- Whale transfers, lower NVT, and Spot Taker CVD dominance indicated revived XRP interest.

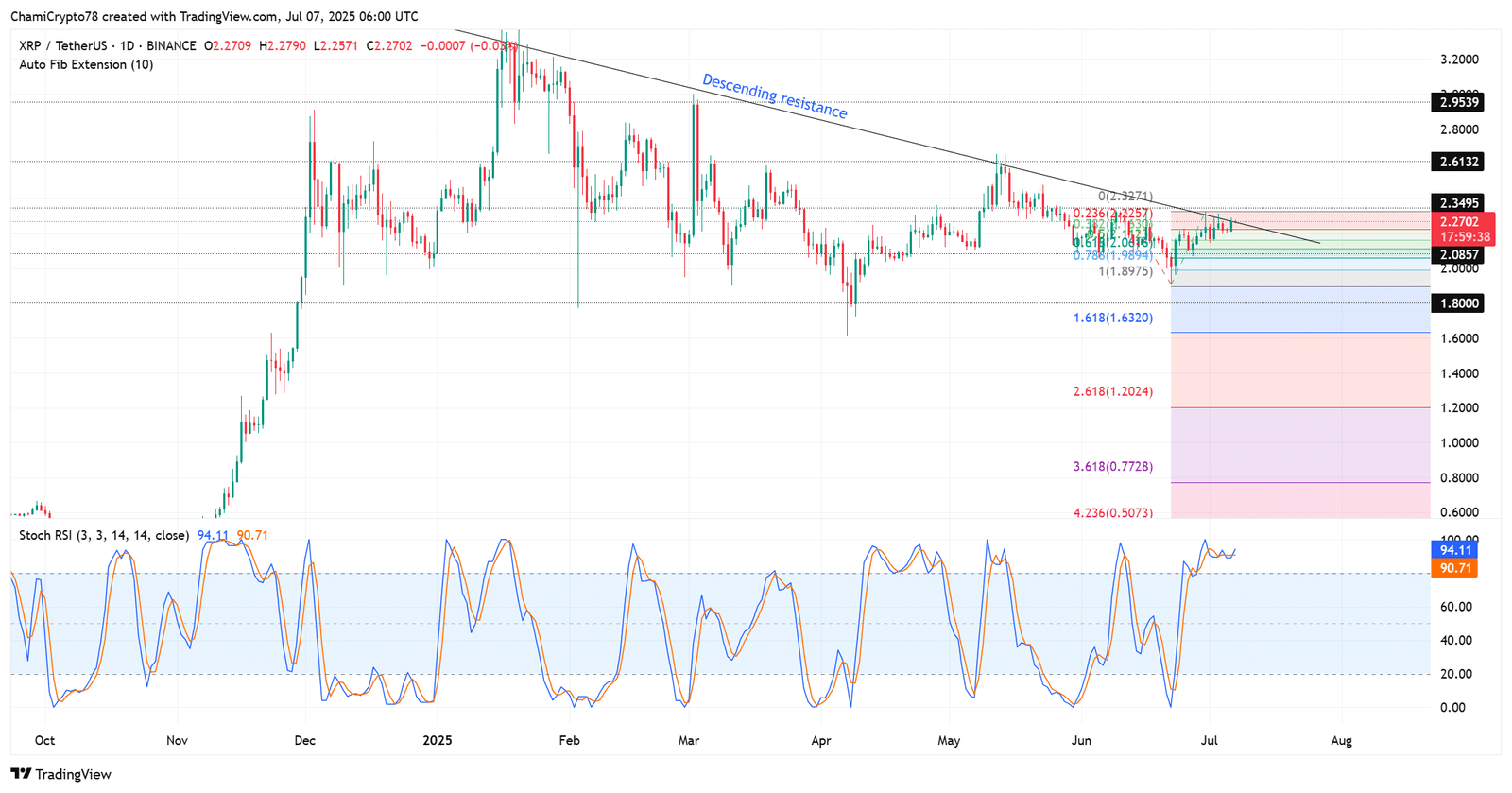

- The altcoin traded near descending resistance at $2.35, while the SRSI hovered in overbought territory.

A sudden movement of 50 million Ripple [XRP] between unknown wallets, worth over $113 million, has drawn market attention.

Such large-scale, anonymous transactions often signal potential strategic positioning, particularly by whales. Having said that, the movement stoked speculation about behind-the-scenes accumulation.

Can a 44% plunge in transactions revive XRP?

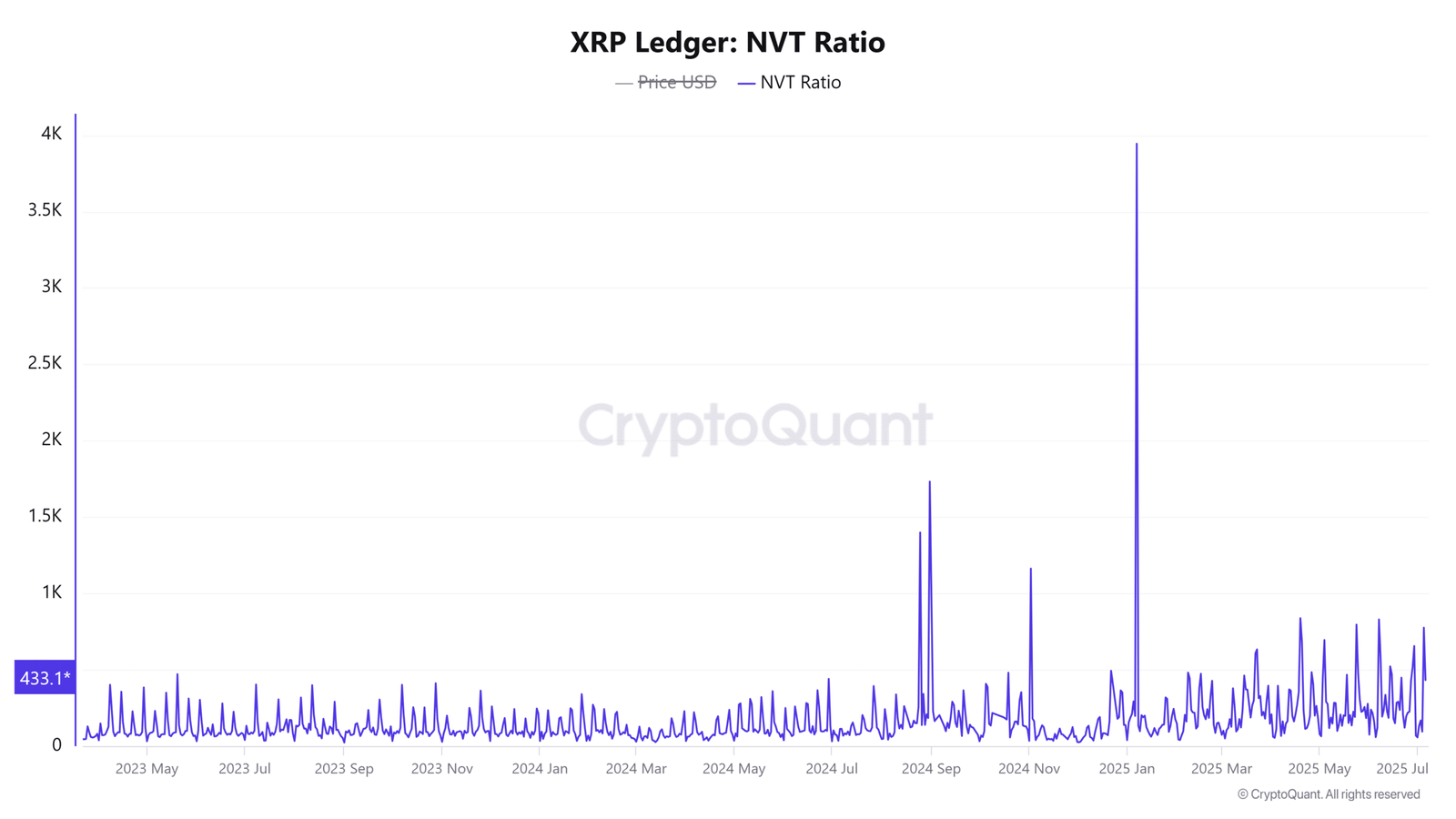

Ripple’s Network Value to Transactions (NVT) ratio plummeted by 44.23% in the past 24 hours, dropping to 433.1.

This steep drop reflected surging transaction volumes versus market capitalization.

Of course, a lower NVT Ratio typically suggests improving network health. If this trend persists, XRP’s long-term on-chain narrative might strengthen.

Source: CryptoQuant

Looming sell pressure or strategic loading?

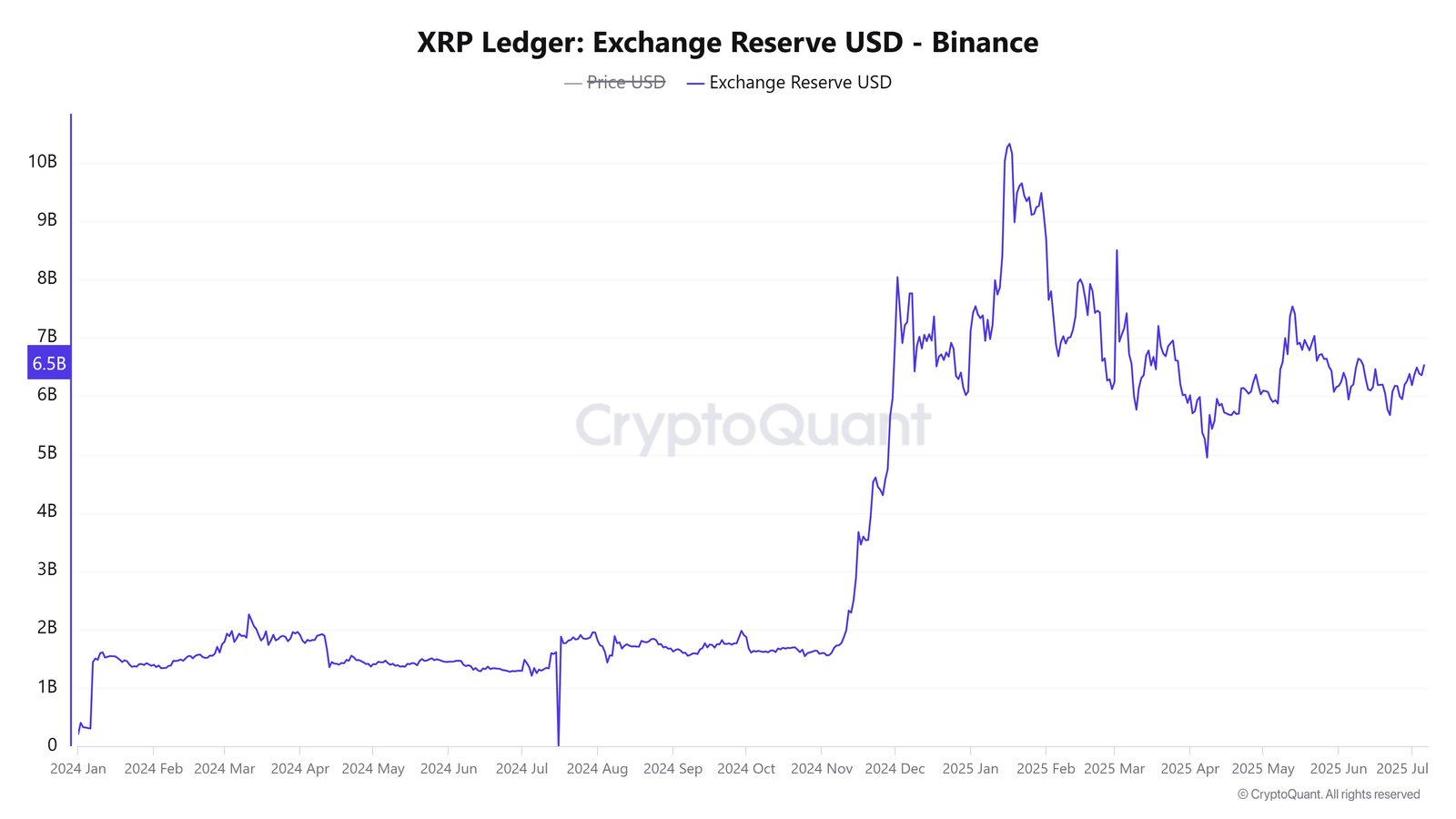

Binance’s Exchange Reserves climbed 2.62%, reaching $6.54 billion. Traditionally, rising reserves imply potential sell-side pressure as more tokens sit idle on exchanges.

However, context matters.

This uptick could also reflect investor anticipation of favorable price action, prompting temporary positioning for swift execution. The reserve growth comes alongside increased whale transfers and rising spot demand.

Therefore, it remains uncertain whether the move is preemptive profit-taking or accumulation for an incoming breakout.

Source: CryptoQuant

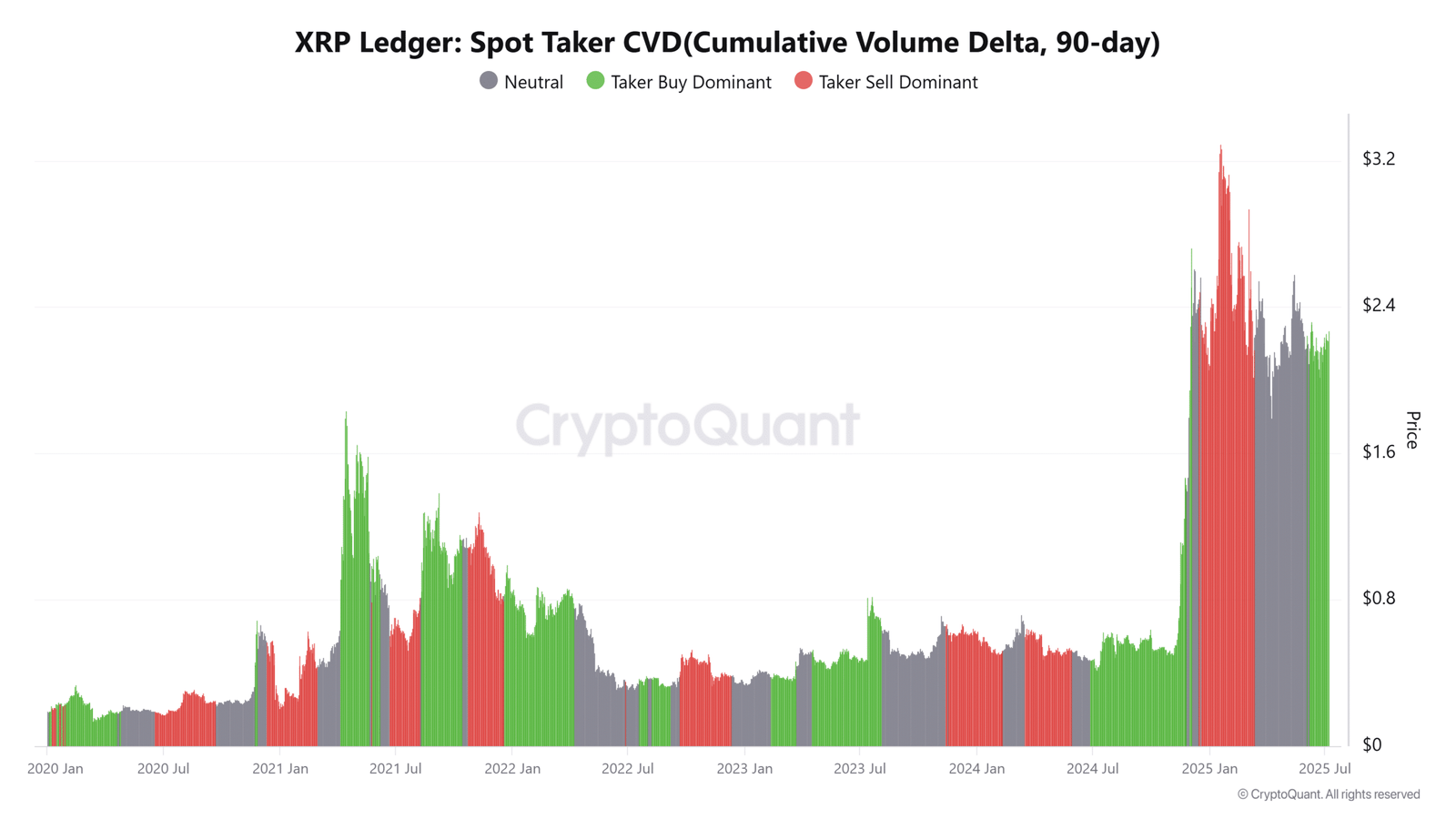

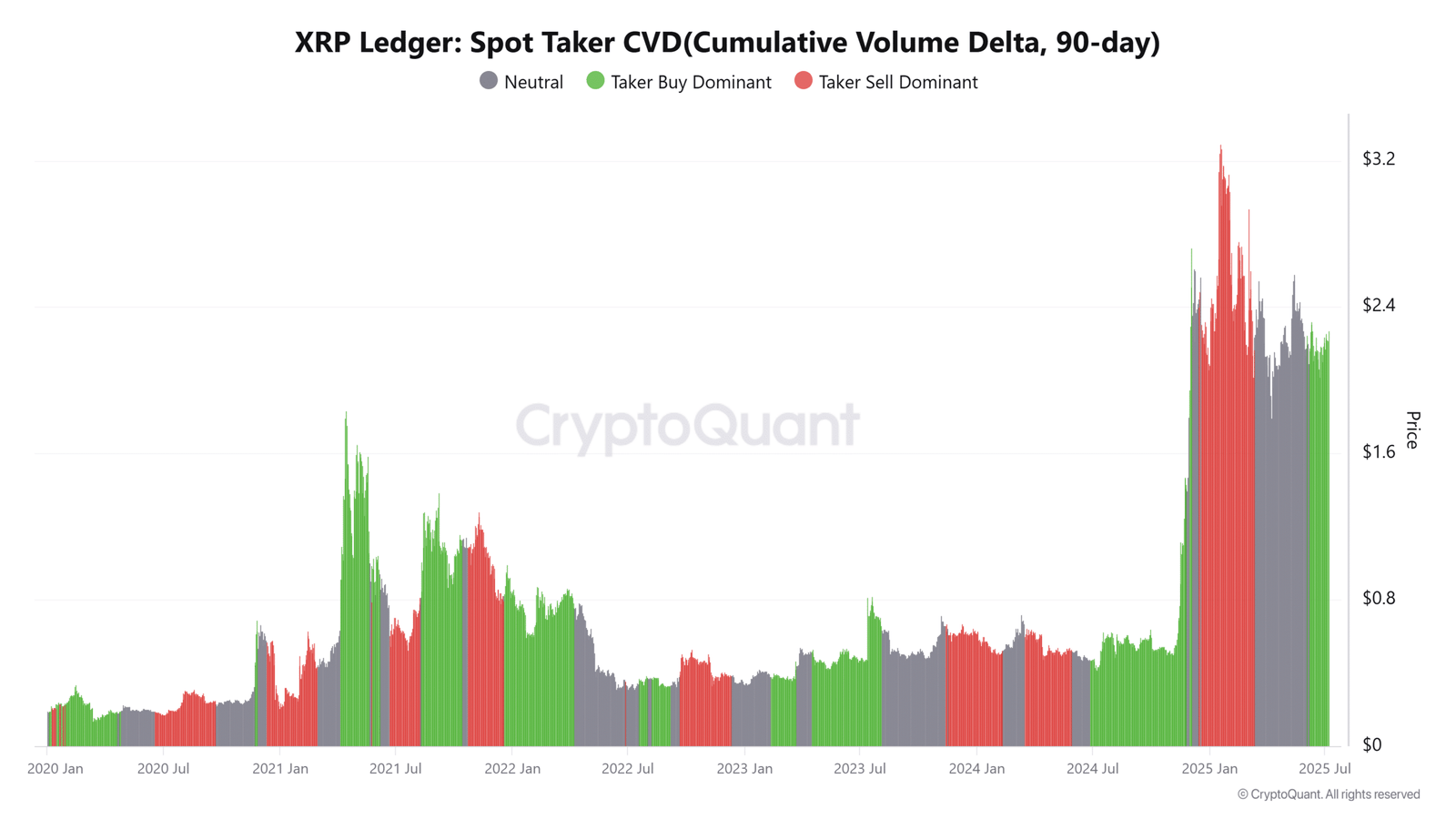

Are buyers setting the tone for a recovery?

Spot Taker CVD revealed taker buy orders dominating sell orders. This pattern often preceded bullish breakouts as buyers drove the price higher.

In fact, combining long-biased derivative positions with a falling NVT Ratio painted rising investor confidence. Consequently, sustained buyer aggression suggested traders were bracing for a breakout attempt.

Source: CryptoQuant

Will XRP finally break its descending resistance?

XRP continued to coil just below a long-standing descending resistance near $2.35. At press time, its $2.27 price placed it within striking distance of a decisive breakout.

However, the Stochastic RSI is flashing overbought readings above 90, indicating possible exhaustion. Previous rallies have failed at similar levels, reinforcing the resistance zone’s importance.

Therefore, a clean break above $2.35 would confirm bullish momentum; otherwise, late buyers risked a trap.

Despite overbought technical signals, the convergence of rising buy-side aggression, falling NVT, and whale activity present a potential breakout setup for XRP.