Crypto futures trading lets you speculate on future price movements without owning the actual coins. This type of trading offers chances to profit in both rising and falling markets. With the right platform, you can use tools like leverage to boost potential gains, but it comes with risks that need careful planning. Choosing a trusted and user-friendly platform is crucial for success.

We will also explain what futures trading in crypto is, how to trade perpetual futures contracts, and how to choose the best platforms for trading futures contracts in crypto.

Ranking the Best Futures Trading Platform

We have reviewed over 30 different futures cryptocurrency exchanges based on leverage, security, fees, supported cryptocurrencies, and ease of use. Here is our list of the 8 best crypto futures trading platforms:

- Binance: Overall best crypto futures trading platform

- Bitget: Best platform for altcoin futures trading

- Bybit: Best crypto derivatives platform

- MEXC: Best for low-fee crypto futures trading

- OKX: Regulated crypto exchange for futures trading

- Coinbase: Best crypto futures exchange in the U.S.

- Kraken: Safest crypto futures trading platform

- Gemini: Best Bitcoin futures trading platform

8 Best Futures Trading Platforms Reviewed

1. Binance Futures

Binance Futures is the world’s largest cryptocurrency derivatives platform. Launched in late 2019, it has become the top choice for futures traders. In January 2025, Binance recorded over $1.08 trillion in futures trading volume, surpassing competitors like OKX and Bybit. Its futures platform, Binance Futures, dominates the derivatives market, offering over 340 trading pairs and leverage up to 125x.

The platform supports both USD-M (stablecoin-settled) and COIN-M (cryptocurrency-settled) contracts, catering to diverse trading strategies. Binance Futures is known for its low fees, starting at 0.02% for makers and 0.05% for takers, with a 10% discount when using BNB. The exchange’s advanced trading tools, including real-time charting, multiple order types, and trading bots, make it ideal for both beginners and professionals.

Binance offers measures like two-factor authentication, cold storage, and a Secure Asset Fund for Users (SAFU). It also offers a demo account for practice, ensuring new traders can learn without risk. The exchange supports over 250 million users across more than 180 countries. The platform processes over 1.4 million transactions per second, ensuring high liquidity and fast trade execution.

Pros of Binance

- High liquidity with $50 billion daily trading volume

- Low fees: 0.02% maker, 0.05% taker, 10% BNB discount

- Over 340 futures trading pairs for diverse strategies

- Leverage up to 125x for amplified trading potential

- Advanced tools: real-time charts, trading bots, multiple order types

Cons of Binance

- Past regulatory challenges in various jurisdictions

- Regulatory restrictions in the U.S. and Binance.US do not offer futures trading

2. Bitget Futures

Bitget is another best platforms for trading futures, particularly best for copy trading. Headquartered in Singapore, it’s a centralized platform known for its robust futures trading capabilities, offering up to 125x leverage on over 560 derivative pairs, including major cryptocurrencies like Bitcoin, Ethereum, and XRP.

The platform supports USDT-M, USDC-M, and COIN-M futures, and Bitget’s high-performance matching engine ensures swift trade execution within 10 milliseconds, complemented by deep liquidity for minimal slippage. The platform maintains a Protection Fund exceeding $600 million to safeguard user assets. Plus, Bitget stores over 90% of user funds in cold wallets and employs two-factor authentication (2FA) to enhance account security.

Its futures trading fees are competitive, with 0.02% for makers and 0.06% for takers, and discounts are available for VIP traders or those paying with Bitget Token (BGB). The platform’s copy trading feature is a game-changer, allowing novices to mirror elite traders’ strategies.

Pros of Bitget

- High leverage up to 125x for futures trading

- Copy trading allows mirroring elite traders’ strategies

- $600 million protection fund ensures asset security

- Supports over 560 derivative trading pairs

- Fast trade execution within 10 milliseconds

Cons of Bitget

- Limited fiat-to-crypto trading options

- Restrictions in certain countries due to regulatory constraints

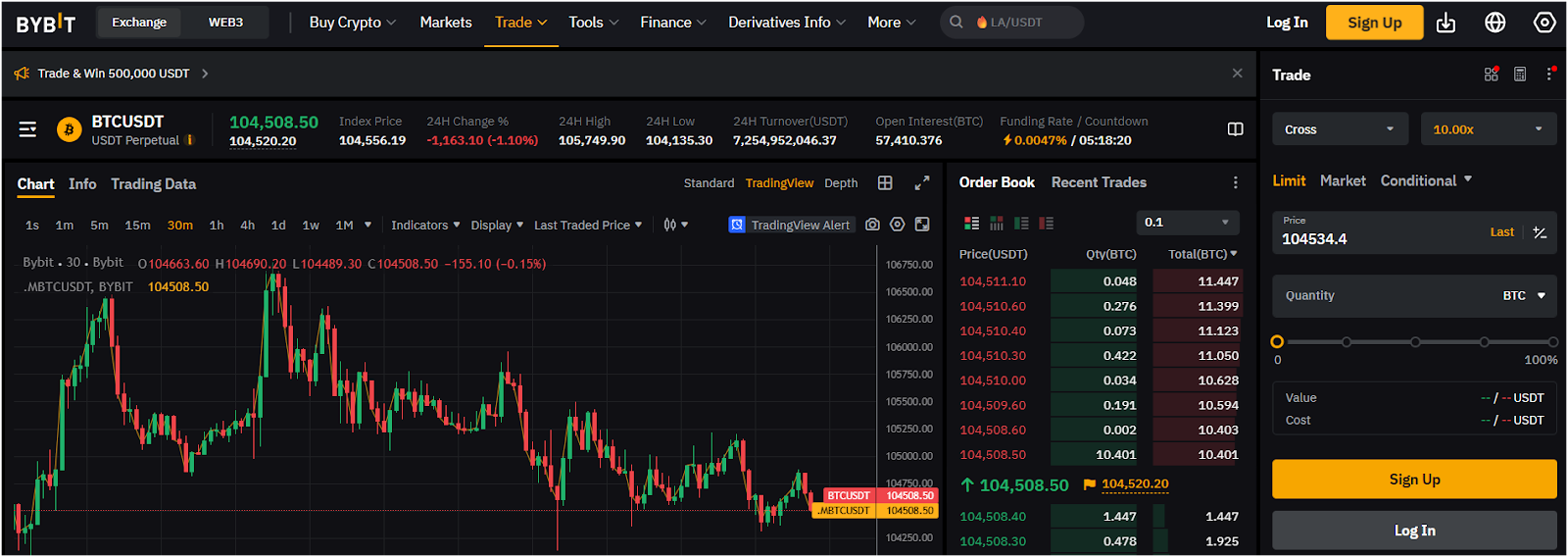

3. Bybit Futures

Bybit is another best crypto derivatives trading platforms. It has over 60 million users globally and a daily trading volume exceeding $60 billion. Bybit is the world’s second-largest crypto exchange by trading volume, as noted by CoinMarketCap.

The platform specializes in futures, offering perpetual and quarterly contracts with up to 100x leverage on major cryptocurrencies like Bitcoin and Ethereum, alongside over 1,500 cryptocurrencies and 500+ futures trading pairs. Bybit’s user-friendly interface, high liquidity, and advanced tools make it a top choice for both novice and experienced traders. Its 100K TPS matching engine ensures fast order execution without overloads, and a 99.99% system uptime guarantees reliability.

Bybit supports USDT-margined, coin-margined, and USDC-settled contracts. The platform also offers copy trading, trading bots, and a demo mode for risk-free practice. Bybit’s competitive fee structure includes 0.02% maker and 0.055% taker fees for non-VIP users, with even lower rates for VIP and Pro tiers.

Pros of Bybit

- High liquidity with over $60 billion daily trading volume

- Up to 100x leverage on diverse futures contracts

- Supports 1,500+ cryptocurrencies and 500+ trading pairs

- Advanced tools like copy trading and trading bots

- 99.99% system uptime with a fast 100K TPS engine

Cons of Bybit

- Unavailable in the US and other restricted regions

- A $1.5 billion Ethereum hack in 2025 raised concerns

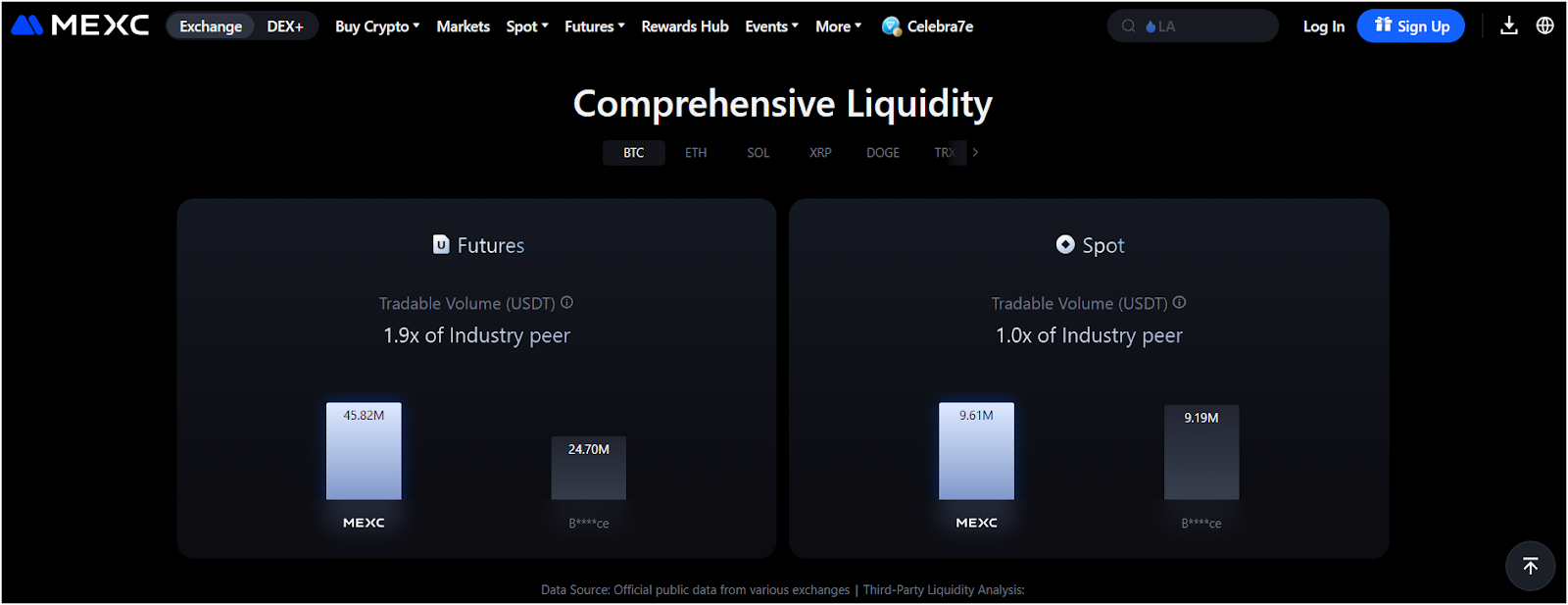

4. MEXC

MEXC is the best low-fee crypto futures trading exchange. It supports over 3,000 cryptocurrencies and 3,100+ trading pairs, making it one of the most diverse exchanges available. Its futures trading stands out with up to 200x leverage on perpetual contracts.

MEXC’s fee structure is a key highlight: futures trading fees are 0.01% for makers and 0.04% for takers, among the lowest in the industry. Holding 1,000 MX tokens unlocks a 50% fee discount, further reducing costs. The exchange provides robust liquidity, with a 24-hour futures trading volume exceeding $10 billion, and integrates TradingView for advanced charting.

MEXC also offers a demo trading mode with $50,000 in virtual funds, ideal for practicing futures strategies risk-free. Security is prioritized with cold wallet storage, two-factor authentication, and bi-monthly Proof of Reserves updates showing reserve ratios above 100%. Also, MEXC is good in token variety and low fees, but it lacks direct fiat withdrawals and is unavailable in the U.S. and Canada.

Pros of MEXC

- Ultra-low futures fees, industry-leading

- High leverage up to 200x on perpetual futures contracts

- Supports 3,000+ cryptocurrencies and 3,100+ trading pairs

- Demo trading with $50,000 virtual funds for risk-free practice

- TradingView integration for advanced charting and technical analysis

Cons of MEXC

- No direct fiat withdrawals, requiring P2P or external platforms

- Limited liquidity for niche, lesser-known cryptocurrencies

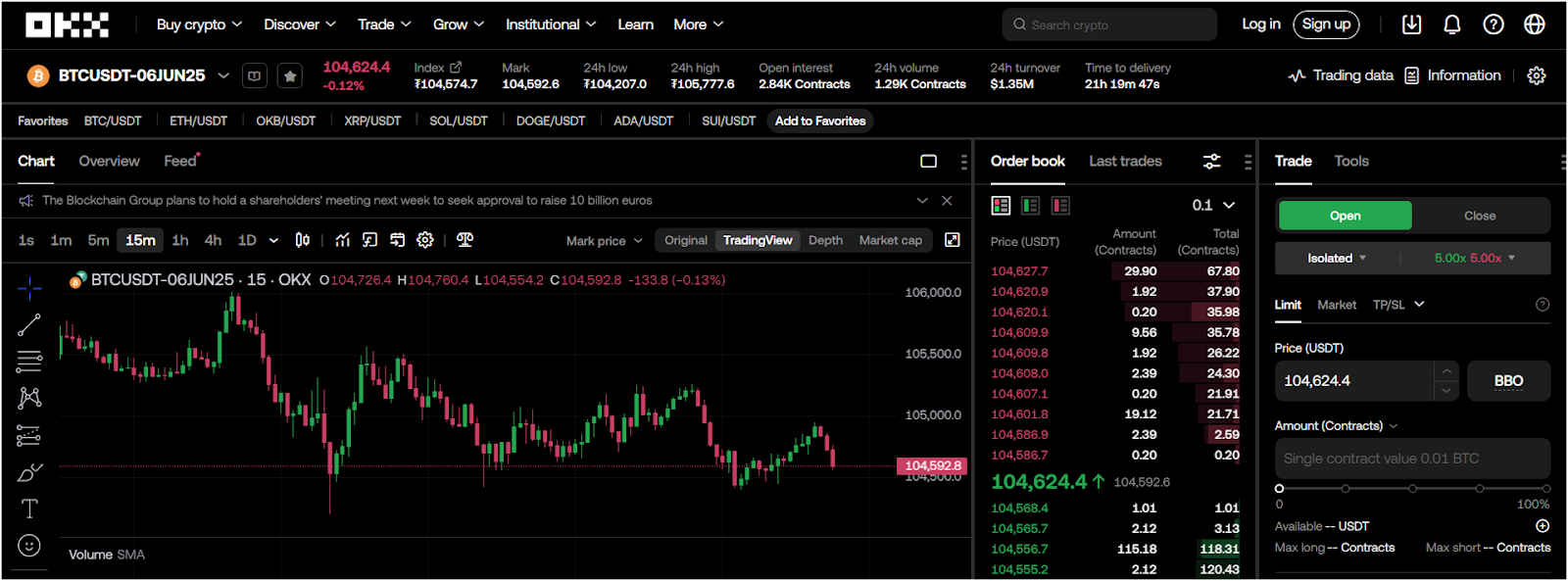

5. OKX Futures

OKX is the best-regulated crypto futures trading platform. Founded in 2017 and headquartered in Seychelles, OKX serves millions of users across over 100 countries, and is now also available in the U.S. The exchange supports over 300 cryptocurrencies and 340+ futures trading pairs, offering perpetual and expiry futures with leverage up to 125x. OKX’s futures market is one of the largest, with a 24-hour trading volume of $40 billion and high open interest.

Its tiered fee structure starts at 0.02% for makers and 0.05% for takers, with discounts for high-volume traders or OKB token holders. The platform’s advanced tools, including trading bots and real-time market data, cater to both beginners and seasoned traders. OKX emphasizes security with bank-level SSL encryption, cold storage, and monthly Proof of Reserves reports, showcasing a 1:1 reserve ratio.

You can also use the OKX Web3 wallet. It supports over 70 blockchains, enhancing DeFi and NFT capabilities. Partnerships with brands like Manchester City and the Tribeca Film Festival boost its global presence.

Pros of OKX

- High liquidity with $40 billion daily futures trading volume

- Low fees: 0.02% maker, 0.05% taker for futures

- Advanced tools like trading bots and real-time data

- Strong security with SSL encryption and cold storage

- Monthly Proof of Reserves ensures 1:1 asset backing

Cons of OKX

- Withdrawal fees are high compared to other crypto exchanges

- Futures trading is unavailable in the U.S. due to regulatory restrictions

6. Coinbase Advanced

Coinbase is the best crypto futures platform for U.S. users. As the only publicly traded crypto exchange in the U.S. (NASDAQ: COIN), Coinbase offers a secure and transparent environment for traders. Its futures trading, accessible through Coinbase Advanced and Coinbase Derivatives Exchange, supports nano-sized contracts for Bitcoin (1/100 BTC), Ethereum (1/10 ETH), Solana (5 SOL), XRP, ADA, HBAR, and more, with 24/7 market access.

In 2023, Coinbase acquired a CFTC-regulated derivatives exchange, enabling federally regulated futures trading for U.S. users, a rare feature due to strict regulations. The platform offers up to 5x leverage on perpetual futures settled in USDC for institutional clients outside the U.S., while U.S. retail traders can access micro-sized contracts.

Coinbase’s interface integrates spot and futures trading, supported by TradingView-powered charting and real-time order books. In terms of trading fees, Coinbase offers fees at 0.05% per trade.

Pros of Coinbase

- Regulated by CFTC, ensuring compliance and trust for U.S. traders

- Nano-sized contracts (e.g., 1/100 BTC) suit small-scale retail traders

- 24/7 trading for BTC, ETH, SOL, XRP, ADA, HBAR futures.

- Advanced TradingView charting and real-time order books enhance trading

- Beginner-friendly interface with educational resources for new traders

Cons of Coinbase

- U.S. traders restricted to nano-sized BTC, ETH futures, with less leverage

- Customer service issues, including slow responses and non-human support

- Instances of system errors during volatile markets

7. Kraken Pro

Kraken, founded in 2011, is the safest cryptocurrency futures exchange based in San Francisco, serving over 15 million clients in 190+ countries. Its futures trading platform, Kraken Futures, is designed for seamless, high-performance trading with low latency.

Today, Kraken ranks among the top 10 global exchanges for derivatives trading, with a high daily futures trading volume. The platform supports futures for Bitcoin, Ethereum, Solana, and more, offering up to 50x leverage and nine collateral options for flexibility.

Regulated by the UK’s FCA and Europe’s MiFID II, Kraken ensures compliance. The TradingView-powered interface includes advanced charting and order types like limit and iceberg orders. Fees range from 0% to 0.06% for maker-taker trades, ensuring cost efficiency. Kraken Pro’s mobile app and APIs support dynamic trading strategies. Despite a $30 million SEC settlement in 2023, Kraken’s security, with Proof of Reserves audits, remains robust.

Pros of Kraken

- Supports over 350 perpetual futures contracts

- Nine collateral options enhance capital efficiency

- Regulated by the FCA and MiFID II for compliance

- TradingView-powered interface with advanced charting tools

- Unified interface for spot and futures trading

Cons of Kraken

- Limited access for U.S. retail futures traders

- Past SEC lawsuits raise regulatory concerns

8. Gemini Derivatives

Gemini, founded in 2014 by Cameron and Tyler Winklevoss, is a leading cryptocurrency derivatives exchange based in New York, known for its strong security and regulatory compliance. It operates in over 60 countries, including all 50 U.S. states.

The Gemini ActiveTrader platform offers perpetual futures with up to 100x leverage, deep order book visibility, and microsecond trade execution, though derivatives are restricted in the U.S., UK, and EU. These contracts have no expiry date, enabling you to hold positions as long as your margin requirements are met. Also, it supports cross-collateralization. This means you can use various assets as collateral for your trades.

Gemini is recognized for its stringent security measures. It holds certifications such as ISO/IEC 27001:2013 and SOC 2 Type 2, ensuring high standards in information security management. The majority of assets are stored in offline cold storage, and customer fiat funds are insured up to $250,000.

Pros of Gemini

- High security with SOC 1 and SOC 2 certifications

- Licensed by NYDFS and operates in all U.S. states

- ActiveTrader offers 100x leverage and deep order books

- User-friendly mobile and web apps for easy trading

- GUSD stablecoin provides stability for futures trading

Cons of Gemini

- Derivatives unavailable in the U.S., UK, and EU

- Only six crypto pairs for futures trading

- Limited staking options like Ethereum and Polygon

What is a Crypto Futures Exchange?

A crypto futures exchange is a platform where you can trade contracts to buy or sell cryptocurrencies at a set price on a future date. These exchanges, like Bybit or Binance, let you use leverage, meaning you can control a big position with a small deposit, like putting down $100 to trade $1,000 worth of Bitcoin.

You can go “long” if you think the price will rise or “short” if you expect it to drop. Futures contracts have expiration dates, but some, called perpetual futures, don’t expire.

How to Choose a Crypto Futures Trading Platform

Safety Measures

You should choose a platform that protects your funds with strong security features. Always check for two-factor authentication (2FA) and cold wallet storage. Avoid any exchange that has been hacked before. Make sure the platform follows your country’s regulations to avoid legal issues. You can also read user reviews on sites like CoinGecko to understand how safe the platform really is.

Trading Volume

A high trading volume means you can buy or sell quickly without major price changes. Platforms like Binance have high activity, so your trades happen faster and with less slippage. On the other hand, low trading volume can make prices move against you while trading.

Futures Fee or Cost

Trading fees can reduce your profit, so it’s important to check them before you start. Some platforms like MEXC offer very low trading fees. You should compare the maker and taker fees; maker fees are usually lower, and taker fees are higher. Also, check for funding fees on perpetual contracts, as they can add up over time.

Leverage Options

Leverage allows you to trade with more money than you actually hold. It increases both risk and reward. The best crypto futures trading platforms, like MEXC, offer very high leverage, sometimes up to 200x, while others like Coinbase offer lower leverage, around 10x. You should choose a level of leverage that matches your risk tolerance. High leverage is risky and can lead to large losses if used carelessly.

Cryptocurrencies and Trading Pairs

You should pick a platform that offers the cryptocurrencies and trading pairs you want. Binance has a wide range of pairs, including Bitcoin and altcoins like Cardano. If you prefer smaller or newer coins, platforms like MEXC and Bitget might be a better option. Also, make sure the platform offers the contract type you want, such as perpetual contracts. More coins and pairs mean you get more trading opportunities.

Ease of Use

A good platform should be easy for you to understand and use. If you trade on your phone, look for a platform with a good mobile app; it must be user-friendly. Demo accounts, such as the one offered by Bitget, let you practice without using real money. If you are an advanced trader, look for tools like TradingView. A bad layout can make trading slow and frustrating.

Customer Support and Tools

Reliable customer support is important when you face problems. Platforms like Binance offer 24/7 support through chat or email. Some, like OKX, also include trading bots that automate your trades. You should test the support response time before committing. Also, make sure the platform has tools like stop-loss orders to help control your risk and avoid big losses.

Benefits and Risks of Crypto Futures Trading

What are the benefits of trading crypto futures?

- Profit from both rising and falling prices, giving flexibility in any market condition.

- Use leverage to control larger positions with less capital, boosting potential returns.

- Hedge existing crypto holdings to protect against price drops, securing your portfolio.

- Trade anytime in the 24/7 crypto market, unlike traditional markets with fixed hours.

- Enjoy high liquidity in futures contracts, allowing quick entry and exit from trades.

- Apply advanced trading strategies to tailor your approach to specific goals and trends.

What are the risks associated with crypto futures trading?

- Extreme price volatility can lead to rapid, significant losses in a short time.

- Leverage amplifies losses, potentially wiping out your capital on small market moves.

- Margin calls may force you to add funds or liquidate at unfavorable moments.

- Regulatory changes may limit access or impose new restrictions, disrupting your trades.

Types of Crypto Futures

Perpetual Contracts

You can trade perpetual contracts without any expiry date. These are the most common types in crypto. Prices follow the spot market closely. A funding fee is used to keep the price stable. You can hold the contract for as long as you want. These are good for short-term and long-term trades. Most major exchanges offer them.

Traditional Futures

These are contracts to buy or sell crypto at a set price on a specific date. You agree now, but the deal happens later. They’re good for locking in prices if you think the market will move. You can use leverage, but you need to be ready for the contract to end.

Inverse Futures

With inverse futures, you’re trading contracts priced in crypto, not dollars. For example, you use Bitcoin to trade Bitcoin futures. Your profit or loss is paid in the same crypto. It’s a bit tricky since the math flips – when the crypto’s price rises, the contract’s value in crypto drops. You’d pick this if you want to stay in crypto and avoid fiat.

Options on Futures

Options on futures give you the right, but not the obligation, to buy or sell a futures contract at a fixed price before a certain date. You pay a fee called a premium to get this right. Options help you limit losses while keeping a chance for profit. They are used to protect investments or to bet on big price changes.

Leverage Tokens

Leverage tokens are special tokens that give you leveraged exposure to crypto prices without needing to manage margin or liquidation risks. For example, a 3x long leverage token moves three times the daily price of Bitcoin. You just buy or sell these tokens like normal crypto. They are easier to use than futures for leverage. However, they reset daily, which can cause value changes over time.

How to Trade Crypto Futures?

- Choose a Platform: Pick a reliable platform to trade futures. Look for one with good security, like 2FA and cold storage, and high trading volume for smooth trades – Binance or Bybit are popular.

- Set Up Your Account and Deposit Funds: After choosing a platform, create an account and complete verification – most platforms need ID proof for futures trading. Deposit funds into your wallet; stablecoins like USDT are common for futures. Transfer funds to your futures account.

- Pick a Trading Pair and Contract: Choose the crypto pair you want to trade, like BTC/USDT or ETH/USDT. Decide on the contract type; perpetual contracts have no expiry, while traditional futures have a set end date.

- Place Your Trade: Open the futures trading section on your platform. Select your pair, like BTC/USDT, and choose long or short. Set your leverage (e.g., 5x) and enter the amount you’re trading. Use a stop-loss order to limit losses if the market moves against you, and a take-profit order to lock in gains. Double-check everything, then hit “buy” for long or “sell” for short.

- Monitor and Manage Your Position: Once your trade is live, keep an eye on it. Prices move fast in crypto, so check your position regularly on the platform’s dashboard. Adjust your stop-loss or take-profit if the market shifts. For perpetual contracts, watch funding fees – they’re charged every 8 hours and can add up.

Best Market to Trade Cryptocurrency Futures In

Bitcoin and Ethereum are the best markets for trading crypto futures. These two coins have the highest trading volume and strongest liquidity. That means you can enter and exit trades fast without big price slippage. Bitcoin is the most popular and most traded cryptocurrency. It moves with big trends and is good for both short and long positions. Ethereum has strong price action and reacts well to market news and updates in its network.

Both are supported on all major crypto leverage trading platforms like Binance, Bybit, OKX, and Kraken. You also get the most trading tools, analytics, and futures types on these two coins.

Conclusion

In a nutshell, Crypto futures trading is a popular way to make money by betting on future crypto prices. In 2025, choosing the right platform is key for success. Binance stands out as the top choice due to its high trading volume, low fees (0.02%-0.04%), and over 340 trading pairs, offering great flexibility.

However, it’s not available for US traders, who can use Binance.US instead. Coinbase is the best for US traders, offering regulated futures with up to 5x leverage and a user-friendly interface. Other platforms like Bybit, MEXC, and Kraken also shine with high leverage (up to 200x), diverse coins, and strong security.

FAQ

Can you trade futures in the US?

Yes, you can trade crypto futures in the US, but not all exchanges offer them due to strict regulations. Platforms like Coinbase allow futures trading for eligible users, following rules set by the Commodity Futures Trading Commission (CFTC).

What is the best crypto futures trading platform in the US?

Coinbase is considered the best futures trading platform for crypto in the US. It’s regulated, user-friendly, and offers futures trading for eligible users. Coinbase complies with US laws, ensuring safety and transparency. It provides tools for beginners and advanced traders, with competitive fees and strong security.

What is the best crypto for future trading?

Bitcoin and Ethereum are the best cryptocurrencies for futures trading. They have high liquidity, meaning you can trade them easily without big price swings. Both have strong market demand and are widely supported on exchanges like Binance or Coinbase.

Is crypto futures trading profitable?

Yes, crypto futures trading can be profitable, but it depends on your strategy, market knowledge, and risk management. Profits come from price movements, but losses are also possible due to volatility. Leverage can amplify gains or losses. Success requires discipline, research, and experience.

What is the most trusted crypto futures trading platform?

Binance is the most trusted crypto futures trading platform globally. It offers a wide range of cryptocurrencies, low fees, and strong security measures. Binance has a solid reputation, high trading volume, and user-friendly features. However, in the US, ensure you use Binance.US for compliance with local regulations.

What is leverage in crypto futures trading?

Leverage in crypto futures trading lets you control a larger position with less money. For example, 10x leverage means $1,000 controls $10,000 in trades. It can increase profits if the market moves in your favor, but also magnifies losses if it moves against you. High leverage is risky, so use it carefully and understand margin requirements to avoid liquidation.