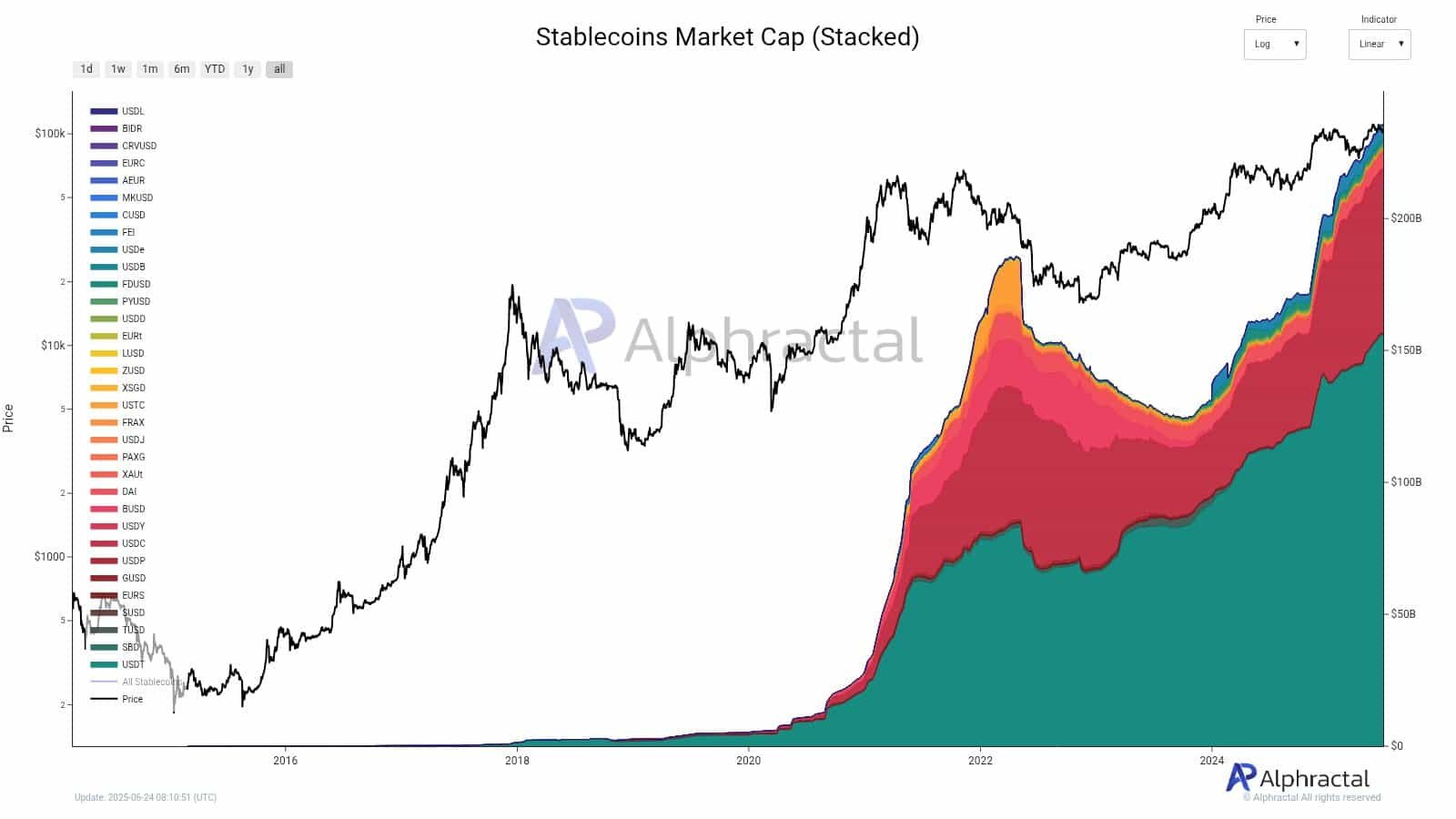

As the total stablecoin market cap inches toward $250 billion – roughly 7.5% of crypto’s total valuation – one player continues to tower above the rest.

Tether [USDT] now accounts for a commanding 66.2% of all stablecoins in circulation. This dominance shows deep liquidity and trader trust, positioning Tether as the primary bridge between fiat and crypto.

USDT dominates capital flows, centralizes liquidity, and signals when and where stablecoin reserves will move next.

However, there’s rising concern that this concentration of liquidity may not translate into direct support for decentralized markets, as some had anticipated.

Sebastian Pfeiffer, Managing Director of Impossible Cloud Network, told AMBCrypto,

“Many are celebrating the liquidity this stablecoin boom will supposedly bring to digital assets, but few seem to be clear where that liquidity will go…”

He further added,

“Because it seems unlikely all of this stablecoin liquidity will find its way into the decentralized crypto ecosystem. Indeed, it seems far more likely it will stay in the hands of the centralized providers and systems controlling these assets.”

So, how much of this boom translates to altcoin upside?

Can any of this lead to altseason?

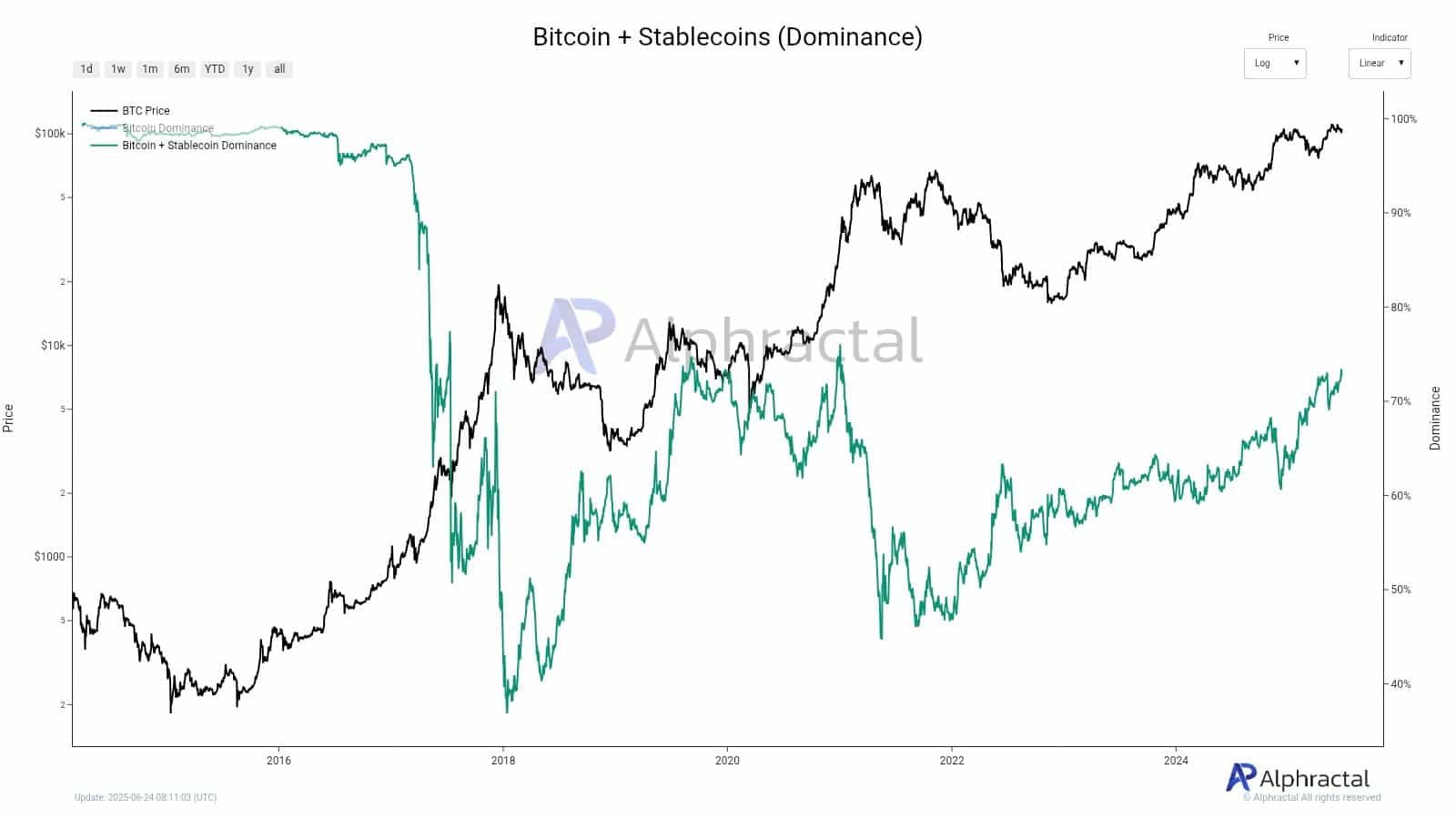

Bitcoin and stablecoins now make up 73.5% of the total crypto market cap—a level last seen during major altcoin accumulation phases in previous cycles.

Historically, when BTC and stablecoin dominance surges above 70%, it signals that investors are parking capital in lower-volatility assets, often a precursor to rotating into riskier altcoins once market conditions turn favorable.

Despite skepticism about an incoming altseason, current data tells a different story. \

A large amount of sidelined capital is parked in Bitcoin and stablecoins, waiting for the right technical setup or narrative spark to flow back into higher-risk altcoins.