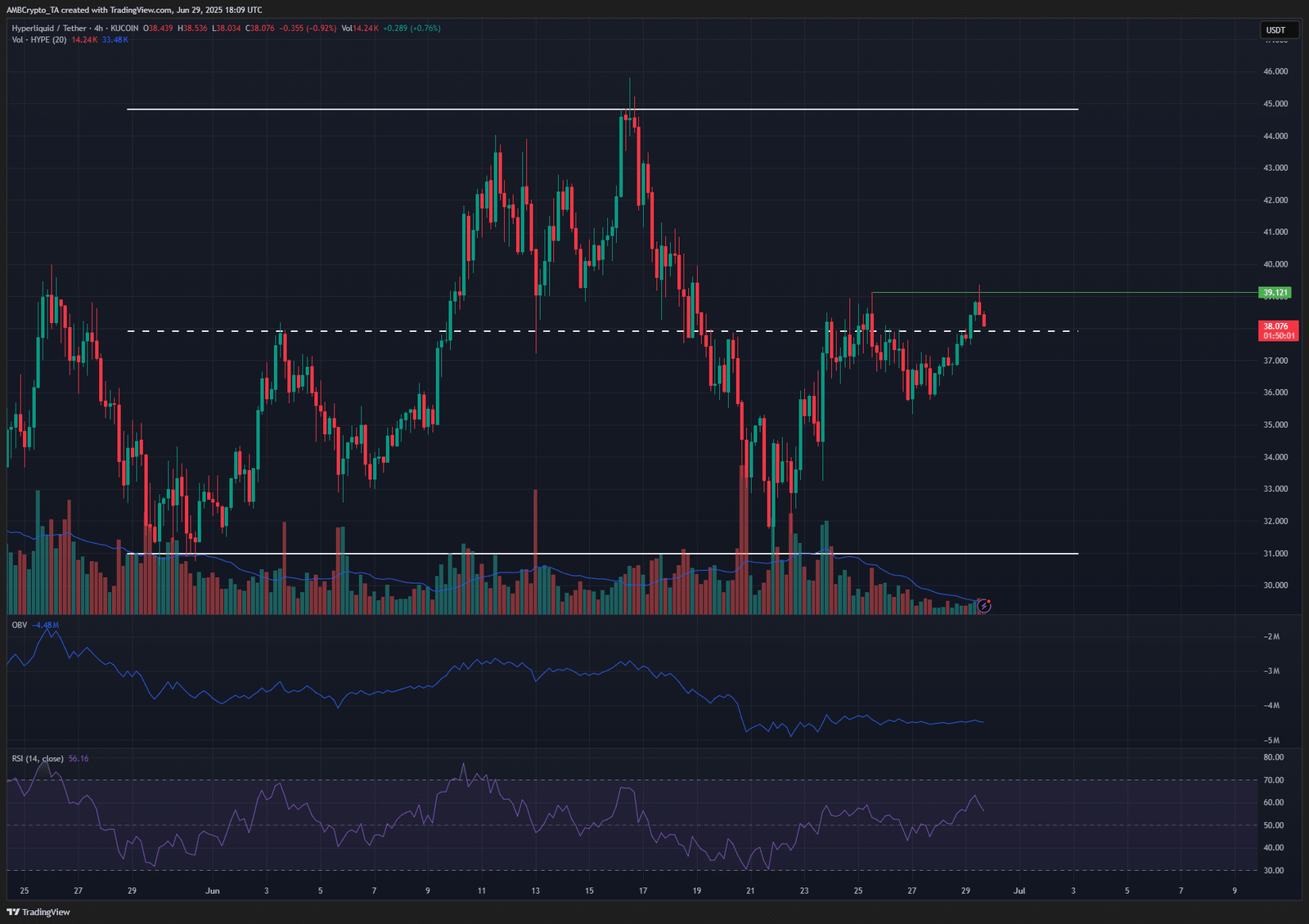

Hyperliquid [HYPE] has performed well over the past week, with its 12% gains among the highest in crypto’s top 20 by market capitalization. However, the $39-level rebuffed HYPE’s bulls in recent hours. This, despite the decentralized exchange posting good trading volume too.

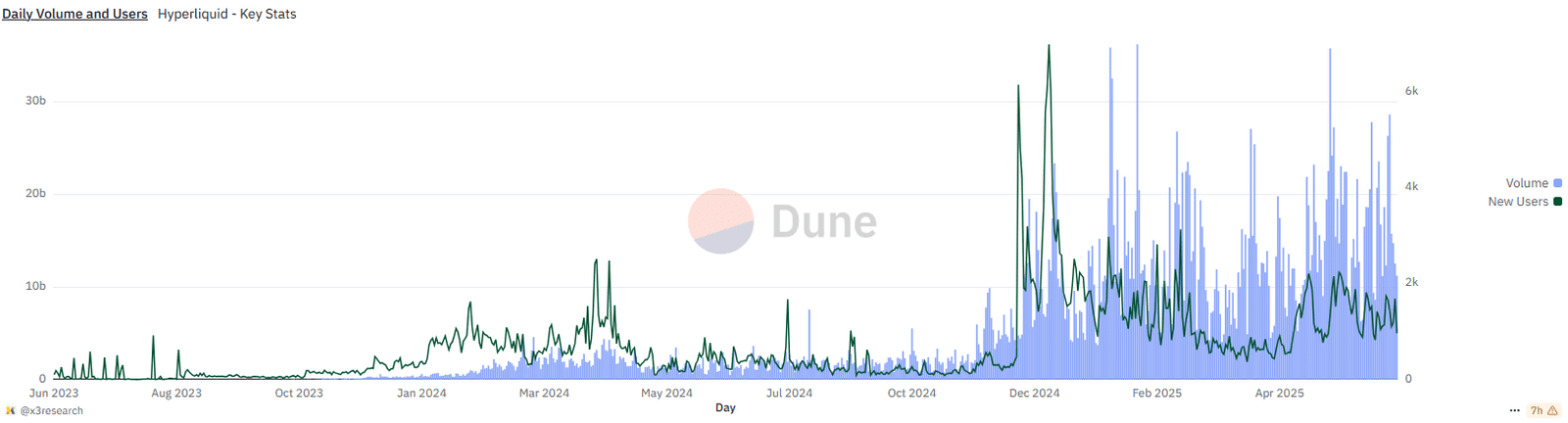

Source: Dune Analytics

The aforementioned chart revealed that the DEX’s volume was steady, comparable to levels from February.

Interestingly, the new user count has also been on the rise over the past two months. Could this drive a resurgence in HYPE’s price?

Technical analysis underlines key HYPE levels to watch

The 4-hour chart showed a bullish market structure for HYPE after it went above the $37.25-level on 28 June. Since then, the bulls have challenged the $39.12 local top, but were unsuccessful.

The OBV has been flat in recent days as the trading volume dwindled from last week. The low HYPE trading volume during the recovery from $36 was a sign of weak bullish sentiment. The RSI showed bullishness with a reading of 56, but without sustained demand, the momentum could more easily reverse.

Since late May, HYPE has traded within a range (white) from $31 to $44.8. The recent rally brought the price above the mid-range level at $37.9. If Hyperliquid bulls can defend this level as support, a move towards the range high would be possible. However, a hike in buying volume would be necessary here.

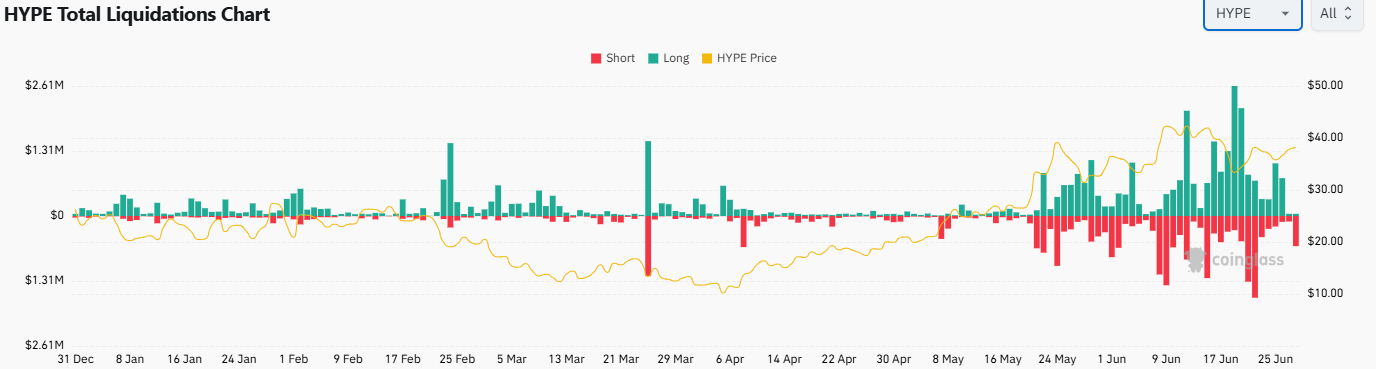

Source: Coinglass

The liquidations chart showed that the bounce from $36 to $39 saw short liquidations, but few long liquidations. According to Coinalyze data, the funding rate has been positive recently as well. The Open Interest was up 4% in the last 24 hours. Together, they signaled short-term bullish expectations.

Traders would want to see greater trading volume and demand, which would increase the chances of a recovery. Bitcoin [BTC] can also influence market sentiment and move HYPE’s price.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion