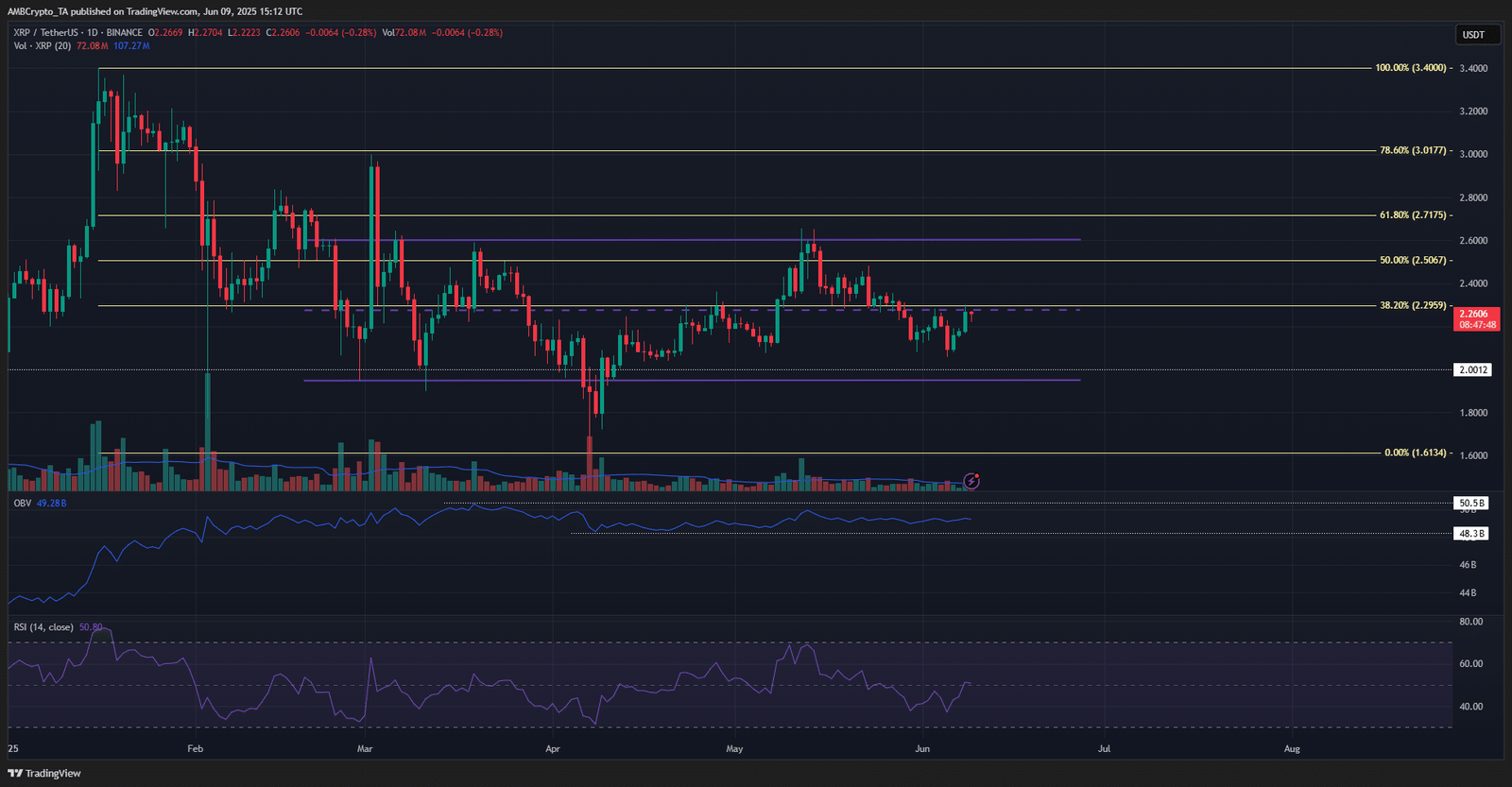

- XRP has a bearish swing structure on the 1-day timeframe

- Metrics showed buyers were dominant, but it was not yet time for an explosive rally

XRP saw a slight edge in capital outflows from exchanges on 05 June. The capital outflows had been heavier in May, but they reduced in strength in June. A recent AMBCrypto report also revealed that the Network Value to Transactions (NVT) ratio was down lately, compared to previous sessions.

This reflected a potential that the token might be undervalued due to a spike in utility, compared to its market cap. The fall in exchange reserves suggested accumulation was going apace.

Despite spot buyers being dominant based on the 3-month CVD, the price has remained stuck within a range.

XRP supply zone at $2.3 remains formidable

The mid-range resistance at $2.28 coincided with the 38.2% Fibonacci retracement level plotted based on the 2025 drop from $3.4 to $1.61. The 1-day timeframe RSI had been below neutral 50 in recent weeks, signaling bearish momentum.

At press time, the RSI was at 50.8. The indicator wandering above 50 was an early bullish sign of a shift in momentum. However, the swing structure of XRP’s price action remained bearish, following its rejection from the range high at $2.6.

The OBV has also been stuck within a range since April, but was unable to set a higher high beyond the ones from March. On the other hand, it set a series of higher lows over the past two months, which was encouraging.

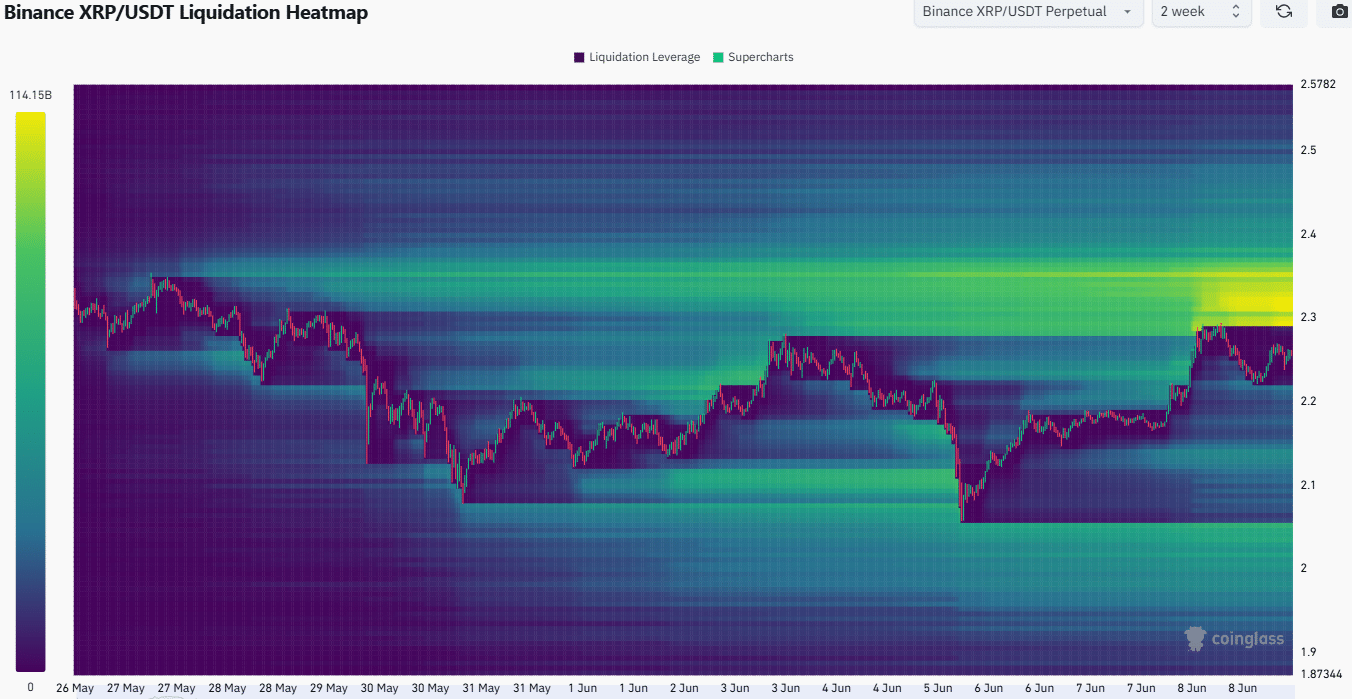

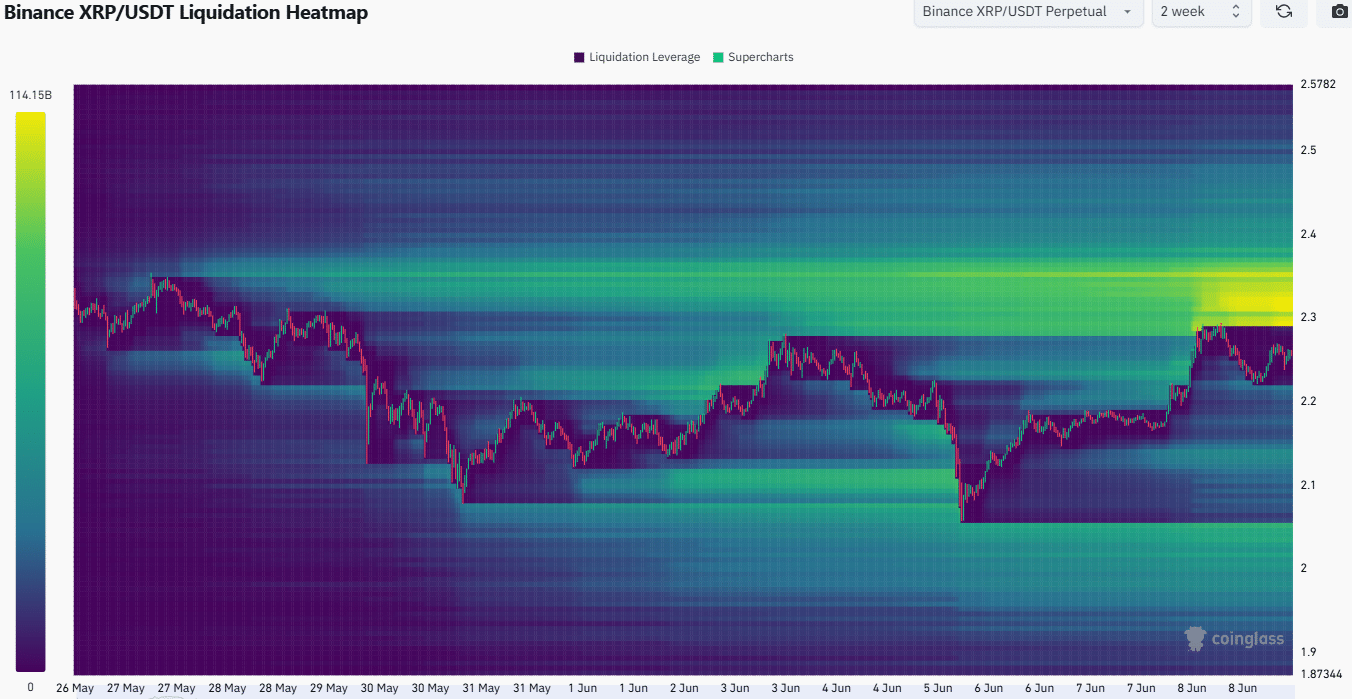

Source: Coinglass

The 2-week liquidation heatmap underlined the large pool of levels that had built up from the $2.29-$2.36 region. This liquidity cluster was close to the press time market price, which meant that an XRP move to $2.36 appeared likely.

A bearish reversal from the $2.35-$2.4 region could be feasible. After sweeping the liquidity overhead, a bearish reversal would hurt more traders. As seen on the 1-day OBV, the buying pressure was present, but not overwhelming. Hence, a rally towards the range high might have to wait.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion