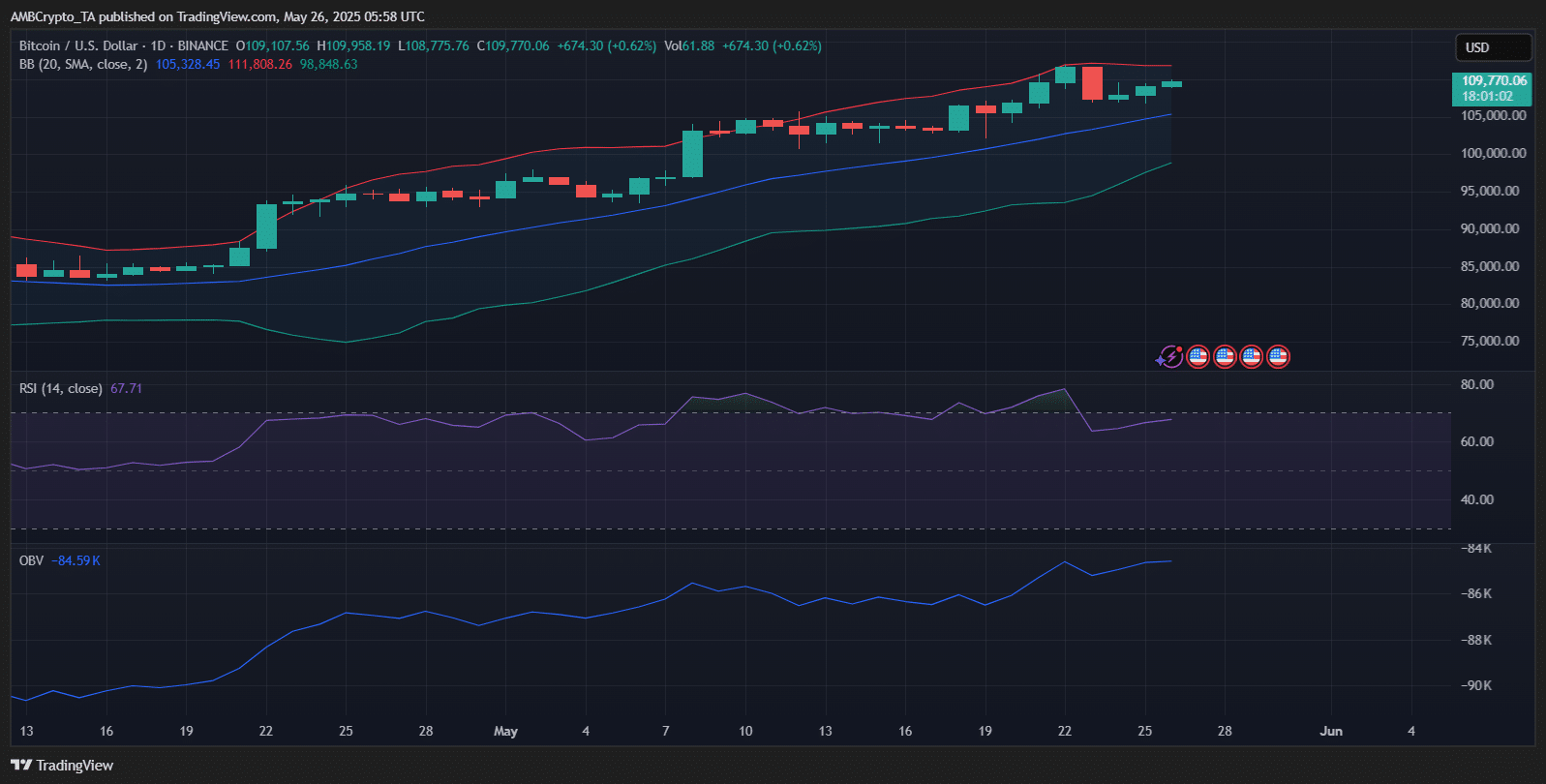

Bitcoin, at press time, was consolidating above $109,000, showing resilience within the upper Bollinger Band range. The RSI was at at 67.71 – hovering near overbought territory – A sign of strong bullish momentum without immediate signs of exhaustion.

Meanwhile, the OBV remained flat – A sign of a pause in buying pressure, despite recent gains.

This steady range-trading in Bitcoin has opened the door for capital rotation into altcoins like XMR, AAVE, and WLD.

With BTC holding support and volatility compressing across the board, traders might be increasingly willing to chase higher returns in riskier assets. Especially since Bitcoin serves as a stable anchor for the market.

WLD breaks out, but…

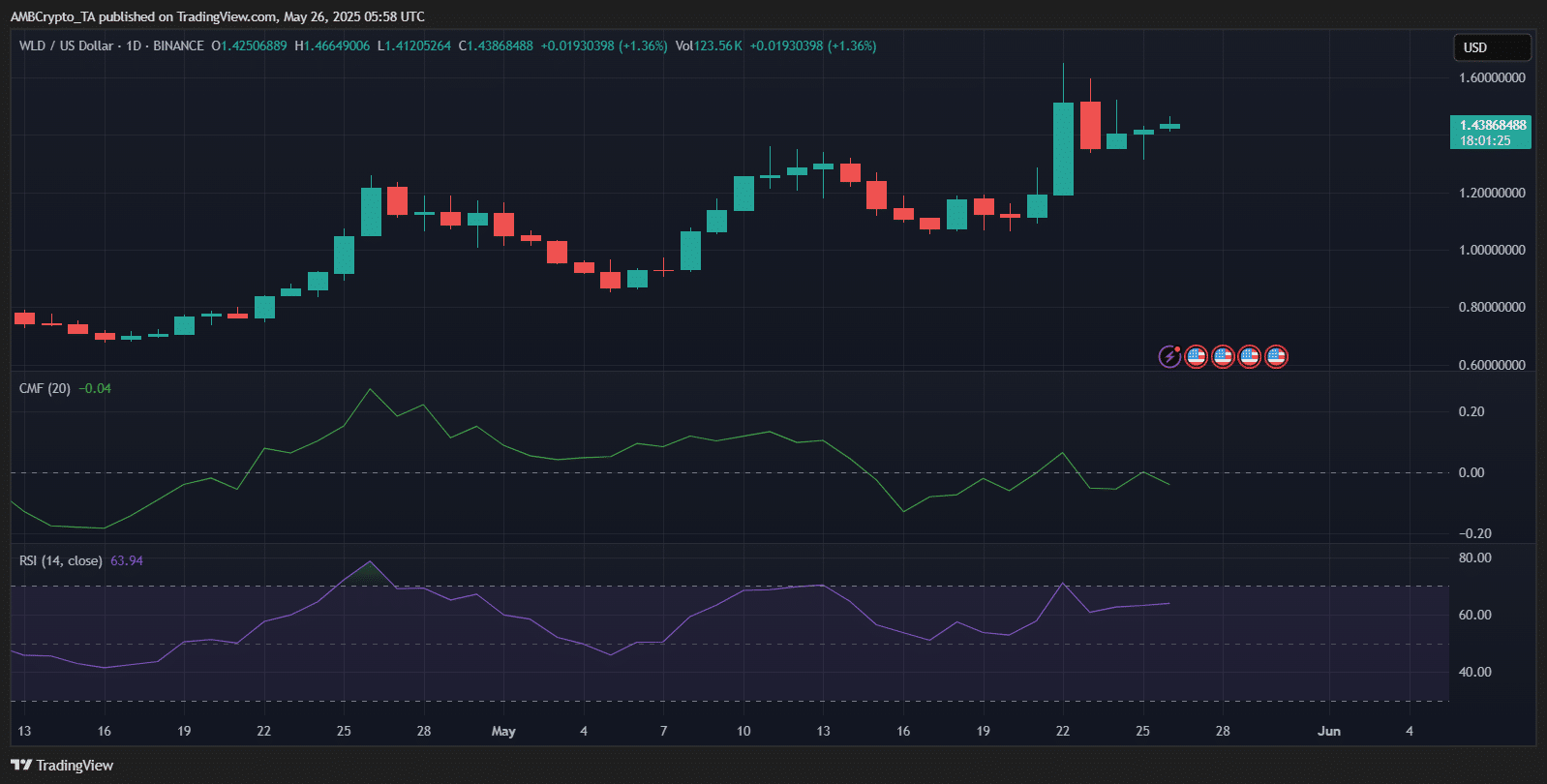

Worldcoin has climbed by over 35% in the past two weeks, consolidating above $1.43 with its bullish momentum still intact.

The RSI was at 63.94 at press time, reflecting steady upward pressure without overbought signals. However, the CMF remained slightly negative, indicating a potential drop in sustained buying power.

This, after the broader privacy coin sector advanced by over 3%, pushing its combined valuation past $10 billion.

While the sector-wide rally did offer some respite, WLD’s muted on-chain flows do raise some questions about whether it can maintain its gains without stronger capital inflows.

XMR hits overdrive, but is a cool-off coming?

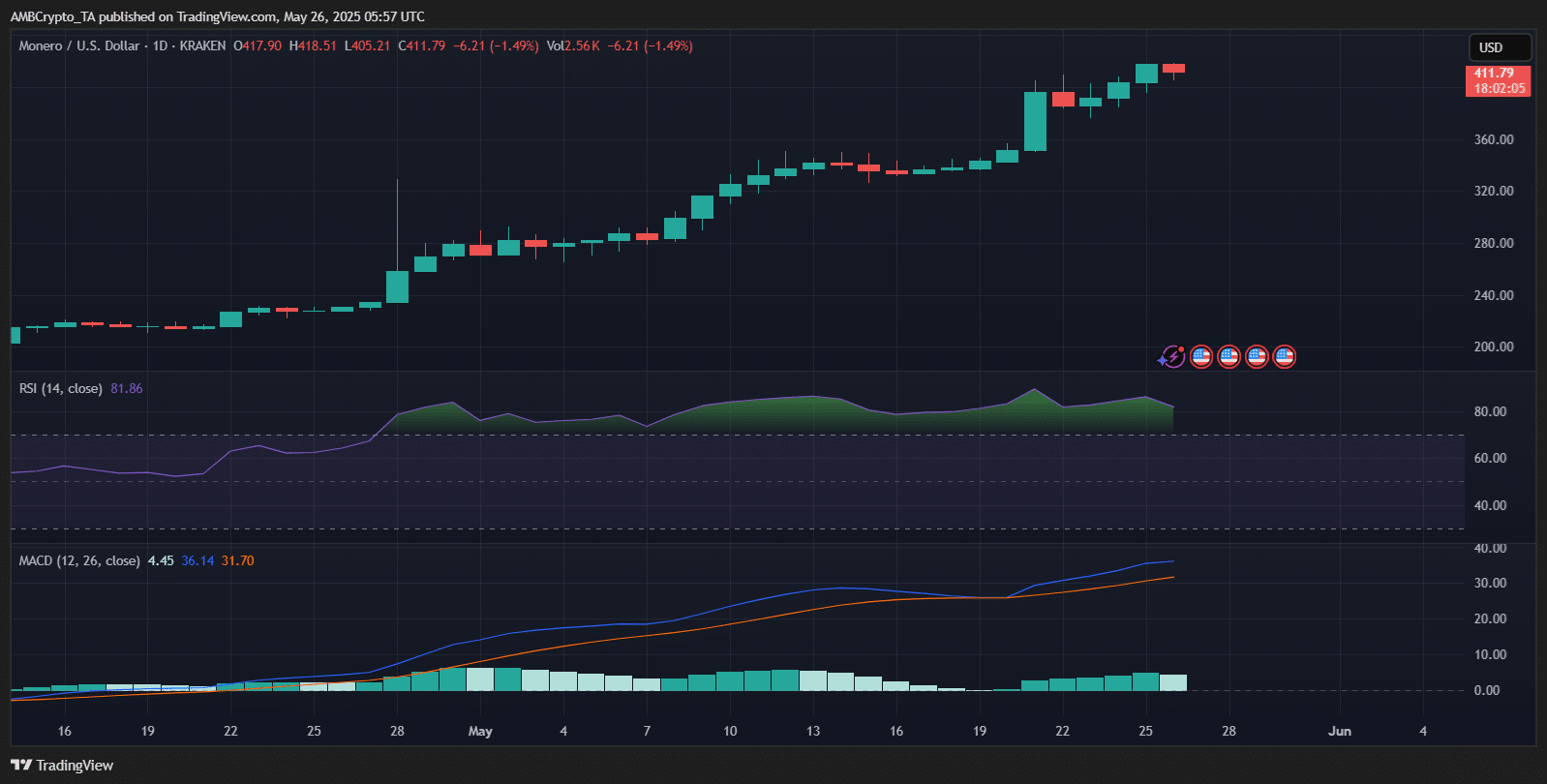

Monero surged to $411, mirroring the broader privacy coin rally that pushed the sector past a $10 billion valuation.

However, its daily RSI soared to 81.86 – firmly in overbought territory – raising caution about a potential short-term correction. The MACD was bullish, with wide separation between signal lines, reinforcing the strength of the uptrend.

Still, the slight dip in daily volume hinted at waning momentum. While XMR has clearly benefited from the privacy coin narrative, traders may want to brace for consolidation or a retest unless fresh catalysts emerge to support sustained vertical price action.

AAVE joins the rally, but signs hinted at exhaustion

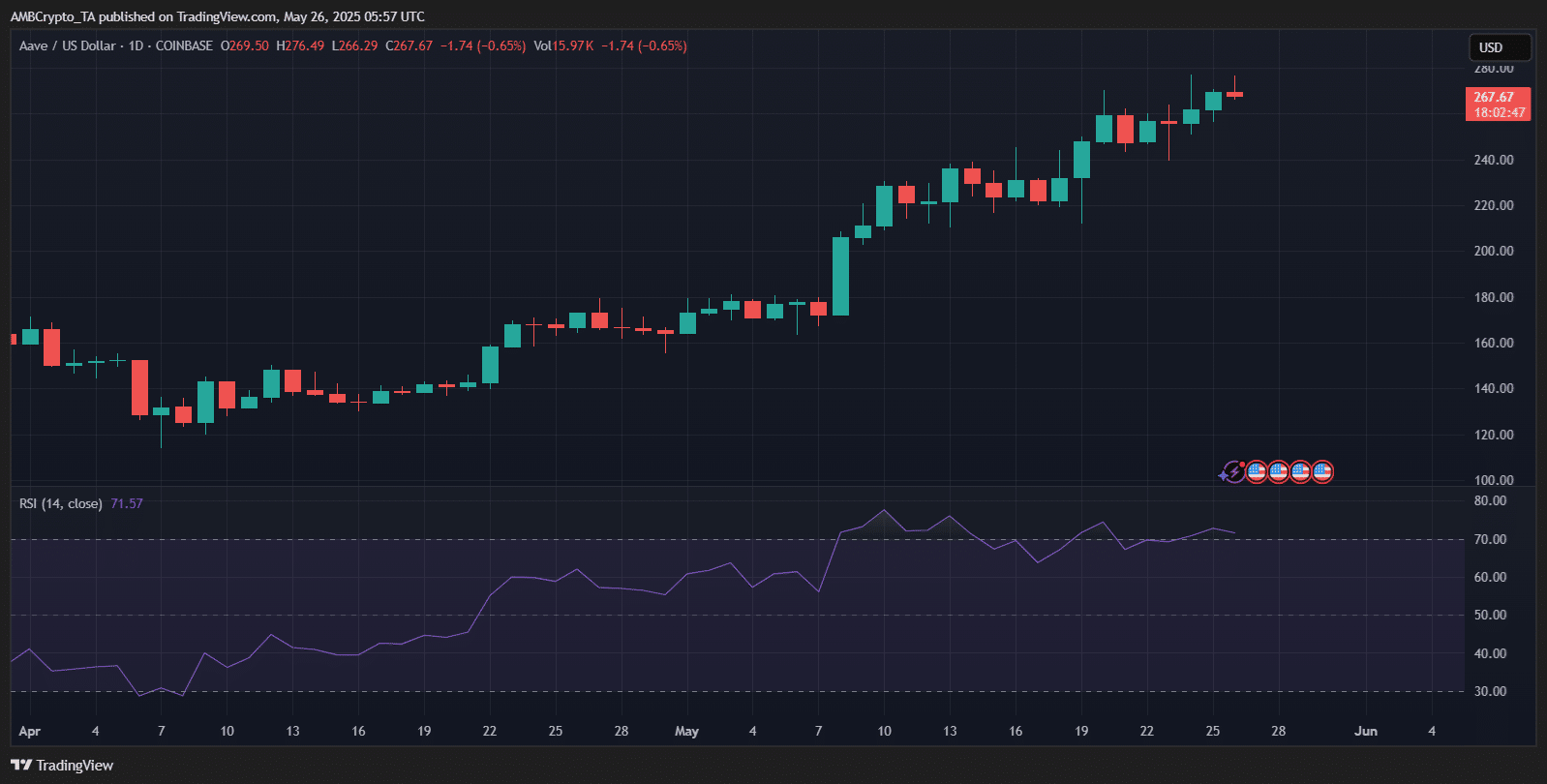

AAVE climbed to $267, extending gains from its mid-May breakout and riding the sector-wide upswing in privacy and DeFi-linked tokens.

However, with the RSI at 71.57, the asset entered overbought territory – Often a precursor to short-term pullbacks.

Despite solid momentum and higher lows supporting the uptrend, the recent string of small-bodied candles alluded to indecision creeping in.

With volume slightly falling too, bulls may need a fresh catalyst to sustain the climb. A brief consolidation phase could be healthy, especially after the nearly 80% rally seen over the past month.